[ad_1]

One crypto dealer earned $427,000 in income inside a month after shopping for the native tokens of main decentralized finance(DeFi) tasks, together with Uniswap’s UNI, Lido’s LDO, and Aave’s AAVE.

In accordance with Lookonchain, the dealer made these income with out buying and selling memecoins by merely capitalizing on the bull run of the crypto belongings throughout the previous month.

Crypto Dealer Nets 40% Revenue in 30 Days

Utilizing the Ox123d deal with, the dealer spent $942,000 to purchase 71,891 UNI at $4.34, 6,371 AAVE at $50, and 189,255 LDO at $1.64 on June 16.

As of July 15, UNI’s worth had reached $5.85, whereas AAVE was value $79, and LDO traded at $2.37. This meant the dealer made a 40% achieve on his transactions, promoting all of the tokens for $1.37 million.

Whereas this commerce is an ideal instance of good cash strikes, it additionally highlights how properly the DeFi tokens carried out prior to now 30 days. On July 10, blockchain analytical agency Kaiko reported that blue-chip DeFi tokens had carried out phenomenally over the previous month.

Crypto Market Maintains Optimistic Outlook Over Previous Month

Nevertheless, this optimistic worth efficiency was not restricted to simply DeFi tokens, because the broader crypto market rallied inside that interval too. In accordance with BeInCrypto information, the highest two flagship digital belongings, Bitcoin and Ethereum, rallied to their yearly highs throughout this era.

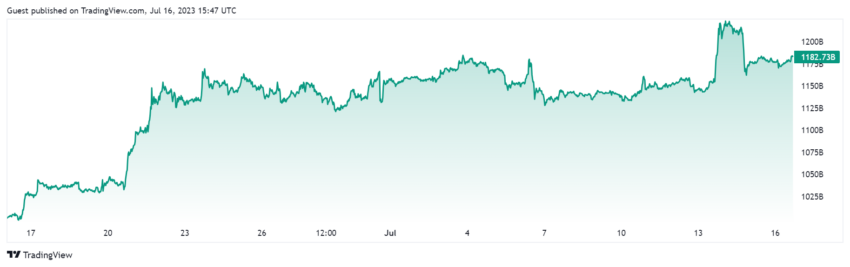

In the meantime, a number of medium-cap digital belongings like Bitcoin Money, Solana, and others additionally noticed their values spike to uncharted territories. Throughout the interval, all crypto belongings market capitalization rose by 17% to $1.18 trillion on the time of writing, in keeping with Tradingview information.

Learn extra: 9 Finest AI Crypto Buying and selling Bots To Maximize Your Income

This optimistic worth efficiency will not be fully shocking contemplating the a number of optimistic developments within the crypto business over the past 30 days.

In direction of the tip of June, a number of conventional monetary establishments, spearheaded by BlackRock, utilized for a spot Bitcoin exchange-traded fund (ETF). Round this era, an institution-facing crypto alternate, EDX Markets, backed by Wall Road giants, started its operations.

Learn extra: 9 Finest Crypto Futures Buying and selling Platforms in 2023

The optimistic market sentiment continued into July, with crypto cost firm Ripple scoring a major victory towards the US Securities and Alternate Fee (SEC) over its classification of XRP as a safety.

Nevertheless, the momentum has cooled, with the market seeing slight declines over the previous two days. Nonetheless, most digital belongings stay inexperienced on account of their optimistic runs over the past 30 days.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material.

[ad_2]

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

naturally like your web site however you need to take a look at the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth on the other hand I will surely come again again.

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.