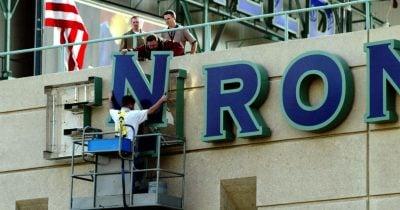

In an era where the lines between innovation and intrigue blur, the world of cryptocurrency continues to captivate the imagination of investors and spectators alike. Recently, an unexpected player has emerged on the horizon, sending ripples through the digital landscape: Enron. The infamous energy corporation, once synonymous with scandal and corporate collapse, appears to have dropped hints that they may be eyeing a foray into the crypto space. As social media buzzes with speculation and excitement, the question looms large—could the echoes of Enron’s storied past signal a new chapter in the blockchain narrative? In this article, we explore the implications of such a move, the reactions from the crypto community, and what it might mean for both Enron’s legacy and the broader world of digital currencies.

Table of Contents

- Emerging Trends: Enrons Surprising Nod to Cryptocurrency

- Analyzing the Implications of Corporate Stunts in the Crypto Sphere

- Navigating the Risks and Opportunities of Enrons Potential Crypto Venture

- Informed Participation: Recommendations for Investors in the Evolving Crypto Landscape

- Q&A

- Closing Remarks

Emerging Trends: Enrons Surprising Nod to Cryptocurrency

In an unexpected twist, the legacy of Enron seems to be hinting at a potential entry into the cryptocurrency arena. This twist has ignited discussions across social media platforms, creating a wave of speculation among enthusiasts and skeptics alike. The recent wave of memes and cryptic posts attributed to Enron’s presence online suggest a deliberate PR maneuver to engage a younger, tech-savvy demographic. As traditional finance wrestles with the growing popularity of blockchain technology, the once-embattled energy company appears keen on revitalizing its image by embracing the innovative potential that crypto offers.

Industry insiders are already speculating about the implications of such a move. Could this be an early stage marketing ploy, or is Enron truly preparing to launch a cryptocurrency initiative? The conversation has shifted towards the possible advantages of Enron’s involvement, including:

- Enhanced Legitimacy: Aligning with a disruptive technology may help to redefine the company’s image.

- Market Innovation: Infusing capital into crypto-focused projects could drive technological advancements.

- Community Engagement: Deepening ties with a younger audience through social media and innovative financial solutions.

| Potential Pros | Potential Cons |

|---|---|

| Reinvigorated brand perception | Distraction from core business |

| Access to new funding sources | Regulatory scrutiny |

| Opportunities for innovation | Market volatility risks |

Analyzing the Implications of Corporate Stunts in the Crypto Sphere

In the ever-evolving landscape of cryptocurrency, corporate stunts often serve as a litmus test for public sentiment and market reaction. Enron’s recent cryptic social media hints have sparked both intrigue and skepticism, drawing attention to the larger implications of such actions within the crypto sphere. With faltering reputations and pioneering aspirations, companies like Enron face the dual challenge of navigating public trust while exploring new financial avenues. As industry players scrutinize these messages, the potential motivations behind them raise critical questions about credibility and market influence.

The communication strategy employed by Enron can be seen as a calculated attempt to re-engage with a tech-savvy audience. This stunt may signal an overarching trend of established companies attempting to position themselves within the digital currency conversation, tapping into a skeptical yet curious market. Factors contributing to this phenomenon include:

- The resurgence of interest in cryptocurrencies and decentralized finance (DeFi)

- Utilization of social media as a powerful marketing tool

- Heightened competition within the financial industry to innovate

| Company | Past Reputation | Possible Crypto Strategy |

|---|---|---|

| Enron | Infamous | Tech Integration |

| Blockbuster | Defunct | Revive Through NFTs |

| Nokia | Restructured | Blockchain Devices |

Navigating the Risks and Opportunities of Enrons Potential Crypto Venture

The possibility of Enron stepping into the crypto arena presents a complex landscape filled with both potential and pitfalls. On one hand, the allure of blockchain technology and decentralized finance offers Enron a chance to reinvent its reputation and tap into a burgeoning market. The company could explore various avenues, such as launching its own cryptocurrency or investing in blockchain projects, thereby diversifying its portfolio and attracting a new generation of investors. However, with such opportunities come significant risks, including regulatory scrutiny and the volatile nature of cryptocurrencies, which could impact their financial stability and public perception.

