[ad_1]

Soiled cash is pouring into the crypto business at an alarming charge, in response to a brand new examine. Greater than 1 / 4 (28 %) of crypto corporations have reported an increase within the variety of Suspicious Exercise Experiences over the previous six months.

Monetary professionals, together with solicitors, accountants, and property brokers, use Suspicious Exercise Experiences (SARs) to alert legislation enforcement about potential circumstances of cash laundering or terrorist financing. They provide legislation enforcement in the UK added perspective on financial crime within the non-public sector. Nevertheless, they don’t seem to be the identical as against the law or a fraud report. Nor do they represent an official felony grievance.

Crypto Is a Prime Alternative for Soiled Cash

The brand new knowledge come from SmartSearch, which surveyed 500 compliance decision-makers in varied sectors. Together with crypto platforms, playing corporations, property builders, and banks.

Current numbers spotlight compliance professionals’ ongoing wrestle to fight the rising scourge of crypto-related cash laundering. BeInCrypto not too long ago reported on a survey revealing that two-thirds of crypto corporations have worries about anti-money laundering (AML) violations.

However that’s not the one knowledge level. Based on a First AML survey, 53% imagine that present practices solely partially deal with the dangers of cash laundering by means of cryptocurrencies.

Furthermore, 41% have recognized circumstances of cash laundering involving cryptocurrencies. Moreover, 51% have confronted fines or penalties for failing to adjust to anti-money laundering rules.

Criminals see cryptocurrency as a profitable different to conventional cash laundering for a number of causes. First, cryptocurrencies like Bitcoin are pseudonymous and tougher to trace than financial institution transfers in fiat foreign money.

Crypto can also be straightforward and fast to transact in massive sums and may be accessed wherever worldwide. Additionally, many Digital Asset Service Suppliers (VASPs) lack the constructions or assets to observe criminal activity successfully.

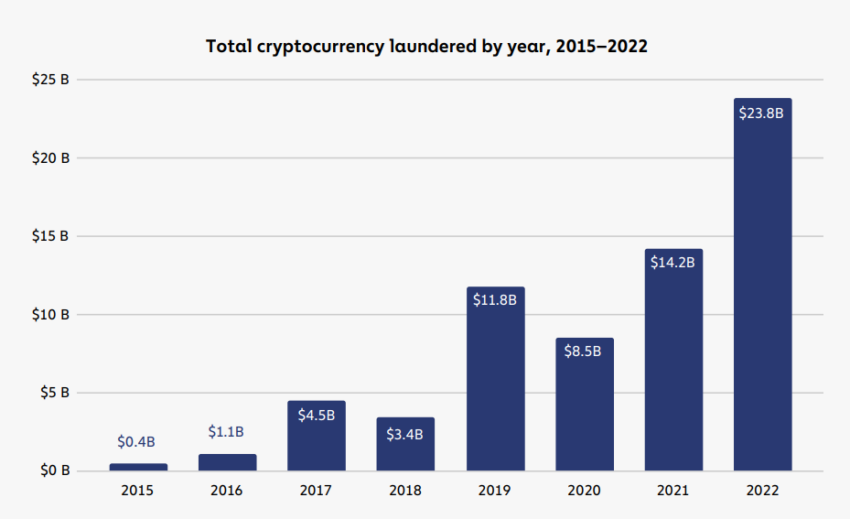

In Chainalysis’s most up-to-date Crypto Crime Report, we be taught that 2022 was a document yr for crypto cash laundering, with $23.8 billion USD price of funds “cleaned” utilizing cryptocurrency.

That marks a 68% improve from the yr earlier than. Nevertheless, the identical report additionally famous how lower than 1% of all crypto bears any relationship to illicit exercise.

Binance Investigated in France For “Aggravated Cash Laundering”

Martin Cheek, managing director of SmartSearch, believes felony gangs goal crypto corporations to take advantage of weaknesses of their compliance processes, particularly when flawed guide buyer checks are used.

“These frequent practices, akin to requesting an ID doc, are not adequate,” he defined. “Not solely do they not meet know-your-customer (KYC) and AML requirements, however they will additionally depart the door open for id theft.”

Cheek continued:

“The standard of cast paperwork has advanced to a stage of sophistication that makes identification more and more troublesome. The Residence Workplace’s personal steerage on checking for forgeries of official documentation lists 24 potential failure factors, a lot of which require knowledgeable data to identify.”

The specter of cash laundering has plagued the cryptocurrency business because it tries to current a legit and compliant public face. On June 16, French authorities introduced they’re trying into Binance, the world’s largest change, for “aggravated cash laundering.”

The EU is at the moment present process a session course of on together with VASPs in its anti-money laundering rules.

Bear in mind, SARs are usually not crime or fraud studies. To report against the law or a fraud within the UK, name 101 or Motion Fraud on 0300 123 2040.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material.

[ad_2]

I’m really inspired together with your writing abilities and also with the format on your weblog. Is that this a paid topic or did you modify it your self? Either way keep up the nice high quality writing, it is uncommon to look a great weblog like this one these days!