In an era marked by fluctuating financial landscapes and the quest for stability, the rise of stablecoins has captured the attention of investors and analysts alike. Over the past 14 months, this segment of the cryptocurrency market has experienced a remarkable trajectory, culminating in a market capitalization of $190 billion—the highest it has seen in two years. As the digital economy continues to evolve, stablecoins have emerged as a pivotal tool for bridging traditional finance and the burgeoning world of decentralized assets. This article delves into the factors driving the sustained growth of stablecoins, exploring their implications for the broader cryptocurrency ecosystem and what this upward trend could mean for the future of digital currencies.

Table of Contents

- The Resurgence of Stablecoins: Analyzing the Markets Steady Climb

- Factors Driving Stability: Understanding the Forces Behind Record Highs

- Investment Opportunities in Stablecoins: Strategies for Navigating the Market

- Future Trends and Risks: Preparing for the Next Phase of Stablecoin Evolution

- Q&A

- Future Outlook

The Resurgence of Stablecoins: Analyzing the Markets Steady Climb

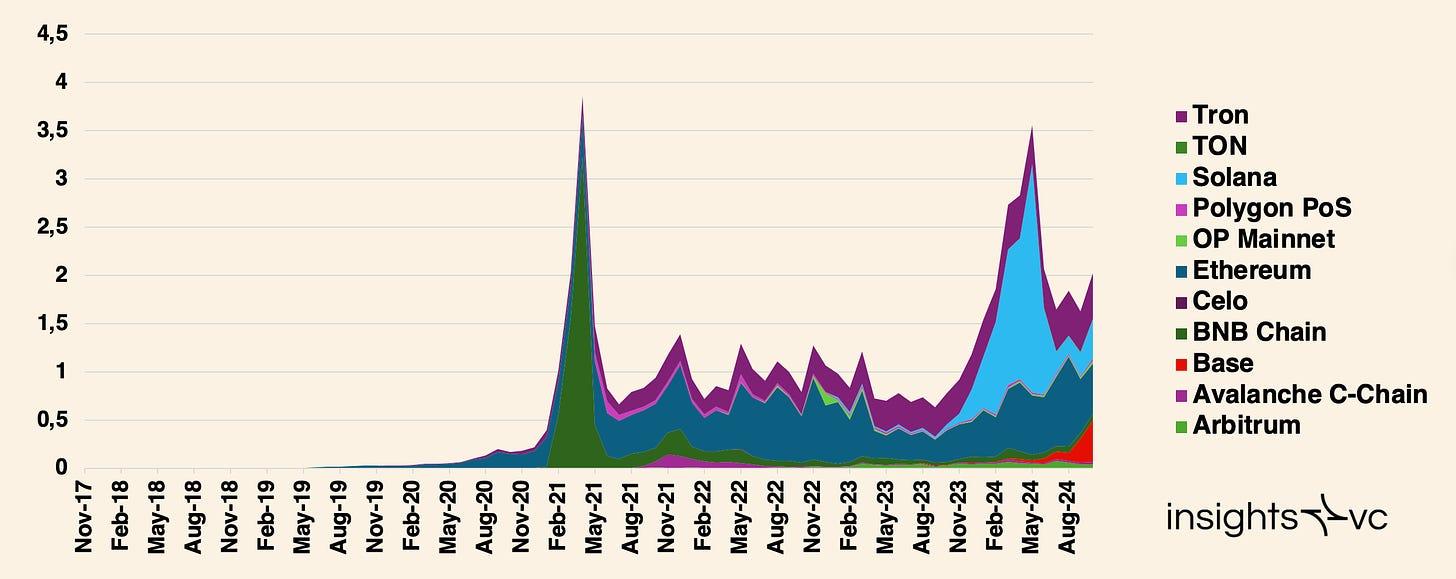

The stablecoin landscape has witnessed a remarkable evolution, evidenced by a sustained market capitalization increase spanning 14 months, culminating in a peak of $190 billion. This trajectory is not merely reflective of fluctuating demand but signals a growing confidence in these digital assets as viable alternatives to traditional currencies. The rise of stablecoins has been fostered by several key factors:

- Increased Institutional Adoption: Financial institutions are beginning to incorporate stablecoins into their services, recognizing the benefits of operational efficiency and reduced transaction costs.

- Regulatory Clarity: As regulatory frameworks evolve globally, stablecoins are becoming more compliant, attracting both retail and institutional investors who prioritize security.

- DeFi Integration: Stablecoins play a crucial role in decentralized finance, serving as essential collateral for loans and providing liquidity in various protocols.

As more users engage with stablecoins, their utility only grows. Innovative projects and technologies are being introduced, thereby enhancing functionality and driving further investment. The following table illustrates notable stablecoins and their respective market shares as of now:

| Stablecoin | Market Share (%) | Backing Asset |

|---|---|---|

| USDT | 55% | USD |

| USDC | 30% | USD |

| Dai | 6% | Crypto Collateral |

| BUSD | 5% | USD |

| TUSD | 4% | USD |

This dynamic growth narrative encapsulates a transformative moment for stablecoins, carving a space for them in both everyday transactions and sophisticated financial systems.

Factors Driving Stability: Understanding the Forces Behind Record Highs

The stablecoin market’s remarkable ascent to a $190 billion valuation over the past 14 months can be attributed to several key elements that underpin its resilience and growth. Central to this success is the increasing acceptance of stablecoins in various economic sectors, allowing for seamless transactions and reduced volatility. As businesses and consumers alike recognize the benefits of utilizing stablecoins for daily transactions, their adoption has surged, contributing to stable demand. Additionally, the expansion of decentralized finance (DeFi) platforms has created an ecosystem that incentivizes liquidity and accessibility, enabling users to earn yield on their stablecoin holdings.

Furthermore, the regulatory landscape is evolving, with a growing number of jurisdictions embracing cryptocurrency, including stablecoins, as legitimate financial instruments. This regulatory clarity offers users enhanced confidence and security, paving the way for institutional investors to engage in the market. Moreover, technological advancements in blockchain technology have bolstered transaction efficiency and security, making it easier for individuals and organizations to integrate stablecoins into their financial strategies. As we navigate this transformative period, the combination of adoption trends, regulatory support, and technological improvements continues to drive the market for stablecoins to new heights.

Investment Opportunities in Stablecoins: Strategies for Navigating the Market

As the stablecoin market cap reaches a remarkable high of $190 billion, investors are keenly exploring various strategies to maximize their return on investment. With the stability these digital assets offer, there are several avenues to consider. Yield farming, a practice where investors lend their stablecoins in exchange for interest, has become increasingly popular. This can provide a steady income stream in addition to capital appreciation. Similarly, staking stablecoins on decentralized finance (DeFi) platforms allows investors to earn rewards while participating in the network’s security and operations.

Moreover, understanding the unique characteristics of different stablecoins can play a pivotal role in developing an effective investment strategy. Consider the following factors when evaluating stablecoins:

- Backing methods: Assess whether the stablecoin is collateralized by fiat currency, cryptocurrencies, or algorithmic mechanisms.

- Liquidity: Ensure that the stablecoin has sufficient trading volume to allow for quick transactions without large price swings.

- Regulatory compliance: Investigate the legal standing of the stablecoin to mitigate risks associated with restrictions or bans.

By carefully analyzing these aspects, investors can navigate the stablecoin landscape more effectively and harness the opportunities it presents.

Future Trends and Risks: Preparing for the Next Phase of Stablecoin Evolution

As the stablecoin market experiences unprecedented growth, stakeholders must remain vigilant regarding emerging trends and potential risks that could shape its future trajectory. The ongoing evolution of stablecoins could lead to shifts in regulatory frameworks, affecting how these digital assets are perceived and utilized. Key trends to watch include:

- Decentralization vs. Centralization: The tug-of-war between decentralized stablecoins and those backed by central authorities will shape market dynamics.

- Interoperability: Increased focus on cross-chain solutions enabling seamless transactions across different blockchains.

- Integration with Financial Systems: The potential for stablecoins to be embedded in traditional financial services will redefine their role in global finance.

- Technological Innovations: Advancements in smart contracts and blockchain technology that can enhance security and reduce transaction costs.

However, with these advancements come notable risks that participants in the stablecoin market must consider. The landscape may face challenges such as:

- Regulatory Scrutiny: Increased oversight from government bodies could lead to tighter regulations that may stifle innovation.

- Market Volatility: While stablecoins aim for price stability, unexpected market events can still create fluctuations.

- Security Threats: Cybersecurity concerns remain a critical issue, as breaches can undermine trust and integrity.

- Liquidity Risks: As demand fluctuates, the ability to maintain liquidity may pose challenges for certain stablecoin issuers.

| Trend/Risk | Implication |

|---|---|

| Decentralization vs. Centralization | Potential for conflict in regulatory approaches. |

| Interoperability | Enhanced connectivity between different blockchain ecosystems. |

| Regulatory Scrutiny | Possibility of stringent compliance requirements. |

| Security Threats | Increased focus on robust security measures. |

Q&A

Q&A: Understanding the Surge in Stablecoins Market Cap

Q1: What has been the recent trend in the stablecoins market cap?

A1: Over the past 14 months, the stablecoins market cap has consistently increased, reaching a remarkable two-year high of $190 billion. This steady growth showcases the increasing acceptance and utilization of stablecoins in the broader cryptocurrency ecosystem.

Q2: What are stablecoins, and why are they gaining traction?

A2: Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging their worth to traditional currencies or assets, such as the US dollar. Their stability makes them appealing for traders and investors as a safe haven during market volatility. The rising interest in decentralized finance (DeFi) and digital payments has further fueled their adoption.

Q3: What factors have contributed to this consistent growth over 14 months?

A3: Several factors have driven this trend, including increased institutional adoption, a growing number of use cases in remittances and payments, and the expanding DeFi sector which relies heavily on stablecoins for transactions and liquidity. Additionally, regulatory clarity in some regions has bolstered confidence in these assets.

Q4: How do investors perceive the role of stablecoins in the current financial landscape?