As Enron navigates these waters, a few key factors will likely determine the success of any crypto endeavor:

- Regulatory Compliance: Ensuring alignment with global regulations to avoid past pitfalls.

- Market Volatility: Developing strategies to mitigate risks associated with cryptocurrency price fluctuations.

- Transparency and Trust: Building systems that prioritize transparency to regain investor trust.

- Innovation: Staying ahead of trends and adopting cutting-edge technology to maintain a competitive edge.

| Opportunities | Risks |

|---|---|

| Diversification of assets | Regulatory challenges |

| Access to a new investor demographic | Market instability |

| Innovation through blockchain solutions | Reputation risk |

Informed Participation: Recommendations for Investors in the Evolving Crypto Landscape

As the crypto landscape continues to evolve, it’s essential for investors to stay informed and proactive. Engaging with reliable sources of information and participating in community discussions can help in understanding the market dynamics better. Some key strategies include:

- Research Thoroughly: Exposure to new players and trends such as Enron’s hinted entry necessitates comprehensive due diligence.

- Diversify Investments: Given the volatility in the crypto space, diversifying across different assets can mitigate risks.

- Follow Regulatory Changes: Keep abreast of regulatory frameworks in your jurisdiction as they can significantly impact investment viability.

Moreover, leveraging insights from market analysts and favored platforms can provide a competitive edge. Staying engaged in forums and following thought leaders can also enhance decision-making. The following table summarizes some recommended platforms for real-time analysis:

| Platform | Type | Notable Features |

|---|---|---|

| CoinMarketCap | Market Data | Price Tracking, Portfolio Management |

| Decrypt | News & Analysis | In-Depth Articles, Interviews |

| TradingView | Charting Tools | Custom Indicators, Community Scripts |

Q&A

Q&A: New Social Media Stunt in Crypto – Did Enron Just Hint at Joining the Crypto Space?

Q: What sparked the recent speculation about Enron’s potential entry into the crypto space?

A: The speculation began with a series of cryptic posts on social media accounts associated with Enron’s legacy. The posts featured references to blockchain technology, cryptocurrency trends, and even a memetic nod to the concept of decentralized finance (DeFi). While it could easily be dismissed as a marketing gimmick, the timing and content of these posts have caught the attention of both crypto enthusiasts and the financial community, igniting discussions about possible strategies for a modern rebranding.

Q: Is Enron actually considering jumping into the cryptocurrency market?

A: As of now, there has been no official confirmation from Enron or its current stakeholders about any plans to enter the cryptocurrency market. The company, which famously collapsed in the early 2000s due to financial malpractices, has been largely dormant in the public eye. The recent social media activity seems more like a publicity stunt or an attempt to engage with a new audience rather than a concrete move towards adopting cryptocurrency.

Q: How does this tie into current trends in the cryptocurrency space?

A: The cryptocurrency market is experiencing a surge in interest from traditional companies looking to modernize or rebrand themselves. This includes fintech firms, major retailers, and even legacy businesses exploring ways to incorporate blockchain technology. Enron’s flirtation with these concepts, albeit tenuous, reflects a broader trend of established brands investigating the potential of crypto to innovate and revitalize their image.

Q: What are the implications of a former company like Enron getting involved in crypto?

A: If a company with Enron’s history were to enter the crypto space, it would raise eyebrows and spark debate about credibility and regulatory oversight. On one hand, it could bring a significant amount of attention to the industry, highlighting the potential for disruption. On the other hand, it could lead to concerns about governance, transparency, and ethical considerations, given Enron’s troubled past. The notion of a reformed Enron embracing crypto may push conversations about accountability in emerging financial technologies.

Q: Should investors take these social media posts seriously?

A: While the posts are intriguing and could fuel speculation, investors should approach them with caution. Social media stunts can often be designed for exposure or engagement rather than genuine corporate strategy. Without clear, actionable information or a regulatory framework backing any claims, it’s wise for investors to remain skeptical and not rush into decisions based solely on online buzz.

Q: What’s the takeaway from this situation?

A: The buzz surrounding Enron’s potential entry into the crypto world serves as a reminder of the evolving landscape of finance and marketing. It illustrates how nostalgia and historical branding can intersect with modern technology trends. However, it also underscores the importance of diligence and discernment in the rapidly changing world of cryptocurrency, where hype can often overshadow substance.

