[ad_1]

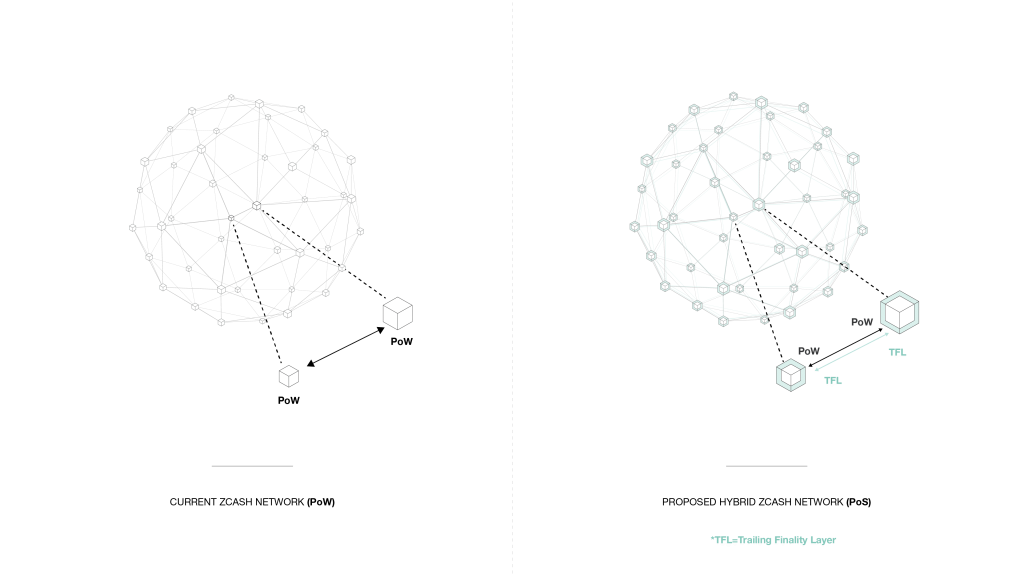

At Electrical Coin Co. (ECC) we’re exploring a transition in Zcash from the present proof-of-work (PoW) consensus to a proof-of-stake (PoS) consensus. We’re proposing a step on this path that we name the Trailing Finality Layer (TFL). If deployed, this could be mixed with Zcash’s current consensus; the ensuing consensus protocol at that time could be a hybrid of PoW and PoS.

The general aim is to allow finality and PoS on Zcash in a minimally disruptive method. Finality is a assure that when a block is finalized, that block and the transactions it incorporates can’t be rolled again. Finality can scale back delays for some use instances (similar to centralized trade deposit wait occasions) and allow new enhancements similar to safer cross-chain bridges.

If the TFL method is adopted by the Zcash group, it might allow some new use instances, similar to staking ZEC to earn protocol rewards, whereas minimizing disruption to current use instances. Mining is an instance of a course of that will be impacted in a hybrid mannequin, as mining rewards could be lowered whereas the remainder of mining infrastructure and processes would stay unchanged.

We additionally purpose to reduce disruption to evaluation of consensus safety, as most of the current consensus properties stay intact in a hybrid mannequin.

We’ve solely begun to outline the design of this PoW/PoS hybrid protocol. Many key particulars stay open questions, as we increase on under. By sharing our method early on this course of, we’re aiming to collect and incorporate suggestions as we go, discover potential collaborators, and stimulate dialogue about this method.

Get entangled

For those who’re considering offering suggestions or collaborating on this venture, please get in contact! A great alternative to study extra and be a part of the dialog is to attend (in individual or just about) the Interactive Design of a Zcash Trailing Finality Layer workshop I’m main at Zcon4. Additionally be happy to electronic mail me, [email protected], about your curiosity. We’re searching for contributors from a variety of backgrounds, together with technical, product, group, and any Zcash customers who need to weigh in because the proposal evolves.

PoS transition background

ECC beforehand shared our rationale for why we consider it’s in one of the best curiosity of present and future ZEC customers to transition the protocol to proof of stake within the weblog put up Ought to Zcash transition from Proof of Work to Proof of Stake? and the Zcon3 presentation Motivations of Proof of Stake. In 2022, we printed a high-level overview of our Proof-of-Stake Analysis method, a extra detailed Strategy, Focus, and Subsequent Steps companion put up, and gave a Zcon3 presentation about high-level design challenges in Proof of Stake.

A proof-of-stake transition path

Our imaginative and prescient for a transition to proof of stake contains a minimum of two main milestones:

- Transferring Zcash from its present proof-of-work mannequin to a hybrid PoW/PoS system.

