[ad_1]

Fast Take

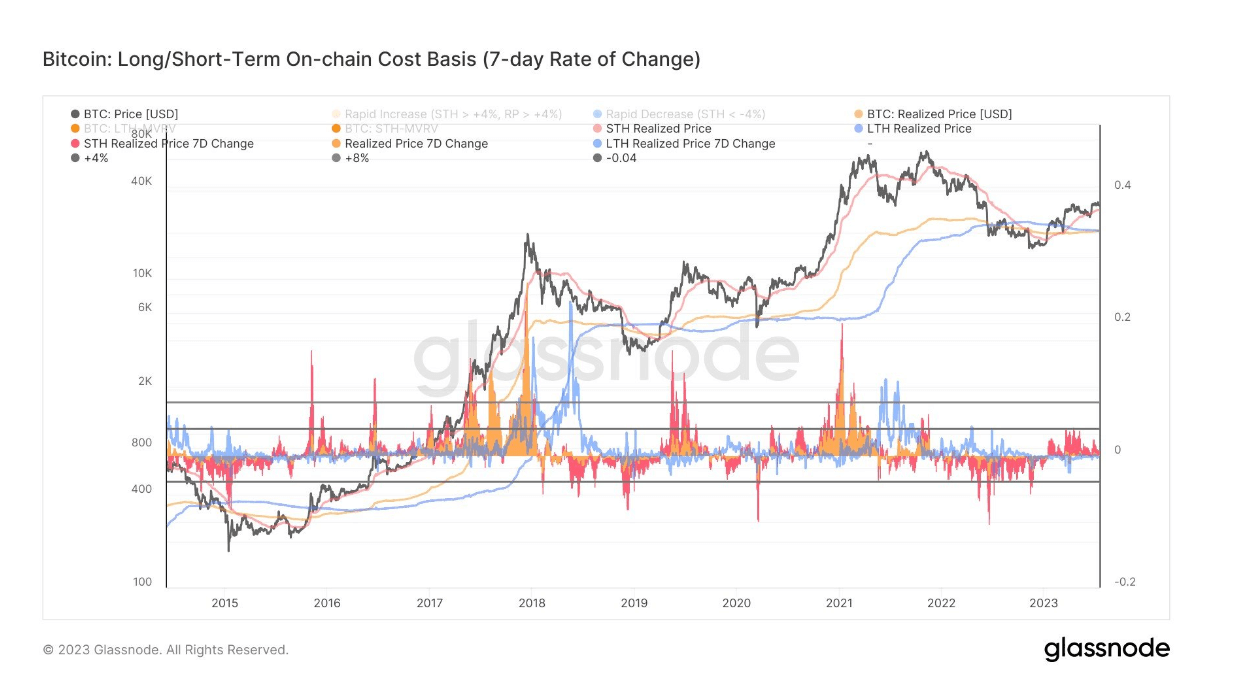

Information evaluation agency Glassnode provides a chart that tracks the weekly share shift within the Realized Worth for various on-chain teams. This device aids in detecting instances when the collective value foundation has both elevated or decreased notably inside a quick interval.

The Realized Worth is the collected value at which every coin was final used on-chain. The usage of Brief-Time period and Lengthy-Time period Holder heuristics permits for the computation of the Realized Worth, which might be interpreted because the estimated common buy value, for every investor group.

Key metrics embrace:

- The Realized Worth, proven in orange, mirrors the common on-chain buy value for your complete provide of cash.

- Brief-Time period Holder Realized Worth depicted in purple, represents the common on-chain buy value for cash not stored in alternate reserves and that had been transacted inside the earlier 155 days. These cash have the very best likelihood of being spent on any given day.

- Lengthy-Time period Holder Realized Worth, proven in blue, demonstrates the common on-chain buy value for cash not stored in alternate reserves and never moved inside the final 155 days. These cash are least prone to be spent on any given day.

CryptoSlate just lately famous that the Realized Worth is now inside a $100 vary of the Lengthy-Time period Holder’s Realized Worth. Traditionally, this has been a sign of an ending bear market, a sample witnessed on the conclusion of every bear market up to now.

CryptoSlate had beforehand examined a comparable state of affairs the place the Brief-Time period Holder Realized Worth surpassed each the Realized Worth and the Lengthy-Time period Holder Realized Worth, an occasion that happened again in March.

Presently, the Realized Worth is $20,425, whereas the Lengthy-Time period Holder Realized Worth is at $20,557.

The put up Realized value closing in long-term holder value: Does this sign a attainable finish of the bear market? appeared first on CryptoSlate.

[ad_2]

I’m really inspired together with your writing skills as neatly as with the format for your blog. Is that this a paid subject or did you customize it yourself? Either way stay up the excellent high quality writing, it is rare to look a nice weblog like this one these days!