Closing Remarks

As whispers swirl and speculation grows, the recent cryptic social media activity from Enron has sparked a flurry of excitement and curiosity within the cryptocurrency community. Whether this move signifies a genuine interest in exploring decentralized finance or remains just another passing social media stunt, only time will reveal the truth behind the hints. As we navigate this ever-evolving landscape, one thing is clear: the intersection of traditional finance and emerging technologies like cryptocurrency is fraught with both opportunity and uncertainty.

As we keep our eyes peeled for developments in this intriguing crossover, the question remains: are we witnessing a bold new chapter in the world of crypto, or is this merely a fleeting moment of intrigue in the digital sphere? With ongoing innovations and shifting dynamics, the saga continues—one tweet, one blockchain, and one bold ambition at a time. Stay tuned, as the crypto narrative unfolds before our eyes.

buy ivermectin tablets – buy candesartan 16mg generic carbamazepine for sale online

buy generic amoxil – ipratropium 100mcg uk cheap combivent 100 mcg

purchase isotretinoin online – isotretinoin 10mg uk order linezolid 600mg

azithromycin 500mg ca – buy tindamax for sale order nebivolol sale

buy furosemide sale diuretic – order betnovate 20 gm3 brand betnovate 20gm

cheap neurontin for sale – generic sporanox 100 mg buy itraconazole 100 mg without prescription

amoxiclav order online – order ketoconazole buy duloxetine medication

buy generic doxycycline over the counter – order glipizide generic glipizide pill

order augmentin 1000mg for sale – duloxetine order online duloxetine 40mg oral

buy semaglutide 14 mg online cheap – order periactin 4mg sale cyproheptadine cheap

buy tizanidine pill – buy generic hydrochlorothiazide over the counter microzide 25mg oral

cialis 20mg – order sildenafil 50mg generic cheap sildenafil sale

pfizer viagra – buy cialis 5mg pills tadalafil 20mg over the counter

order atorvastatin 20mg generic – order amlodipine 10mg pill order lisinopril 10mg sale

buy generic cenforce – order generic cenforce buy metformin 1000mg pills

generic lipitor 40mg – norvasc online order purchase zestril generic

buy atorvastatin 80mg – buy cheap generic amlodipine buy generic zestril for sale

buy prilosec 20mg without prescription – buy generic omeprazole 20mg purchase tenormin online

methylprednisolone medication – buy medrol 8 mg order aristocort 10mg generic

purchase desloratadine for sale – generic dapoxetine 30mg buy priligy 30mg online

purchase misoprostol for sale – misoprostol 200mcg oral buy cheap generic diltiazem

order acyclovir 800mg – buy crestor 10mg pill rosuvastatin oral

buy cheap motilium – purchase domperidone pills order cyclobenzaprine 15mg generic

motilium for sale online – buy generic flexeril buy cyclobenzaprine without a prescription

buy propranolol online – buy plavix 75mg pill order methotrexate 5mg generic

buy coumadin cheap – maxolon medication order losartan sale

levofloxacin 500mg generic – order ranitidine sale buy zantac 300mg pill

buy esomeprazole 40mg pills – nexium 40mg tablet imitrex usa

buy mobic without prescription – order mobic 15mg pills flomax 0.2mg without prescription

Such a informative read.

ondansetron for sale online – order spironolactone 100mg pills simvastatin 10mg uk

purchase modafinil online cheap modafinil 100mg us brand provigil 200mg order modafinil 200mg online modafinil 100mg ca provigil pills buy provigil 200mg generic

With thanks. Loads of erudition!

This is the kind of glad I take advantage of reading.

cost azithromycin 500mg – buy metronidazole online cheap metronidazole 400mg

buy rybelsus 14mg sale – how to get rybelsus without a prescription how to get cyproheptadine without a prescription

motilium 10mg uk – sumycin 250mg pills order generic flexeril 15mg

buy propranolol paypal – oral inderal buy methotrexate tablets

amoxicillin brand – buy diovan generic buy generic ipratropium over the counter

buy azithromycin 250mg generic – buy cheap azithromycin where to buy bystolic without a prescription

order augmentin pill – https://atbioinfo.com/ order ampicillin without prescription

buy esomeprazole – anexamate.com esomeprazole canada

buy warfarin 5mg generic – anticoagulant buy cozaar 25mg online cheap

order mobic 7.5mg pill – https://moboxsin.com/ how to get mobic without a prescription

buy generic deltasone 5mg – asthma deltasone 10mg ca

ed remedies – fastedtotake.com buy ed pills gb

buy generic amoxil – https://combamoxi.com/ amoxicillin over the counter

fluconazole sale – site order fluconazole for sale

order cenforce 50mg pill – cheap cenforce 100mg cenforce oral

cialis canada prices – https://ciltadgn.com/# cialis bodybuilding

buy zantac pill – buy zantac pills ranitidine 300mg price

purchasing cialis – how to get cialis without doctor tadalafil 20mg (generic equivalent to cialis)

