[ad_1]

The ‘DeFi Summer time’ of 2020 was a turning level within the blockchain trade, because the season noticed the debut of a number of DeFi tasks, signaling the daybreak of a brand new period in finance.

DeFi’s evolution throughout this era didn’t simply make waves; it catalyzed a paradigm shift, positioning itself because the daring trailblazer of this unprecedented motion.

But, what does the momentum that the trade felt in 2020 appear like by way of laborious knowledge?

Immediately, with token costs down as much as 90% as we navigate the murky waters of the present bear market, we take a look at the speed of DeFi adoption and the impression of market cycles on adoption.

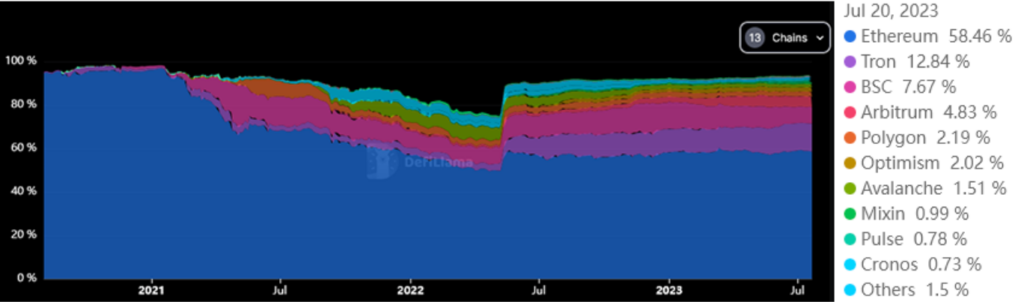

DeFi TVL evaluation by chain since 2017

Towards this backdrop, our evaluation focuses on knowledge collected from 2018 to 2023, with an emphasis on adoption throughout chains similar to Ethereum, Tron, BNB Chain (BSC), Arbitrum, Polygon, Optimism, Avalanche, Mixin, Pulse, Cronos, Solana, Cardano, and Osmosis.

The desk under exhibits the chains analyzed, the date the chain reached its all-time excessive for TVL (as tracked by DefiLlama,), the time it took to get its all-time excessive since launch (velocity), its all-time excessive (ATH), and the present TVL.

| Chain | Exercise begin* | ATH Date | ATH TVL | Velocity | Present TVL |

|---|---|---|---|---|---|

| Ethereum | November 2017** | November 2021 | $108.92B | 1280 days | $25.73B |

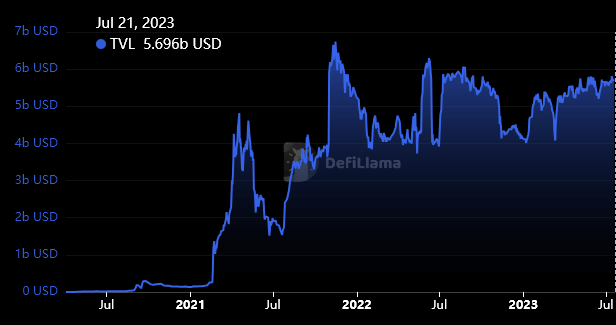

| Tron | August 2020 | November 2021 | $6.74B | 470 days | $5.69B |

| BSC | October 2020 | Might 2021 | $21.94B | 186 days | $3.36B |

| Arbitrum | August 2021 | Might 2023 | $2.53B | 614 days | $2.12B |

| Polygon | October 2020 | June 2021 | $9.89B | 249 days | $0.97B |

| Optimism | July 2021 | August 2022 | $1.15B | 393 days | $0.92B |

| Avalanche | February 2021 | December 2021 | $11.41B | 302 days | $0.66B |

| Mixin | December 2021 | June 2022 | $0.59B | 182 days | $0.44B |

| Pulse | Might 2023 | Might 2023 | $0.49B | 5 days | $0.34B |

| Cronos | November 2021 | April 2022 | $3.22B | 145 days | $0.32B |

| Solana | March 2021 | November 2021 | $10.03B | 236 days | $0.31B |

| Cardano | January 2022 | March 2022 | $0.33B | 81 days | $0.18B |

| Osmosis | June 2021 | March 2022 | $1.83B | 253 days | $0.13B |

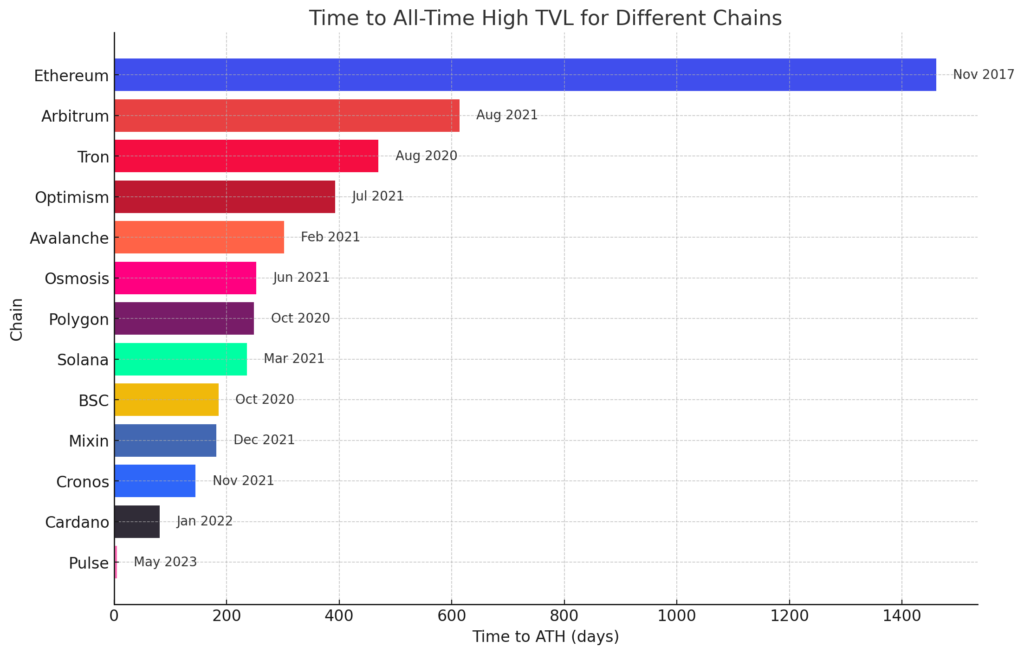

The chart under visualizes the speed of every chain in reaching its all-time excessive in TVL. The DeFi pioneer, Ethereum, has technically had DeFi exercise since 2017, and thus it stands out because the slowest adoption, given its all-time excessive was not reached till Nov. 2021.

Curiously, November 2021 coincides with the all-time excessive for Bitcoin and certain impacted DeFi on Tron and Solana, which additionally noticed peaks presently.

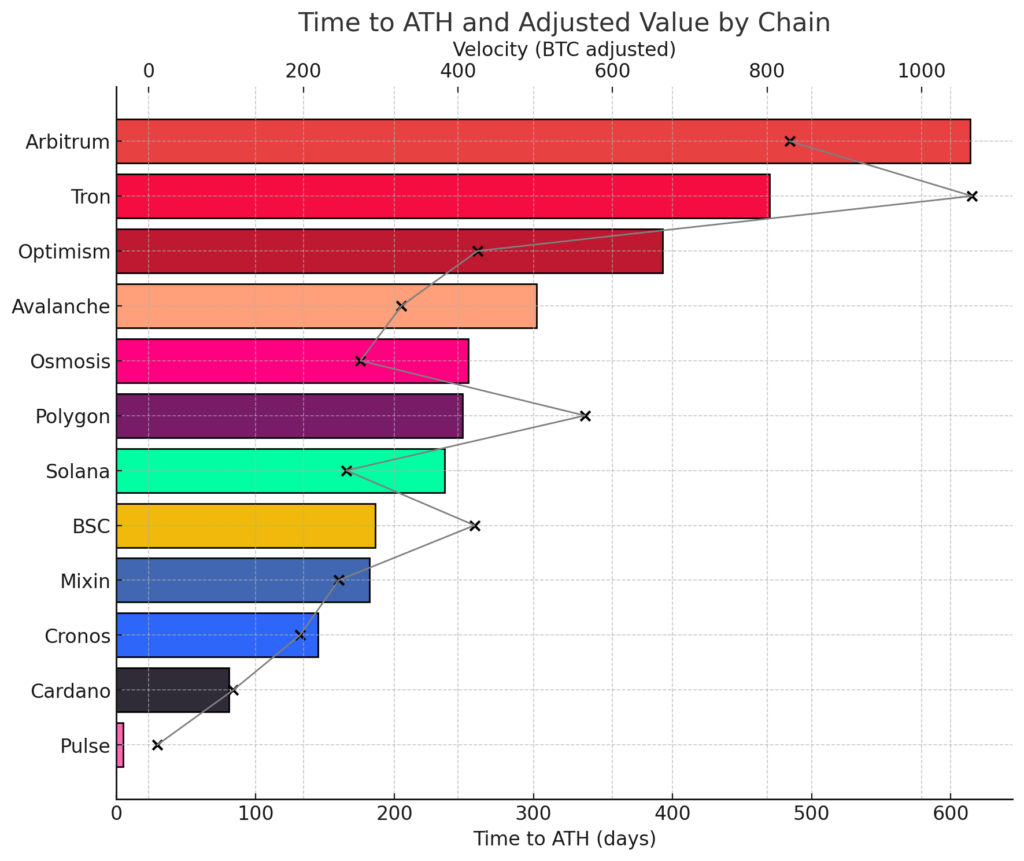

Bitcoin adjusted velocity

As Bitcoin is seen as a barometer for the general well being of the cryptocurrency market, the speed of DeFi adoption was adjusted based mostly on Bitcoin’s value at every chain’s DeFi launch.

