[ad_1]

07 Jul The Significance of P2P Buying and selling in Rising Markets

Bitfinex launched a brand new peer to see (P2P) crypto buying and selling platform for residents in Colombia, Argentina, and Venezuela this month. We take a look at how P2P buying and selling isn’t just a helpful option to purchase crypto property, but in addition a key driver behind world crypto adoption. That is significantly the case in creating markets, the place P2P grants instantaneous open entry to monetary providers and markets for the unbanked.

Adoption From the Floor Up Begins Domestically

Many longtime Bitcoiners and crypto fans have fond recollections of buying their first BTC or ETH – often from a peer to see (P2P) buying and selling platform like LocalBitcoin or LocalCryptos – and involving a gathering with a stranger in a espresso store and buying and selling for money. Because the markets have matured and many countries and jurisdictions have adopted regulatory tips, full-service centralised buying and selling exchanges have now grow to be the “go to” methodology for buying and selling digital property.

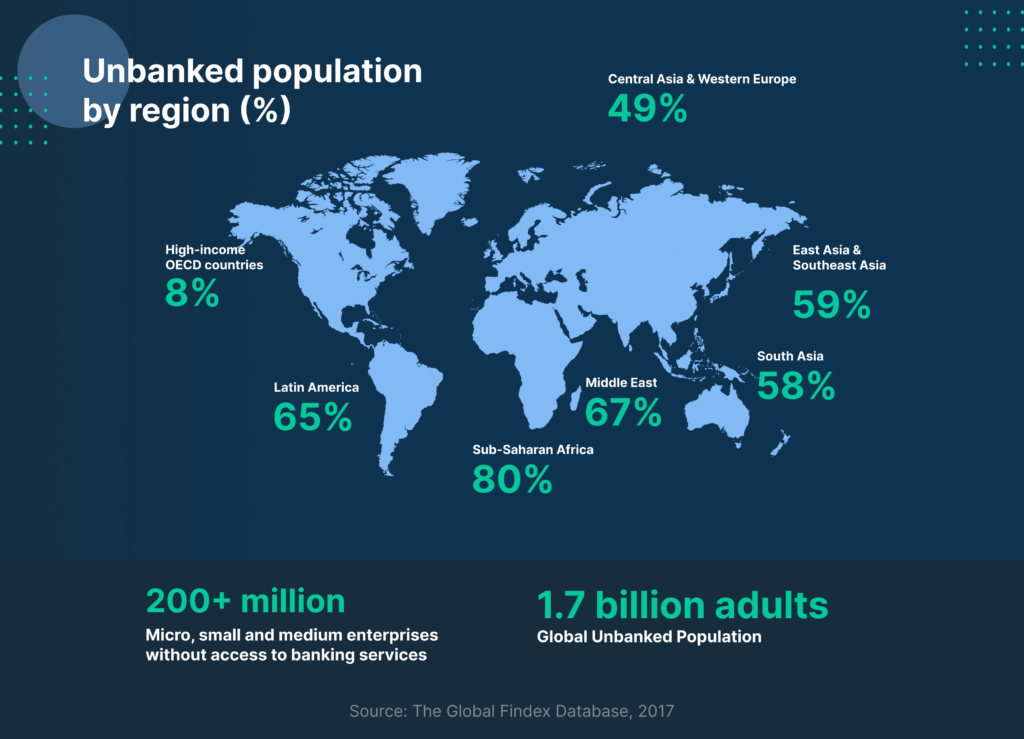

Nevertheless, in rising markets, the place grass roots adoption continues to be rising exponentially, P2P markets by no means went out of favor. Quite the opposite, they’re usually the predominant method that individuals purchase and promote Bitcoin and crypto tokens. This could come as no shock, because the lion’s share of the world’s nearly 2 billion unbanked reside in rising economies.

P2P crypto markets provide a trust-minimised method to purchase and promote digital property, coping with full strangers, utilising escrow providers, repute programs, and dispute moderation to make sure that unhealthy actors can’t abscond with person funds. This can be a essential and crucial service in areas with out regulatory readability, entry to exchanges and liquidity, and with small, native, teams of early adopters utilizing crypto in communal settings.

P2P markets provide entry to digital property that may be in any other case unobtainable. Digital property in flip, provide entry to items and providers which can be inaccessible or unobtainable domestically. They grant the unbanked the flexibility to make and obtain digital funds, make purchases on-line, obtain remittances, and procure items, and providers from overseas, which can be found solely in worldwide markets.

For individuals who shouldn’t have entry to financial institution accounts, bank cards, or cost apps, property akin to Bitcoin, Ethereum and Tether are actually lifelines. In nations like Argentina, Colombia, Cuba, Nigeria, Pakistan, and Vietnam, the place there may be both low entry to monetary providers or an onerous quantity of paperwork in an effort to conduct easy monetary transactions like cash transfers and even funds, crypto property present a sensible workaround to beat these obstacles. Individuals residing in these locations are energetic fans and infrequently inform their household and pals the right way to onboard and profit from these open monetary networks.