A4: Investors view stablecoins as a bridge between traditional finance and the burgeoning world of cryptocurrencies. They provide a reliable medium for preserving value, mitigating risks associated with market volatility, and facilitating seamless transactions in various digital platforms. As the crypto ecosystem evolves, stablecoins have solidified their importance.

Q5: What implications does this growth have for the broader cryptocurrency market?

A5: The rise in stablecoins market cap suggests a maturing cryptocurrency market, where stablecoins play a crucial role in fostering trade and liquidity. This growth can also indicate a shift towards more regulated and mainstream acceptance of cryptocurrencies, potentially leading to increased retail and institutional interest.

Q6: Are there concerns with the increasing market cap of stablecoins?

A6: While the growth is generally viewed positively, there are concerns regarding stability, transparency, and regulation. Questions about the backing of stablecoins—especially regarding the reserves held—can lead to skepticism. Additionally, a large concentration of assets in stablecoins can pose risks if there’s a sudden shift in market sentiment.

Q7: What does the future hold for the stablecoins market?

A7: The future of the stablecoins market appears promising, with expectations of continued growth and innovation. As regulatory frameworks develop and new use cases emerge, stablecoins are likely to further integrate within traditional financial systems and continue to play a vital role in the cryptocurrency ecosystem. However, ongoing vigilance and adaptation to regulatory changes will be essential for sustainable growth.

Future Outlook

As the stablecoin market continues to establish its foothold, reaching a notable milestone of $190 billion in market capitalization, it becomes increasingly clear that these digital assets are reshaping the landscape of finance. The uninterrupted rise over 14 consecutive months not only highlights the growing trust and adoption of stablecoins, but it also reflects a broader trend toward digital asset integration in everyday transactions and global economies. With ongoing innovations and regulatory developments on the horizon, the future of stablecoins remains poised for further evolution. As we gaze into this dynamic realm, one thing is certain: the journey of stablecoins is far from over, and their impact will likely resonate throughout the financial sector for years to come.

ivermectin drug – ivermectin for humans carbamazepine over the counter

order generic isotretinoin – isotretinoin for sale online linezolid buy online

buy amoxicillin generic – purchase amoxil without prescription order ipratropium 100mcg sale

zithromax 250mg price – tinidazole online buy bystolic 5mg pills

buy cheap prednisolone – cheap progesterone 200mg progesterone 100mg oral

buy generic neurontin – clomipramine pills itraconazole drug

order furosemide generic – buy lasix 100mg generic order betamethasone generic

order augmentin – buy cymbalta 40mg online generic duloxetine 20mg

order doxycycline sale – buy glucotrol 10mg generic purchase glucotrol pills

order augmentin – ketoconazole where to buy buy duloxetine 20mg online

buy generic rybelsus 14 mg – purchase vardenafil generic cyproheptadine usa

buy zanaflex medication – buy hydroxychloroquine medication cost microzide 25mg

purchase tadalafil generic – sildenafil without a doctor’s prescription order viagra pill

sildenafil 20mg – order viagra 100mg online cheap usa cialis overnight

order atorvastatin 20mg pills – zestril 5mg pills buy lisinopril 2.5mg pills

cenforce 100mg for sale – generic cenforce 100mg cheap metformin

purchase prilosec without prescription – cheap lopressor 50mg atenolol canada

fda methylprednisolone – pregabalin online order buy aristocort without prescription

buy desloratadine generic – where to buy desloratadine without a prescription order generic priligy

purchase misoprostol generic – generic diltiazem 180mg order diltiazem without prescription

buy zovirax 400mg generic – zyloprim 100mg usa crestor 10mg without prescription

order domperidone 10mg online – order sumycin 500mg online order cyclobenzaprine 15mg without prescription

motilium without prescription – tetracycline cheap cyclobenzaprine 15mg pill

buy inderal 10mg without prescription – purchase clopidogrel online methotrexate order

order coumadin – buy losartan tablets order cozaar 50mg pill

levaquin 250mg pill – levofloxacin 500mg canada brand ranitidine

nexium online buy – cheap nexium 20mg buy imitrex sale

buy meloxicam 15mg generic – mobic buy online order tamsulosin 0.4mg generic

oral ondansetron 4mg – buy generic simvastatin for sale buy simvastatin generic

buy cheap valacyclovir – buy generic diflucan 100mg diflucan order online

purchase modafinil online cheap order modafinil 100mg pills provigil without prescription modafinil 200mg sale order modafinil 100mg generic buy provigil sale order provigil 200mg pill

Greetings! Very gainful recommendation within this article! It’s the crumb changes which wish turn the largest changes. Thanks a quantity towards sharing!

Thanks on putting this up. It’s evidently done.

zithromax cheap – how to get tindamax without a prescription flagyl order

buy rybelsus without a prescription – rybelsus 14mg canada periactin 4mg brand

domperidone buy online – buy domperidone 10mg pills order cyclobenzaprine online cheap

order inderal pill – order plavix 75mg sale order methotrexate 2.5mg sale

purchase amoxil generic – purchase diovan online generic combivent

Ремонт бампера автомобиля — это актуальная услуга, которая позволяет обновить изначальный вид транспортного средства после мелких повреждений. Новейшие технологии позволяют устранить потертости, трещины и вмятины без полной замены детали. При выборе между ремонтом или заменой бампера [url=https://telegra.ph/Remont-ili-zamena-bampera-05-22]https://telegra.ph/Remont-ili-zamena-bampera-05-22[/url] важно учитывать степень повреждений и экономическую выгодность. Качественное восстановление включает шпатлевку, грунтовку и покраску.

Установка нового бампера требуется при серьезных повреждениях, когда ремонт бамперов нецелесообразен или невозможен. Цена восстановления варьируется от типа материала изделия, характера повреждений и модели автомобиля. Полимерные элементы подлежат ремонту лучше металлических, а новые композитные материалы требуют особого оборудования. Профессиональный ремонт расширяет срок службы детали и обеспечивает заводскую геометрию кузова.

С радостью предложу свою помощь, при возникновении необходимости по вопросам Ремкомплект для ремонта бамперов купить – обращайтесь в Телеграм hst19

order augmentin pill – https://atbioinfo.com/ ampicillin pills

buy nexium without a prescription – https://anexamate.com/ buy esomeprazole tablets

oral warfarin – coumamide losartan 50mg sale

order mobic 15mg – https://moboxsin.com/ mobic 7.5mg pill

prednisone medication – https://apreplson.com/ order generic prednisone 40mg

ed pills comparison – https://fastedtotake.com/ the blue pill ed

amoxil medication – https://combamoxi.com/ buy amoxicillin sale

buy fluconazole 200mg sale – https://gpdifluca.com/# order diflucan 200mg online cheap

buy cenforce 50mg for sale – on this site cenforce where to buy

cialis time – https://ciltadgn.com/# why does tadalafil say do not cut pile

how long does cialis take to work 10mg – click free cialis samples

buy zantac 300mg online cheap – site order zantac 150mg pill

cheap viagra tablets – discount viagra for sale buy levitra viagra

More articles like this would pretence of the blogosphere richer. https://gnolvade.com/es/accutane-comprar-espana/

This is the kind of post I look for.

More posts like this would create the online elbow-room more useful. https://buyfastonl.com/furosemide.html

This is a question which is forthcoming to my callousness… Diverse thanks! Faithfully where can I lay one’s hands on the phone details for questions? https://ursxdol.com/augmentin-amoxiclav-pill/

More posts like this would prosper the blogosphere more useful. https://prohnrg.com/product/diltiazem-online/

I discovered useful points from this.

The breadth in this article is noteworthy.

Thanks recompense sharing. It’s top quality. https://aranitidine.com/fr/prednisolone-achat-en-ligne/

Such a helpful read.

Such a valuable bit of content.

I’ll surely be back for more.

I absolutely valued the approach this was presented.

I gained useful knowledge from this.

Such a helpful bit of content.

This piece is outstanding.

More articles like this would make the blogosphere more useful.

I really liked the style this was explained.

I really appreciated the way this was laid out.

The clarity in this piece is commendable.

More content pieces like this would make the web richer.

More articles like this would make the blogosphere richer. https://ondactone.com/simvastatin/

This is the kind of writing I truly appreciate.

Such a useful resource.

Thanks on putting this up. It’s evidently done.

https://doxycyclinege.com/pro/ranitidine/

More articles like this would remedy the blogosphere richer. http://www.fujiapuerbbs.com/home.php?mod=space&uid=3616677

dapagliflozin 10mg pill – dapagliflozin over the counter buy dapagliflozin 10 mg online

buy orlistat sale – https://asacostat.com/# buy xenical 60mg

This is a topic which is in to my fundamentals… Myriad thanks! Quite where can I notice the phone details in the course of questions? http://www.cs-tygrysek.ugu.pl/member.php?action=profile&uid=98765

Эта информационная статья охватывает широкий спектр актуальных тем и вопросов. Мы стремимся осветить ключевые факты и события с ясностью и простотой, чтобы каждый читатель мог извлечь из нее полезные знания и полезные инсайты.

Подробнее можно узнать тут – https://quick-vyvod-iz-zapoya-1.ru/

You can keep yourself and your ancestors by way of being cautious when buying prescription online. Some pharmacopoeia websites control legally and offer convenience, secretiveness, cost savings and safeguards over the extent of purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/imitrex.html imitrex

При обращении по телефону или через сайт диспетчер уточняет ФИО пациента, адрес, краткую историю запоя и наличие хронических заболеваний. Затем он передаёт информацию дежурному наркологу, который готовится к выезду.

Ознакомиться с деталями – [url=https://narkolog-na-dom-rostov-na-donu13.ru/]нарколог на дом круглосуточно цены в ростове-на-дону[/url]

Перед применением конкретных средств врач проводит обследование, определяет уровень интоксикации и выявляет сопутствующие заболевания. Это позволяет максимально точно подобрать лечение. Ниже представлены ключевые методы, которые применяются для стабилизации состояния пациента:

Ознакомиться с деталями – http://vyvod-iz-zapoya-rostov-na-donu14.ru/vyvedenie-iz-zapoya-rostov-na-donu/

More articles like this would make the blogosphere richer. TerbinaPharmacy

Время — ключевой ресурс при абстиненции и интоксикации. Ниже — ориентиры, которые помогут семье принять решение не откладывать обращение. Если совпадает хотя бы один пункт, лучше сразу обсудить ситуацию с дежурным наркологом и подготовить пространство для визита.