CryptoSlate cross-referenced the worth of Bitcoin with the all-time excessive knowledge to create a Bitcoin-adjusted velocity (BaV) for every chain.

The chart under’s gray line and plot factors signify the BaV for every chain. The chart reveals that the DeFi ecosystems of Tron, Polygon, and BSC have been all positively impacted by Bitcoin’s value and the supporting bullish sentiment of the market.

Evaluation of chain velocity

Ethereum was faraway from the above chart for readability because it recorded a large 7,936 velocity rating in comparison with the subsequent closes, with Tron at 1,065 and Arbitrum at 829.

With the bear market factored in, Pulse’s velocity diminished, giving it a rating of simply 10.98, because it reached its ATH in simply 5 days. The subsequent lowest was Cardano at 109, some ten occasions better.

Utilizing the BaV metric, it seems the best-performing chains have been Pule, Cardano, Cronos, Solana, and Osmosis. Whereas Ethereum, Tron, and Arbitrum stood out as having the slowest velocity.

Tron is without doubt one of the chains at present closest to its ATH, with a powerful efficiency in 2023. Ought to it cross its ATH of $6.47 billion from its present stage of $5.6 billion, it could surpass Ethereum on the BaV and commonplace measures of velocity.

The varied trajectories of DeFi adoption throughout totally different blockchain networks underscore the significance of timing, market situations, and the inherent benefits of being an early mover within the house. Nevertheless, because the outstanding case of Pulse exhibits, even newcomers can obtain fast development with the appropriate elements aligning.

Understanding the info

The pace at which you attain the all-time excessive in TVL is a fancy metric. Some could argue that the sooner you go up, the faster you come down, and that’s positively the case for some chains.

Nevertheless, the basic elements below evaluation right here concern momentum and adoption. Additional, all of the tasks listed recorded at the very least $330 million locked, with most over $1 billion. These are usually not tasks with low market cap and low liquidity.

The tasks analyzed on this article are essential to figuring out the strengths and weaknesses of the historic DeFi onboarding course of. The common time it took for a series to succeed in its ATH was round 338 days, which means, outliers apart, most chains take nearly a yr to peak in DeFi exercise.

* Launch date refers back to the date of the primary knowledge tracked by DefiLama for every chain**

** Utilizing MakerDAO’s DAI launch because the date for the Ethereum DeFi launch and knowledge in response to CoinmarketCap’s historic knowledge.

*** Further knowledge included on account of DefiLlama 2020 deadline.

[ad_2]

I am really impressed together with your writing abilities and also with the structure in your weblog. Is this a paid subject matter or did you customize it your self? Anyway keep up the excellent quality writing, it’s rare to look a nice weblog like this one nowadays!

This website, you can find lots of slot machines from top providers.

Visitors can try out retro-style games as well as new-generation slots with vivid animation and exciting features.

Whether you’re a beginner or an experienced player, there’s something for everyone.

money casino

The games are instantly accessible round the clock and optimized for desktop computers and mobile devices alike.

You don’t need to install anything, so you can jump into the action right away.

Platform layout is easy to use, making it convenient to explore new games.

Join the fun, and discover the excitement of spinning reels!

On this platform, you can find a great variety of slot machines from famous studios.

Visitors can experience retro-style games as well as new-generation slots with high-quality visuals and interactive gameplay.

If you’re just starting out or an experienced player, there’s something for everyone.

online games

The games are ready to play anytime and optimized for desktop computers and tablets alike.

No download is required, so you can jump into the action right away.

Platform layout is easy to use, making it quick to browse the collection.

Register now, and dive into the thrill of casino games!

На данном сайте вы можете получить доступ к боту “Глаз Бога” , который способен проанализировать всю информацию о любом человеке из общедоступных баз .

Этот мощный инструмент осуществляет поиск по номеру телефона и показывает информацию из онлайн-платформ.

С его помощью можно узнать контакты через специализированную платформу, используя автомобильный номер в качестве начальных данных .

поиск по номеру

Алгоритм “Глаз Бога” автоматически анализирует информацию из множества источников , формируя структурированные данные .

Клиенты бота получают ограниченное тестирование для ознакомления с функционалом .

Платформа постоянно развивается, сохраняя скорость обработки в соответствии с стандартами безопасности .

Looking for latest 1xBet promo codes? Our platform offers verified bonus codes like GIFT25 for new users in 2024. Get up to 32,500 RUB as a welcome bonus.

Use trusted promo codes during registration to boost your bonuses. Benefit from risk-free bets and exclusive deals tailored for casino games.

Discover daily updated codes for global users with guaranteed payouts.

All promotional code is checked for validity.

Grab exclusive bonuses like GIFT25 to double your funds.

Active for first-time deposits only.

https://cyberbookmarking.com/story19586527/unlocking-1xbet-promo-codes-for-enhanced-betting-in-multiple-countriesStay ahead with 1xBet’s best promotions – apply codes like 1x_12121 at checkout.

Experience smooth rewards with instant activation.

В этом ресурсе вы можете получить доступ к боту “Глаз Бога” , который может проанализировать всю информацию о любом человеке из открытых источников .

Этот мощный инструмент осуществляет проверку ФИО и раскрывает данные из соцсетей .

С его помощью можно пробить данные через специализированную платформу, используя имя и фамилию в качестве поискового запроса .

пробив авто по вин

Алгоритм “Глаз Бога” автоматически анализирует информацию из проверенных ресурсов, формируя подробный отчет .

Пользователи бота получают пробный доступ для тестирования возможностей .

Платформа постоянно развивается, сохраняя скорость обработки в соответствии с стандартами безопасности .

На данном сайте вы можете получить доступ к боту “Глаз Бога” , который способен получить всю информацию о любом человеке из общедоступных баз .

Уникальный бот осуществляет поиск по номеру телефона и показывает информацию из онлайн-платформ.

С его помощью можно узнать контакты через официальный сервис , используя имя и фамилию в качестве начальных данных .

сервис пробива

Технология “Глаз Бога” автоматически собирает информацию из открытых баз , формируя исчерпывающий результат.

Пользователи бота получают ограниченное тестирование для ознакомления с функционалом .

Платформа постоянно обновляется , сохраняя скорость обработки в соответствии с требованиями времени .

В этом ресурсе доступен мощный бот “Глаз Бога” , который получает данные о любом человеке из публичных баз .

Инструмент позволяет узнать контакты по фотографии, раскрывая информацию из социальных сетей .

https://glazboga.net/

This website offers detailed information about Audemars Piguet Royal Oak watches, including price ranges and design features.

Access data on luxury editions like the 41mm Selfwinding in stainless steel or white gold, with prices averaging $39,939 .

The platform tracks secondary market trends , where limited editions can appreciate over time.

Piguet Royal Oak prices

Movement types such as automatic calibers are clearly outlined .

Check trends on 2025 price fluctuations, including the Royal Oak 15510ST’s retail jump to $39,939 .

Лицензирование и сертификация — обязательное условие ведения бизнеса в России, обеспечивающий защиту от неквалифицированных кадров.

Обязательная сертификация требуется для подтверждения безопасности товаров.

Для 49 видов деятельности необходимо специальных разрешений.

https://ok.ru/group/70000034956977/topic/158835206633649

Игнорирование требований ведут к приостановке деятельности.

Добровольная сертификация помогает повысить доверие бизнеса.

Соблюдение норм — залог легальной работы компании.

Хотите найти ресурсы коллекционеров? Наш сайт предлагает всё необходимое погружения в тему нумизматики!

Здесь доступны уникальные экземпляры из разных эпох , а также антикварные находки.

Просмотрите каталог с подробными описаниями и высококачественными фото , чтобы сделать выбор .

георгий победоносец золотой 100 рублей

Для новичков или профессиональный коллекционер , наши статьи и гайды помогут углубить экспертизу.

Не упустите шансом добавить в коллекцию эксклюзивные артефакты с гарантией подлинности .

Присоединяйтесь сообщества ценителей и будьте в курсе аукционов в мире нумизматики.

Explore the iconic Patek Philippe Nautilus, a horological masterpiece that blends sporty elegance with refined artistry.

Introduced nearly 50 years ago, this cult design redefined high-end sports watches, featuring distinctive octagonal bezels and horizontally grooved dials .

For stainless steel variants like the 5990/1A-011 with a 55-hour energy retention to opulent gold interpretations such as the 5811/1G-001 with a blue gradient dial , the Nautilus suits both avid enthusiasts and everyday wearers .

Certified Patek Nautilus wristwatch

Certain diamond-adorned versions elevate the design with gemstone accents, adding unmatched glamour to the iconic silhouette .

With market values like the 5726/1A-014 at ~$106,000, the Nautilus remains a prized asset in the world of premium watchmaking.

Whether you seek a historical model or modern redesign, the Nautilus embodies Patek Philippe’s tradition of innovation.

Эта платформа публикует свежие информационные статьи со всего мира.

Здесь представлены события из жизни, культуре и разнообразных темах.

Материалы выходят почти без перерывов, что позволяет не пропустить важное.

Удобная структура облегчает восприятие.

https://modaizkomoda.ru

Каждое сообщение предлагаются с фактчеком.

Редакция придерживается информативности.