Roughly, 92 % of the world’s inhabitants reside in Latin America, Africa, and Asia. See under on why P2P buying and selling is central to the explosion of crypto adoption in these rising markets.

Latin America

As we coated in our article on the state of crypto adoption in Latin America, LATAM appears to be main the race in the direction of mainstream crypto adoption. El Salvador stands out as the obvious instance, with its Bitcoin authorized tender legislation, Bitcoin workplace, Bitcoin embassies, and Digital Securities legislation, having set the bar for adoption excessive and laying out the template for nations that want to observe go well with.

Except for El Salvador, Latin America appears to supply the excellent cocktail for grass roots adoption, together with affected by excessive inflation, sturdy demand for remittances, and having youthful, educated, technically proficient populations with an absence of entry to monetary providers, or very restricted entry.

Latin American nations like Argentina, Brazil, Colombia, and Venezuela have all seen an enormous enhance in demand for digital property like Bitcoin and USDt as a option to protect buying energy amidst the instability of nationwide currencies, and excessive inflation. Every of those nations have traditionally had thriving P2P buying and selling markets with volumes being among the highest on the planet.

This pattern of quickly rising grass roots crypto adoption, nation state adoption, and weakening financial situations is just anticipated to proceed as P2P buying and selling continues to be the first method by which adopters commerce digital property. We anticipate quite a lot of modern new providers to emerge as traditional fintech and digital property proceed to blur the strains and merge collectively.

Africa

Africa faces most of the identical hurdles and challenges as these in Latin America, in that weak nationwide currencies, excessive inflation, and political instability have been catalysts for a excessive diploma of grass roots crypto adoption. Like Latin America, a majority of the area’s digital asset buying and selling quantity takes place in P2P markets.

Nigeria leads the African continent for crypto adoption, with an estimated 10.34 % of the inhabitants proudly owning digital property. Nigeria is ranked eleventh globally for crypto adoption, and is joined by Kenya and Morocco on Chainalysis’ 2022 checklist of the highest 20 nations around the globe main crypto adoption.

Africa’s P2P buying and selling markets make up 6% of all crypto transactions, worldwide. Sub-Saharan Africa additionally leads the world in crypto funds for retail purchases, with 80 % of the world’s retail funds of lower than $1000, being made inside the area.

On the regulatory entrance, South Africa and Mauritius lead the continent with regulatory frameworks in place, in addition to market oversight from monetary authorities. Africa stands to be one of many areas that might profit essentially the most from widespread crypto adoption, as the dearth of entry to monetary providers is extra excessive than in different areas.

Crypto adoption is probably going the quickest and least resource-intensive method to offer giant scale monetary inclusion to very large segments of the unbanked populations all through nearly each nation on the continent. Crypto gives alternatives to residents who could not produce other choices for revenue amidst excessive unemployment, financial difficulties, political turmoil, and weak nationwide currencies.

Asia

Asia is an enormous area with an informed, digitally native, tech savvy and youthful inhabitants, which is spearheading adoption at an ever rising tempo. Main the world in grass roots crypto adoption is Vietnam, with the Philippines, Thailand, Pakistan, and India not far behind. It’s estimated that 21 % of Vietnamese residents use or personal crypto, and the state of affairs within the Philippines is analogous with an estimated 20 % of the inhabitants proudly owning or utilizing digital property.

Remittances are a serious contributor for this adoption, as a less expensive, extra handy method for members of the Asian diaspora overseas, to ship cash to household again residence. One other lesser identified contributor to the excessive ranges of grass roots adoption has been DeFi adoption, yield farming, NFTs, and play to earn gaming, which have been in style among the many area’s youth, as methods to earn revenue.

P2P buying and selling has been the main driver behind the massive buying and selling volumes seen in Asian nations, by which residents usually shouldn’t have entry to formal exchanges. In nations like India and the place rules haven’t been “pleasant” to crypto, or Pakistan which is contemplating an outright ban for digital property, grass roots adoption has not been slowed, with buying and selling going down by means of P2P providers.

The keenness for crypto is maybe unrivalled in Asia, as populations who’re tech savvy and used to digital funds by way of apps like Alipay and Wechat, uncover decentralised alternate options providing monetary inclusion, entry to worldwide markets, and maybe even a possibility to commerce and make a revenue. Transferring ahead, Asia will proceed to be a hotspot for adoption and innovation, as adopters discover new use instances and monetary alternatives in crypto.

[ad_2]

I am really inspired together with your writing talents as smartly as with the format to your weblog. Is this a paid subject matter or did you customize it your self? Anyway keep up the nice high quality writing, it is uncommon to peer a nice weblog like this one nowadays!