[ad_1]

Stablecoins, the digital property designed to keep up a secure worth, have lengthy been considered as a possible bridge between the cryptocurrency world and the normal monetary trade. Nonetheless, latest developments have forged a shadow of uncertainty over their perceived stability.

As international policymakers proceed to grapple with issues in regards to the crypto sector’s influence on the established monetary system, a stunning twist occurred when stress within the US banking trade reverberated all through the stablecoin market.

Based on Fitch Rankings, the tightening of monetary circumstances, culminating within the high-profile failures of a number of banks, notably together with the collapse of the esteemed Silicon Valley Financial institution, had a profound influence on stablecoins.

Stablecoins: Market Shakeup

As an illustration, Fitch Rankings reviews that the market capitalization of USD Coin (USDC), a stablecoin pegged to the US greenback at a 1:1 ratio, skilled a pointy decline of over 25% within the first quarter. Though the coin’s worth stays depressed, Fitch famous that it managed to get well its peg quickly after.

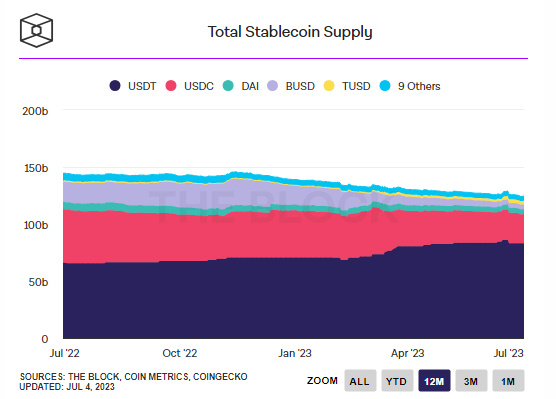

Based on information from The Block, the overall provide of stablecoins has decreased from $138 billion initially of the 12 months to $124 billion as of July 3. This decline in provide additional underscores the challenges confronted by stablecoins and their wrestle to keep up stability amidst market turbulence.

Chart: The Block Crypto Information

“Important volatility, shaken investor confidence, and short-term however sharp de-pegging occurred within the stablecoin market in March as shockwaves unfold from conventional finance,” Fitch wrote.

Tether Bucks Pattern

In distinction to USDC, Tether, one other outstanding stablecoin, noticed a 12% enhance in its market capitalization throughout the identical interval. Notably, Tether captured roughly 72% of USDC’s redemption quantity, indicating a rising choice for Tether amongst buyers.

Regardless of Tether’s optimistic efficiency, the high 10 stablecoins skilled a decline of their month-to-month common of day by day buying and selling volumes. From March to Could 2023, these buying and selling volumes decreased from $53 billion to $28 billion.

This discount signifies a lower in exercise throughout the stablecoin market, presumably pushed by cautious investor sentiment within the face of ongoing market uncertainties.

Bitcoin approaches the $31K territory on the day by day chart: TradingView.com

Fitch famous that efforts to manage stablecoins have been unfolding at various speeds in the US and Europe, resulting in notable variations within the reporting and transparency requirements of those digital property.

The contrasting approaches taken by the 2 areas have resulted in distinct regulatory landscapes for stablecoins, inflicting direct penalties on their reporting and transparency practices.

(The data supplied on this web site shouldn’t be interpreted as funding recommendation. Investing carries inherent dangers, and while you make investments, there’s a chance of experiencing capital loss as a consequence of these dangers).

Featured picture from Zebpay

[ad_2]