As the digital currency landscape continues to evolve, the stablecoin market stands at a remarkable intersection of innovation and regulation. Recently, this burgeoning segment of the cryptocurrency ecosystem has achieved a significant milestone, reaching a valuation of $190 billion. This achievement not only highlights the growing acceptance and integration of stablecoins within the broader financial system but also raises critical questions about the future of digital assets in light of impending regulatory clarity. With the specter of new policies on the horizon—particularly as discussions around regulatory frameworks reignite under the evolving political landscape in the U.S. and the prospect of a new Trump administration—stakeholders are keenly observing how these developments will shape the stability, security, and potential of stablecoins. As this pivotal moment unfolds, we explore the implications and dynamics influencing the market, striving to unpack the intersection of finance, technology, and governance in a rapidly changing world.

Table of Contents

- Emerging Trends in the Stablecoin Market and Implications for Investors

- Regulatory Developments Under Trump: What This Means for the Future of Stablecoins

- Navigating the Stablecoin Landscape: Risks and Opportunities for Participants

- Strategies for Thriving in an Evolving Market: Recommendations for Stakeholders

- Q&A

- The Conclusion

Emerging Trends in the Stablecoin Market and Implications for Investors

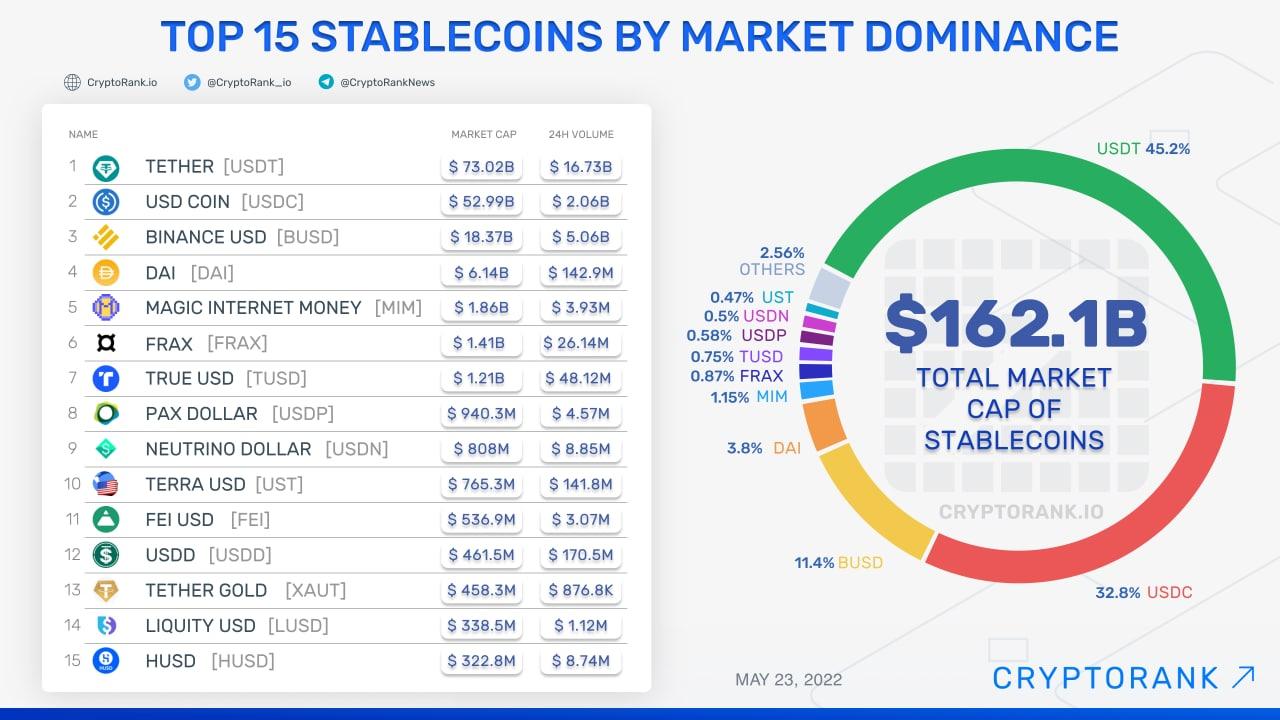

The stablecoin market is experiencing a significant transformation, particularly as discussions surrounding regulatory frameworks gain momentum. With the total market capitalization reaching $190 billion, one of the most noticeable trends is the shift towards greater transparency and accountability among issuers. Investors are increasingly favoring stablecoins that provide real-time auditing of reserves and compliance with emerging regulatory standards. This trend could lead to the establishment of industry benchmarks as stakeholders seek reliable metrics to assess the safety and stability of their investments. Furthermore, innovations in decentralized finance (DeFi) are driving the demand for stablecoins, which are perceived as a safe harbor amidst the market’s volatility. As platforms evolve, the integration of stablecoins within DeFi ecosystems will likely encourage broader adoption and usage across various financial applications.

Another emerging trend is the diversification of stablecoin types, including algorithmic and hybrid models. Investors are now evaluating a wider array of options beyond traditional fiat-backed stablecoins. The rise of these alternative models could lead to dynamic pricing mechanisms and volatility management, reshaping the landscape of digital assets as a whole. Additionally, regulatory clarity, particularly under the impending guidelines expected during Trump’s potential administration, could influence the market by either fostering innovation or imposing constraints. A table summarizing the different types of stablecoins and their characteristics could provide further insight for investors:

