In a significant move that has captured the attention of financial markets and policymakers alike, former President Donald Trump has officially appointed Paul Atkins as the new Chair of the Securities and Exchange Commission (SEC). This appointment comes at a time when the regulatory landscape for the financial industry is under intense scrutiny and evolution. Atkins, a seasoned veteran in regulatory affairs and a former SEC commissioner, brings with him a wealth of experience and a unique perspective on the balance between oversight and innovation. As he steps into this pivotal role, stakeholders across the spectrum are keenly watching to see how his leadership will shape the future of securities regulation in the United States. With challenges ranging from technological advancements in trading to increasing calls for transparency and accountability, Atkins is poised to navigate a complex terrain that could redefine the regulatory framework for years to come.

Table of Contents

- Impact of Paul Atkins Appointment on SEC Regulatory Landscape

- Analyzing the Priorities and Challenges Ahead for the New SEC Chair

- Strategic Recommendations for Strengthening Investor Confidence

- The Future of Financial Regulation Under a New Leadership Vision

- Q&A

- Concluding Remarks

Impact of Paul Atkins Appointment on SEC Regulatory Landscape

Paul Atkins’ appointment as Chair of the SEC heralds a significant shift in the regulatory landscape, aligning with a more market-friendly and less intrusive approach to financial oversight. Traditional regulatory frameworks may undergo transformations as Atkins emphasizes the importance of fostering innovation among public companies and capital markets. His track record suggests an inclination towards reducing compliance burdens, which could lead to an increase in public listings and entrepreneurial ventures. Key areas likely to be influenced by his leadership include:

- Capital Formation: Streamlining processes to encourage capital access for startups.

- Regulatory Flexibility: Implementing less restrictive measures on emerging technologies.

- Investor Protection: Balancing deregulation with adequate safeguards for investors.

Atkins is also expected to strengthen dialogues with industry players to ensure that the SEC’s rules reflect the realities of modern finance. This collaborative approach may foster a regulatory environment that not only encourages growth but also prioritizes transparency and accountability. With increasing scrutiny of environmental, social, and governance (ESG) practices, his governance strategy may involve a careful evaluation of ESG disclosures, as per the following overview:

| Aspect | Potential Change |

|---|---|

| Disclosure Requirements | Rethink stringent guidelines to support voluntary yet meaningful disclosures. |

| Enforcement Actions | Focus on transparency and education rather than punitive measures. |

Analyzing the Priorities and Challenges Ahead for the New SEC Chair

As Paul Atkins assumes the leadership of the Securities and Exchange Commission, he steps into a role that demands balancing the intricacies of market oversight with evolving policy landscapes. His prior experience with the SEC gives him unique insights into operational challenges, while his commitment to free markets could reshape certain regulatory frameworks. Key priorities in his agenda will likely include:

- Enhancement of Market Transparency: Fostering clearer communication and reporting standards for public companies.

- Regulatory Simplification: Streamlining complex compliance processes to support smaller firms.

- Cryptocurrency Regulation: Addressing the urgent need for a framework regulating digital assets.

- Investor Protection: Reinforcing measures to safeguard retail investors in a rapidly changing financial landscape.

However, with these priorities come substantial challenges. The evolving geopolitical climate and unprecedented market volatility necessitate a careful approach to regulatory interventions. Additionally, Atkins will need to navigate internal and external pressures, including:

- Balancing Industry Interests: Ensuring that regulations do not stifle innovation while still maintaining investor safety.

- Adapting to Technology: Keeping pace with fintech innovations that disrupt traditional market structures.

- Building Consensus: Collaborating with fellow commissioners amidst diverging opinions on regulatory pathways.

| Challenges | Potential Solutions |

|---|---|

| Market Volatility | Implementing flexible regulatory measures to adapt to market conditions. |

| Technological Disruption | Creating a dedicated task force for emerging technologies. |

| Sectorial Divergence | Engaging in dialog with diverse industry groups to unify approaches. |