- Transferring Zcash from a hybrid PoW/PoS system to pure PoS.

Our major motivation for proposing (a minimum of) two steps is to reduce disruption of usability, security, safety, and the ecosystem throughout every step.

This method of transitioning from PoW to hybrid to PoS was executed by Ethereum with the deployment of the Beacon Chain (hybrid) then The Merge (pure PoS).

Design objectives for a hybrid PoW/PoS system

ECC is refining the design of TFL with a number of objectives in thoughts, and we’ll probably be including extra as we proceed to develop this proposal. Presently:

- We need to reduce disruption to current pockets use instances and UX. For instance, nothing ought to change within the consumer flows for storing or transferring funds, the format of addresses, and so on.

- We need to reduce complexity of safety analyses by preserving current evaluation outcomes the place potential.

- We need to allow new PoS use instances that permit cell shielded pockets customers to earn a return on delegated ZEC.

- We need to allow trust-minimized bridges and different advantages by offering a protocol with finality.

- We need to enhance the modularity of the consensus protocol. Modularity has a number of loosely outlined and associated meanings, e.g., it’s potential to know some consensus properties solely given data of a element of the protocol, and it’s potential to implement consensus guidelines in modular code parts with clear interfaces.

Trailing Finality Layer in a nutshell

The hybrid PoW/PoS protocol we envision at ECC is structured like at present’s Zcash NU5 protocol with a brand new Trailing Finality Layer. We describe it as a layer, as a result of the present nodes and most of their logic will proceed to function largely as-is with minimal modifications, whereas a lot of the brand new performance can be supplied by new, supplementary parts and community protocols.

This new layer offers the blockchain with a trailing finality assure: after blocks are mined they are often finalized that means they is probably not rolled again. This assure extends to any of the transactions inside the blocks. It’s trailing as a result of this finality property follows the PoW mining system “trailing behind it.”

As a result of this hybrid design depends totally on PoW for producing new blocks, this protocol is immune to halting in the identical approach Bitcoin or present Zcash is — though the finality assure could stall, as we describe subsequent.This design paradigm has each a theoretical and sensible observe file: It’s analyzed in a analysis paper, Ebb-and-Circulation Protocols, and it’s the identical paradigm utilized by Ethereum each within the pre-Merge hybrid design of the Beacon chain in addition to in present day Ethereum.

Why finality issues

Nakamoto PoW consensus, launched with Bitcoin and inherited by Zcash, offers probabilistic finality. This implies the possibility {that a} block may be rolled again falls as extra blocks are mined.

In our view, the first problem with this type of finality is that totally different individuals independently react to rollbacks. For instance, in all probability most individuals anticipate 1-block rollbacks (that are comparatively frequent), however as the dimensions of rollbacks develop bigger, three challenges emerge:

- Bigger rollbacks turn into extra uncommon, so some individuals could not have a course of or coverage for dealing with that scenario.

- Totally different individuals could have totally different insurance policies, so within the occasion of a big rollback, the ecosystem could fracture as totally different individuals disagree on the right way to get better.

- When counterparties require a sufficiently low tolerance for rollbacks, their interplay should incur a considerable delay.

Instance: trust-minimized bridge

To drive this level house, contemplate the dear use case of a trust-minimized bridge: ZEC despatched right into a bridge have to be locked up whereas an equal variety of proxy tokens are issued on one other community.

If a rollback reverts a bridge deposit after the proxy tokens are issued elsewhere, these ZEC are not locked within the bridge, and the proxy tokens at the moment are unbacked. This breaks the peg of the bridge, and lots of bridge customers will concurrently lose funds. If the bridge designers resolve to require sufficient PoW blocks to make the likelihood of this occasion astronomically small, then issuing the proxy tokens on the opposite community may have an especially giant delay.

Instance: trade deposits

If a consumer deposits ZEC on a centralized trade, their account on the trade is credited the suitable quantity. If a rollback of this residue happens, the trade accounting now has extra ZEC liabilities than precise ZEC held.

Exchanges search to deal with this by requiring extra PoW blocks to succeed in a sufficiently low likelihood of this occasion. Nonetheless, this can be a balancing act: If an trade imposes a delay of n hours, the likelihood remains to be not “astronomically small,” so customers are inconvenienced by n hours and the trade nonetheless carries a sensible danger of a legal responsibility overhang occasion.

Moreover, due to problem quantity 2 above, totally different exchanges require totally different deposit delays, which probably confuses customers and places exchanges into competitors to tackle extra danger by accepting fewer block confirmations.