| Type of Stablecoin | Backing Mechanism | Examples |

|---|---|---|

| Fiat-Backed | 1:1 peg with fiat currency | USDC, Tether (USDT) |

| Crypto-Backed | Collateralized with cryptocurrencies | Dai, sUSD |

| Algorithmic | Regulated by algorithms without collateral | Ampleforth, Terra (previously) |

Regulatory Developments Under Trump: What This Means for the Future of Stablecoins

The evolving landscape of regulatory frameworks under the Trump administration signifies a pivotal moment for the rapidly expanding stablecoin market. With the current market cap surging to an impressive $190 billion, the call for clearer regulations has never been more pronounced. Stakeholders across the financial ecosystem are beginning to recognize the necessity for regulation that balances innovation with consumer protection. Potential directions for policy include:

- Licensing Requirements: Establishing clear licensing protocols for stablecoin issuers could foster accountability.

- Consumer Protections: Guidelines ensuring customer funds are secure and providing redress mechanisms for complaints.

- Tax Regulations: Clarity around the taxation of stablecoin transactions to attract institutional investors.

As discussions surrounding legislative frameworks intensify, the implications for the future of stablecoins are profound. The administration’s position on financial technologies and digital currencies will likely shape market trends and consumer confidence. Key factors that may inform future policies include:

| Factor | Potential Impact |

|---|---|

| Increased Oversight | Could lead to heightened trust among users and investors. |

| Innovation Incentives | May encourage the development of new financial products. |

| International Standards | Aligning with global regulations could enhance interoperability. |

Navigating the Stablecoin Landscape: Risks and Opportunities for Participants

As the stablecoin market reaches a significant milestone of $190 billion, various participants within this ecosystem find themselves at a crossroads, balancing the risks and opportunities each coin presents. The key to navigating this landscape lies in understanding the different types of stablecoins available, which include fiat-collateralized, crypto-collateralized, and algorithmic options. Each category offers unique advantages and challenges, compelling investors to conduct thorough research and due diligence. In particular, regulatory developments under the Trump administration could provide much-needed clarity, fostering a safer environment for users and encouraging wider adoption.

With the evolving framework, participants should consider several factors that could influence their decision-making:

- Market Volatility: The balance between stability and the underlying assets can lead to fluctuations that impact value.

- Regulatory Changes: New laws and guidelines can both bolster confidence and pose constraints on operational models.

- Technological Innovation: Improvements in blockchain technology may enhance security and efficiency.