Получить дополнительные сведения – [url=https://vivod-iz-zapoya-rostov14.ru/]вывод из запоя ростов-на-дону[/url]

Капельницы с растворами электролитов, витаминов, глюкозы и гепатопротекторов обеспечивают быстрое восстановление водно-солевого баланса, детоксикацию и поддержку печени. Инфузионное лечение позволяет нормализовать артериальное давление и сердечный ритм.

Выяснить больше – [url=https://vyvod-iz-zapoya-rostov-na-donu13.ru/]вывод из запоя клиника в ростове-на-дону[/url]

Наркологическая клиника в Ростове-на-Дону предоставляет полный спектр услуг по диагностике, лечению и реабилитации пациентов с алкогольной и наркотической зависимостью. Применение современных медицинских протоколов и индивидуальный подход к каждому пациенту обеспечивают высокую эффективность терапии и снижение риска рецидивов.

Углубиться в тему – https://narkologicheskaya-klinika-rostov-na-donu13.ru/narkologicheskaya-klinika-v-rostove

Клиника использует проверенные подходы с понятной логикой применения. Ниже — обзор ключевых методик и их места в маршруте терапии. Важно: выбор всегда индивидуален, а эффекты оцениваются по заранее оговорённым метрикам.

Углубиться в тему – [url=https://narkologicheskaya-klinika-rostov-na-donu14.ru/]наркологическая клиника нарколог ростов-на-дону[/url]

Домашний формат подходит при: длительном запое (более 48 часов), выраженной интоксикации без судорог и психотических симптомов, невозможности или нежелании пациента ехать в стационар, необходимости срочной психологической стабилизации. Также вызов на дом показан тем, кто желает анонимности и минимального вмешательства в рабочий и семейный график.

Углубиться в тему – [url=https://narkolog-na-dom-rostov-na-donu13.ru/]частный нарколог на дом[/url]

Нижегородская наркологическая клиника «Честный врач» предлагает услуги по выведению из запоя и лечению зависимости. Возможен вызов нарколога на дом, постановка капельниц при алкогольной интоксикации, а также полноценные программы лечения алкоголизма и наркомании.

Исследовать вопрос подробнее – [url=https://otalkogolizma.ru/stati/psihoterapiya-i-psihiatriya-v-borbe-s-ehmocionalnoj-zavisimostyu/]эмоциональная зависимость от человека[/url]

Время — ключевой ресурс при абстиненции и интоксикации. Ниже — ориентиры, которые помогут семье принять решение не откладывать обращение. Если совпадает хотя бы один пункт, лучше сразу обсудить ситуацию с дежурным наркологом и подготовить пространство для визита.

Разобраться лучше – https://vivod-iz-zapoya-rostov14.ru/

Домашний визит нарколога — это формат, который соединяет клиническую безопасность и человеческую деликатность. В «КубаньМедЦентре» (Краснодар) мы организуем помощь так, чтобы пациент получал её там, где ему спокойнее всего — у себя дома. Дежурная команда работает круглосуточно, а среднее окно прибытия по городу составляет 30–40 минут с момента подтверждения заявки. Врач приезжает без опознавательных знаков, проводит экспресс-оценку состояния, запускает индивидуально подобранную инфузионную терапию и оставляет подробный план на ближайшие 72 часа. Каждый шаг объясняется простым языком: что мы делаем, зачем это нужно и по каким критериям поймём, что динамика идёт правильно.

Разобраться лучше – [url=https://narcolog-na-dom-krasnodar14.ru/]вызвать нарколога на дом в краснодаре[/url]

В «РостовМедЦентре» лечение начинается с подробной оценки факторов риска и мотивации. Клиническая команда анализирует стаж употребления, тип вещества, эпизоды срывов, соматический фон, лекарства, которые пациент принимает постоянно, и уровень социальной поддержки. Уже на первой встрече составляется «дорожная карта» на ближайшие 72 часа: диагностический минимум, объём медицинских вмешательств, пространство для психологической работы и точки контроля. Безопасность — не абстракция: скорости инфузий рассчитываются в инфузомате, седацию подбирают по шкалам тревоги и с обязательным контролем сатурации, а лекарственные взаимодействия сверяет клинический фармаколог. Пациент получает прозрачные цели на день, на неделю и на месяц — без обещаний мгновенных чудес и без стигмы.

Изучить вопрос глубже – [url=https://narkologicheskaya-klinika-rostov-na-donu14.ru/]наркологическая клиника лечение алкоголизма[/url]

Используются препараты, нормализующие работу центральной нервной системы, корректирующие электролитный баланс и устраняющие симптомы алкогольной интоксикации. Применение седативных и противосудорожных средств снижает риск осложнений.

Получить дополнительную информацию – [url=https://vyvod-iz-zapoya-rostov-na-donu13.ru/]вывод из запоя вызов на дом в ростове-на-дону[/url]

Нарколог прибывает в течение 30 минут, оснащённый переносным оборудованием: портативным электрокардиографом, спирометром, прибором для измерения сатурации, набором необходимых медикаментов и расходных материалов. На первом этапе проводится замер давления, пульса, температуры и сатурации, берётся капиллярная проба крови для экспресс-анализа глюкозы и электролитов.

Получить больше информации – http://narkolog-na-dom-rostov-na-donu13.ru

*Седативные препараты применяются строго по показаниям и под мониторингом дыхания.

Получить дополнительные сведения – [url=https://vivod-iz-zapoya-rostov14.ru/]вывод из запоя цена[/url]

*Метод подбирается индивидуально и применяется только по информированному согласию.

Разобраться лучше – [url=https://narkologicheskaya-klinika-rostov-na-donu14.ru/]наркологическая клиника нарколог ростов-на-дону[/url]

Современная наркологическая помощь в Ростове-на-Дону базируется на комплексном подходе, который объединяет медицинское лечение, психологическую поддержку и социальную реабилитацию. Такой подход доказал свою эффективность в многочисленных исследованиях, доступных на сайте Российского общества наркологов.

Получить больше информации – [url=https://narkologicheskaya-klinika-rostov-na-donu13.ru/]анонимная наркологическая клиника[/url]

Доктор Елена Иванова, ведущий специалист клиники, отмечает: «Комбинация современных медикаментозных средств и психотерапии значительно повышает шансы на успешное избавление от зависимости».

Исследовать вопрос подробнее – [url=https://narkologicheskaya-klinika-rostov-na-donu13.ru/]запой наркологическая клиника ростов-на-дону[/url]

Наша философия проста: минимум медикаментов, максимум управляемости процесса. Мы не используем «универсальные капельницы», а собираем схему под клиническую картину: длительность запоя, выраженность тремора и тошноты, качество сна, уровень тревоги, исходное давление и частоту пульса, сопутствующие заболевания, текущие лекарства (антигипертензивные, антиаритмические, сахароснижающие, средства для сна). Скорость инфузии задаётся инфузоматом, витальные показатели контролируются портативным кардиомонитором и пульсоксиметром, глюкоза и электролиты — по экспресс-панелям. Такой подход снижает риск осложнений и делает результат предсказуемым и устойчивым.

Разобраться лучше – https://narcolog-na-dom-krasnodar14.ru/narkolog-krasnodar-anonimno/

Состав капельницы никогда не «копируется»; он выбирается по доминирующему симптому и соматическому фону. Ниже — клинические профили, которые помогают понять нашу логику. Итоговая схема формируется на месте, а скорость и объём зависят от текущих показателей.

Подробнее тут – [url=https://narcolog-na-dom-krasnodar14.ru/]нарколог на дом круглосуточно цены в краснодаре[/url]

Нарколог прибывает в течение 30 минут, оснащённый переносным оборудованием: портативным электрокардиографом, спирометром, прибором для измерения сатурации, набором необходимых медикаментов и расходных материалов. На первом этапе проводится замер давления, пульса, температуры и сатурации, берётся капиллярная проба крови для экспресс-анализа глюкозы и электролитов.

Подробнее тут – [url=https://narkolog-na-dom-rostov-na-donu13.ru/]вызвать нарколога на дом срочно[/url]

Используются препараты, нормализующие работу центральной нервной системы, корректирующие электролитный баланс и устраняющие симптомы алкогольной интоксикации. Применение седативных и противосудорожных средств снижает риск осложнений.

Выяснить больше – [url=https://vyvod-iz-zapoya-rostov-na-donu13.ru/]нарколог на дом вывод из запоя[/url]

Процесс лечения разделён на несколько этапов, каждый из которых важен для безопасности и эффективности терапии.

Ознакомиться с деталями – [url=https://narkolog-na-dom-rostov-na-donu13.ru/]вызов нарколога на дом[/url]

Если требуется срочная наркологическая помощь в Нижнем Новгороде, клиника «Честный врач» готова помочь. Врачи выезжают на дом, проводят капельницы при запое, обеспечивают безопасное выведение из запойного состояния и предлагают программы лечения наркомании и алкоголизма.

Получить больше информации – [/url]

Нижегородская наркологическая клиника «Честный врач» предлагает услуги по выведению из запоя и лечению зависимости. Возможен вызов нарколога на дом, постановка капельниц при алкогольной интоксикации, а также полноценные программы лечения алкоголизма и наркомании.

Выяснить больше – [/url]

В процессе вывода из запоя специалисты проводят регулярный контроль жизненно важных показателей — пульса, давления, температуры и уровня насыщения кислородом крови. Это позволяет своевременно выявлять и корректировать отклонения.

