[ad_1]

Fast Take

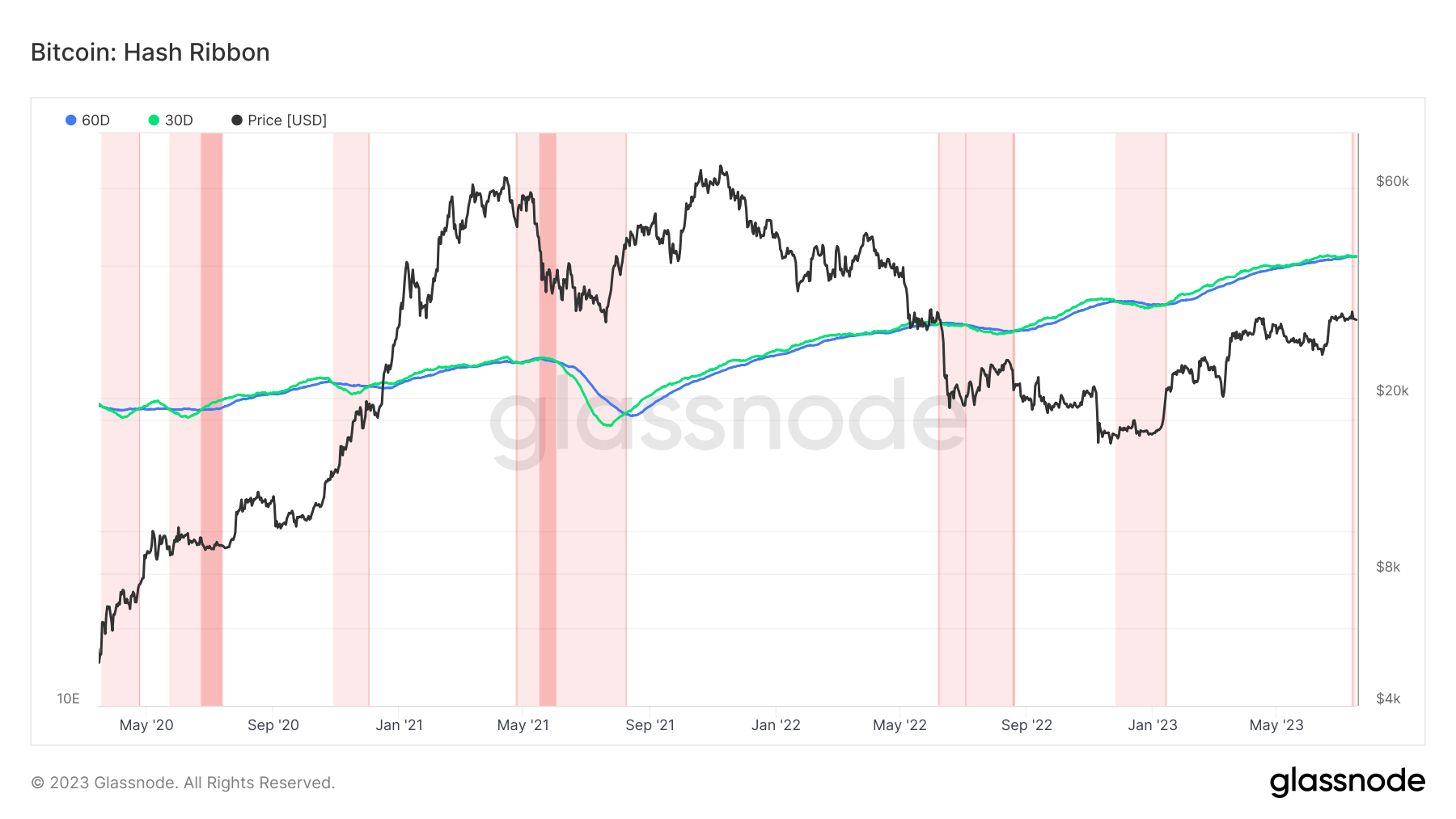

The Hash Ribbon, a market indicator outlined by Glassnode, operates on the belief that Bitcoin tends to backside out when miners capitulate, which occurs when the price of mining Bitcoin exceeds the potential return.

The Hash Ribbon traditionally indicators the top of the miner capitulation section when the 30-day shifting common (MA) of the hash fee surpasses the 60-day MA, reworking from gentle purple to darkish purple areas on the under chart. This metric, coupled with a shift in value momentum from destructive to constructive, has traditionally indicated promising shopping for alternatives, as represented by the transition from darkish purple to white.

For the primary time because the FTX collapse, the ribbon has inverted, marked by an 8% drop within the hash fee inside a span of some days. Apparently, patterns of miner capitulation have been recurrent each summer time, doubtlessly on account of the next electrical energy price throughout these months.

Traditionally, situations of miner capitulation have been seen in June 2020, Might 2021, June 2022, and most just lately in July 2023. On common, these capitulation intervals span one to 2 months.

The submit Summer time sparks Bitcoin miner capitulation: a recurrent seasonal pattern appeared first on CryptoSlate.

[ad_2]