[ad_1]

Within the ever-evolving crypto area, stability is a coveted advantage, and stablecoins have performed a pivotal position over the previous. But, a storm might be brewing, casting a shadow of uncertainty over the whole crypto market.

Techteryx Takes Full Cost Over TUSD

At present, the official Twitter account of TUSD an introduced that, “efficient July 13, 2023, the ultimate stage of TUSD’s worldwide transition will start and Techteryx will assume full administration of all offshore operations and providers associated to TUSD, together with minting and redemptions […] Plus buyer onboarding and compliance, in addition to fiat reserve and supervision of all banking and fiduciary relationships.”

1/🗣️#TrueUSD Announcement:

In December 2020, TrueCoin, LLC (a subsidiary of Archblock, Inc.) transferred the enterprise possession of TrueUSD (“TUSD”) to Techteryx, an Asia-based consortium.

— TrueUSD (@tusdio) July 14, 2023

The completion of this switch of energy, coupled with the dearth of transparency and data surrounding Techteryx, are elevating pink flags, because the famend analysis agency Kaiko said yesterday:

Whereas Circle has made enormous efforts to enhance USDC transparency (and even Tether has made some efforts over the previous 12 months), the comparatively unknown TUSD is right this moment posing the most important danger, providing the least details about its reserves or company construction.

