[ad_1]

The current drop in Bitcoin’s value to $29,200 has sparked vital liquidations, with the market witnessing practically $50 million in realized losses, most coming from short-term holders.

The habits of long-term holders (LTH) and short-term holders (STH) is essential to understanding market dynamics. LTHs are those that have held their Bitcoin for greater than 155 days, whereas STHs have held their Bitcoin for lower than this era. The actions of those two teams can present priceless insights into market sentiment and potential future actions.

LTHs are thought of buyers with a excessive conviction in Bitcoin’s long-term worth and are much less more likely to promote their cash in response to short-term market fluctuations. Alternatively, STHs are usually extra attentive to short-term value actions and market information. They’re extra doubtless to purchase throughout market upswings and promote throughout downturns, contributing to market volatility. A rise within the proportion of Bitcoin held by short-term holders can typically sign elevated speculative exercise and may generally precede elevated value volatility.

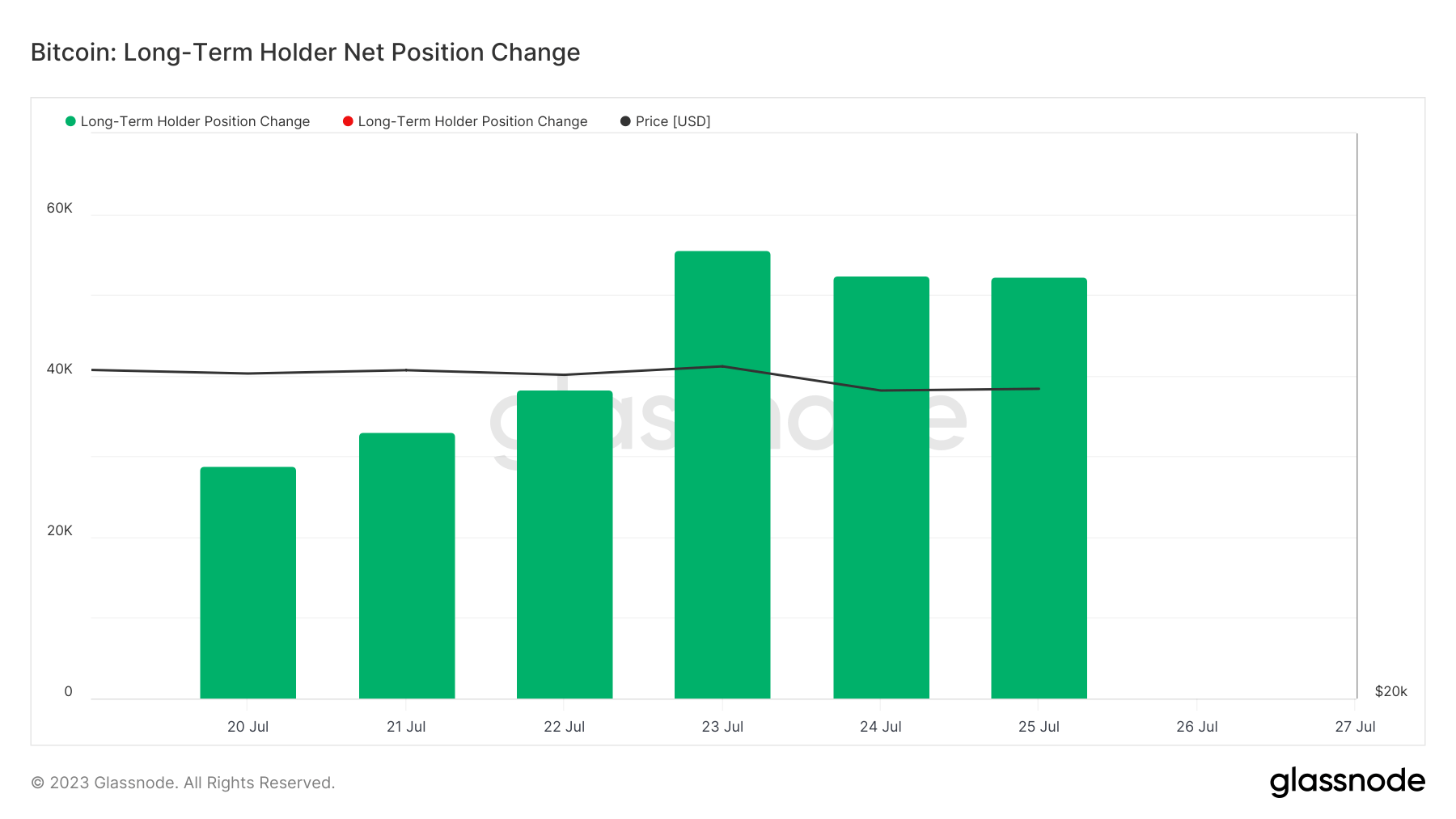

Regardless of the current value volatility and elevated realized losses, information from on-chain analytics agency Glassnode signifies that LTHs seem to carry sturdy. There was little change within the provide of Bitcoin held by this group, suggesting resilience within the face of the present value droop.

