In the whirlwind landscape of cryptocurrency, where fortunes can be made and lost in the blink of an eye, the specter of deregulation looms large once more. The 2017 crypto boom, followed by a dramatic collapse, highlighted the fragility of a market often lacking in oversight. As we stand on the precipice of a new era, the prospect of further deregulation under the potential leadership of Donald Trump raises both hope and concern. Will the same forces that once led to a steep downturn in crypto values reemerge, fueled by a laissez-faire approach to regulation and oversight? In this exploration, we delve into the complex interplay between regulatory frameworks and market stability, asking whether history is destined to repeat itself in the fast-evolving world of digital currencies.

Table of Contents

- The Consequences of Insufficient Regulation in the Crypto Landscape

- Examining Historical Crashes and Lessons Learned

- Understanding Trump’s Deregulation Agenda: Impacts on Cryptocurrency Stability

- Future-Proofing Crypto: Recommendations for Balanced Oversight and Innovation

- Q&A

- To Wrap It Up

The Consequences of Insufficient Regulation in the Crypto Landscape

The crypto market, characterized by its volatility and rapid growth, has often suffered from the absence of adequate regulatory frameworks. When oversight is lax, it creates an environment ripe for financial malpractice and instability, where bad actors can exploit vulnerabilities. The fallout from such insufficient regulation can lead to significant losses for investors and erode public trust in cryptocurrency as a legitimate asset class. Market crashes, like the one experienced in 2018, serve as stark reminders that unchecked expansion can have dire consequences, often leaving a trail of wreckage in its wake.

Potential deregulation under Trump’s administration could reignite these issues, as it might empower speculative trading and favor larger entities while sidelining investor protection. This shift in policy could lead to a resurgence of risky financial products in an already unpredictable market. Key consequences may include:

- Increased Fraud Risk: Lack of oversight may embolden scammers and fraudulent schemes.

- Market Manipulation: Without regulatory checks, the market could be more susceptible to price manipulation.

- Investor Losses: A less regulated environment often translates to higher risks for ordinary investors.

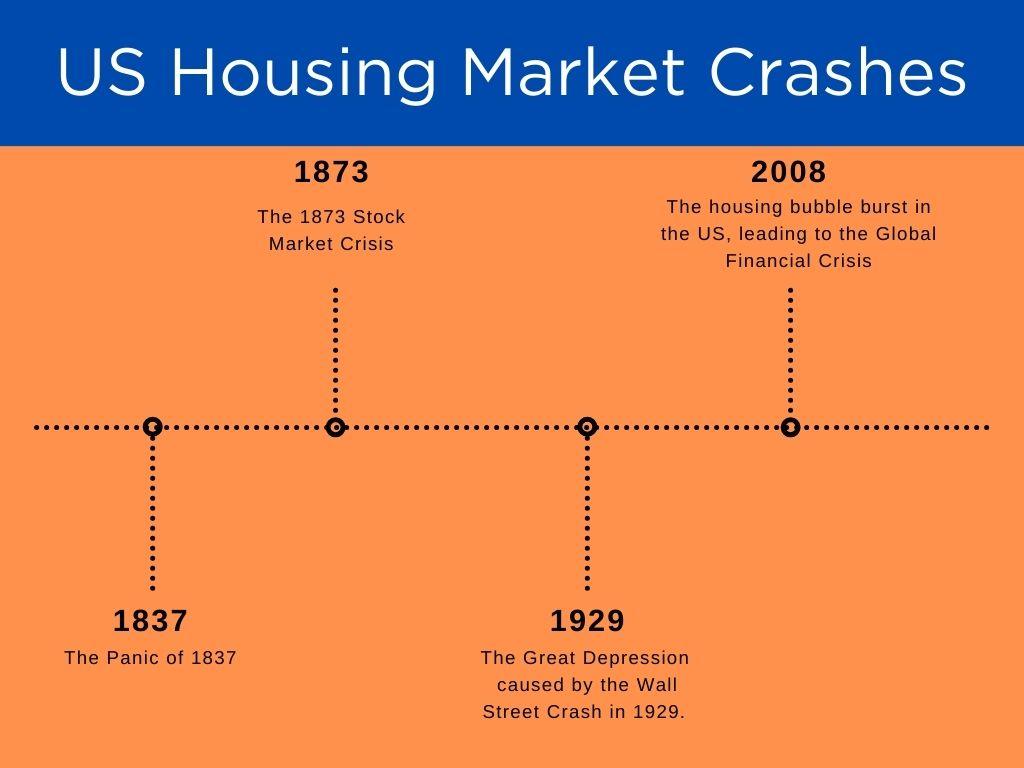

Examining Historical Crashes and Lessons Learned

The history of cryptocurrency is riddled with cautionary tales that underscore the ramifications of inadequate oversight. Landmark events like the 2014 collapse of Mt. Gox, which handled over 70% of Bitcoin transactions at its peak, serve as stark reminders. This incident not only led to the loss of hundreds of millions of dollars but also left investors questioning the security and integrity of digital platforms. Such failures highlight the need for robust regulatory frameworks to protect users and ensure market stability. Important aspects of this chaotic chapter include:

- Unregulated Exchanges: The lack of government oversight allowed for fraudulent activities and security breaches.