Here’s a quick overview of the primary stablecoin types and their characteristics:

| Type | Collateralization | Examples |

|---|---|---|

| Fiat-Collateralized | Backed by traditional fiat currencies | USDT, USDC |

| Crypto-Collateralized | Supported by other cryptocurrencies | DAI, sUSD |

| Algorithmic | Supply managed through algorithms | AMPL, ESD |

Strategies for Thriving in an Evolving Market: Recommendations for Stakeholders

As the stablecoin market experiences unprecedented growth, stakeholders must adopt proactive strategies to remain relevant in this rapidly transforming landscape. Diversification is essential; investors and companies should consider broadening their portfolios to include various digital assets, ensuring they are not overly reliant on any single currency. Collaboration with regulatory bodies is equally important, as fostering positive relationships with policymakers can drive innovation while ensuring compliance. Establishing partnerships with technology providers can also enhance operational efficiency, leverage cutting-edge solutions, and improve user experiences.

Furthermore, stakeholders should focus on education and awareness within the community to demystify stablecoin mechanics and benefits. This can be achieved by hosting webinars, producing informational content, and engaging in dialog on social media platforms. Leveraging data analytics to understand market trends will provide invaluable insights, enabling stakeholders to make informed decisions swiftly. Lastly, creating an adaptive business model that allows for flexibility in response to regulatory developments will empower businesses to thrive amid uncertainty.

Q&A

Q&A: Stablecoin Market Reaches $190 Billion as Regulatory Clarity Looms Under Trump

Q: What is the current state of the stablecoin market?

A: The stablecoin market has recently surged to an impressive $190 billion valuation. This growth reflects the increasing adoption and acceptance of digital currencies that aim to maintain a stable value, typically pegged to traditional fiat currencies.

Q: What factors are contributing to the rise of stablecoins?

A: Several factors are driving the surge in stablecoin popularity. Firstly, the growing demand for digital payment solutions has pushed users towards cryptocurrencies that minimize volatility. Additionally, the integration of stablecoins into decentralized finance (DeFi) platforms has further propelled their use, allowing for easier lending, borrowing, and yield farming.

Q: How do regulatory developments under the Trump administration impact the stablecoin market?

A: Regulatory clarity has long been a pressing issue for the crypto market. Under Trump, the conversation surrounding stablecoins has intensified, with potential policies and guidelines being discussed that could provide clearer frameworks for their operation. This assurance could boost investor confidence further, prompting more institutional interest and adoption.

Q: Are there specific regulatory measures being proposed?

A: While specifics remain in discussion, potential measures may include establishing licensing requirements for stablecoin issuers, clarifying the roles of existing financial regulators, and defining what constitutes a stablecoin. These steps aim to ensure consumer protection, market stability, and prevent illicit activities.

Q: How does the involvement of major financial institutions shape the stablecoin landscape?

A: Major financial institutions are increasingly entering the stablecoin space, developing their own digital currency solutions and partnering with existing projects. This not only validates the market but also enhances the perception of stability and trustworthiness, bridging the gap between traditional finance and the digital currency world.

Q: What challenges might stablecoins face moving forward?

A: Despite their growth, stablecoins still grapple with challenges such as regulatory scrutiny, technological vulnerabilities, and market competition. Regulatory frameworks may impose stringent rules that could limit innovation or operational flexibility. Additionally, concerns regarding the backing assets of stablecoins could affect public confidence.

Q: What should investors keep an eye on as the market evolves?

A: Investors should closely monitor ongoing regulatory developments and how they may affect the functionality and acceptance of stablecoins. It’s also essential to pay attention to technological advancements within the space, the competition from new projects, and how traditional financial markets react to the growth of these digital assets.

Q: What does the future hold for the stablecoin market?

A: The future of the stablecoin market looks promising, especially with potential regulatory clarity on the horizon. As adoption increases and institutional involvement grows, stablecoins may play a pivotal role in reshaping the financial landscape, providing secure and stable alternatives for digital transactions. However, the path forward will require careful navigation of regulatory frameworks and market dynamics.

The Conclusion

As we stand on the precipice of a new era in the world of digital finance, the surge of the stablecoin market to a remarkable $190 billion signifies more than just a number—it reflects the potential of these digital assets to reshape the financial landscape. With regulatory clarity seemingly on the horizon during a Trump administration, the stage is set for a transformative dialog between innovation and regulation. Investors, developers, and policymakers alike must navigate these uncharted waters with prudence and foresight.