Finality

In distinction to probabilistic finality, a consensus protocol could present a finality assure. Protocols that do that make sure that all individuals agree on which set of blocks and transactions are closing. The trade-off is that finality could fail to make progress within the occasion of community disruptions. As soon as the community recovers, the trailing finality can “catch up” to the PoW blocks which have been produced within the interim.1

Virtually, this implies if individuals are ready for a transaction to turn into closing, typically they could want to attend an arbitrarily lengthy period of time.

Finality addresses all three challenges to some extent:

- Members now not have to anticipate rollbacks of various possibilities when designing their procedures and insurance policies. As a substitute, they have to anticipate the chance that typically finality fails to progress in a well timed trend.

- All individuals agree precisely which blocks and transactions are closing, although they could disagree on the right way to react if finality is stalled for lengthy durations of time.

- Members could now depend on the finality assure to make sure they solely react to some transactions when there may be zero likelihood of the transaction being reverted.

Within the examples above:

- A trust-minimized bridge can depend on finality for issuing proxy tokens. This ensures the bridge won’t ever be under-collateralized. The trade-off is that so long as finality stalls, cross-bridge transfers may also be stalled.

- All exchanges can use the identical finality assure, so customers can count on the identical deposit delay in every single place (and it’s more likely to be notably decrease than the established order). The trade-off is that if finality stalls, new deposits may also be stalled, although all exchanges will behave persistently on this regard.

The tip consequence for customers is that some high-value interactions (similar to bridging or trade deposits) will now be sooner and safer more often than not. Typically finality could stall. When finality resumes, it would “catch up” to the PoW chain, so customers who don’t want the finality assure can proceed utilizing this hybrid protocol, equally to how they use Zcash at present, and be unaffected if finality stalls.

Standing and open questions

This weblog put up introduction covers most of our R&D, to this point, on the TFL design. There are nonetheless many open points that should be resolved with collaboration and enter from the Zcash group earlier than a TFL design is prepared as a proposal for a Zcash improve.

An incomplete listing of points that also should be resolved embody:

- Is that this common method acceptable to the Zcash group?

- How will new ZEC issuance be distributed between PoW, PoS, and any potential Dev Fund successor? It is a key concern for each miners and potential stakers or delegators.

- How can we combine another modifications to issuance mechanics, such because the Zcash Sustainability Fund?

- All the PoS accounting mechanics, similar to how bonding works, how delegation works, what sorts of slashing could happen, withdrawal delays and mechanics, and so on.

- How would PoS operations work together with all different Zcash ledger actions, similar to shielded swimming pools, and so on.? This can be a key space for understanding how privateness and staking work together.

- Ought to the chain tip ever stall with a view to certain the hole between the finalized block and the chain tip?

- Detailed safety analyses, together with financial safety, a case evaluation of PoW seize, PoS seize, community safety (esp. given two separate community protocols/layers).

- How can we guarantee cell shielded wallets are first-class individuals? For instance, can we guarantee they will safely and effectively delegate stake and handle stake-delegation positions? This contains each UX points, like delegation UI flows, in addition to implementation, similar to lightwalletd protocol modifications.

- Methods to combine any TFL protocol modifications with different proposed protocol modifications in a secure and well timed method. Examples: Zcash Sustainability Fund, Zcash Shielded Property, bridging efforts, Namada integrations, and so on.

- Choice of a selected finalizing PoS protocol. We’re at the moment specializing in utilizing Tendermint and ABCI as a strategy to quickly prototype and validate the design.

- Prototypes, testnets, code structure, and so on.

As we handle the open points above, particularly the interplay with different protocol options and coordination with these groups on timing, we are able to start to refine a deployment timeline.

Subsequent steps

Our subsequent steps for this TFL R&D initiative are to get group suggestions on this weblog, host a workshop at Zcon4, and produce R&D updates on the open points above.

As we collaborate with different protocol improvement groups, we’d wish to create a tentative deployment timeline that includes the entire different protocol characteristic efforts similar to ZSF, ZSAs, and potential cross-chain bridge efforts.

Lastly, we’re searching for out different groups or people who’re considering collaborating on this TFL venture, so when you’re , please see the Get entangled part above.

1 In a pure finalizing PoS protocol, the equal “stalls” are literally network-wide halts. One power of this hybrid design is that PoW needn’t halt, and if it doesn’t then customers who don’t depend upon finality can proceed utilizing the community.

[ad_2]

I am really impressed together with your writing abilities as neatly as with the layout in your blog. Is this a paid subject matter or did you customize it yourself? Anyway stay up the nice high quality writing, it is rare to see a nice blog like this one nowadays!