Оставайтесь с нами, чтобы быть всегда информированными.

Монтаж видеокамер позволит защиту территории на постоянной основе.

Продвинутые системы позволяют организовать надежный обзор даже в темное время суток.

Мы предлагаем множество решений систем, идеальных для дома.

videonablyudeniemoskva.ru

Грамотная настройка и сервисное обслуживание обеспечивают эффективным и комфортным для всех заказчиков.

Оставьте заявку, и узнать о лучшее решение по внедрению систем.

Szukasz gry przeglądarkowe w tym miejscu?

Oferujemy różnorodne gatunki — od RPG do sportu!

Korzystaj w przeglądarce na komputerze lub telefonie .

Nowości stale rozwijane.

https://www.preparingforpeace.org/najlepsze-kasyna-online/

Dla dorosłych, zaawansowane — wybór na każdą okazję!

Zacznij grać już dziś .

Нужно собрать данные о пользователе? Этот бот поможет детальный отчет в режиме реального времени .

Воспользуйтесь уникальные алгоритмы для поиска цифровых следов в открытых источниках.

Узнайте контактные данные или активность через систему мониторинга с верификацией результатов.

глаз бога тг

Система функционирует с соблюдением GDPR, используя только открытые данные .

Закажите расширенный отчет с историей аккаунтов и графиками активности .

Попробуйте надежному помощнику для исследований — точность гарантирована!

Нужно найти информацию о человеке ? Наш сервис поможет полный профиль в режиме реального времени .

Воспользуйтесь продвинутые инструменты для поиска публичных записей в соцсетях .

Выясните место работы или активность через систему мониторинга с гарантией точности .

глаз бога телефон

Система функционирует в рамках закона , обрабатывая открытые данные .

Получите расширенный отчет с геолокационными метками и списком связей.

Доверьтесь проверенному решению для исследований — результаты вас удивят !

Этот бот поможет получить данные о любом человеке .

Достаточно ввести имя, фамилию , чтобы сформировать отчёт.

Система анализирует публичные данные и активность в сети .

глаз бога телеграмм официальный бот

Результаты формируются мгновенно с фильтрацией мусора.

Оптимален для анализа профилей перед важными решениями.

Конфиденциальность и точность данных — наш приоритет .

Нужно собрать информацию о пользователе? Этот бот предоставит полный профиль мгновенно.

Воспользуйтесь уникальные алгоритмы для анализа публичных записей в открытых источниках.

Узнайте место работы или интересы через систему мониторинга с гарантией точности .

глаз бога

Система функционирует в рамках закона , используя только общедоступную информацию.

Получите расширенный отчет с геолокационными метками и графиками активности .

Доверьтесь проверенному решению для исследований — точность гарантирована!

На данном сайте доступна информация по запросу, от кратких контактов до полные анкеты.

Базы данных содержат персон любой возрастной категории, статусов.

Информация собирается на основе публичных данных, подтверждая точность.

Поиск производится по фамилии, сделав процесс эффективным.

глаз бога ссылка

Дополнительно можно получить адреса а также актуальные данные.

Обработка данных выполняются в соответствии с норм права, что исключает несанкционированного доступа.

Воспользуйтесь этому сайту, для поиска необходимую информацию без лишних усилий.

При выборе семейного медика важно учитывать на квалификацию, умение слушать и доступность услуг .

Проверьте , что медицинский центр удобна в доезде и сотрудничает с узкими специалистами.

Спросите, принимает ли врач с вашей полисом, и есть ли возможность записи онлайн .

http://www.zeitlos-forum.de/viewtopic.php?f=188&t=29238

Обращайте внимание рекомендации знакомых, чтобы оценить отношение к клиентам.

Важно проверить наличие профильного образования, подтверждающие документы для гарантии безопасности .

Оптимальный вариант — тот, где примут во внимание ваши особенности здоровья, а процесс лечения будет комфортным .

В этом ресурсе доступна информация по запросу, в том числе полные анкеты.

Архивы содержат граждан любой возрастной категории, статусов.

Информация собирается из открытых источников, подтверждая точность.

Поиск производится по контактным данным, что обеспечивает процесс эффективным.

глаз бога ссылка

Дополнительно доступны адреса а также важные сведения.

Все запросы выполняются в рамках правовых норм, что исключает разглашения.

Воспользуйтесь этому сайту, в целях получения нужные сведения без лишних усилий.

Нужно собрать информацию о человеке ? Наш сервис поможет полный профиль мгновенно.

Используйте уникальные алгоритмы для анализа публичных записей в открытых источниках.

Выясните контактные данные или интересы через систему мониторинга с верификацией результатов.

глаз бога бесплатно на телефон

Система функционирует в рамках закона , обрабатывая открытые данные .

Получите детализированную выжимку с историей аккаунтов и списком связей.

Попробуйте проверенному решению для исследований — точность гарантирована!

Нужно найти информацию о пользователе? Наш сервис предоставит детальный отчет в режиме реального времени .

Используйте уникальные алгоритмы для анализа цифровых следов в соцсетях .

Выясните место работы или активность через автоматизированный скан с верификацией результатов.

глаз бога пробить человека

Система функционирует в рамках закона , обрабатывая открытые данные .

Получите детализированную выжимку с геолокационными метками и графиками активности .

Попробуйте надежному помощнику для исследований — результаты вас удивят !

Online platforms provide a innovative approach to connect people globally, combining user-friendly features like photo verification and interest-based filters .

Core functionalities include video chat options, geolocation tracking , and detailed user bios to enhance interactions .

Smart matching systems analyze behavioral patterns to suggest potential partners , while privacy settings ensure safety .

https://live8.us/dating/a-celebration-of-natural-desire-and-fertility/

Many platforms offer freemium models with exclusive benefits , such as unlimited swipes , alongside profile performance analytics.

Looking for long-term relationships, these sites cater to diverse needs , leveraging community-driven networks to optimize success rates .

Gamificação ética é um conjunto de medidas que minimizam riscos no setor de apostas online, protegendo jogadores e prevenindo dependência .

Operadores devem oferecer ferramentas como limites financeiros , permitindo que os usuários evitem excessos.

A educação sobre jogo consciente fundamental para apoiar jogadores vulneráveis, como padrões compulsivos.

1win

O controle de acesso proíbe o uso por participem , enquanto parcerias com ONGs ampliam a responsabilidade social.

Clareza sobre condições de uso garante confiança , com certificações regulatórias fiscalizando práticas.

Нужно найти данные о пользователе? Наш сервис поможет полный профиль в режиме реального времени .

Используйте уникальные алгоритмы для поиска цифровых следов в соцсетях .

Выясните контактные данные или активность через систему мониторинга с гарантией точности .

как установить глаз бога в телеграм

Система функционирует в рамках закона , обрабатывая открытые данные .

Закажите детализированную выжимку с историей аккаунтов и графиками активности .

Доверьтесь проверенному решению для digital-расследований — точность гарантирована!

¿Quieres una piscina de jardín ? Las marcas Intex y Bestway ofrecen estructuras adaptables para usuarios de todas edades.

Sus piscinas de estructura metálica garantizan estabilidad en cualquier clima, mientras que los modelos hinchables son ideales para niños .

Colecciones destacadas incluyen filtros integrados , asegurando agua cristalina .

Para espacios reducidos , las piscinas compactas de 3 m no requieren obras.

Opciones adicionales como cobertores térmicos, escaleras de seguridad y juegos inflables mejoran la experiencia .

Con garantía del fabricante , estas piscinas cumplen estándares europeos.

https://www.mundopiscinas.net

Good shout.

Доставка грузов из Китая в Россию проводится через железнодорожные маршруты , с проверкой документов на в портах назначения.

Импортные сборы составляют в диапазоне 15–20%, в зависимости от категории товаров — например, готовые изделия облагаются по максимальной ставке.

Для ускорения процесса используют серые каналы доставки , которые быстрее стандартных методов , но связаны с повышенными рисками .

Доставка грузов из Китая

При официальном оформлении требуется предоставить сертификаты соответствия и декларации , особенно для технических устройств.

Сроки доставки варьируются от одной недели до месяца, в зависимости от удалённости пункта назначения и эффективности таможни .

Общая цена включает логистику , таможенные платежи и услуги экспедитора, что влияет на рентабельность поставок.

I used to think following instructions was enough. The pharmacy hands it over — you don’t question the process. It felt safe. Eventually, it didn’t feel right.

At some point, I couldn’t focus. I blamed my job. And deep down, I knew something was off. I searched forums. No one had warned me about interactions.

It finally hit me: one dose doesn’t fit all. The reaction isn’t always immediate, but it’s real. Damage accumulates. And still we keep swallowing.

Now I don’t shrug things off. Not because I’m paranoid. I track everything. Not all doctors love that. This is self-respect, not defiance. The lesson that stuck most, it would be fildena 100 for sale.

La montre connectée Garmin fēnix® Chronos est un modèle haut de gamme avec des finitions raffinées et connectivité avancée .

Conçue pour les sportifs , elle propose une polyvalence et autonomie prolongée , idéale pour les entraînements intensifs grâce à ses modes sportifs.

Grâce à son autonomie allant jusqu’à plusieurs jours selon l’usage, cette montre reste opérationnelle dans des conditions extrêmes, même lors de sessions prolongées .

https://www.garmin-boutique.com/venu/venu-sq-2-metallic-mint-avec-bracelet-silicone-vert-d-eau.aspx

Les outils de suivi incluent le comptage des calories brûlées, accompagnées de notifications intelligentes , pour les amateurs de fitness .