Разобраться лучше – [url=https://vyvod-iz-zapoya-rostov-na-donu13.ru/]вывод из запоя на дому в ростове-на-дону[/url]

Основной метод — инфузионная терапия с применением сбалансированных растворов: глюкоза, плазмозамещающие, витаминные комплексы, гепатопротекторы и антиоксиданты. В зависимости от состояния пациента используются седативные и противосудорожные средства. Общая продолжительность инфузий составляет 3–5 часов, возможно разделение на несколько сеансов в течение первого дня.

Подробнее тут – [url=https://narkolog-na-dom-rostov-na-donu13.ru/]нарколог на дом недорого в ростове-на-дону[/url]

Вывод из запоя проводится с применением современных медицинских технологий и препаратов, направленных на детоксикацию и стабилизацию состояния организма. Основные этапы включают:

Углубиться в тему – https://vyvod-iz-zapoya-rostov-na-donu13.ru/vyvod-iz-zapoya-na-donu/

Hello guys

Hi. A 24 nice website 1 that I found on the Internet.

Check out this website. There’s a great article there. https://drugstats.org/gambling/how-to-become-a-vegetarian-and-not-ruin-your-health/|

There is sure to be a lot of useful and interesting information for you here.

You’ll find everything you need and more. Feel free to follow the link below.

При обращении по телефону или через сайт диспетчер уточняет ФИО пациента, адрес, краткую историю запоя и наличие хронических заболеваний. Затем он передаёт информацию дежурному наркологу, который готовится к выезду.

Подробнее тут – https://narkolog-na-dom-rostov-na-donu13.ru

Капельницы с растворами электролитов, витаминов, глюкозы и гепатопротекторов обеспечивают быстрое восстановление водно-солевого баланса, детоксикацию и поддержку печени. Инфузионное лечение позволяет нормализовать артериальное давление и сердечный ритм.

Узнать больше – https://vyvod-iz-zapoya-rostov-na-donu13.ru/vyvod-iz-zapoya-rostov

Основной метод — инфузионная терапия с применением сбалансированных растворов: глюкоза, плазмозамещающие, витаминные комплексы, гепатопротекторы и антиоксиданты. В зависимости от состояния пациента используются седативные и противосудорожные средства. Общая продолжительность инфузий составляет 3–5 часов, возможно разделение на несколько сеансов в течение первого дня.

Углубиться в тему – [url=https://narkolog-na-dom-rostov-na-donu13.ru/]нарколог на дом круглосуточно[/url]

Вывод из запоя проводится с применением современных медицинских технологий и препаратов, направленных на детоксикацию и стабилизацию состояния организма. Основные этапы включают:

Получить дополнительные сведения – https://vyvod-iz-zapoya-rostov-na-donu13.ru/vyvod-iz-zapoya-staczionar-rostov/

Используются препараты, нормализующие работу центральной нервной системы, корректирующие электролитный баланс и устраняющие симптомы алкогольной интоксикации. Применение седативных и противосудорожных средств снижает риск осложнений.

Получить дополнительную информацию – [url=https://vyvod-iz-zapoya-rostov-na-donu13.ru/]вывод из запоя на дому[/url]

Вывод из запоя проводится с применением современных медицинских технологий и препаратов, направленных на детоксикацию и стабилизацию состояния организма. Основные этапы включают:

Получить дополнительную информацию – [url=https://vyvod-iz-zapoya-rostov-na-donu13.ru/]вывод из запоя на дому ростов-на-дону[/url]

При обращении по телефону или через сайт диспетчер уточняет ФИО пациента, адрес, краткую историю запоя и наличие хронических заболеваний. Затем он передаёт информацию дежурному наркологу, который готовится к выезду.

Разобраться лучше – [url=https://narkolog-na-dom-rostov-na-donu13.ru/]вызвать нарколога на дом срочно в ростове-на-дону[/url]

При обращении по телефону или через сайт диспетчер уточняет ФИО пациента, адрес, краткую историю запоя и наличие хронических заболеваний. Затем он передаёт информацию дежурному наркологу, который готовится к выезду.

Узнать больше – [url=https://narkolog-na-dom-rostov-na-donu13.ru/]платный нарколог на дом в ростове-на-дону[/url]

Наркологическая клиника «Честный врач» в Нижнем Новгороде оказывает круглосуточную помощь людям с алкогольной и наркотической зависимостью. Возможен выезд нарколога на дом, проведение капельницы при запое и комплексное лечение алкоголизма и наркомании с сохранением конфиденциальности.

Выяснить больше – [url=https://otalkogolizma.ru/uslugi/narkologicheskaya-pomosh/narkologicheskiy-tsentr/]наркологический центр в в новгороде

Нарколог прибывает в течение 30 минут, оснащённый переносным оборудованием: портативным электрокардиографом, спирометром, прибором для измерения сатурации, набором необходимых медикаментов и расходных материалов. На первом этапе проводится замер давления, пульса, температуры и сатурации, берётся капиллярная проба крови для экспресс-анализа глюкозы и электролитов.

Получить дополнительные сведения – [url=https://narkolog-na-dom-rostov-na-donu13.ru/]частный нарколог на дом[/url]

Процесс лечения разделён на несколько этапов, каждый из которых важен для безопасности и эффективности терапии.

Углубиться в тему – [url=https://narkolog-na-dom-rostov-na-donu13.ru/]нарколог на дом ростов-на-дону[/url]

This is the tolerant of enter I turn up helpful.

Если требуется срочная наркологическая помощь в Нижнем Новгороде, клиника «Честный врач» готова помочь. Врачи выезжают на дом, проводят капельницы при запое, обеспечивают безопасное выведение из запойного состояния и предлагают программы лечения наркомании и алкоголизма.

Детальнее – [url=https://otalkogolizma.ru/stati/chto-delat-v-sluchae-sryva-posle-kodirovaniya/]что делать при нервном срыве[/url]

Публикация предлагает читателю не просто информацию, а инструменты для анализа и саморазвития. Мы стимулируем критическое мышление, предлагая различные точки зрения и призывая к самостоятельному поиску решений.

Посмотреть всё – https://shauncrobinson.com/live-retired-now

Этот текст призван помочь читателю расширить кругозор и получить практические знания. Мы используем простой язык, наглядные примеры и структурированное изложение, чтобы сделать обучение максимально эффективным и увлекательным.

Ознакомиться с полной информацией – http://www.livsnyteri.no/cropped-anjaogtorill2-1-jpg

Читатель отправляется в интеллектуальное путешествие по самым ярким событиям истории и важнейшим научным открытиям. Мы раскроем тайны эпох, покажем, как идеи меняли миры, и объясним, почему эти знания остаются актуальными сегодня.

Не упусти важное! – https://www.nadnet.ma/new-post-2

Эта информационная заметка содержит увлекательные сведения, которые могут вас удивить! Мы собрали интересные факты, которые сделают вашу жизнь ярче и полнее. Узнайте нечто новое о привычных аспектах повседневности и откройте для себя удивительный мир информации.

Полезно знать – http://granato.tv/?page_id=400

В обзорной статье вы найдете собрание важных фактов и аналитики по самым разнообразным темам. Мы рассматриваем как современные исследования, так и исторические контексты, чтобы вы могли получить полное представление о предмете. Погрузитесь в мир знаний и сделайте шаг к пониманию!

Получить больше информации – https://catrankers.com/revolutionize-your-business-with-our-cutting-edge

Этот информативный материал предлагает содержательную информацию по множеству задач и вопросов. Мы призываем вас исследовать различные идеи и факты, обобщая их для более глубокого понимания. Наша цель — сделать обучение доступным и увлекательным.

Провести детальное исследование – https://choofercolombia.com/2022/12/21/club-membership-opitons

Этот информационный материал привлекает внимание множеством интересных деталей и необычных ракурсов. Мы предлагаем уникальные взгляды на привычные вещи и рассматриваем вопросы, которые волнуют общество. Будьте в курсе актуальных тем и расширяйте свои знания!

Смотри, что ещё есть – https://www.p2law.com.br/o-direito-de-imagem-empresarial-e-sua-protecao-legal

Эта статья предлагает уникальную подборку занимательных фактов и необычных историй, которые вы, возможно, не знали. Мы постараемся вдохновить ваше воображение и разнообразить ваш кругозор, погружая вас в мир, полный интересных открытий. Читайте и открывайте для себя новое!

Изучить материалы по теме – https://banskonews.com/po-predlojenie-na-gucanov-e-podmenen-kandidata-za-kmet-na-bansko-i-listata-za-suvetnici

Этот информационный обзор станет отличным путеводителем по актуальным темам, объединяющим важные факты и мнения экспертов. Мы исследуем ключевые идеи и представляем их в доступной форме для более глубокого понимания. Читайте, чтобы оставаться в курсе событий!

Исследовать вопрос подробнее – https://pentvars.edu.gh/pentecost-university-celebrates-students-entrepreneurial-achievement

В этой статье представлен занимательный и актуальный контент, который заставит вас задуматься. Мы обсуждаем насущные вопросы и проблемы, а также освещаем истории, которые вдохновляют на действия и изменения. Узнайте, что стоит за событиями нашего времени!

Нажмите, чтобы узнать больше – https://www.consergra.com/icomoon-numbers-32×32

В этом интересном тексте собраны обширные сведения, которые помогут вам понять различные аспекты обсуждаемой темы. Мы разбираем детали и факты, делая акцент на важности каждого элемента. Не упустите возможность расширить свои знания и взглянуть на мир по-новому!

Прочесть заключение эксперта – https://starpeople.jp/seijingoroku/takashimayasushi/20190621/6345

В этой статье вы найдете познавательную и занимательную информацию, которая поможет вам лучше понять мир вокруг. Мы собрали интересные данные, которые вдохновляют на размышления и побуждают к действиям. Открывайте новую информацию и получайте удовольствие от чтения!

Следуйте по ссылке – https://themonamarshall.com/indian-bride-traditions

В этом интересном тексте собраны обширные сведения, которые помогут вам понять различные аспекты обсуждаемой темы. Мы разбираем детали и факты, делая акцент на важности каждого элемента. Не упустите возможность расширить свои знания и взглянуть на мир по-новому!