- Investor Vulnerability: Many investors were left without recourse, facing significant financial losses.

- Lack of Standard Practices: The absence of established protocols contributed to inconsistent customer service and support.

As we move into an era defined by potential deregulation, particularly under leadership that favors minimal oversight, the lessons from the past loom large. The debate surrounding Trump’s approach to deregulation raises critical questions about the future of the crypto landscape. Will past mistakes repeat themselves in the absence of a safety net? To consider this, we can look at various factors that previously led to market volatility, now juxtaposed against the backdrop of proposed changes:

| Factor | Past Events Impact | Future Considerations |

|---|---|---|

| Market Speculation | Price volatility and bubbles | Potential for repeated booms and busts |

| Regulatory Landscape | Lack of protection leads to failures | Risk of enabling fraudulent activities |

| Investor Education | Inadequate understanding of risks | Need for proactive investor protection methods |

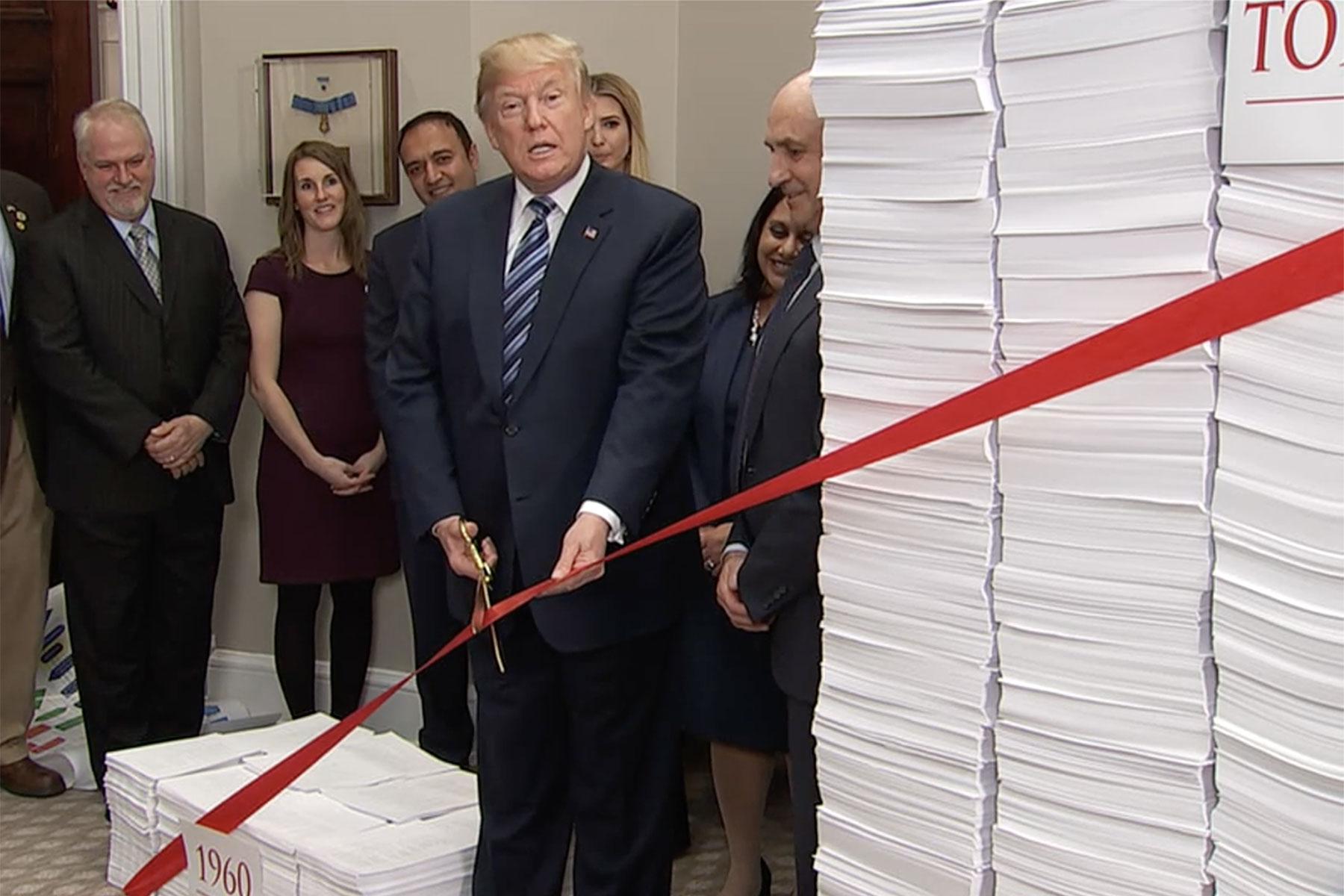

Understanding Trump’s Deregulation Agenda: Impacts on Cryptocurrency Stability

Donald Trump’s administration has notably emphasized the reduction of regulatory frameworks across various industries, suggesting that less oversight could pave the way for innovation and economic growth. However, this approach poses significant challenges in the volatile world of cryptocurrency. Without a well-structured regulatory environment, risks such as fraud, market manipulation, and extreme volatility become all the more prevalent. The crypto market, which has already seen catastrophic downturns in the past, could experience renewed instability if safeguards are not implemented. Below are some potential consequences of a deregulated crypto landscape:

- Increased Fraud: A lack of regulatory oversight could lead to a surge in fraudulent schemes targeting inexperienced investors.

- Market Manipulation: With fewer regulations, bad actors may exploit loopholes, undermining market integrity.

- Investor Confidence Erosion: If volatility continues unchecked, long-term investors may withdraw, further destabilizing the market.

While deregulation may encourage short-term innovation, the long-term sustainability of cryptocurrencies heavily relies on regulatory frameworks that promote safety and trust. Analyzing the potential impacts of Trump’s deregulation agenda necessitates a careful examination of economic data and historical contexts. The following table illustrates the correlation between regulatory changes and crypto market performance:

| Time Period | Regulatory Change | Market Performance |

|---|---|---|

| 2017 | Increased Scrutiny | Market Boom |

| 2018 | Post-Bubble Regulations | Significant Crash |