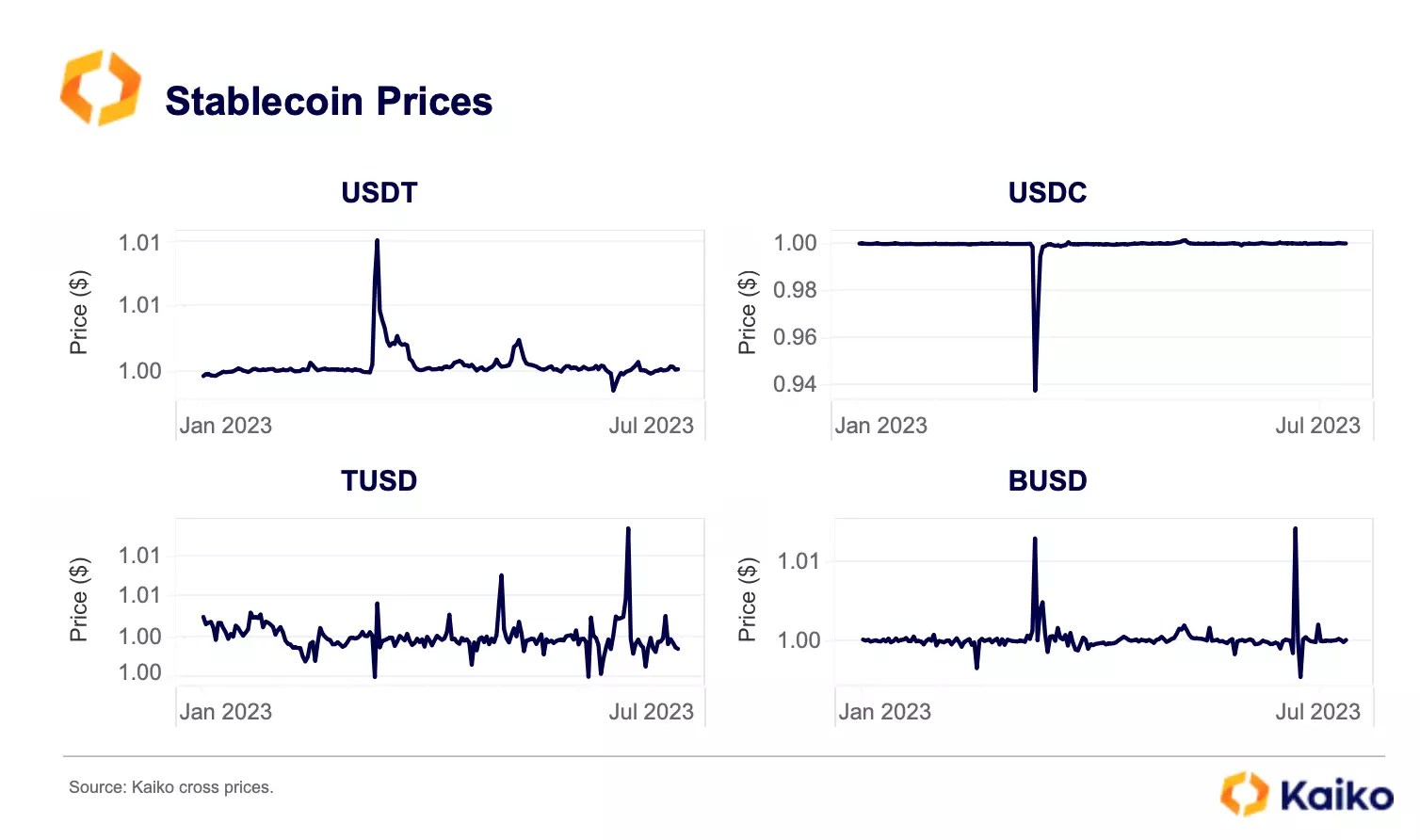

As stablecoins are systemically vital in crypto markets, any disturbance of their peg or instability can set off mass market contagion. The volatility of stablecoins corresponding to TUSD, USDT, BUSD, and USDC has despatched shockwaves by means of the crypto ecosystem in 2023.

Dangers For The Crypto Market

Nevertheless, TUSD’s offshore transition amplifies the magnitude of this danger, particularly with reference to the rising market share attributable to Binance. “Whereas TUSD just isn’t but a systemically vital stablecoin, Binance is an especially influential trade, so any exercise on it ought to be scrutinized,” says Kaiko.

The dearth of readability surrounding TUSD’s reserves and company construction provides to the already mounting considerations. Kaiko warns, “Whereas upcoming regulation within the European area places stress on stablecoins to scrub up their governance, there may be nonetheless a protracted technique to go.” The European Banking Authority’s name for stablecoin issuers to adjust to the upcoming MiCA regulation additional underscores the urgency to deal with these transparency points.

Tether’s market share has lengthy been unmatched. Nevertheless, the sudden rise of TUSD has shaken the established order. Inside a brief span of three months, TUSD’s market share climbed from lower than 1% to a staggering 19%. Binance’s assist, notably by means of its zero-fee BTC-TUSD pair, performed a pivotal position on this meteoric ascent.

Nonetheless, the sudden prominence of TUSD raises a crucial query: What are the dangers for the crypto market related to a stablecoin that lacks transparency?

Remarkably, the considerations about TUSD usually are not new. As Bitcoinist reported, TUSD noticed a wave of criticism attributable to doubts about its stability following considerations over its custodian, PrimeTrust. Adam Cochran, a accomplice at Cinneamhain Ventures, identified a number of pink flags surrounding TrueUSD.

Amongst them: The auditor accountable for certifying Prime Belief’s USD audits is identical particular person concerned within the FTX scandal. TUSD’s chain oracle, which verifies reserves, consists of solely 17 nodes from a single supply.

Crypto Market Rallies

With Ripple’s victory towards the SEC, the general crypto market cap has surged, with yearly highs persevering with to behave as upside resistance.

Featured picture from Daniel Lerman / Unsplash, chart from TradingView.com

[ad_2]

https://t.me/iGaming_live/4869

В лабиринте азарта, где любой площадка норовит привлечь обещаниями легких выигрышей, рейтинг казино рф

превращается именно той ориентиром, что направляет через дебри рисков. Для ветеранов и новичков, кто устал от ложных обещаний, это средство, дабы увидеть подлинную выплату, будто ощущение золотой монеты у пальцах. Без пустой болтовни, просто реальные площадки, где отдача не лишь цифра, а реальная удача.Составлено по гугловых запросов, словно ловушка, что захватывает наиболее свежие тенденции в интернете. Тут минуя роли про шаблонных приёмов, любой пункт как ставка у столе, в котором обман проявляется мгновенно. Хайроллеры знают: на стране тон письма с сарказмом, в котором ирония скрывается словно рекомендацию, помогает обойти рисков.На https://www.don8play.ru данный список лежит как раскрытая колода, готовый на игре. Зайди, если хочешь ощутить биение настоящей игры, минуя мифов да провалов. Для что знает вес приза, это словно держать ставку на пальцах, вместо смотреть в экран.