[ad_1]

The main Spanish personal financial institution A&G has launched a crypto funding fund providing, in an indication adoption is continuous to rise within the European nation.

Europa Press reported that A&G will launch an funding fund product after registering the fund’s brochure with the regulatory Nationwide Securities Market Fee (CNMV).

The fund would be the first of its sort in Spain.

The financial institution stated traders had expressed “nice curiosity” in crypto funding.

A&G stated crypto funding “may be channeled with extra environment friendly threat administration and management, by way of funding merchandise which might be safer and higher regulated.”

The financial institution additionally stated that funds the place “professionals topic to supervision are concerned” represented a protected selection for crypto-keen traders.

One other financial institution, CACEIS, will operate because the fund’s depositary, whereas PwC (PricewaterhouseCoopers) will function its auditor.

CACEIS Financial institution is the joint asset servicing arm of the European banking powerhouses Crédit Agricole and Santander.

Final month, CACEIS was awarded a crypto custody license by the French markets regulator.

A&G stated that the precise composition of the fund had not but been decided.

However the financial institution stated the fund will “have between 50% and 100% publicity to cryptocurrencies, solely by way of monetary devices whose profitability is linked to [tokens].”

The fund may have publicity to each Bitcoin (BTC) and Ethereum (ETH).

It’s going to even have a “minority” publicity to “different current or future cryptocurrencies which have passable ranges of quantity and liquidity.”

New Spanish Crypto Fund: Adoption Rising?

The brochure notes that A&G’s new fund “might not be appropriate for traders who plan to withdraw their cash in a interval of lower than 4 years.”

Nevertheless, the brochure additionally consists of necessary warnings from the CNMV.

The regulator notes that the fund includes “investments in monetary devices whose profitability is linked to cryptocurrencies.”

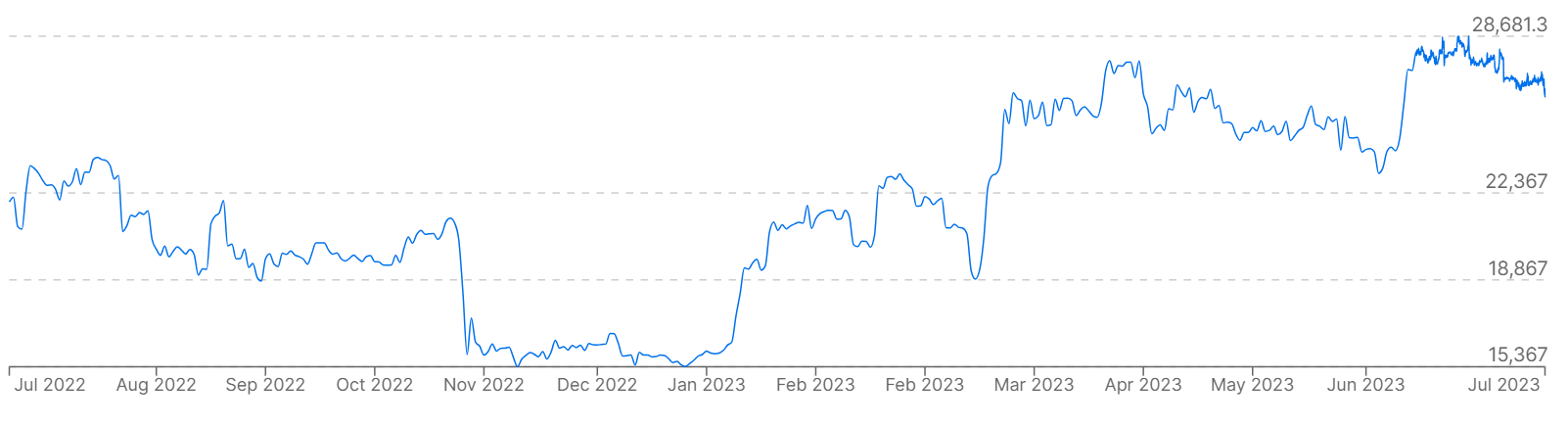

This entails, per the regulator, “very excessive ranges of threat because of cryptocurrencies’ excessive volatility, complexity, lack of transparency, custody, and focus threat, which can result in the entire lack of [your] funding.”

In March, a outstanding Spanish MP stated he was stepping down from his position in parliament to pursue a crypto-related profession.

And earlier this month, a tax agency claimed that 70% of Spanish crypto holders making tax declarations had skilled losses on their token investments in FY2022.

[ad_2]