Откройте для себя больше – https://www.luisa-wammes.at/uncategorized/hello-world

Эта публикация погружает вас в мир увлекательных фактов и удивительных открытий. Мы расскажем о ключевых событиях, которые изменили ход истории, и приоткроем завесу над научными достижениями, которые вдохновили миллионы. Узнайте, чему может научить нас прошлое и как применить эти знания в будущем.

Перейти к полной версии – https://www.lacreativitedanslapeau.fr/jason-shulman-captures-entire-movies

Этот информационный материал привлекает внимание множеством интересных деталей и необычных ракурсов. Мы предлагаем уникальные взгляды на привычные вещи и рассматриваем вопросы, которые волнуют общество. Будьте в курсе актуальных тем и расширяйте свои знания!

Посмотреть подробности – https://www.reginejackson.com/introducing-regines-book-club

Откройте для себя скрытые страницы истории и малоизвестные научные открытия, которые оказали колоссальное влияние на развитие человечества. Статья предлагает свежий взгляд на события, которые заслуживают большего внимания.

Как достичь результата? – https://ilovetostyle.com/?page_id=174

Эта информационная статья содержит полезные факты, советы и рекомендации, которые помогут вам быть в курсе последних тенденций и изменений в выбранной области. Материал составлен так, чтобы быть полезным и понятным каждому.

Обратиться к источнику – https://londonairportcarhire.co.uk/2019/05/13/hello-world

В этой статье вы найдете уникальные исторические пересечения с научными открытиями. Каждый абзац — это шаг к пониманию того, как наука и события прошлого создают основу для технологического будущего.

Прочесть заключение эксперта – https://shoppingstock.it/index.php/component/k2/item/2-pucho-na-alphabet-de-lahoita-mundde-astapun?start=17690

Этот информативный текст выделяется своими захватывающими аспектами, которые делают сложные темы доступными и понятными. Мы стремимся предложить читателям глубину знаний вместе с разнообразием интересных фактов. Откройте новые горизонты и развивайте свои способности познавать мир!

Ознакомиться с теоретической базой – https://sidoharjo-mojokerto.id/sanggar-tari

Эта публикация погружает вас в мир увлекательных фактов и удивительных открытий. Мы расскажем о ключевых событиях, которые изменили ход истории, и приоткроем завесу над научными достижениями, которые вдохновили миллионы. Узнайте, чему может научить нас прошлое и как применить эти знания в будущем.

Интересует подробная информация – https://luvfurpaws.com/product/budgies-food-natural-healthy-premium-mix-seeds

Эта познавательная публикация погружает вас в море интересного контента, который быстро захватит ваше внимание. Мы рассмотрим важные аспекты темы и предоставим вам уникальные Insights и полезные сведения для дальнейшего изучения.

Ознакомьтесь с аналитикой – https://psychomatrix.in/product/specific-learning-disability-comprehensive-diagnostic-battery

Этот обзорный материал предоставляет информационно насыщенные данные, касающиеся актуальных тем. Мы стремимся сделать информацию доступной и структурированной, чтобы читатели могли легко ориентироваться в наших выводах. Познайте новое с нашим обзором!

Раскрыть тему полностью – https://lamariluna.com/amor-de-miel-l-pelicula-completa

Эта статья для ознакомления предлагает читателям общее представление об актуальной теме. Мы стремимся представить ключевые факты и идеи, которые помогут читателям получить представление о предмете и решить, стоит ли углубляться в изучение.

Как это работает — подробно – https://mikltd.eu/blog/2020/03/21/%D0%BC%D0%B8%D0%BA-%D0%B1%D0%B3-%D0%B5%D0%BE%D0%BE%D0%B4-%D0%BF%D1%80%D0%BE%D0%B2%D0%B5%D0%B4%D0%B5-%D0%BA%D1%80%D1%8A%D0%B3%D0%BB%D0%B0-%D0%BC%D0%B0%D1%81%D0%B0-%D1%81-%D1%86%D0%B5%D0%BB-%D0%BF%D1%80

В этом интересном тексте собраны обширные сведения, которые помогут вам понять различные аспекты обсуждаемой темы. Мы разбираем детали и факты, делая акцент на важности каждого элемента. Не упустите возможность расширить свои знания и взглянуть на мир по-новому!

Осуществить глубокий анализ – https://nexguardians.com/p4-bugs-and-their-poc-steps-part-1

Эта публикация погружает вас в мир увлекательных фактов и удивительных открытий. Мы расскажем о ключевых событиях, которые изменили ход истории, и приоткроем завесу над научными достижениями, которые вдохновили миллионы. Узнайте, чему может научить нас прошлое и как применить эти знания в будущем.

Изучить материалы по теме – https://wtosport.com/kemarin-dividen-bumn-hingga-target-penyelesaian-16-psn

Эта информационная заметка содержит увлекательные сведения, которые могут вас удивить! Мы собрали интересные факты, которые сделают вашу жизнь ярче и полнее. Узнайте нечто новое о привычных аспектах повседневности и откройте для себя удивительный мир информации.

Ознакомиться с теоретической базой – https://hierhoudenwevan.nl/6-redenen-waarom-een-gembershot-je-weerstand-verhoogt

Эта статья для ознакомления предлагает читателям общее представление об актуальной теме. Мы стремимся представить ключевые факты и идеи, которые помогут читателям получить представление о предмете и решить, стоит ли углубляться в изучение.

Узнать больше > – https://compta-btp.com/aide-gnr-btp-comment-les-pme-du-batiment-peuvent-en-beneficier

В этом интересном тексте собраны обширные сведения, которые помогут вам понять различные аспекты обсуждаемой темы. Мы разбираем детали и факты, делая акцент на важности каждого элемента. Не упустите возможность расширить свои знания и взглянуть на мир по-новому!

Всё, что нужно знать – https://seautomotriz.com/hello-world

В данной статье вы найдете комплексный подход к изучению насущных тем. Мы комбинируем теоретические сведения с практическими советами, чтобы читатель мог не только понять проблему, но и найти пути её решения.

Получить больше информации – https://about.weatherplus.vn/agrimedia-cung-nha-nong-hoi-nhap

Эта информационная статья содержит полезные факты, советы и рекомендации, которые помогут вам быть в курсе последних тенденций и изменений в выбранной области. Материал составлен так, чтобы быть полезным и понятным каждому.

Хочу знать больше – https://rotulosolmedo.com/how-to-choose-perfect-gadgets-7

Этот текст призван помочь читателю расширить кругозор и получить практические знания. Мы используем простой язык, наглядные примеры и структурированное изложение, чтобы сделать обучение максимально эффективным и увлекательным.

Эксклюзивная информация – https://www.bharatsokagakkai.org/news-bgtop

Эта статья для ознакомления предлагает читателям общее представление об актуальной теме. Мы стремимся представить ключевые факты и идеи, которые помогут читателям получить представление о предмете и решить, стоит ли углубляться в изучение.

Ознакомиться с отчётом – https://storylab8.com/science-of-storytelling

Эта публикация погружает вас в мир увлекательных фактов и удивительных открытий. Мы расскажем о ключевых событиях, которые изменили ход истории, и приоткроем завесу над научными достижениями, которые вдохновили миллионы. Узнайте, чему может научить нас прошлое и как применить эти знания в будущем.

Хочешь знать всё? – https://www.hydrau-tech.net/aside-post-format

Перед началом терапии врач проводит осмотр, собирает анамнез, измеряет давление и сатурацию, при необходимости делает экспресс-тесты. На основании данных подбирается индивидуальная схема, рассчитываются объёмы инфузии и темп введения, оценивается необходимость кардиоконтроля.

Получить дополнительные сведения – [url=https://vyvod-iz-zapoya-reutov7.ru/]скорая помощь вывода из запоя[/url]

Домашний визит нарколога — это быстрый и конфиденциальный способ стабилизировать состояние без госпитализации. «РеАл Мед» организует выезд по всему Жуковскому и близлежащим посёлкам (Быково, Кратово, Ильинский, Островцы) круглосуточно: врач приедет с оборудованием, оценит риски на месте и запустит инфузионную терапию, чтобы снять интоксикацию, тремор, тошноту и тревожность. Процедуры проводятся по медицинским протоколам, с индивидуальным подбором схем под показатели пациента и сопутствующие заболевания, а вся коммуникация выстроена максимально деликатно — без лишнего внимания соседей и персонала дома.

Подробнее – https://narkolog-na-dom-zhukovskij7.ru/vyzov-narkologa-na-dom-v-zhukovskom

Каждая процедура проводится под контролем квалифицированного врача. При необходимости возможен экстренный выезд специалиста на дом, что позволяет оказать помощь пациенту в привычной и безопасной обстановке.

Подробнее можно узнать тут – http://vyvod-iz-zapoya-odincovo6.ru/vyvod-iz-zapoya-kruglosutochno-v-odincovo/

Выездная бригада прибывает с необходимым оборудованием. Инфузионная терапия длится 60–120 минут; по ходу процедуры контролируются давление, пульс, дыхание и субъективное самочувствие, при необходимости схема корректируется (темп капания, смена растворов, добавление противорвотных или седативных средств). Чаще всего уже к концу первой инфузии снижается тошнота, уходит дрожь и «внутренняя дрожь», нормализуется сон. Врач оставляет пошаговый план на 24–72 часа: питьевой режим, щадящее питание (дробно, без жирного и острого), режим сна, рекомендации по витаминам и гепатопротекции. Если в процессе выявляются тревожные признаки (нестабильная гемодинамика, выраженная аритмия, спутанность сознания), будет предложен перевод в стационар.

Подробнее – http://vyvod-iz-zapoya-reutov7.ru/vyvedenie-iz-zapoya-v-reutove/

Домашний визит нарколога — это быстрый и конфиденциальный способ стабилизировать состояние без госпитализации. «РеАл Мед» организует выезд по всему Жуковскому и близлежащим посёлкам (Быково, Кратово, Ильинский, Островцы) круглосуточно: врач приедет с оборудованием, оценит риски на месте и запустит инфузионную терапию, чтобы снять интоксикацию, тремор, тошноту и тревожность. Процедуры проводятся по медицинским протоколам, с индивидуальным подбором схем под показатели пациента и сопутствующие заболевания, а вся коммуникация выстроена максимально деликатно — без лишнего внимания соседей и персонала дома.