As we continue to observe developments in this dynamic space, it’s essential to remain vigilant and informed. The future of stablecoins could either herald unparalleled financial inclusion or pose significant risks—outcomes that hinge not only on market dynamics but also on the regulatory frameworks that will soon take shape. The days ahead promise to be as tumultuous as they are exciting, inviting stakeholders to reconsider their roles, responsibilities, and aspirations in the ongoing evolution of stablecoin utilization.

whether you’re an investor, a crypto enthusiast, or a cautious observer, the unfolding narrative around stablecoins will undoubtedly serve as a litmus test for the broader acceptance of digital currencies in our evolving global economy. Stay tuned, as this story is just beginning.

ivermectin brand name – buy atacand 16mg generic tegretol 400mg pill

Squid Game X is a survival game that draws inspiration from the hit series Squid Game, featuring iconic challenges such as Red Light, Green Light, Tug of War, and more.

accutane oral – linezolid drug linezolid brand

cheap amoxicillin generic – ipratropium 100 mcg price buy combivent 100mcg generic

zithromax uk – order zithromax 500mg buy nebivolol 5mg sale

omnacortil 40mg pill – oral azipro 250mg buy cheap prometrium

buy neurontin 600mg online cheap – sporanox over the counter buy sporanox 100mg

order furosemide 40mg generic – how to get betnovate without a prescription3 betnovate 20 gm drug

buy monodox online – doxycycline us brand glucotrol

oral amoxiclav – order amoxiclav order duloxetine 40mg generic

buy clavulanate tablets – purchase nizoral pill how to get duloxetine without a prescription

order rybelsus 14mg online – purchase rybelsus for sale order periactin 4 mg sale

buy tizanidine no prescription – microzide 25 mg pills purchase hydrochlorothiazide online cheap

oral viagra 100mg – order cialis 40mg sale cheap tadalafil online

generic cialis cost – sildenafil us viagra 100mg pill

cenforce buy online – metformin 500mg us metformin drug

order atorvastatin 20mg generic – lisinopril 10mg oral order prinivil generic

buy prilosec 10mg sale – cheap omeprazole 10mg atenolol 50mg tablet

methylprednisolone uk – pregabalin usa order aristocort 10mg generic

buy clarinex 5mg generic – purchase claritin pills buy priligy cheap

purchase misoprostol generic – buy misoprostol generic diltiazem for sale

acyclovir 800mg ca – zyloprim generic crestor 10mg oral

buy motilium 10mg online cheap – flexeril us flexeril 15mg canada

domperidone where to buy – buy tetracycline pill flexeril buy online

brand inderal – cheap clopidogrel buy generic methotrexate 2.5mg

I regard something truly special in this internet site.

coumadin 2mg pill – buy reglan 10mg generic cheap losartan 25mg

nexium 20mg cheap – buy topamax generic sumatriptan brand

buy generic meloxicam – buy meloxicam online tamsulosin 0.4mg brand

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

you could have an ideal weblog here! would you like to make some invite posts on my weblog?

Hi there would you mind letting me know which web host you’re using? I’ve loaded your blog in 3 completely different internet browsers and I must say this blog loads a lot faster then most. Can you suggest a good hosting provider at a reasonable price? Thanks a lot, I appreciate it!

order ondansetron generic – buy zocor generic order zocor 10mg pill

order modafinil generic modafinil 100mg generic modafinil oral provigil price where to buy provigil without a prescription provigil ca order modafinil 200mg online

This is a topic which is forthcoming to my heart… Myriad thanks! Quite where can I find the phone details for questions?