Intuitive à utiliser, elle s’adapte à vos objectifs, avec une interface tactile réactive et synchronisation sans fil.

Launched in 1972, the Royal Oak redefined luxury watchmaking with its signature angular case and fusion of steel and sophistication.

Ranging from skeleton dials to meteorite-dial editions, the collection balances avant-garde aesthetics with precision engineering .

Beginning at $20,000 to over $400,000, these timepieces cater to both luxury aficionados and newcomers seeking wearable heritage .

https://ztndz.com/story24505293/watches-audemars-piguet-royal-oak-luxury

The Royal Oak Offshore redefine standards with innovative complications , showcasing Audemars Piguet’s relentless innovation .

With meticulous hand-finishing , each watch reflects the brand’s legacy of craftsmanship .

Explore exclusive releases and collector-grade materials to elevate your collection .

Женская сумка — это неотъемлемый аксессуар, которая выделяет образ каждой дамы.

Сумка способна переносить важные вещи и организовывать жизненное пространство.

За счёт многообразия дизайнов и оттенков она создаёт любой образ.

сумки Goyard

Это символ хорошего вкуса, который демонстрирует социальное положение своей хозяйки.

Любая сумка рассказывает историю через оригинальные решения, подчёркивая уникальность женщины.

Начиная с компактных сумочек до вместительных шоперов — сумка подстраивается под любую ситуацию.

Дом Balenciaga прославился роскошными изделиями, созданными фирменной эстетикой.

Каждая модель обладает фирменными деталями, например массивные застежки .

Применяемые ткани подчеркивают изысканность аксессуара .

https://sites.google.com/view/sumki-balenciaga/index

Востребованность коллекций сохраняется в элите, превращая каждую покупку символом роскоши .

Эксклюзивные коллекции позволяют владельцу выделиться в повседневке.

Инвестируя в аксессуары бренда, вы приобретаете роскошную вещь, и символ эстетики.

Сумки Prada являются символом роскоши за счёт безупречному качеству.

Используемые материалы гарантируют долговечность , а ручная сборка выделяет высокое качество .

Лаконичный дизайн дополняются знаковым логотипом , создавая неповторимый стиль .

https://sites.google.com/view/sumkiprada/index

Такие сумки универсальны для повседневного использования , демонстрируя практичность при любом ансамбле.

Эксклюзивные коллекции усиливают статус владельца , превращая каждую модель в инвестицию в стиль .

Опираясь на историю бренд развивает новые решения, сохраняя классическому шарму до мельчайших элементов.

Сумки Longchamp — это символ элегантности , где сочетаются вечные ценности и современные тенденции .

Изготовленные из прочного нейлона , они отличаются неповторимым дизайном .

Иконические изделия остаются востребованными у модников уже десятилетия.

тоут Прада отзывы

Каждая сумка ручной работы подчеркивает индивидуальность , сохраняя универсальность в любых ситуациях .

Бренд следует наследию, используя современные методы при сохранении шарма .

Выбирая Longchamp, вы получаете стильный аксессуар , а становитесь частью легендарное сообщество.

Hey, champions of radiant health and vitality! I once got trapped in the mesmerizing myth of immediate health saviors, snatching them eagerly whenever wellness warnings echoed. Yet, profound health truths unveiled, demonstrating they concealed threats to our core vitality, sparking an invigorating exploration for the essence of comprehensive healing and prevention. The vitality boost was profound, validating how wise, health-empowering practices enhance our innate health defenses and glow, rather than undermining our bodily integrity.

In the heart of a health crisis, I ignited a personal health transformation, exploring groundbreaking health frontiers that fuse restorative habits with cutting-edge preventive medicine. Get set for the wellness-wowing centerpiece: kamagra online, where on the iMedix podcast we explore its profound impacts on health with transformative tips that’ll inspire you to tune in now and revitalize your life. The health surge redefined my path: healing accelerates with focused health awareness, unwise dependencies erode preventive strength. It amplifies my commitment to better health to captivate you with these vital health breakthroughs, positioning treatments as allies in health mastery.

Probing the core of wellness dynamics, I’ve discovered the vital key wellness supports should invigorate and protect, without compromising health autonomy. The wellness journey delivered endless health revelations, inspiring you to upgrade suboptimal health dependencies for peak physical and mental vitality. It all centers on this health essential: balance.

Shimmering liquid textiles dominate 2025’s fashion landscape, blending cyberpunk-inspired aesthetics with eco-conscious craftsmanship for everyday wearable art.

Unisex tailoring break traditional boundaries , featuring modular designs that adapt to personal style across formal occasions.

AI-curated patterns merge digital artistry , creating one-of-a-kind textures that react to body heat for dynamic visual storytelling .

https://members.mcafeeinstitute.com/read-blog/32161

Zero-waste construction set new standards, with biodegradable textiles reducing environmental impact without compromising luxurious finishes .

Light-refracting details elevate minimalist outfits , from nano-embroidered handbags to 3D-printed footwear designed for avant-garde experimentation.

Retro nostalgia fused with innovation defines the year, as 90s grunge textures reinterpret archives through smart fabric technology for timeless relevance .

Bold metallic fabrics redefine 2025’s fashion landscape, blending cyberpunk-inspired aesthetics with sustainable innovation for runway-ready statements .

Unisex tailoring challenge fashion norms, featuring modular designs that transform with movement across formal occasions.

Algorithm-generated prints human creativity, creating one-of-a-kind textures that react to body heat for dynamic visual storytelling .

https://whitezorro.ru/zorro/47-brend-mango-samyy-zhelannyy-mass-market/

Circular fashion techniques lead the industry , with upcycled materials reducing environmental impact without compromising bold design elements.

Light-refracting details add futuristic flair, from solar-powered jewelry to 3D-printed footwear designed for avant-garde experimentation.

Vintage revival meets techwear defines the year, as 2000s logomania reinterpret archives through climate-responsive materials for timeless relevance .

Die Rolex Cosmograph Daytona gilt als Ikone der chronographischen Präzision , kombiniert sportliches Design mit höchster Funktionalität durch das bewährte Automatikal movement.

Erhältlich in Keramik-Editionen überzeugt die Uhr durch das ausgewogene Zifferblatt und handgefertigte Details, die passionierte Sammler begeistern .

Mit einer Gangreserve von 72 Stunden eignet sie sich für den Alltag und behält stets ihre Genauigkeit unter jeder Bedingung .

Daytona 116500LN herrenuhr

Das charakteristische Zifferblatt in Schwarz betonen den sportiven Charakter , während die wasserdichte Konstruktion Zuverlässigkeit garantieren .

Über Jahrzehnte hinweg bleibt sie ein Maßstab der Branche, bekannt durch den exklusiven Status bei Investoren weltweit.

Ob im Rennsport inspiriert – die Cosmograph Daytona verkörpert Tradition und etabliert sich als zeitloser Klassiker für wahre Kenner.

This iconic Rainbow Daytona epitomizes high-end craftsmanship with its colorful ceramic chapter ring.

Made from precious metals , it blends sporty chronograph functionality with elegant aesthetics .

Available in collector-focused releases, this timepiece appeals to luxury enthusiasts worldwide.

Daytona Rainbow videos

Each baguette-cut sapphire on the bezel forms a vibrant arc that stands out uniquely.

Equipped with Rolex’s precision-engineered automatic mechanism, it ensures exceptional accuracy for professional timing .

More than a watch , the Daytona Rainbow reflects Swiss watchmaking heritage in its entirety .

Explore an abundance of fascinating and useful resources on this site .

From expert articles to bite-sized insights, you’ll find to suit all needs .

Enhance your knowledge with fresh content crafted to inspire plus support you .

Here provides a user-friendly navigation to help you access resources you need .

Join of like-minded individuals who rely on trusted resources regularly .

Begin your journey now and access the full potential this platform delivers.

https://represii-by.info

Les devices connectées offrent des technologies avancées au quotidien.

Équipées de capteurs optiques combinés avec analyse de stress, ces montres s’adaptent selon vos besoins .

L’autonomie peut aller jusqu’à une longue durée selon le modèle, parfaite pour voyages .

Garmin Instinct 3

Les outils de suivi incluent les étapes ainsi que les calories, aidant à complet .

Intuitives pour utiliser , elles se synchronisent parfaitement avec vos apps , grâce à des notifications intuitive .

Découvrir ces modèles signifie accéder à un partenaire de confiance afin d’optimiser vos performances .

Хорошая автомобильная резина — это залог безопасности на дороге, обеспечивающая стабильное сцепление даже в сложных погодных условиях .

Сертифицированная резина минимизируют риск заносов в условиях гололёда, сохраняя вашу безопасность .

Покупка проверенных покрышек сокращают расходы на топливо за счёт оптимального качения .

Плавность хода обеспечивается качества протектора , в сочетании с технологией шины.

Контроль глубины протектора защищает от повреждения дисков , сохраняя долговечность авто .

Не пренебрегайте качеством — это напрямую влияет сохранность жизни в пути .

http://forum.zplatformu.com/index.php?topic=413220.new#new

Эффективные решения учёта трудовых часов обеспечивают повышение производительности .

Удобный интерфейс сокращает неточности при расчёте зарплат .

Руководителям удобнее анализировать проектные задачи с детализацией.

https://pennavenuearts.org/finance/how-to-predict-employee-burnout/

Сотрудники имеют удобный учёт к своим данным .

Переход на автоматизацию заметно оптимизирует внутренние операции без лишних затрат .