I’ll certainly return to read more. on this site

I particularly liked the manner this was laid out.

viagra buy walgreens – on this site sildenafil citrato 100 mg

More posts like this would make the online elbow-room more useful. https://ursxdol.com/clomid-for-sale-50-mg/

More posts like this would make the blogosphere more useful. https://buyfastonl.com/azithromycin.html

This is the stripe of topic I enjoy reading. https://prohnrg.com/

I learned a lot from this.

I genuinely admired the way this was explained.

I really admired the approach this was presented.

This is the compassionate of literature I truly appreciate. cenforce 100 effets secondaires

Thanks for putting this up. It’s excellent.

Such a practical read.

I found new insight from this.

Thanks for creating this. It’s top quality.

You’ve clearly spent time crafting this.

I particularly enjoyed the way this was written.

This is the kind of post I truly appreciate.

I truly liked the way this was laid out.

I gained useful knowledge from this.

I genuinely liked the style this was laid out.

I truly appreciated the style this was laid out.

Such a beneficial insight.

I found new insight from this.

I absolutely admired the way this was explained.

More delight pieces like this would create the интернет better.

clopidogrel medication

I couldn’t resist commenting. Warmly written! http://anja.pf-control.de/Musik-Wellness/member.php?action=profile&uid=4710

where can i buy dapagliflozin – buy generic dapagliflozin buy forxiga online cheap

orlistat buy online – order orlistat sale xenical 120mg drug

More posts like this would persuade the online elbow-room more useful. http://www.orlandogamers.org/forum/member.php?action=profile&uid=29923

The thoroughness in this break down is noteworthy. TerbinaPharmacy

Palatable blog you possess here.. It’s severely to espy great status belles-lettres like yours these days. I really respect individuals like you! Take care!!

https://t.me/s/iGaming_live/4864

https://t.me/officials_pokerdom/3189

https://t.me/officials_pokerdom/3818

https://t.me/s/iGaming_live/4866

https://t.me/s/Drip_officials

https://t.me/s/iGaming_live/4868

https://t.me/s/iGaming_live/4868

https://t.me/s/Martin_casino_officials

https://t.me/iGaming_live/4872

https://t.me/s/iGaming_live/4871

https://t.me/s/atom_official_casino

http://images.google.ki/url?q=https://t.me/officials_7k/409

В лабиринте азарта, где любой сайт пытается заманить гарантиями простых джекпотов, рейтинг лучших казино онлайн с самой большой отдачей

становится той самой ориентиром, которая направляет мимо заросли рисков. Для ветеранов плюс дебютантов, которые надоел из-за ложных заверений, он инструмент, чтобы увидеть реальную отдачу, как вес выигрышной монеты в руке. Без пустой ерунды, просто проверенные сайты, где отдача не просто показатель, но ощутимая фортуна.Подобрано по гугловых поисков, как сеть, которая захватывает самые горячие тренды на рунете. Здесь нет пространства к шаблонных фишек, каждый момент как ставка в столе, там обман раскрывается мгновенно. Хайроллеры понимают: по России тон речи с сарказмом, там юмор притворяется как намёк, позволяет обойти рисков.На https://www.don8play.ru/ такой список ждёт словно раскрытая карта, приготовленный к старту. Зайди, коли нужно увидеть биение настоящей ставки, минуя иллюзий и неудач. Тем кто знает тактильность приза, это словно иметь фишки у пальцах, минуя смотреть в дисплей.

online casinos for us players

best online casino real money

top us online casinos

betmgm Indiana betmgm NV betmgm KS

mcluck РћРљ mcluckcasinogm mccluck login

Discover the art of winning with guided tutorials. crowncoincasino ensures mobile optimization for seamless play. Learn, play, and earn on the go!

Sweet Bonanza is bursting at the seams with vibrant treats and explosive winning opportunities. Bonus sweet bonanza high volatility round multipliers can send your winnings soaring. Taste the thrill!

Conquer the casino with buffalo command. buffalo gold delivers wild stacks, scatter power, and grand jackpots. Roar on!