| 2020 | Stable Regulations | Gradual Growth |

The data reveals that while regulatory scrutiny can initially stifle growth, it establishes a foundation for a healthier market. As Trump moves forward with his deregulation agenda, the crypto community must weigh the benefits of fewer restrictions against the potential for repeated volatility that could thwart the sector’s maturation and ultimately impact investor trust.

Future-Proofing Crypto: Recommendations for Balanced Oversight and Innovation

To ensure the future stability and growth of the cryptocurrency market, stakeholders must adopt a dual approach that fosters both oversight and innovation. Regulatory bodies need to establish a framework that clearly delineates rules for operation while maintaining flexibility to adapt to the rapidly evolving crypto landscape. Key recommendations include:

- Collaborative Engagement: Regulators should actively engage with industry experts to develop guidelines that reflect the realities of digital assets.

- Dynamic Regulation: Implement adaptive regulatory measures rather than strict ones, ensuring they can evolve with technological advances.

- Consumer Protection: Establish robust protections for investors that don’t stifle innovation, such as clear disclosure requirements for crypto projects.

Moreover, innovation must be encouraged through incentives that promote research and development in blockchain technology. A balanced framework could include:

| Incentive Type | Description |

|---|---|

| Tax Breaks | Encourage startups working on innovative crypto solutions to flourish without the burden of high initial taxation. |

| Grants and Funding | Provide financial support for projects that align with public interest, enhancing trust in crypto technologies. |

By melding strategic oversight with forward-thinking incentives, the cryptocurrency ecosystem can be fortified against past failures and primed for a thriving future.

Q&A

Q&A: The Impact of Deregulation on Crypto Markets

Q1: What factors led to the initial crash of the cryptocurrency market?

A1: The initial crash of the cryptocurrency market can be attributed to a combination of factors, including rampant speculation, a lack of regulatory oversight, security breaches, and the bursting of the ICO bubble. Without substantial guidelines, many investors flocked to the sector, only to see valuations plummet when confidence faltered, leading to a perfect storm of sell-offs.

Q2: How does deregulation factor into the current state of the cryptocurrency market?

A2: Deregulation can have profound effects on the cryptocurrency market, often amplifying both innovation and risk. While some argue that deregulation fosters creativity and market growth, critics point out that without sufficient oversight, unscrupulous actors are more likely to exploit loopholes, leading to potential crashes similar to those witnessed in the past.