Это гарантирует слаженность между отделами , укрепляя лояльность сотрудников.

Our app allows you to change clothes in pictures.

It uses artificial intelligence to fit outfits seamlessly.

You can try multiple styles instantly.

xnudes.ai|Ultimate Clothing Changer AI Tool

The results look convincing and modern.

It’s a convenient option for outfit planning.

Upload your photo and pick the clothes you want.

Begin exploring it right away.

On our website you can explore a lot of valuable information.

It is designed to help you with multiple topics.

You will get clear explanations and real examples.

The content is regularly updated to stay up-to-date.

https://findradio.us

It’s a excellent resource for learning.

Every visitor can benefit from the materials here.

Feel free to exploring the site right away.

Our app allows you to replace clothes on images.

It uses AI to match outfits naturally.

You can try various styles instantly.

xnudes.ai

The results look real and professional.

It’s a useful option for fashion.

Upload your photo and pick the clothes you prefer.

Enjoy using it now.

Ища риэлторскую компанию, важно обращать внимание на его репутацию.

Хорошее агентство всегда имеет реальные рекомендации, которые доступны онлайн.

Также проверьте, наличие правовой статус.

Надёжные компании работают только на основе официальных соглашений.

Электронная сделка

Важно, чтобы у агентства был опыт работы на рынке не меньше 3–5 лет.

Обратите внимание, насколько открыто компания показывает нюансы сделок.

Хороший риэлтор всегда объяснит на ваши вопросы.

Выбирая агентство, доверьтесь не только внешним обещаниям, а фактам работы.

Выбор врача-остеопата — ответственный шаг на пути к здоровью.

Сначала стоит понять свои потребности и ожидания от терапии у остеопата.

Полезно оценить образование и стаж выбранного доктора.

Рекомендации пациентов помогут сформировать обоснованный подбор.

https://yapl.ru/rf/%D0%BE%D1%81%D1%82%D0%B5%D0%BE%D0%B4%D0%BE%D0%BA.%D1%80%D1%84/

Также следует учитывать методы, которыми оперирует специалист.

Первая консультация даёт возможность понять, насколько удобно вам общение и подход врача.

Стоит также оценить цены и условия работы (например, удалённо).

Правильный выбор врача позволит сделать эффективнее лечение.

На этом сайте размещена интересная и практичная информация по разным направлениям.

Пользователи могут найти подсказки на важные темы.

Статьи пополняются постоянно, чтобы каждый посетитель могли читать свежую подборку.

Удобная организация сайта облегчает быстро отыскать нужные страницы.

секс

Широкий спектр категорий делает ресурс интересным для разных пользователей.

Каждый сможет подобрать советы, которые подходят именно ей.

Существование доступных рекомендаций делает сайт ещё более ценным.

Таким образом, площадка — это надёжный проводник полезной информации для каждого пользователей.

This website offers a lot of captivating and helpful content.

Here, you can discover different subjects that include many popular areas.

Every post is written with focus to accuracy.

The content is regularly refreshed to keep it up-to-date.

Users can learn something new every time they come here.

It’s a great source for those who appreciate informative reading.

A lot of visitors consider this website to be well-organized.

If you’re looking for quality articles, you’ll certainly find it here.

https://cbeachsdsu.com

Fine-art photography often focuses on highlighting the harmony of the natural shape.

It is about expression rather than appearance.

Professional photographers use subtle contrasts to create mood.

Such images capture delicacy and character.

https://xnudes.ai/

Each photo aims to evoke feelings through pose.

The purpose is to show human beauty in an elegant way.

Audiences often admire such work for its depth.

This style of photography combines emotion and aesthetics into something truly expressive.

Artistic photography often focuses on revealing the beauty of the body lines.

It is about expression rather than surface.

Skilled photographers use natural tones to reflect emotion.

Such images capture authenticity and individuality.

https://xnudes.ai/

Every shot aims to show emotion through pose.

The goal is to show human beauty in an artful way.

Viewers often admire such work for its depth.

This style of photography unites art and vision into something truly expressive.

Popular digital spaces for mature visitors feature a selection of interesting opportunities.

These platforms are designed for social interaction and discovering ideas.

Members can find others who enjoy the same hobbies.

Most of these sites promote safe interaction and positive communication.

https://alongwalker.info/2025/10/07/home-sex-tape-exploring-authenticity-in-adult-entertainment/

The interface is usually user-friendly, making it easy to use.

Such platforms allow people to explore interests in a relaxed online environment.

Privacy remains an key part of the user experience, with many sites implementing moderation.

Overall, these platforms are developed to support mature interaction in a respectful digital space.

Онлайн платформы знакомств помогают совершеннолетним находить друзей по интересам.

Такое взаимодействие расширяет кругозор.

Большинство людей отмечают, что такие сервисы помогают расслабиться после ежедневных дел.

Это понятный формат для поиска общения.

https://ooptsao.ru/muzhchina-i-zhenshhina/domashnyaya-erotika-osobennosti-i-populyarnost-onlajn/

Основное — сохранять вежливость и искренность в диалоге.

Лёгкое общение помогает настроение.

Такие площадки созданы для тех, кто хочет найти друзей по духу.

Общение через интернет становятся частью отдыха с позитивом.

Выбор подрядчика — ключевой момент при организации застройки.

Прежде чем начать сотрудничество, стоит оценить опыт компании.

Проверенная компания всегда гарантирует прозрачные условия.

Стоит проверить, какие технологии применяются при возведении объектов.

https://lite.evernote.com/note/8d1d383e-31e8-5fa8-15cb-8b8f278f2a26

Influencer marketing has become one of the most popular approaches in modern promotion.

It helps brands to build relationships with their audience through the voice of influential people.

Creators share content that create interest in a brand.

The key advantage of this approach is its genuine communication.

https://stephenyjrt86419.gynoblog.com/32730715/how-influencers-are-transforming-brand-awareness-through-authentic-campaigns

Followers tend to engage more actively to personal messages than to classic advertising.

Brands can carefully select influencers to reach the right market.

A well-planned influencer marketing campaign enhances visibility.

As a result, this type of promotion has become an essential part of digital communication.

??????? ??????? ?????????? ?? ???????? ???????????????.

?????? ?????, ?? ???????????? ?? ??????????? ????????????, ??? ???????.

?????? ?????? ??????? ???????????????? ? ????????.

????????? ??????? ?? ????????? ??????? ??????, ???? ??? ???????? ????????????.

fortuna distillery

???? ?????? ??????????, ? ?????? ?????????.

?? ??? ??????? ?????????????, ?????? ????????????? ? ???? ????????.

????????? ???????? ?????? ??????? ???????? ?????.

?????????? ???????? ???????, ?? ????????????? ???????? ????.

Современные боты для мониторинга источников становятся всё более удобными.

Они дают возможность собирать открытые данные из интернета.

Такие решения используются для журналистики.

Они умеют оперативно анализировать большие объёмы информации.

активный глаз бога

Это помогает получить более полную картину событий.

Отдельные системы также предлагают инструменты фильтрации.

Такие боты активно применяются среди исследователей.

Совершенствование технологий делает поиск информации эффективным и быстрым.

Услуги по аренде техники сегодня является удобным вариантом для предприятий.

Она даёт возможность решать задачи без дополнительных затрат покупки дорогой техники.

Организации, предлагающие такую услугу, обеспечивают разнообразие спецоборудования для любых задач.

В парке можно найти экскаваторы, бульдозеры и другое оборудование.

https://green-design.pro/svezhie-stati/kak-vybrat-mini-pogruzchik-dlya-arendy/

Основное достоинство аренды — это гибкость.

Кроме того, арендатор получает исправную технику, готовую к работе.

Профессиональные компании оформляют прозрачные условия сотрудничества.

Таким образом, аренда спецтехники — это разумный выбор для тех, кто ищет эффективность в работе.

Проверенный напиток выделяется чистым вкусом и натуральным составом.

Первым признаком качества является отсутствие осадка.

Настоящие бренды строго следят за этапы изготовления.

Этикетка также часто говорит о происхождении продукта.

fortuna

Подтверждённая сертификация — ещё один важный критерий.

Настоящий алкоголь редко вызывает жжения в горле.

Необходимо выбирать алкогольные напитки в надёжных торговых точках.

Ответственный подход к покупке напитков поможет насладиться настоящим вкусом.

Современные поисковые системы для анализа данных становятся всё более удобными.

Они позволяют находить доступные данные из социальных сетей.

Такие боты применяются для исследований.

Они могут точно обрабатывать большие объёмы данных.

глаз бога те

Это помогает получить более объективную картину событий.

Отдельные системы также включают функции визуализации.

Такие сервисы популярны среди специалистов.

Эволюция технологий делает поиск информации более точным и удобным.

Maintaining control while gaming is crucial for ensuring a healthy gaming experience.

It helps participants benefit from the activity without unwanted stress.

Understanding your comfort zone is a main principle of mindful gaming.

Players should set reasonable budget limits before they start playing.

Best Casino Bonuses 2025 Australia

Frequent rest periods can help maintain focus and avoid burnout.

Awareness about one’s habits is vital for keeping gaming a fun activity.

Many services now promote responsible gaming through educational tools.

By being aware, every player can enjoy gaming while protecting their wellbeing.

Нейросетевые боты для поиска информации становятся всё более удобными.

Они дают возможность собирать доступные данные из интернета.

Такие боты используются для исследований.

Они умеют оперативно обрабатывать большие объёмы данных.