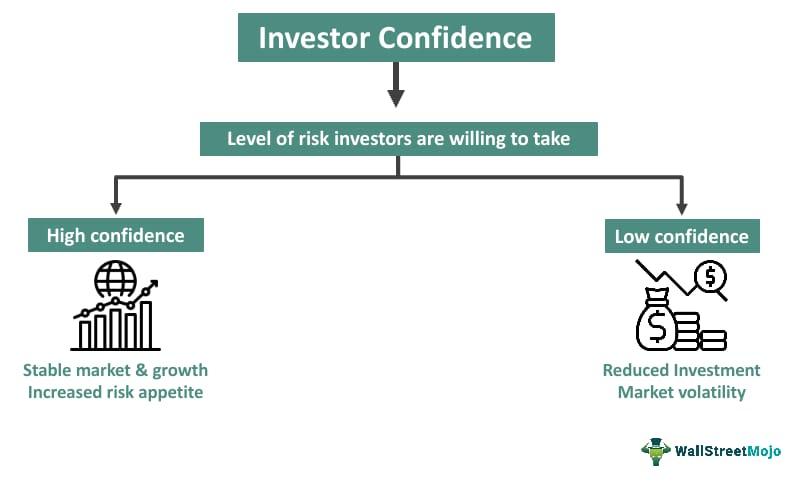

Strategic Recommendations for Strengthening Investor Confidence

To bolster investor confidence in the wake of Paul Atkins’ appointment as SEC Chair, the implementation of transparent and proactive communication strategies will be crucial. Regular updates regarding regulation changes, market conditions, and the SEC’s strategic initiatives can instill greater trust among stakeholders. Additionally, fostering an environment that encourages dialog and feedback from investors can help align the SEC’s actions with community expectations. This could be achieved through various channels such as public forums, webinars, or even dedicated Q&A sessions with the Chair, which would allow investors to voice their concerns directly.

Furthermore, the SEC can enhance its credibility by focusing on regulatory clarity and consistency. Establishing clear guidelines and maintaining a steady approach to enforcement will dispel any uncertainties that may deter investment. Implementing a systematic review of existing regulations to identify and update outdated provisions can optimize market operations. The SEC can also consider creating a dedicated task force aimed at investor education, ensuring that both novice and seasoned investors understand their rights and the functions of the SEC, ultimately fostering a more informed and confident investment landscape.

The Future of Financial Regulation Under a New Leadership Vision

With Paul Atkins at the helm of the SEC, a new chapter in financial regulation is set to unfold. Drawing from his extensive background in both the private sector and governmental roles, Atkins is poised to redefine the regulatory landscape. His agenda appears to emphasize a balance between fostering innovation and maintaining market integrity, with a focus on reducing unnecessary bureaucratic hurdles. Stakeholders can anticipate a shifting framework that prioritizes:

- Enhanced transparency: Outreach initiatives aimed at demystifying complex regulations for market participants.

- Encouraging innovation: Supporting fintech advancements and adapting regulations to keep pace with technological developments.

- Market stability: Implementing safeguards to protect consumers and investors while nurturing a competitive atmosphere.

Atkins’ vision could lead to a re-evaluation of existing policies, possibly encouraging collaboration between the SEC and industry leaders. This partnership is key to addressing emerging challenges, particularly in areas like cryptocurrency and digital commodities. By recalibrating regulatory priorities, Atkins aims to ensure that financial markets remain robust and resilient. His administration is likely to explore:

| Area of Focus | Potential Impact |

|---|---|

| Cryptocurrency Regulation | Clarity for investors, fostering responsible growth. |

| Environmental, Social, and Governance (ESG) | Standardizing reporting practices for consistency. |

| Private Equity & Venture Capital | Streamlining compliance processes for emerging startups. |

Q&A

Q&A: Trump Officially Appoints Paul Atkins as SEC Chair

Q1: Who is Paul Atkins, and what qualifies him for the role of SEC Chair?

A1: Paul Atkins is a seasoned financial services professional and an experienced public servant. He previously served as a commissioner at the Securities and Exchange Commission (SEC) from 2002 to 2008, where he was involved in significant reforms and policies impacting U.S. markets. With a background in law and finance, Atkins brings a wealth of knowledge on regulatory issues, making him a suitable candidate for the chair position.

Q2: What significance does the SEC Chair position hold in the financial landscape?