Узнать больше – http://narkolog-na-dom-zhukovskij7.ru/narkolog-na-dom-kruglosutochno-v-zhukovskom/

Если состояние тяжёлое либо есть серьёзные сопутствующие заболевания, оптимален стационар. Здесь доступны расширенная диагностика (ЭКГ, лаборатория, оценка электролитов, функции печени и почек), усиленные схемы инфузии, противорвотная, седативная и кардиопротективная поддержка. Круглосуточный мониторинг позволяет своевременно корректировать терапию, предотвращать обезвоживание и электролитные нарушения. Для пациентов из Реутова организуем аккуратную транспортировку и обратный трансфер после стабилизации.

Детальнее – [url=https://vyvod-iz-zapoya-reutov7.ru/]нарколог вывод из запоя реутов[/url]

Для максимальной эффективности мы предлагаем несколько сценариев — от разового экстренного вмешательства до длительного сопровождения ремиссии. Выбор формата определяется состоянием, анамнезом и целями пациента. Возможен гибридный маршрут: старт на дому, затем — дневной стационар или госпитализация, а после стабилизации — амбулаторное сопровождение.

Получить больше информации – [url=https://narkologicheskaya-pomoshch-ramenskoe7.ru/]наркологическая помощь в раменском[/url]

Если по ходу первичного осмотра выявляются «красные флаги» (спутанность сознания, нестабильное давление/ритм, кровавая рвота, подозрение на делирий), врач немедленно предложит госпитализацию и аккуратно организует перевод — безопасность всегда выше удобства.

Получить больше информации – [url=https://narkolog-na-dom-zhukovskij7.ru/]psihiatr-narkolog-na-dom[/url]

В зависимости от клинической картины и предпочтений возможны следующие виды кодирования:

Разобраться лучше – https://kodirovanie-ot-alkogolizma-ehlektrostal6.ru/kodirovanie-ot-alkogolizma-na-domu-v-ehlektrostali

Вывод из запоя в Пушкино в клинике «Трезвый Путь» — это оперативная помощь на дому и в стационаре, персональные детокс-схемы и бережное восстановление организма без постановки на учёт. Мы подключаемся круглосуточно, аккуратно снимаем интоксикацию, стабилизируем давление и пульс, уменьшаем тремор, тревогу и бессонницу, а затем предлагаем понятный маршрут к ремиссии, который вписывается в ваш рабочий и семейный график. Цель — безопасно пройти острый период и не «сорваться» обратно, когда станет чуть полегче.

Подробнее тут – https://vyvod-iz-zapoya-pushkino7.ru/vyvedenie-iz-zapoya-v-pushkino/

Процедура вывода из запоя проводится опытными наркологами с применением современных протоколов и сертифицированных препаратов. Процесс включает несколько ключевых этапов:

Ознакомиться с деталями – http://vyvod-iz-zapoya-odincovo6.ru/vyvod-iz-zapoya-na-domu-v-odincovo/

Перед выбором метода врач проводит диагностику, оценивает физическое и психоэмоциональное состояние пациента, рассказывает о возможных рисках и особенностях процедуры. Только после согласования всех деталей назначается дата и форма кодирования.

Углубиться в тему – [url=https://kodirovanie-ot-alkogolizma-ehlektrostal6.ru/]medicinskij-centr-kodirovanie-ot-alkogolizma[/url]

Чтобы семье было проще ориентироваться во времени и ожиданиях, ниже — последовательность шагов с ориентиром по длительности и ожидаемому эффекту.

Углубиться в тему – [url=https://narkolog-na-dom-zhukovskij7.ru/]vrach-narkolog-na-dom-zhukovskij[/url]

В Реутове помощь при запое должна быть быстрой, безопасной и конфиденциальной. Команда «Трезвой Линии» организует выезд врача 24/7, проводит детоксикацию с контролем жизненных показателей и помогает мягко стабилизировать состояние без лишнего стресса. Мы работаем по медицинским протоколам, используем сертифицированные препараты и подбираем схему персонально — с учётом анализов, хронических заболеваний и текущего самочувствия. Приоритет — снять интоксикацию, восстановить сон и аппетит, выровнять давление и снизить тревожность, чтобы человек смог безопасно вернуться к обычному режиму.

Получить дополнительную информацию – [url=https://vyvod-iz-zapoya-reutov7.ru/]vyvod-iz-zapoya-na-domu[/url]

Медицинское кодирование действует не на симптомы, а на глубинные механизмы зависимости. Оно позволяет не просто временно отказаться от алкоголя, а формирует устойчивое отвращение и помогает преодолеть психологическую тягу. Такой подход снижает риск рецидива, улучшает мотивацию, способствует восстановлению здоровья и психологического баланса. В «Новом Пути» для каждого пациента подбирается индивидуальный метод с учётом анамнеза, возраста, сопутствующих болезней и личных особенностей.

Подробнее тут – http://kodirovanie-ot-alkogolizma-ehlektrostal6.ru/kodirovka-ot-alkogolya-v-ehlektrostali/

Этап процедуры

Получить больше информации – [url=https://vyvod-iz-zapoya-odincovo6.ru/]вывод из запоя[/url]

Эта обзорная заметка содержит ключевые моменты и факты по актуальным вопросам. Она поможет читателям быстро ориентироваться в теме и узнать о самых важных аспектах сегодня. Получите краткий курс по современной информации и оставайтесь в курсе событий!

Познакомиться с результатами исследований – https://fundacjakrajwspanialy.pl/project/nawrzanskie-echa-koncert-fortepianowy-pod-gwiazdami

В зависимости от клинической картины и предпочтений возможны следующие виды кодирования:

Узнать больше – [url=https://kodirovanie-ot-alkogolizma-ehlektrostal6.ru/]kodirovanie-ot-alkogolizma-ukolom[/url]

Эта информационная статья содержит полезные факты, советы и рекомендации, которые помогут вам быть в курсе последних тенденций и изменений в выбранной области. Материал составлен так, чтобы быть полезным и понятным каждому.

Обратиться к источнику – https://goldendigitalgroup.co/2020/08/25/construction-industry-as-their-over-draft-4

Этот информативный материал предлагает содержательную информацию по множеству задач и вопросов. Мы призываем вас исследовать различные идеи и факты, обобщая их для более глубокого понимания. Наша цель — сделать обучение доступным и увлекательным.

Ознакомиться с теоретической базой – http://www.solni.pl/2024/05/16/witaj-swiecie

Эта статья предлагает живое освещение актуальной темы с множеством интересных фактов. Мы рассмотрим ключевые моменты, которые делают данную тему важной и актуальной. Подготовьтесь к насыщенному путешествию по неизвестным аспектам и узнайте больше о значимых событиях.

Углубиться в тему – https://kind-und-gluecklich.de/cropped-20181214_144031-jpg

В этом обзорном материале представлены увлекательные детали, которые находят отражение в различных аспектах жизни. Мы исследуем непонятные и интересные моменты, позволяя читателю увидеть картину целиком. Погрузитесь в мир знаний и удивительных открытий!

Посмотреть всё – https://www.karbonarna.cz/portfolio/udelatko-ii

Эта информационная заметка содержит увлекательные сведения, которые могут вас удивить! Мы собрали интересные факты, которые сделают вашу жизнь ярче и полнее. Узнайте нечто новое о привычных аспектах повседневности и откройте для себя удивительный мир информации.

Ознакомиться с деталями – https://www.p2law.com.br/o-direito-de-imagem-empresarial-e-sua-protecao-legal

В этой статье-обзоре мы соберем актуальную информацию и интересные факты, которые освещают важные темы. Читатели смогут ознакомиться с различными мнениями и подходами, что позволит им расширить кругозор и глубже понять обсуждаемые вопросы.

Полная информация здесь – https://womenworldmagazine.com/reshaping-boardrooms-womens-impact-on-corporate-governance

Эта публикация дает возможность задействовать различные источники информации и представить их в удобной форме. Читатели смогут быстро найти нужные данные и получить ответы на интересующие их вопросы. Мы стремимся к четкости и доступности материала для всех!

Заходи — там интересно – https://climadenegocios.com.ar/cgtn-publico-un-nuevo-documental-sobre-la-ciudad-de-hangzhou

Эта информационная статья охватывает широкий спектр актуальных тем и вопросов. Мы стремимся осветить ключевые факты и события с ясностью и простотой, чтобы каждый читатель мог извлечь из нее полезные знания и полезные инсайты.

ТОП-5 причин узнать больше – https://mdprestations.fr/bonjour-tout-le-monde

В этой статье-обзоре мы соберем актуальную информацию и интересные факты, которые освещают важные темы. Читатели смогут ознакомиться с различными мнениями и подходами, что позволит им расширить кругозор и глубже понять обсуждаемые вопросы.

Что ещё нужно знать? – https://almapps.com/blog/powering-your-productivity-expert-insights-on-industrial-power-generators

В этом информативном тексте представлены захватывающие события и факты, которые заставят вас задуматься. Мы обращаем внимание на важные моменты, которые часто остаются незамеченными, и предлагаем новые перспективы на привычные вещи. Подготовьтесь к тому, чтобы быть поглощенным увлекательными рассказами!

Проследить причинно-следственные связи – https://template168.webekspor.com/how-swiftship-logistics-ensures-on-time-deliveries-every-time

В этом интересном тексте собраны обширные сведения, которые помогут вам понять различные аспекты обсуждаемой темы. Мы разбираем детали и факты, делая акцент на важности каждого элемента. Не упустите возможность расширить свои знания и взглянуть на мир по-новому!

Ознакомиться с теоретической базой – https://nafbeautysupply.com/2024/08/19/hello-world

В этом интересном тексте собраны обширные сведения, которые помогут вам понять различные аспекты обсуждаемой темы. Мы разбираем детали и факты, делая акцент на важности каждого элемента. Не упустите возможность расширить свои знания и взглянуть на мир по-новому!