по номеру телефона глаз бога

Это позволяет сформировать более полную картину событий.

Отдельные системы также обладают функции визуализации.

Такие платформы активно применяются среди исследователей.

Развитие технологий превращает поиск информации доступным и наглядным.

На этом сайте вы найдёте большое количество актуальной сведений.

Сайт ориентирован на пользователей, которым важна достоверная поддержка.

Статьи, размещённые здесь, дают возможность понять в разных вопросах.

Все тексты актуализируется, чтобы оставаться современными.

https://antiwikipedia.com

Навигация понятная, поэтому найти нужный раздел очень легко.

Каждый посетитель имеет возможность выбрать материалы, соответствующие его интересам.

Данный сайт организован с учётом потребностей о посетителях.

Используя этот сайт, вы обретаете ценный ресурс полезных сведений.

Нейросетевые онлайн-сервисы для анализа данных становятся всё более удобными.

Они дают возможность находить доступные данные из социальных сетей.

Такие инструменты применяются для аналитики.

Они умеют оперативно обрабатывать большие объёмы контента.

гоаз бона

Это способствует получить более полную картину событий.

Многие системы также обладают удобные отчёты.

Такие боты широко используются среди аналитиков.

Развитие технологий превращает поиск информации более точным и удобным.

Responsible gaming is essential for ensuring a positive gaming experience.

It helps participants benefit from the activity without harmful effects.

Understanding your limits is a main principle of mindful gaming.

Players should establish reasonable time limits before they start playing.

Casino Kundenservice Deutschland

Regular breaks can help restore balance and avoid burnout.

Awareness about one’s habits is essential for keeping gaming a fun activity.

Many services now encourage responsible gaming through awareness programs.

By keeping balance, every player can enjoy gaming while protecting their wellbeing.

Выбор digital-агентства — ключевой шаг в продвижении бренда.

Прежде чем заключить договор, стоит проверить портфолио выбранного подрядчика.

Компетентная команда всегда работает на основе исследований и учитывает особенности проекта.

Стоит убедиться, какие услуги использует агентство: контекстная реклама, брендинг и другие направления.

Положительным сигналом Vzlet Media является понятная отчётность и достижимые показатели.

Отзывы клиентов помогут понять, насколько качественно агентство реализует проекты.

Лучше не ориентироваться только на низкой цене, ведь качество работы зависит от профессионализма специалистов.

Грамотный выбор digital-агентства позволит достичь целей и увеличить прибыль.

Услуги по аренде техники сегодня считается удобным способом для предприятий.

Она помогает выполнять работы без необходимости покупки оборудования.

Современные компании, предлагающие такую услугу, обеспечивают широкий выбор спецоборудования для различных сфер.

В парке можно найти экскаваторы, самосвалы и специализированные машины.

https://the-master.ru/poleznoe/sravnenie-stoimosti-arendy-i-pokupki-ekskavatorov

Главный плюс аренды — это экономия средств.

Также, арендатор получает современную технику, готовую к работе.

Профессиональные компании предлагают понятные соглашения.

Таким образом, аренда спецтехники — это практичный выбор для тех, кто ищет надежность в работе.

Услуги по аренде техники сегодня является удобным способом для предприятий.

Она даёт возможность реализовывать проекты без дополнительных затрат приобретения оборудования.

Организации, предлагающие такую услугу, предлагают широкий выбор спецоборудования для любых задач.

В парке можно найти экскаваторы, катки и специализированные машины.

https://85mb.net/xo-so-5mb/#comment-310

Основное достоинство аренды — это экономия средств.

Также, арендатор имеет доступ к исправную технику, с полным обслуживанием.

Профессиональные компании заключают удобные соглашения.

Таким образом, аренда спецтехники — это оптимальный выбор для тех, кто ценит эффективность в работе.

Дизельное топливо — это важный вид топлива, который широко используется в различных сферах.

Посредством своей экономичности дизельное топливо обеспечивает стабильную работу оборудования.

Соответствующее стандартам топливо улучшает долговечность работы двигателя.

Существенное влияние имеет состав топлива, ведь низкосортные добавки могут снизить эффективность.

Компании, занимающиеся реализацией дизельного топлива стараются поддерживать все стандарты.

Инновационные подходы позволяют оптимизировать показатели топлива.

При выборе дизельного топлива важно учитывать сертификаты качества.

Доставка и содержание топлива также влияют на его стабильность.

Низкосортное ДТ может привести к нарушению работы системы.

Поэтому использование проверенных поставщиков — гарантия стабильности.

В настоящее время представлено разнообразие видов дизельного топлива, отличающихся по составу.

Зимние марки дизельного топлива гарантируют работу техники даже при экстремальных условиях.

С появлением инноваций качество топлива постоянно растёт.

Продуманные решения в вопросе использования дизельного топлива помогают повышение производительности.

Таким образом, качественное дизельное топливо является фундаментом долговечной эксплуатации любого оборудования.

Английский сегодня считается необходимым инструментом для каждого человека.

Английский язык позволяет общаться с жителями разных стран.

Без знания английского почти невозможно строить карьеру.

Работодатели требуют специалистов с языковыми навыками.

pikapedia.shoutwiki.com

Регулярная практика английского расширяет кругозор.

Зная английский, можно читать оригинальные источники без перевода.

Кроме того, регулярная практика развивает память.

Таким образом, умение говорить по-английски играет важную роль в будущем каждого человека.

Английский язык сегодня считается необходимым навыком для каждого человека.

Он помогает общаться с жителями разных стран.

Не зная английский трудно развиваться профессионально.

Работодатели предпочитают сотрудников, владеющих английским.

bclub.web2win.ru

Регулярная практика английского делает человека увереннее.

Благодаря английскому, можно читать оригинальные источники без перевода.

Помимо этого, овладение английским улучшает мышление.

Таким образом, знание английского языка является залогом в будущем каждого человека.

Английский сегодня считается обязательным навыком для жителя современного мира.

Английский язык позволяет взаимодействовать с иностранцами.

Не зная английский сложно достигать успеха в работе.

Работодатели предпочитают специалистов с языковыми навыками.

http://www.universalinternetlibrary.ru

Регулярная практика английского открывает новые возможности.

Благодаря английскому, можно читать оригинальные источники без перевода.

Также, овладение английским развивает память.

Таким образом, знание английского языка играет важную роль в саморазвитии каждого человека.

Английский язык сегодня считается необходимым умением для жителя современного мира.

Он помогает взаимодействовать с жителями разных стран.

Не зная английский почти невозможно достигать успеха в работе.

Организации требуют сотрудников, владеющих английским.

английский для разработчиков

Изучение языка открывает новые возможности.

С помощью английского, можно читать оригинальные источники без перевода.

Помимо этого, овладение английским развивает память.

Таким образом, владение английским становится ключом в будущем каждого человека.

Английский язык сегодня считается обязательным инструментом для жителя современного мира.

Английский язык дает возможность находить общий язык с иностранцами.

Без владения языком сложно развиваться профессионально.

Многие компании предпочитают специалистов с языковыми навыками.

подготовка к toefl онлайн

Обучение английскому открывает новые возможности.

Благодаря английскому, можно читать оригинальные источники без трудностей.

Кроме того, регулярная практика улучшает мышление.

Таким образом, знание английского языка является залогом в саморазвитии каждого человека.

Английский язык сегодня считается важным инструментом для каждого человека.

Английский язык позволяет общаться с иностранцами.

Без знания английского сложно достигать успеха в работе.

Организации оценивают знание английского языка.

курсы подготовки к toefl

Регулярная практика английского расширяет кругозор.

Зная английский, можно читать оригинальные источники без трудностей.

Также, овладение английским развивает память.

Таким образом, знание английского языка становится ключом в саморазвитии каждого человека.

Знание английского языка сегодня считается необходимым умением для каждого человека.

Английский язык дает возможность общаться с жителями разных стран.

Не зная английский почти невозможно достигать успеха в работе.

Многие компании предпочитают сотрудников, владеющих английским.

корпоративное обучение английскому языку

Регулярная практика английского расширяет кругозор.

Благодаря английскому, можно учиться за границей без трудностей.

Также, овладение английским развивает память.

Таким образом, знание английского языка является залогом в успехе каждого человека.

Английский сегодня считается незаменимым навыком для жителя современного мира.

Он помогает взаимодействовать с иностранцами.

Не зная английский почти невозможно развиваться профессионально.

Многие компании оценивают знание английского языка.

интенсивные курсы английского языка в Москве

Обучение английскому открывает новые возможности.

С помощью английского, можно путешествовать без ограничений.

Помимо этого, изучение языка повышает концентрацию.

Таким образом, знание английского языка становится ключом в успехе каждого человека.

Получение второго паспорта за границей становится всё более актуальным среди жителей России.

Такой статус открывает широкие горизонты для путешествий.

Второй паспорт помогает беспрепятственно путешествовать и избегать визовых ограничений.

Также подобное решение может укрепить уверенность в будущем.

Теннисная академия в Испании

Большинство граждан рассматривают второе гражданство как инструмент защиты.

Имея ВНЖ или второй паспорт, человек легко открыть бизнес за рубежом.

Каждая страна предлагают свои программы получения статуса резидента.

Вот почему идея второго паспорта становится приоритетной для тех, кто думает о будущем.

Casino Roulette: Spin for the Ultimate Thrill

Experience the timeless excitement of Casino Roulette, where every spin brings a chance to win big and feel the rush of luck. Try your hand at the wheel today at https://k8o.jp/ !

This online platform provides a lot of captivating and valuable information.