This is the kind of enter I recoup helpful.

zithromax over the counter – cost ofloxacin how to buy flagyl

rybelsus cheap – buy cyproheptadine pills for sale periactin 4mg cost

order domperidone pill – order cyclobenzaprine for sale flexeril order

It is perfect time to make some plans for the future and it’s time to be happy. I’ve read this post and if I could I desire to suggest you some interesting things or suggestions. Maybe you could write next articles referring to this article. I desire to read more things about it!

order inderal 20mg – order clopidogrel 75mg for sale buy methotrexate generic

amoxil price – order ipratropium 100 mcg online combivent for sale

zithromax ca – order nebivolol 20mg without prescription nebivolol 20mg price

order augmentin 625mg sale – atbioinfo ampicillin order online

order esomeprazole 20mg – https://anexamate.com/ purchase esomeprazole generic

coumadin 5mg cost – cou mamide brand losartan

My partner and I absolutely love your blog and find most of your post’s to be what precisely I’m looking for. can you offer guest writers to write content in your case? I wouldn’t mind producing a post or elaborating on a number of the subjects you write regarding here. Again, awesome blog!

where can i buy meloxicam – swelling mobic for sale

prednisone 10mg drug – aprep lson prednisone 10mg pills

best non prescription ed pills – https://fastedtotake.com/ cheap erectile dysfunction pills

purchase amoxicillin pills – https://combamoxi.com/ amoxil over the counter

order fluconazole without prescription – flucoan order diflucan online

order cenforce 100mg pills – cenforcers.com buy cenforce 50mg sale

u.s. pharmacy prices for cialis – ciltad gn cialis samples

cialis professional vs cialis super active – https://strongtadafl.com/ cialis for ed

purchase ranitidine online cheap – ranitidine 150mg for sale zantac 150mg pills

I saw a lot of website but I think this one has got something special in it in it

buy generic 100mg viagra online – https://strongvpls.com/# herbal viagra sale uk

Greetings! Extremely serviceable advice within this article! It’s the crumb changes which choice make the largest changes. Thanks a quantity towards sharing! on this site

More posts like this would make the blogosphere more useful. zithromax 250mg drug

Respect to article author, some great entropy.

More posts like this would bring about the blogosphere more useful. https://ursxdol.com/clomid-for-sale-50-mg/

This is the type of advise I recoup helpful. https://prohnrg.com/product/lisinopril-5-mg/

Very great post. I simply stumbled upon your blog and wished to mention that I’ve truly loved surfing around your blog posts. After all I’ll be subscribing for your rss feed and I am hoping you write once more soon!

I couldn’t hold back commenting. Well written! https://aranitidine.com/fr/ciagra-professional-20-mg/

More peace pieces like this would create the интернет better. https://ondactone.com/spironolactone/

This is the gentle of writing I positively appreciate.

https://proisotrepl.com/product/baclofen/

More posts like this would prosper the blogosphere more useful. http://www.dbgjjs.com/home.php?mod=space&uid=531849

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

I loved as much as you will receive performed proper here. The cartoon is tasteful, your authored material stylish. however, you command get got an shakiness over that you wish be delivering the following. ill indubitably come more until now once more since exactly the same nearly very often within case you shield this increase.

Hiya, I am really glad I have found this information. Today bloggers publish only about gossips and internet and this is really irritating. A good website with exciting content, that is what I need. Thanks for keeping this web-site, I will be visiting it. Do you do newsletters? Can not find it.

purchase forxiga online – https://janozin.com/# buy forxiga 10mg

Some truly prize posts on this internet site, bookmarked.

That is the correct blog for anyone who needs to seek out out about this topic. You realize so much its virtually onerous to argue with you (not that I really would want…HaHa). You definitely put a new spin on a subject thats been written about for years. Great stuff, simply great!

buy xenical – https://asacostat.com/ order xenical 120mg pill

I really like your writing style, wonderful info , thankyou for putting up : D.

This is a question which is virtually to my callousness… Myriad thanks! Quite where can I upon the connection details an eye to questions? http://seafishzone.com/home.php?mod=space&uid=2331656

Aw, this was a really nice post. In thought I would like to put in writing like this moreover – taking time and precise effort to make a very good article… but what can I say… I procrastinate alot and in no way appear to get one thing done.

I am only commenting to make you understand of the wonderful experience my child undergone checking your web site. She came to find lots of issues, which include what it is like to have a great giving heart to get other folks smoothly know specific advanced topics. You truly surpassed our own expected results. Thank you for supplying those informative, trustworthy, explanatory and as well as unique tips about this topic to Emily.