Ознакомиться с теоретической базой – https://activo2030sanjose.com/2024/05/29/proyecto-rueditas-de-amor-celebra-su-octava-edicion-en-costa-rica-beneficiando-a-mas-de-220-personas

Публикация приглашает вас исследовать неизведанное — от древних тайн до современных достижений науки. Вы узнаете, как случайные находки превращались в революции, а смелые мысли — в новые эры человеческого прогресса.

Читать далее > – https://noto-highschool.com/2020/03/02/%E8%83%BD%E7%99%BB%E7%94%BA%E6%B0%91%E3%81%97%E3%81%8B%E7%9F%A5%E3%82%89%E3%81%AA%E3%81%84%EF%BC%81%EF%BC%9F%E5%A4%8F%E3%82%92%E6%A5%BD%E3%82%80%E3%81%9F%E3%82%81%E3%81%AE%E7%A5%AD%E3%82%8A

Этот информационный обзор станет отличным путеводителем по актуальным темам, объединяющим важные факты и мнения экспертов. Мы исследуем ключевые идеи и представляем их в доступной форме для более глубокого понимания. Читайте, чтобы оставаться в курсе событий!

Получить профессиональную консультацию – https://mktpopular.com.br/blog-mkt-popular/o-que-e-google-partner

Эта информационная статья содержит полезные факты, советы и рекомендации, которые помогут вам быть в курсе последних тенденций и изменений в выбранной области. Материал составлен так, чтобы быть полезным и понятным каждому.

Перейти к полной версии – https://realrenovations.net/home-electrical-repairs

Эта статья сочетает в себе как полезные, так и интересные сведения, которые обогатят ваше понимание насущных тем. Мы предлагаем практические советы и рекомендации, которые легко внедрить в повседневную жизнь. Узнайте, как улучшить свои навыки и обогатить свой опыт с помощью простых, но эффективных решений.

Перейти к статье – https://www.grupolic.com.co/etiam-bibendum-elit-eget-erat

Этот информативный текст выделяется своими захватывающими аспектами, которые делают сложные темы доступными и понятными. Мы стремимся предложить читателям глубину знаний вместе с разнообразием интересных фактов. Откройте новые горизонты и развивайте свои способности познавать мир!

Узнайте всю правду – https://viajaporelmundo.com/index.php/2022/03/14/what-is-a-blockchain-dao-and-should-you-join-one

Этот информативный текст отличается привлекательным содержанием и актуальными данными. Мы предлагаем читателям взглянуть на привычные вещи под новым углом, предоставляя интересный и доступный материал. Получите удовольствие от чтения и расширьте кругозор!

Смотрите также… – https://www.nishio-seifun.co.jp/2025/01/06/marche-recrutment

В этом обзорном материале представлены увлекательные детали, которые находят отражение в различных аспектах жизни. Мы исследуем непонятные и интересные моменты, позволяя читателю увидеть картину целиком. Погрузитесь в мир знаний и удивительных открытий!

Полезно знать – https://sushispy.com/486-2

В этой публикации мы предлагаем подробные объяснения по актуальным вопросам, чтобы помочь читателям глубже понять их. Четкость и структурированность материала сделают его удобным для усвоения и применения в повседневной жизни.

Где можно узнать подробнее? – https://inputovanja.ba/index.php/2019/07/26/venecija-trazi-da-bude-na-listi-ugrozenih-destinacija

Эта информационная заметка содержит увлекательные сведения, которые могут вас удивить! Мы собрали интересные факты, которые сделают вашу жизнь ярче и полнее. Узнайте нечто новое о привычных аспектах повседневности и откройте для себя удивительный мир информации.

Не упусти важное! – http://www.fredrikbackman.com/2015/06/01/om-ni-behover-mig-sa-ar-jag-pa-instagram

Этот информационный материал привлекает внимание множеством интересных деталей и необычных ракурсов. Мы предлагаем уникальные взгляды на привычные вещи и рассматриваем вопросы, которые волнуют общество. Будьте в курсе актуальных тем и расширяйте свои знания!

Посмотреть всё – https://personalchefbenjamin.com/index.php/contact

Эта информационная статья содержит полезные факты, советы и рекомендации, которые помогут вам быть в курсе последних тенденций и изменений в выбранной области. Материал составлен так, чтобы быть полезным и понятным каждому.

Обратитесь за информацией – https://shoppersmack.biz/hello-world

Публикация предлагает читателю не просто информацию, а инструменты для анализа и саморазвития. Мы стимулируем критическое мышление, предлагая различные точки зрения и призывая к самостоятельному поиску решений.

Хочу знать больше – https://www.cncr.org/fierte-de-la-production-de-nos-exposants-madame-khady-diagne-expose-avec-fierte-lhuile-et-le-savon-que-son-gie-keur-baye-de-djossome

Этот обзор предлагает структурированное изложение информации по актуальным вопросам. Материал подан так, чтобы даже новичок мог быстро освоиться в теме и начать использовать полученные знания в практике.

Не упусти важное! – https://grandeatomy.com.br/novidade-em-produtos

По прибытии проводится экспресс-диагностика: измеряются артериальное давление, пульс, сатурация, температура, оценивается уровень обезвоживания и неврологический статус; при показаниях выполняется ЭКГ. Врач простым языком объясняет, какие препараты и в каком порядке будут вводиться, отвечает на вопросы и получает информированное согласие.

Получить дополнительные сведения – [url=https://narkolog-na-dom-serpuhov6.ru/]выезд нарколога на дом[/url]

В «АльтерМед» используются самые актуальные технологии, прошедшие проверку временем и доказавшие эффективность в тысячах клинических случаев. Выбор методики зависит от тяжести зависимости, состояния здоровья, наличия хронических заболеваний, прошлых попыток лечения и психологической мотивации пациента.

Исследовать вопрос подробнее – [url=https://kodirovanie-ot-alkogolizma-dolgoprudnyj6.ru/]kodirovanie-ot-alkogolizma-ceny-dolgoprudnyj[/url]

Пациенты клиники могут быть уверены: здесь предлагаются только официально одобренные, доказавшие эффективность методы, которые подбираются строго индивидуально. После детального обследования и консультации нарколога принимается решение о наиболее подходящем виде кодирования. В зависимости от особенностей организма и психики, общего состояния и стадии зависимости применяются:

Выяснить больше – https://kodirovanie-ot-alkogolizma-kolomna6.ru/kodirovanie-ot-alkogolizma-ceny-v-kolomne

Вывод из запоя — это управляемая медицинская процедура, а не «волшебная капля» или крепкий чай с рассолом. «Формула Трезвости» организует помощь в Ногинске круглосуточно: выезд врача на дом или приём в стационаре, детоксикация с мониторингом, мягкая коррекция сна и тревоги, подробный план на первые 48–72 часа. Мы действуем безопасно, конфиденциально и без «мелкого шрифта» — объясняем, что и зачем делаем, согласовываем схему и фиксируем смету до начала процедур.

Исследовать вопрос подробнее – https://vyvod-iz-zapoya-noginsk7.ru/vyvod-iz-zapoya-na-domu-v-noginske

Кому подходит

Углубиться в тему – http://kodirovanie-ot-alkogolizma-vidnoe7.ru/anonimnoe-kodirovanie-ot-alkogolizma-v-vidnom/

Этап

Получить больше информации – https://vyvod-iz-zapoya-noginsk7.ru/vyvedenie-iz-zapoya-v-noginske

Медикаментозное пролонгированное

Изучить вопрос глубже – http://kodirovanie-ot-alkogolizma-vidnoe7.ru

Экстренная выездная помощь клиники «Ренессанс Здоровья» — это быстрый и безопасный способ стабилизировать состояние без поездок в стационар и без огласки. Мы работаем круглосуточно по Серпухову и Серпуховскому городскому округу, приезжаем с укомплектованной сумкой врача, проводим осмотр, подбираем индивидуальную инфузионную терапию, купируем абстинентные симптомы и интоксикацию, помогаем восстановить сон и снизить тревожность. Все обращения — анонимно, без постановки на учет; при необходимости специалист приедет в гражданской одежде, чтобы визит остался незаметным для соседей и посторонних.

Изучить вопрос глубже – [url=https://narkolog-na-dom-serpuhov6.ru/]anonimnyj-vrach-narkolog-na-dom[/url]

Когда уместен

Подробнее – https://narkologicheskaya-pomoshch-orekhovo-zuevo7.ru/narkologicheskaya-pomoshch-na-domu-v-orekhovo-zuevo/

Пациенты, выбравшие «АльтерМед», могут рассчитывать на индивидуальный подход, деликатность и полную анонимность. Врачи клиники используют только официально одобренные Минздравом РФ методы кодирования, опираются на современные научные данные, а процедуры проходят в условиях максимального комфорта и безопасности.

Узнать больше – https://kodirovanie-ot-alkogolizma-dolgoprudnyj6.ru/kodirovanie-ot-alkogolizma-ceny-v-dolgoprudnom

Перед тем как рекомендовать кодирование, специалисты проводят полную диагностику и беседу с пациентом. Само по себе кодирование — это комплексный терапевтический шаг, который дополняет другие этапы лечения, такие как детоксикация и психотерапия. Методика направлена на создание устойчивого барьера против алкоголя, будь то физиологического или психологического. Решение о кодировании принимается только после оценки готовности и мотивации самого пациента.

Исследовать вопрос подробнее – http://kodirovanie-ot-alkogolizma-kolomna6.ru/klinika-kodirovaniya-ot-alkogolizma-v-kolomne/

Этап

Исследовать вопрос подробнее – https://vyvod-iz-zapoya-noginsk7.ru/vyvedenie-iz-zapoya-v-noginske/

Как работает

Подробнее – http://kodirovanie-ot-alkogolizma-vidnoe7.ru

Чтобы у семьи было чёткое понимание, что и в какой последовательности мы делаем, ниже — рабочий алгоритм для стационара и для выезда на дом (шаги идентичны, различается только объём мониторинга и доступная диагностика).