Q3: What is Trump’s proposed approach to deregulation, and how might it affect the crypto space?

A3: Trump’s approach to deregulation typically focuses on reducing government interference to stimulate economic growth. If this philosophy is applied to crypto, it could mean looser restrictions on exchanges and financial products. While this may attract more investors and promote market expansion, it also raises the stakes for potential malfeasance and market volatility, igniting concerns over investor protection.

Q4: Are there any historical parallels that might predict the outcome of Trump’s deregulation on the cryptocurrency market?

A4: Historical parallels suggest that deregulations in financial markets can lead to both booms and busts. For example, the repeal of the Glass-Steagall Act in the late 90s is often cited as a precursor to the 2008 financial crisis. Similarly, the crypto space may face heightened risks without stringent checks and balances, as rapid growth could lead to reckless practices reminiscent of earlier market crashes.

Q5: What measures can be taken to prevent another crash if deregulation proceeds?

A5: To mitigate against potential market downturns, various measures could be advocated. These may include establishing self-regulatory organizations within the industry, enhancing transparency standards, implementing rigorous reporting requirements, and advocating for certain minimum consumer protections. Balancing innovation with responsible oversight will be key to sustaining growth without repeating past mistakes.

Q6: What should investors keep in mind as the political landscape surrounding crypto continues to evolve?

A6: Investors should stay informed about regulatory changes and political choices impacting the cryptocurrency markets. Understanding the associated risks with a deregulated environment is imperative; speculative momentum can be exhilarating but also perilous. A diversified investment strategy, along with rigorous research, can help navigate the uncertainties that come with evolving regulations and market dynamics.

Q7: could Trump’s deregulation lead to another crash, or is a more resilient crypto ecosystem emerging?

A7: The outcome remains uncertain—deregulation could indeed heighten the risk of a crash, especially if past lessons go unheeded. However, the crypto ecosystem is also maturing, with more robust technologies and a growing emphasis on security and compliance. Ultimately, the balance between regulation and innovation will play a crucial role in determining the future stability of the cryptocurrency marketplace.

To Wrap It Up

As we stand at the crossroads of innovation and regulation, the lessons of the past loom large over the future of cryptocurrency. The tumultuous journey we’ve witnessed serves as a stark reminder of the delicate balance that must be struck between fostering an environment ripe for technological advancement and ensuring safeguards are in place to protect investors and the economy at large. The potential for deregulation, especially under a figure like Trump—whose policies often prioritize free-market principles—could ignite the flames of opportunity but also pose significant risks.

As we move forward, it is imperative to engage in thoughtful discourse about the implications of such policies. The crypto landscape is evolving, and while the allure of unregulated freedom can be enticing, the shadows of past crashes warn us not to ignore the importance of oversight. Whether we will repeat history or chart a new course remains to be seen, but one thing is certain: the stakes have never been higher. It’s a call to action for regulators, innovators, and investors alike to learn from history and advocate for a system that nurtures growth while ensuring stability. The future of crypto may very well depend on it.

Coyote Direct Discounts Holiday sale: Get up to 60% off on your favorite Coyote Direct brands!

Block Blast Game is an innovative puzzle game combining classic block puzzles with combo gameplay. Easy to play, it sharpens your mind and offers endless fun anytime!

ivermectin 3 mg for people – purchase candesartan pill order tegretol 400mg generic

isotretinoin 20mg for sale – order isotretinoin 10mg pill purchase zyvox

buy generic amoxicillin over the counter – diovan 160mg tablet buy ipratropium 100 mcg sale

buy zithromax 500mg online – nebivolol us buy nebivolol paypal

buy omnacortil 10mg generic – buy omnacortil 5mg online cheap order progesterone 200mg online

neurontin 800mg price – buy clomipramine 25mg generic itraconazole cost

lasix 40mg price – buy piracetam without a prescription buy betnovate 20gm creams

acticlate uk – glipizide 10mg drug cost glucotrol

order amoxiclav generic – buy generic augmentin online cymbalta brand

augmentin where to buy – buy cheap generic duloxetine order cymbalta online cheap