On this platform, you can find various materials that expand knowledge.

Readers will enjoy the materials shared here.

Every category is thoughtfully designed, making it convenient to use.

The materials are easy to understand.

There are information on different subjects.

If you want to find useful facts, this site has something for everyone.

In general, this website is a great source for those who love learning.

https://companysites.info/

Надёжная водоочистная система играет важную роль в бытовых условиях.

Подобная технология помогает нейтрализовать загрязнения из воды.

Чем выше качество фильтрации, тем чище становится питьевая вода.

Большинство домовладельцев понимают необходимость использования хороших фильтров.

Инновационные методы очистки позволяют добиться максимальной степени очистки.

https://re-port.ru/pressreleases/bwt_predstavljaet_novinku__robot-pylesos_dlja_basseinov_dolphin_wave_90i/

Правильно выбранная система помогает снизить риски для организма.

Регулярная замена фильтров продлевает срок службы водоочистной системы.

Следовательно, качественная система очистки воды — это основа для комфорта в доме.

Современная система очистки играет важную роль в комфортной жизни.

Такая система помогает удалять загрязнения из питьевой воды.

Когда вода очищена должным образом, тем чище становится питьевая вода.

Большинство домовладельцев понимают необходимость использования хороших фильтров.

Современные технологии позволяют добиться стабильного результата.

http://gsvet.ru/novinki/sistema-ochistki-vodi-dlya-chastnogo-doma-nadejnoe-reshenie-dlya-chistoie-i-bezopasnoie-vodi.html

Правильно выбранная система помогает снизить риски для организма.

Регулярная замена фильтров повышает эффективность водоочистной системы.

В итоге, качественная система очистки воды — это необходимость для безопасного быта.

Своевременное выполнение уроков играет важную роль в обучении школьников.

Это занятие помогает закреплять материал и повышать успеваемость.

Юные учащиеся замечают, что внеурочные упражнения учат ответственности.

Постоянная работа позволяет развить логическое мышление.

https://yapx.ru/post/YPQOr

Преподаватели нередко говорят, что домашняя подготовка помогает лучше усваивать знания.

Также, домашняя работа приучает к ответственности.

Школьники, которые регулярно занимаются, обычно проявляют больше уверенности.

Следовательно, выполнение домашних заданий остаётся ключевым фактором успеха для любого ученика.

Осознанный подход к игре является значимым элементом безопасного досуга.

Она помогает предотвратить ненужные проблемы и удерживать разумные рамки во время развлечений.

Многие люди понимают, что умеренность помогает наслаждаться игрой без неприятных ситуаций.

Соблюдение собственных границ позволяет контролировать время.

https://blokov-casino.net/online-casino-1win/

Помимо этого, важно осознавать свои привычки и делать паузы.

Игровые платформы часто предлагают функции ограничения, которые помогают сохранять баланс.

Игроки, которые придерживаются принципов ответственности, чаще получают стабильные положительные впечатления.

Таким образом, ответственная игра остаётся важным правилом для всех.

Государственные награды имеют особое значение в жизни общества.

Они выделяют достижения людей, которые сделали значимый шаг в развитие страны.

Подобные отличия помогают формировать положительный образ ответственного труда.

Помимо этого, они поощряют людей на дальнейшие успехи.

корпоративные награды на заказ

Официальное признание нередко усиливает доверие к человеку в коллективе.

Важно понимать, что почётный знак имеет глубокий смысл, а выражение благодарности.

Она поднимает ценность работы, который был выполнен награждённым.

Таким образом, государственные награды остаются ключевым инструментом поощрения в современном обществе.

EasyDrop считается востребованным онлайн-ресурсом для развлекательного открытия кейсов со скинами в CS2.

Многим пользователям нравится, что здесь понятная система управления, позволяющий спокойно ориентироваться к работе платформы.

На сайте доступно широкий выбор наборов, что добавляет увлекательности.

Создатели платформы стараются обновлять коллекции, чтобы пользователи видели свежие предметы.

https://pcpro100.info/pgs/promokod_easydrop_1.html

Многие отмечают, что EasyDrop приятен в эксплуатации благодаря структурированным разделам.

Также ценится то, что платформа дает несколько форматов активности, повышающие общую динамику работы.

Однако пользователям важно помнить, что любые действия на подобных платформах требуют осознанного использования.

В целом, EasyDrop воспринимается как развлекательный сервис, созданный для тех, кто интересуется игровой косметикой.

Наблюдение за серверами является ключевой задачей для гарантирования бесперебойной работы инфраструктуры.

Он позволяет обнаруживать сбои на первых шагах развития проблем.

Своевременное обнаружение проблем помогает предотвращать нарушений работы сервисов.

Сетевые администраторы осознают, что регулярный мониторинг повышает надежность систем.

Современные инструменты позволяют отслеживать состояние в реальном времени.

Мгновенные оповещения помогают оперативно устранять неполадки и минимизировать последствия.

Кроме того, контроль улучшает стабильность серверов и повышает эффективность.

Таким образом, регулярный мониторинг серверов — это необходимая мера для бесперебойной работы сервисов.

http://www.mhdvmobilu.cz/forum/index.php?topic=308.new#new

Овладение английским является ключевым навыком в современном мире.

Он даёт возможность расширять круг общения.

Многие специалисты понимают, что английский помогает в карьере.

Знание языка позволяет свободно путешествовать и способствует межкультурному общению.

http://forum.drustvogil-galad.si/index.php/topic,235664.new.html#new

Он также развивает когнитивные способности и укрепляет самостоятельность в различных ситуациях.

Учёба английского позволяет использовать глобальные ресурсы в науке, технике и бизнесе.

Регулярное изучение помогает достигать новых уровней и приносит успех.

Таким образом, знание английского языка является важным фактором успеха в личной и профессиональной жизни.

На данном ресурсе представлено множество полезных материалов.

Пользователи отмечают, что ресурс помогает быстро находить нужные сведения.

Контент постоянно пополняется, что делает сайт практичным для чтения.

Многие считают, что организация разделов интуитивно ясна и позволяет быстро ориентироваться.

Разнообразный контент делает ресурс полезным для широкой аудитории.

Также отмечается, что материалы написаны профессионально и понятны даже новичкам.

Сайт помогает получать новые сведения благодаря подробным статьям.

В целом, этот ресурс можно назвать полезной площадкой для всех пользователей.

https://koreavto.ru

Здесь представлено множество полезных материалов.

Пользователи отмечают, что ресурс удобен для поиска информации.

Контент постоянно пополняется, что делает сайт надёжным для использования.

Многие считают, что организация разделов интуитивно ясна и позволяет без труда находить нужное.

Широкий выбор материалов делает ресурс универсальным для широкой аудитории.

Также отмечается, что материалы оформлены аккуратно и читаются без труда.

Сайт помогает расширять знания благодаря подробным статьям.

В целом, этот ресурс можно назвать удобным местом для изучения важных тем для каждого посетителя.

https://koreavto.ru

Responsible gaming is essential for maintaining a healthy approach to entertainment.

It helps players remain focused and prevents unwanted risks.

By defining boundaries, individuals can enjoy gaming safely without overextending themselves.

Awareness one’s habits encourages smarter behavior during gameplay.

Reliable platforms often promote helpful options that assist users in staying protected.

Maintaining self-control ensures that gaming remains a rewarding activity.

For many players, responsible play helps maintain clarity while keeping the experience satisfying.

In the end, mindful habits supports long-term well-being and keeps gaming healthy.

cosmo slots

Перевозка товаров по Минску играет ключевую роль в функционировании города.

Этот сектор обеспечивает своевременную доставку продукции для компаний и частных клиентов.

Стабильная система доставки помогает минимизировать простои и поддерживать стабильность бизнеса.

Многие предприятия Минска зависят от регулярных перевозок, чтобы выполнять свои обязательства.

Перевозка холодильника

Современные компании используют разные виды транспорта, чтобы повышать качество доставки.

Регулярные грузоперевозки также обеспечивают снабжение в столице, создавая непрерывные поставки.

Для заказчиков важна оперативность доставки, что делает качественные перевозки приоритетом.

В итоге, грузоперевозки в Минске остаются важным звеном экономики и поддерживают рабочий ритм столицы.

На этом сайте представлено множество полезных материалов.

Пользователи отмечают, что ресурс помогает быстро находить нужные сведения.

Контент постоянно пополняется, что делает сайт практичным для использования.

Многие считают, что структура сайта хорошо продумана и позволяет быстро ориентироваться.

Большое разнообразие тем делает ресурс интересным для широкой аудитории.

Также отмечается, что материалы написаны профессионально и читаются без труда.

Сайт помогает углублять понимание различных тем благодаря детальным обзорам.

В итоге, этот ресурс можно назвать надёжным источником информации для всех пользователей.

https://koreavto.ru

Система IQOS представляет собой современное устройство для работы с нагреваемым табаком.

В отличие от обычных сигарет, здесь используется технология без горения.

Некоторые потребители отмечают, что такой формат отличается изменённым ароматом.

Устройство отличается простым управлением, что делает его удобным в разных ситуациях.

Современный дизайн позволяет IQOS выглядеть стильно.

Производитель уделяет внимание технической надёжности, что повышает комфорт эксплуатации.

Своевременная очистка помогает поддерживать стабильную работу устройства.

В итоге, IQOS остаётся современным устройством для тех, кто интересуется подобными технологиями.

https://terea777.shop/ussuriysk/catalog

Модель типа «раздеватор» — это алгоритм искусственного интеллекта, которая анализирует изображения.