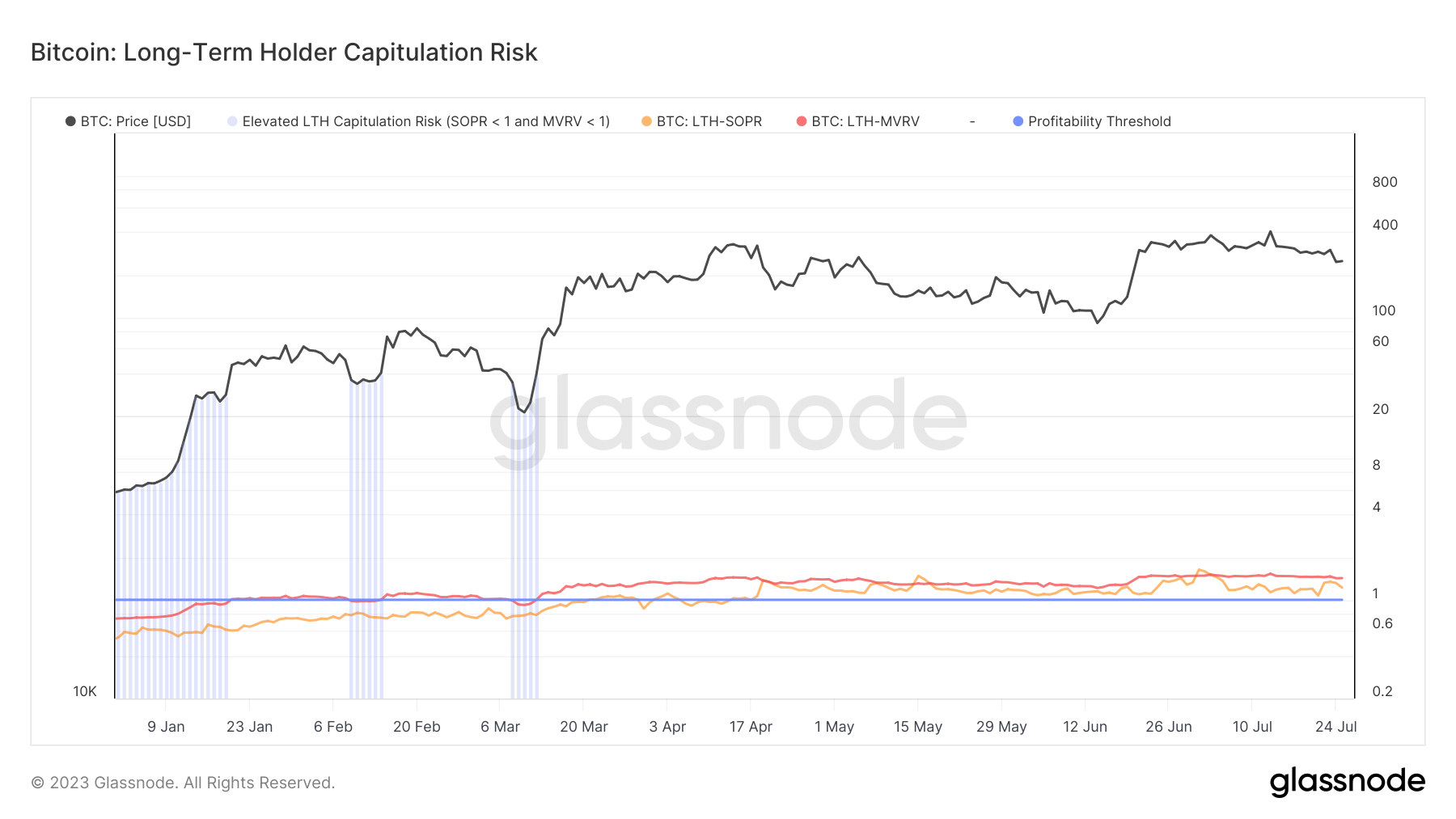

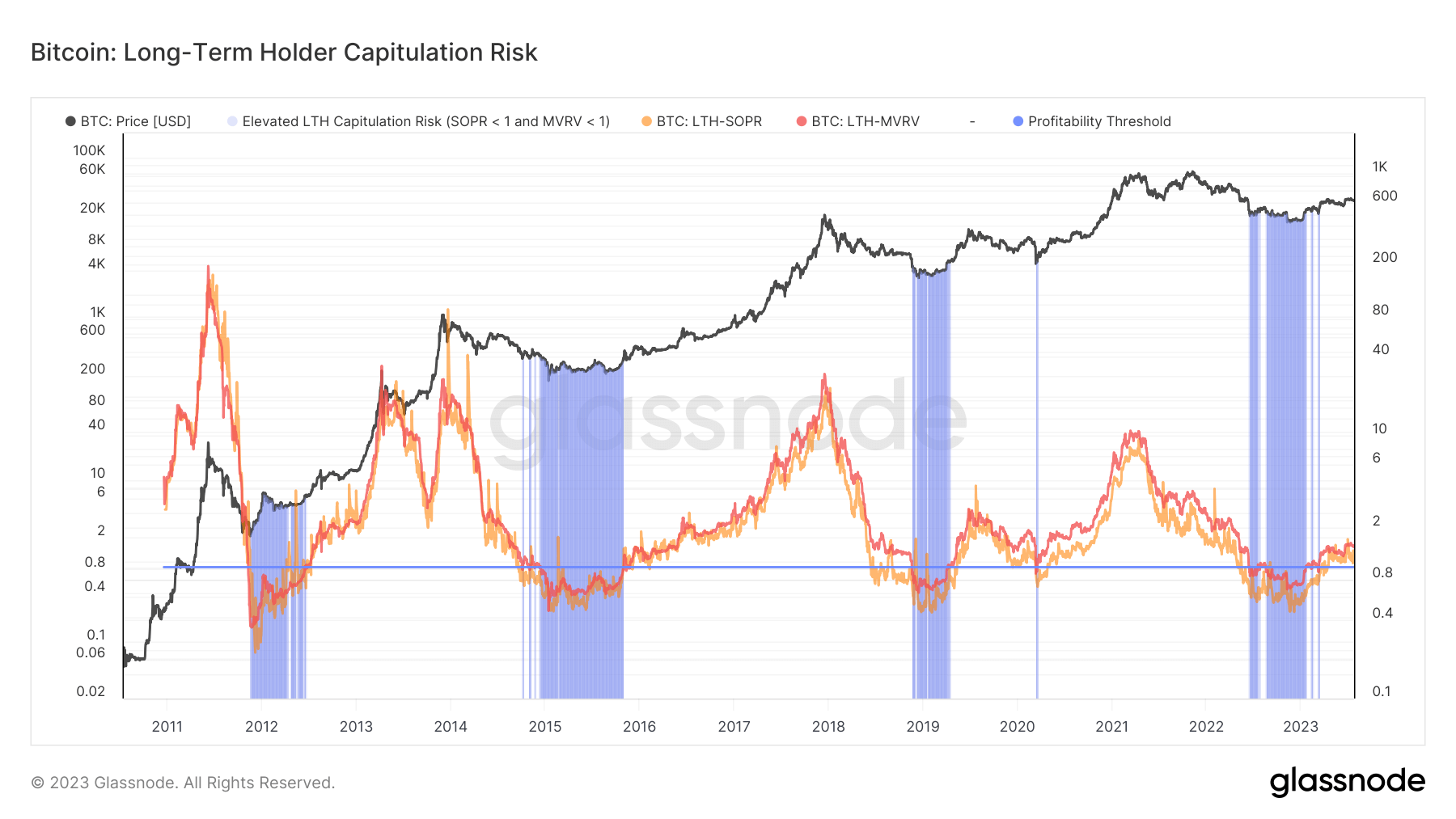

The LTH Capitulation Danger, a metric that identifies intervals of elevated stress on long-term Bitcoin buyers, signifies little hazard of those holders promoting off their BTC holdings.

This metric amalgamates two indicators: the LTH-MVRV, representing the unrealized revenue or lack of long-term holders, and the LTH-SOPR, indicating the realized revenue or lack of the identical group. Traditionally, intervals of elevated capitulation threat have correlated with Bitcoin’s value dips, however at the moment, this threat seems to be low.