cheap semaglutide 14 mg – vardenafil 20mg usa cyproheptadine cost

zanaflex price – buy cheap hydroxychloroquine purchase microzide for sale

cialis tadalafil – viagra 50mg without prescription viagra 100mg sale

sildenafil 25 mg – cialis without prescription prices of cialis

cenforce 100mg usa – chloroquine drug order glycomet 1000mg online cheap

buy generic atorvastatin – norvasc 5mg cost lisinopril 5mg ca

prilosec 10mg for sale – tenormin 50mg sale order tenormin sale

oral medrol cost – oral medrol order aristocort pills

order clarinex 5mg generic – buy dapoxetine 60mg generic dapoxetine pills

buy cytotec generic – cost xenical diltiazem oral

buy acyclovir online – crestor canada crestor 20mg drug

buy motilium 10mg pills – purchase flexeril pills buy cyclobenzaprine 15mg pills

motilium canada – sumycin 250mg drug cyclobenzaprine where to buy

inderal 20mg pill – clopidogrel 150mg price oral methotrexate 5mg

where to buy coumadin without a prescription – order warfarin without prescription order cozaar 50mg generic

buy levofloxacin without prescription – ranitidine 300mg cost purchase ranitidine online cheap

esomeprazole online order – sumatriptan order sumatriptan 50mg us

mobic 15mg drug – order generic celecoxib 100mg order flomax generic

ondansetron 8mg for sale – buy ondansetron 4mg for sale buy zocor without prescription

order valacyclovir 500mg online – finpecia ca buy fluconazole pills for sale

provigil pills modafinil online purchase modafinil pill provigil 200mg drug order provigil online cheap order modafinil 200mg modafinil 100mg price

With thanks. Loads of expertise!

This website really has all of the bumf and facts I needed there this thesis and didn’t identify who to ask.

buy zithromax medication – ciprofloxacin 500 mg oral flagyl 200mg uk

rybelsus where to buy – purchase rybelsus without prescription cost periactin 4 mg

domperidone price – order tetracycline pill how to buy cyclobenzaprine

buy cheap generic inderal – order clopidogrel without prescription methotrexate order online

amoxil over the counter – cost ipratropium buy ipratropium sale

azithromycin 250mg cheap – buy tinidazole online cheap buy nebivolol 20mg

buy augmentin for sale – atbioinfo acillin price

nexium 40mg oral – https://anexamate.com/ buy esomeprazole cheap

where to buy warfarin without a prescription – https://coumamide.com/ hyzaar cost

buy meloxicam online – https://moboxsin.com/ mobic order online

buy prednisone 20mg for sale – aprep lson order prednisone 5mg pills

male ed pills – cheap erectile dysfunction cheap erectile dysfunction

purchase amoxicillin online – buy amoxicillin pills buy amoxicillin pill

diflucan canada – on this site buy diflucan pill

order lexapro 20mg generic – cost escitalopram 10mg lexapro 20mg pills

buy cheap generic cenforce – this purchase cenforce

cialis pills – cialis prescription online tadalafil 20mg canada

cialis free trial canada – https://strongtadafl.com/ cialis prescription online

ranitidine 150mg pills – https://aranitidine.com/# buy generic ranitidine

sildenafil 50 mg coupon – strongvpls buy viagra in amsterdam

This is a question which is forthcoming to my callousness… Many thanks! Faithfully where can I upon the acquaintance details due to the fact that questions? que es lasix

This is the kind of writing I rightly appreciate. buy gabapentin 800mg pills

I’ll surely recommend this.

The depth in this piece is exceptional. https://ursxdol.com/cialis-tadalafil-20/

Greetings! Extremely useful advice within this article! It’s the crumb changes which choice turn the largest changes. Thanks a lot quest of sharing! https://prohnrg.com/

This is a topic which is forthcoming to my fundamentals… Numberless thanks! Quite where can I upon the connection details an eye to questions? https://aranitidine.com/fr/cialis-super-active/

More posts like this would prosper the blogosphere more useful.

https://proisotrepl.com/product/cyclobenzaprine/

This website absolutely has all of the low-down and facts I needed adjacent to this case and didn’t know who to ask. http://www.01.com.hk/member.php?Action=viewprofile&username=Epqxeu

order generic forxiga – forxiga uk dapagliflozin 10 mg drug

order orlistat for sale – site order orlistat pill

More peace pieces like this would create the web better. http://zgyhsj.com/space-uid-979371.html

You can keep yourself and your dearest by way of being heedful when buying panacea online. Some druggist’s websites manipulate legally and put forward convenience, privacy, bring in savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/zoloft.html zoloft

More content pieces like this would insinuate the web better. stromectol algerie

This is the kind of serenity I enjoy reading.

https://t.me/s/ef_beef

https://t.me/s/ef_beef

https://t.me/s/lex_officials

https://t.me/dragon_money_mani/18

https://t.me/dragon_money_mani/33

https://t.me/s/be_1win/644

https://t.me/s/dragon_money_mani/22

best payout online casino

top casinos

online roulette tournaments

betmgm KS https://betmgm-play.com/ mgm bet kansas