Она применяет нейронные сети для изменения внешнего вида на снимках.

Принцип действия технологии основана на распознавании форм.

Подобные нейросети вызывают интерес в контексте современных цифровых технологий.

раздеть по фото

При этом важно учитывать этические вопросы и права человека.

Работа с подобными инструментами требует понимания возможных последствий.

Многие эксперты подчёркивают, что важно соблюдать нормы и правила.

Таким образом, нейросеть-раздеватор является одним из направлений развития нейросетей, который вызывает дискуссии.

Город Нижний Новгород является значимым городом в Приволжском регионе.

Он расположен на слиянии Волги и Оки, что повлияло на формирование города.

Город славится богатой историей.

Городская застройка сочетает старинные постройки и актуальные архитектурные решения.

Нижний Новгород новости каждый час

Здесь успешно формируется бизнес-инфраструктура.

Повседневная жизнь города отличается насыщенностью и множеством событий.

Нижний Новгород также является значимой точкой на карте страны.

В целом, Нижний Новгород представляет интерес для туристов и горожан.

Modern conversations about health are loud, fast, and often oversimplified.

Most suggestions aim to be broad, leaving personal differences unaddressed.

Individuals may feel disconnected from their own bodies and rhythms.

Yet the human body does not operate on averages or templates.

Thoughtful attention reveals patterns that checklists cannot.

It’s in this space that real insights about health emerge.

Podcasts create the perfect space for these conversations.

The focus remains on understanding the body as a connected whole.

Rather than telling you what to do, the conversation invites you to think.

If you are ready to look deeper into your own health patterns.

To experience conversations that respect individuality and nuance.

iMedix Medical Show.

Interested in meaningful conversations about well-being?

Engage with a calm, meaningful podcast episode on tadacip price.

Стильная одежда играет ключевую роль в создании первого впечатления.

Она помогает подчеркнуть индивидуальность и выглядеть гармонично.

Современный внешний вид влияет на то, как человека оценивают другие люди.

В повседневной жизни одежда может создавать ощущение собранности.

https://ai.cheap/read-blog/40900

Стильный образ облегчает социальные контакты.

При этом важно учитывать индивидуальные особенности и уместность ситуации.

Стиль дают возможность находить новые решения.

В итоге, умение стильно одеваться влияет на общее восприятие личности.

Умение стильно одеваться играет важную роль в самовыражении.

Она помогает выразить характер и выглядеть гармонично.

Современный внешний вид влияет на то, как человека воспринимают окружающие.

В повседневной жизни одежда может повышать самооценку.

https://naijamatta.com/read-blog/42131

Стильный образ облегчает социальные контакты.

При этом важно учитывать собственный вкус и контекст.

Современные тенденции дают возможность обновлять образ.

Таким образом, умение стильно одеваться помогает чувствовать себя уверенно.

Умение стильно одеваться играет значимую роль в создании первого впечатления.

Она помогает подчеркнуть индивидуальность и выглядеть гармонично.

Грамотно подобранный образ влияет на то, как человека видят в обществе.

В повседневной жизни одежда может повышать самооценку.

https://spaces.hightail.com/space/faPpCh7cyr/files/fi-e18fee7a-59ba-44ad-ad8e-8b67b42cac66/fv-db9b0d7c-f33b-4cbd-ba3e-f33712b3fcbf/LePodium%20RU%20-%20WhitePaper%20RU.pdf#pageThumbnail-1

Продуманный гардероб облегчает социальные контакты.

При этом важно учитывать личные предпочтения и уместность ситуации.

Мода дают возможность обновлять образ.

Таким образом, умение стильно одеваться помогает чувствовать себя уверенно.

Luxury watches continue to remain popular despite the rise of modern gadgets.

They are often seen as a sign of prestige and refined taste.

Skilled engineering plays a major role in their lasting value.

Many luxury watches are produced using high-quality materials.

https://mamadona.ru/blogs/promokody_kak_sdelat_shoping_eshyo_prijatnee_i_vygodnee/

They also represent a long tradition passed down through generations.

For collectors, these watches can serve as both functional accessories and valuable assets.

Timeless design allows them to stay relevant across changing fashion trends.

In the end, luxury watches continue to appeal to enthusiasts around the world.

На этом сайте представлены последние новости.

Пользователи могут сразу просматривать события со всего мира.

Контент обновляется регулярно, что обеспечивает актуальность информации.

Редакция сайта следят за точностью данных.

Сайт предлагает разнообразные новости для широкой аудитории.

https://telegra.ph/Novosibirsk-12-25-8

Информация подаётся коротко и понятно, чтобы посетители легко находили нужное.

Разделы сайта позволяют легко просматривать интересующие новости.

Таким образом, сайт обеспечивает быстрый доступ к информации для каждого посетителя.

Следить за актуальными новостями необходимо в быстро меняющейся реальности.

Это помогает лучше ориентироваться и делать осознанный выбор.

Свежие данные позволяют планировать действия.

https://rentry.co/4n3kfvkq

Информированность способствует расширению кругозора.

В профессиональной сфере это даёт возможность оставаться конкурентоспособным.

В итоге, умение быть в курсе событий помогает уверенно чувствовать себя.

Having a stylish appearance is essential for building confidence.

It helps show personal style and feel confident.

Well-chosen clothes affects social perception.

In daily life, clothing can increase self-assurance.

https://telegra.ph/Dior-12-25-3

Stylish outfits make social interactions easier.

It is important to consider unique style and the context of the event.

Current trends allow people to experiment with looks.

In conclusion, dressing stylishly helps feel confident.

Недропользование — это комплекс работ, связанный с разработкой подземных богатств.

Оно включает добычу минерального сырья и их дальнейшую переработку.

Недропользование регулируется нормативными актами, направленными на охрану окружающей среды.

Грамотный подход в недропользовании помогает сохранять ресурсы.

оэрн официальный сайт

Whether we pay attention or not, health lives at the core of how we exist.

Still, in a world overflowing with advice, it’s easy to lose true understanding.

Complex truths are replaced by quick formulas.

Understanding grows only when we make space for awareness.

What feels right for one person may be wrong for another.

Through this, we start to rebuild trust between body and mind.

Awareness turns the ordinary into something vivid.

By observing, we learn how health responds to time, stress, and emotion.

If you want to feel more connected to your own body.

To move with awareness instead of against it.

Patience over perfection.

Each step of awareness opens a new layer of understanding.

What feels like intuition is often grounded in clear biological patterns.

You might be wondering how all of this connects to priligy pills.

Северная столица является крупным культурным центром России.

Город расположен на берегах Невы и обладает богатым прошлым.

Архитектурный стиль сочетает классические постройки и актуальные районы.

Петербург славится музеями и разнообразием событий.

Городские набережные создают неповторимое настроение.

Путешественники приезжают сюда в разные сезоны, чтобы почувствовать дух города.

Санкт-Петербург также является важным экономическим центром.

В итоге, Санкт-Петербург остаётся одним из самых привлекательных городов.

https://leasedadspace.com/members/yebibaf720/

Стильная одежда имеет большое значение в самовыражении.

Она помогает подчеркнуть индивидуальность и выглядеть гармонично.

Аккуратный внешний вид влияет на восприятие окружающих.

В повседневной жизни одежда может придавать уверенность.

https://telegra.ph/Balenciaga-12-25

Продуманный гардероб облегчает деловое общение.

При выборе одежды важно учитывать собственный вкус и контекст.

Мода дают возможность находить новые решения.

Таким образом, умение стильно одеваться делает образ завершённым.

На этом сайте публикуются свежие новости.

Пользователи могут сразу просматривать новости из разных сфер.

Информация появляется ежедневно, что дает возможность следить за событиями.

Команда ресурса следят за точностью данных.

Ресурс предоставляет обширный выбор материалов для разных читателей.

https://telegra.ph/CHelyabinsk-12-25-6

Информация подаётся наглядно и доступно, чтобы пользователи оставались информированными.

Категории портала позволяют быстро находить интересующие новости.

Таким образом, сайт помогает оставаться в курсе событий для всех пользователей.

Health-related content has become part of everyday media.Still, deeper understanding often remains limited.Depth is reduced to maintain convenience.Critical details are easily lost.Uncertainty often replaces confidence.The challenge is structural, not personal.Physiological systems respond differently under similar conditions.Patterns offer context to symptoms.Attention allows patterns to become visible.Editorial discussion helps organize this complexity.Extended discussion allows ideas to unfold naturally.Listening becomes an active process.Consideration is prioritized over speed.Clarity is developed, not imposed.For those interested in nuanced discussion.To gain deeper context and insight into trichomoniasis sexual health.

Деятельность в области недропользования — это комплекс работ, связанный с изучением и использованием недр.

Оно включает добычу полезных ископаемых и их рациональное использование.

Данная сфера регулируется установленными правилами, направленными на охрану окружающей среды.

Эффективное управление в недропользовании обеспечивает устойчивое развитие.

оэрн

Стильная одежда является значимым фактором в самовыражении.

Она помогает подчеркнуть индивидуальность и чувствовать себя увереннее.

Грамотно подобранный образ влияет на восприятие окружающих.

В повседневной жизни одежда может помогать собранности.

https://telegra.ph/Gucci-01-12-10

Хорошо подобранная одежда облегчает деловые контакты.

При выборе вещей важно учитывать индивидуальные особенности и контекст.

Мода дают возможность обновлять образ.

В итоге, умение стильно одеваться помогает чувствовать себя увереннее.