Выяснить больше – [url=https://kapelnica-ot-zapoya-vidnoe7.ru/]kapelnica-ot-zapoya-anonimno-na-domu[/url]

По прибытии проводится экспресс-диагностика: измеряются артериальное давление, пульс, сатурация, температура, оценивается уровень обезвоживания и неврологический статус; при показаниях выполняется ЭКГ. Врач простым языком объясняет, какие препараты и в каком порядке будут вводиться, отвечает на вопросы и получает информированное согласие.

Получить дополнительные сведения – https://narkolog-na-dom-serpuhov6.ru/narkolog-na-dom-anonimno-v-serpuhove

Пациенты, выбравшие «АльтерМед», могут рассчитывать на индивидуальный подход, деликатность и полную анонимность. Врачи клиники используют только официально одобренные Минздравом РФ методы кодирования, опираются на современные научные данные, а процедуры проходят в условиях максимального комфорта и безопасности.

Получить дополнительные сведения – http://kodirovanie-ot-alkogolizma-dolgoprudnyj6.ru/kodirovanie-ot-alkogolizma-na-domu-v-dolgoprudnom/

Все процедуры проводятся в максимально комфортных и анонимных условиях, после тщательной диагностики и при полном информировании пациента о сути, длительности и возможных ощущениях.

Ознакомиться с деталями – [url=https://kodirovanie-ot-alkogolizma-kolomna6.ru/]кодирование от алкоголизма выезд на дом[/url]

Как работает

Детальнее – https://kodirovanie-ot-alkogolizma-vidnoe7.ru/anonimnoe-kodirovanie-ot-alkogolizma-v-vidnom/

Вывод из запоя — это управляемая медицинская процедура, а не «волшебная капля» или крепкий чай с рассолом. «Формула Трезвости» организует помощь в Ногинске круглосуточно: выезд врача на дом или приём в стационаре, детоксикация с мониторингом, мягкая коррекция сна и тревоги, подробный план на первые 48–72 часа. Мы действуем безопасно, конфиденциально и без «мелкого шрифта» — объясняем, что и зачем делаем, согласовываем схему и фиксируем смету до начала процедур.

Подробнее можно узнать тут – http://vyvod-iz-zapoya-noginsk7.ru/

Этот перечень помогает быстро оценить необходимость вызова. Если вы узнали в нем свою ситуацию — оптимально начать терапию как можно раньше: так детокс проходит мягче, а риск осложнений и срывов в первые сутки ниже.

Изучить вопрос глубже – [url=https://narkolog-na-dom-serpuhov6.ru/]vyzvat-vracha-narkologa-na-dom-srochno[/url]

Пациенты, выбравшие «АльтерМед», могут рассчитывать на индивидуальный подход, деликатность и полную анонимность. Врачи клиники используют только официально одобренные Минздравом РФ методы кодирования, опираются на современные научные данные, а процедуры проходят в условиях максимального комфорта и безопасности.

Исследовать вопрос подробнее – https://kodirovanie-ot-alkogolizma-dolgoprudnyj6.ru/kodirovanie-ot-alkogolizma-na-domu-v-dolgoprudnom/

Далее проводится сама процедура: при медикаментозном варианте препарат может вводиться внутривенно, внутримышечно или имплантироваться под кожу; при психотерапевтическом — работа проходит в специально оборудованном кабинете, в спокойной атмосфере. После кодирования пациент находится под наблюдением, чтобы исключить осложнения и закрепить эффект. Важно помнить, что соблюдение рекомендаций и поддержка семьи играют решающую роль в сохранении трезвости.

Выяснить больше – https://kodirovanie-ot-alkogolizma-kolomna6.ru/kodirovka-ot-alkogolya-v-kolomne/

Метод

Изучить вопрос глубже – https://kodirovanie-ot-alkogolizma-vidnoe7.ru/kodirovanie-ot-alkogolizma-na-domu-v-vidnom

В этом обзорном материале представлены увлекательные детали, которые находят отражение в различных аспектах жизни. Мы исследуем непонятные и интересные моменты, позволяя читателю увидеть картину целиком. Погрузитесь в мир знаний и удивительных открытий!

Изучите внимательнее – https://topic.lk/6738

Выезд на дом

Подробнее тут – [url=https://narkologicheskaya-pomoshch-orekhovo-zuevo7.ru/]наркологическая помощь на дому[/url]

В этой статье вы найдете познавательную и занимательную информацию, которая поможет вам лучше понять мир вокруг. Мы собрали интересные данные, которые вдохновляют на размышления и побуждают к действиям. Открывайте новую информацию и получайте удовольствие от чтения!

Подробности по ссылке – https://www.quanta-arch.com/a-propos/13248359_1145907718794358_222780492110697437_o

В этом информативном тексте представлены захватывающие события и факты, которые заставят вас задуматься. Мы обращаем внимание на важные моменты, которые часто остаются незамеченными, и предлагаем новые перспективы на привычные вещи. Подготовьтесь к тому, чтобы быть поглощенным увлекательными рассказами!

Узнать напрямую – https://fanstranslations.com/novel/ill-become-a-villainess-that-will-go-down-in-history/chapter-412

Эта информационная статья содержит полезные факты, советы и рекомендации, которые помогут вам быть в курсе последних тенденций и изменений в выбранной области. Материал составлен так, чтобы быть полезным и понятным каждому.

Всё, что нужно знать – https://btcsonic.xyz/home

Этот информационный обзор станет отличным путеводителем по актуальным темам, объединяющим важные факты и мнения экспертов. Мы исследуем ключевые идеи и представляем их в доступной форме для более глубокого понимания. Читайте, чтобы оставаться в курсе событий!

Проследить причинно-следственные связи – https://singelmann.no/bedre-by

Эта публикация дает возможность задействовать различные источники информации и представить их в удобной форме. Читатели смогут быстро найти нужные данные и получить ответы на интересующие их вопросы. Мы стремимся к четкости и доступности материала для всех!

Не упусти важное! – https://setitem.com/ca/avis-legal

Публикация предлагает уникальную подборку информации, которая будет интересна как специалистам, так и широкому кругу читателей. Здесь вы найдете ответы на часто задаваемые вопросы и полезные инсайты для дальнейшего применения.

Как это работает — подробно – https://bersatunews.com/index.php/2023/07/26/olivier-giroud-memuji-rafael-rio-giroud-percaya-leo-memiliki-potensi-untuk-mencapai-level-mbappe

Эта статья предлагает уникальную подборку занимательных фактов и необычных историй, которые вы, возможно, не знали. Мы постараемся вдохновить ваше воображение и разнообразить ваш кругозор, погружая вас в мир, полный интересных открытий. Читайте и открывайте для себя новое!

Получить больше информации – https://panache-tech.com/2008/06/11/gallery-post

В данной обзорной статье представлены интригующие факты, которые не оставят вас равнодушными. Мы критикуем и анализируем события, которые изменили наше восприятие мира. Узнайте, что стоит за новыми открытиями и как они могут изменить ваше восприятие реальности.

Продолжить чтение – https://lazuardi-haura.sch.id/haura-logo-min

Этот текст призван помочь читателю расширить кругозор и получить практические знания. Мы используем простой язык, наглядные примеры и структурированное изложение, чтобы сделать обучение максимально эффективным и увлекательным.

Изучить вопрос глубже – https://150kingwest.ca/gmedia/k025_-_quiet_room_agreement_-_october_2023-pdf

Эта информационная заметка содержит увлекательные сведения, которые могут вас удивить! Мы собрали интересные факты, которые сделают вашу жизнь ярче и полнее. Узнайте нечто новое о привычных аспектах повседневности и откройте для себя удивительный мир информации.

Полезно знать – http://kireina-watashi.com/2019/02/03/hello-world

Публикация предлагает читателю не просто информацию, а инструменты для анализа и саморазвития. Мы стимулируем критическое мышление, предлагая различные точки зрения и призывая к самостоятельному поиску решений.

Перейти к полной версии – https://vcelynastrechach.cz/en/career-we-are-looking-for-a-new-team-member

В этой публикации мы сосредоточимся на интересных аспектах одной из самых актуальных тем современности. Совмещая факты и мнения экспертов, мы создадим полное представление о предмете, которое будет полезно как новичкам, так и тем, кто глубоко изучает вопрос.

Смотри, что ещё есть – https://segredosdojardim.com/7-plantas-aromaticas-e-bonitas-para-a-varanda-repele-as-moscas-e-os-mosquitos-3

Эта публикация погружает вас в мир увлекательных фактов и удивительных открытий. Мы расскажем о ключевых событиях, которые изменили ход истории, и приоткроем завесу над научными достижениями, которые вдохновили миллионы. Узнайте, чему может научить нас прошлое и как применить эти знания в будущем.

ТОП-5 причин узнать больше – https://informatusa.com/negocios-ia

Этот информативный материал предлагает содержательную информацию по множеству задач и вопросов. Мы призываем вас исследовать различные идеи и факты, обобщая их для более глубокого понимания. Наша цель — сделать обучение доступным и увлекательным.

Рассмотреть проблему всесторонне – https://attaqadoumiya.net/?p=383

Откройте для себя скрытые страницы истории и малоизвестные научные открытия, которые оказали колоссальное влияние на развитие человечества. Статья предлагает свежий взгляд на события, которые заслуживают большего внимания.

Погрузиться в детали – https://www.esdemotos.com/noticias/zona-biker/versiones-y-precios-bmw-r-1200-gs

В данной статье вы найдете комплексный подход к изучению насущных тем. Мы комбинируем теоретические сведения с практическими советами, чтобы читатель мог не только понять проблему, но и найти пути её решения.

Дополнительно читайте здесь – https://arabiyanews.com/1048/%D8%B4%D8%B1%D9%88%D8%B7-%D8%A7%D9%84%D8%AA%D8%AC%D9%86%D9%8A%D8%B3-%D9%81%D9%8A-%D8%A7%D9%84%D8%B3%D8%B9%D9%88%D8%AF%D9%8A%D8%A9