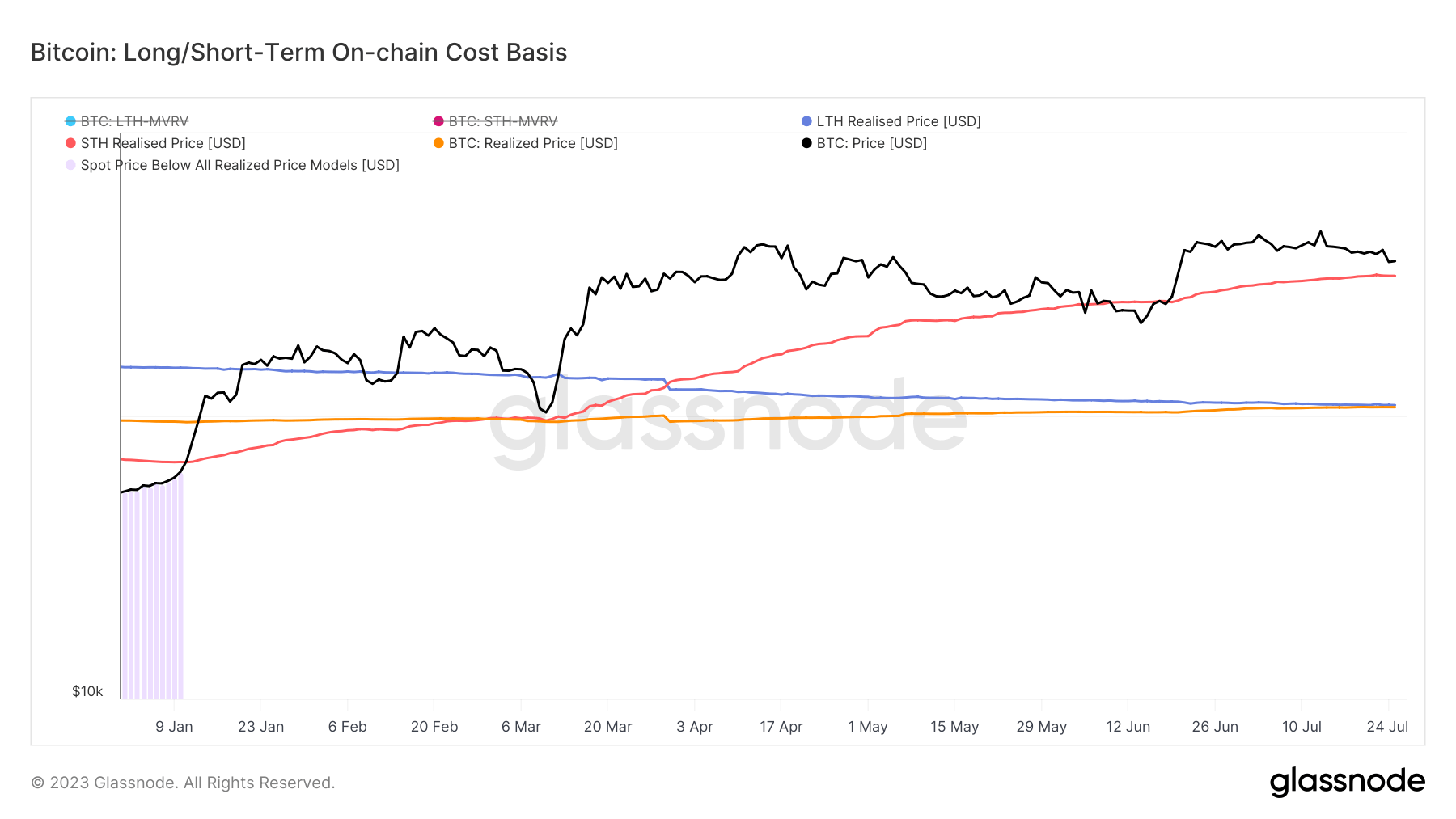

Additional, the realized value, which displays the mixture value at which every coin was final spent on-chain, at the moment stands at $20,540, whereas Bitcoin’s spot value stood at $29,200 at press time. This means a major buffer earlier than Bitcoin’s value drops beneath the acquisition value of long-term holders.

In distinction, the realized value for short-term holders is $28,200, indicating an elevated threat of STH sell-offs. It’s because the spot value is dangerously near the common acquisition value for this group, and an extra dip might set off extra liquidations.

Regardless of Bitcoin’s current value dip and the following market turbulence, long-term holders seem like weathering the storm. Their holding habits and the present metrics recommend a decrease threat of sell-offs from this group. Nonetheless, the state of affairs for short-term holders is extra precarious, and additional value dips might result in elevated sell-offs.

The submit Lengthy-term holders appear unfazed by Bitcoin’s dip to $29K appeared first on CryptoSlate.

[ad_2]

https://t.me/s/ef_beef