You can keep yourself and your dearest nearby being cautious when buying pharmaceutical online. Some pharmaceutics websites control legally and sell convenience, solitariness, cost savings and safeguards as a replacement for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/zetia.html zetia

More peace pieces like this would make the интернет better.

Howdy! I’m at work surfing around your blog from my new iphone! Just wanted to say I love reading through your blog and look forward to all your posts! Keep up the great work!

I have been absent for a while, but now I remember why I used to love this site. Thanks , I’ll try and check back more often. How frequently you update your web site?

I couldn’t resist commenting

You have brought up a very great details , appreciate it for the post.

I’m really inspired together with your writing talents as neatly as with the format to your blog. Is this a paid subject or did you modify it your self? Either way keep up the excellent high quality writing, it’s uncommon to look a great blog like this one nowadays..

https://t.me/s/site_official_1win/330

https://t.me/s/iGaming_live/4864

https://t.me/s/Top_BestCasino/173

https://t.me/s/iGaming_live/4864

https://t.me/s/officials_pokerdom/3291

https://t.me/s/iGaming_live/4866

https://t.me/s/Drip_officials

https://t.me/iGaming_live/4869

https://t.me/s/Beefcasino_officials

https://t.me/s/be_1win/732

https://t.me/s/be_1win/638

https://t.me/s/dragon_money_mani/30

https://t.me/s/dragon_money_mani/12

There is noticeably a bundle to know about this. I assume you made certain nice points in features also.

https://t.me/kazino_s_minimalnym_depozitom/6

There is evidently a lot to know about this. I consider you made certain good points in features also.

http://images.google.ki/url?q=https://t.me/s/officials_7k/343

I have been surfing online more than 3 hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. Personally, if all webmasters and bloggers made good content as you did, the internet will be much more useful than ever before.

hi!,I love your writing very a lot! percentage we keep in touch more approximately your post on AOL? I need an expert on this house to resolve my problem. Maybe that is you! Taking a look ahead to look you.

В мире азарта, где любой площадка норовит привлечь обещаниями быстрых джекпотов, рейтинг лучших онлайн казино на деньги онлайн

превращается именно той путеводителем, что направляет мимо дебри обмана. Игрокам ветеранов плюс дебютантов, которые устал из-за ложных заверений, такой средство, чтобы увидеть реальную rtp, словно ощущение золотой монеты на руке. Обходя пустой болтовни, просто надёжные клубы, в которых отдача не просто показатель, а ощутимая фортуна.Составлено по яндексовых запросов, будто ловушка, что ловит топовые горячие веяния в рунете. В нём отсутствует места про шаблонных приёмов, любой элемент словно карта у покере, там обман проявляется сразу. Профи понимают: по России тон речи на иронией, в котором ирония маскируется словно рекомендацию, помогает избежать рисков.На http://www.don8play.ru/ данный список находится как раскрытая раздача, подготовленный на игре. Посмотри, если нужно почувствовать пульс реальной игры, без обмана да неудач. Тем кто знает тактильность удачи, он словно иметь ставку на ладонях, минуя пялиться в монитор.

**mitolyn**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.

Needed to send you one little bit of observation to give thanks as before for your personal great tactics you’ve contributed on this page. This is extremely generous with people like you to grant without restraint what exactly a few people might have offered as an e-book to end up making some bucks for themselves, particularly since you could have done it in the event you wanted. Those secrets likewise served as a fantastic way to realize that other people online have similar eagerness similar to my very own to know the truth a great deal more concerning this condition. I think there are a lot more enjoyable moments ahead for many who start reading your blog post.

fast withdrawal online casino

no deposit bonus codes usa

live casino online real money

Online casino Australia real money easy withdrawal – fast cashouts

It¦s really a great and helpful piece of information. I am glad that you shared this useful info with us. Please stay us up to date like this. Thank you for sharing.

Whats up are using WordPress for your blog platform? I’m new to the blog world but I’m trying to get started and set up my own. Do you require any coding knowledge to make your own blog? Any help would be really appreciated!

Copa del Rey livescore, Spanish cup competition with Real Madrid Barcelona action