A2: The SEC Chair plays a pivotal role in overseeing the U.S. securities markets, ensuring investor protection, and maintaining fair and efficient market practices. The Chair sets the regulatory agenda for the SEC, influencing rules regarding corporate governance, trading practices, and investor rights. Given the complexity of global financial markets, strong leadership at the SEC can significantly impact economic stability and growth.

Q3: How might Paul Atkins’s appointment affect existing SEC policies?

A3: While it’s challenging to predict specific changes, Atkins’s appointment could signal a shift towards a more market-friendly approach. He has previously advocated for reducing regulatory burdens on companies and fostering innovation within the financial sector. Observers may expect a review of existing regulations to create a balance between investor protection and promoting economic growth, especially for emerging industries such as fintech.

Q4: What are the potential challenges Atkins might face as SEC Chair?

A4: Atkins will likely encounter various challenges, including addressing ongoing concerns about market volatility, cybersecurity threats, and the complexities of regulating cryptocurrencies. Additionally, he will need to navigate the diverse interests of stakeholders, including investors, corporations, and political leaders, while ensuring compliance with existing laws and regulations.

Q5: How does this appointment reflect Trump’s broader agenda?

A5: Trump’s appointment of Paul Atkins could be seen as a move to align the SEC’s agenda with his administration’s emphasis on deregulation and economic growth. By selecting a candidate with a track record of supporting business-friendly policies, the administration may aim to invigorate the financial markets and reduce perceived bureaucratic constraints on businesses.

Q6: What has been the reaction to Atkins’s appointment from different sectors?

A6: Reactions have varied. Industry groups and those advocating for reduced regulation have generally welcomed Atkins, viewing him as a leader who could foster a more conducive environment for business. Conversely, investor advocacy groups have expressed caution, urging the new Chair to prioritize protections for everyday investors and maintain oversight of market practices.

Q7: What should investors keep an eye on following this appointment?

A7: Investors should closely monitor any changes to SEC regulations that may emerge under Atkins’s leadership, particularly in areas like corporate governance, transparency requirements, and rules affecting emerging technologies. Additionally, how Atkins addresses ongoing issues such as market manipulation and investor protections will be critical in shaping the investment landscape in the coming years.

Q8: When will Paul Atkins formally begin his role as SEC Chair?

A8: Paul Atkins’s appointment needs to be confirmed by the Senate before he can formally assume the role of SEC Chair. The timeline for this process can vary, but it typically involves hearings where Atkins will outline his vision for the SEC and respond to legislative inquiries. Following confirmation, he will begin to implement his agenda and policies.

For more insights into Paul Atkins’s priorities and potential impact as SEC Chair, stay tuned for developments in the financial regulatory landscape.

Concluding Remarks

In a move that underscores the ever-evolving landscape of financial regulation, Donald Trump has officially appointed Paul Atkins as the new chair of the Securities and Exchange Commission. As the market watches closely, Atkins’s track record suggests a commitment to enhancing market efficiency while navigating the intricacies of investor protection. The implications of this appointment are substantial, as the SEC plays a pivotal role in shaping the financial framework that governs our economy. Only time will tell how Atkins will steer the commission amidst a fluctuating market and complex regulatory challenges. As stakeholders prepare for what lies ahead, one thing is clear: the realm of finance will remain under intense scrutiny as it adapts to this new leadership. Stay tuned as we continue to monitor the developments in this essential sector.

ivermectin 6 mg tablets – buy generic candesartan 8mg buy carbamazepine 200mg

where to buy accutane without a prescription – order isotretinoin 40mg generic cheap zyvox 600 mg

order amoxil without prescription – ipratropium buy online ipratropium online buy

how to get zithromax without a prescription – buy azithromycin 250mg sale cost nebivolol 5mg

buy prednisolone 20mg – buy prednisolone generic order progesterone sale

cheap neurontin pill – sporanox drug brand itraconazole

buy cheap generic lasix – buy betnovate creams3 betamethasone 20 gm cost

how to get doxycycline without a prescription – glipizide 5mg cheap order glucotrol 5mg online

buy generic clavulanate online – cheap nizoral 200mg buy duloxetine pill

order augmentin 625mg generic – buy amoxiclav generic buy generic duloxetine

brand tizanidine 2mg – buy zanaflex no prescription cheap microzide 25mg

order viagra 50mg for sale – tadalafil 5mg canada buy tadalafil 40mg generic

order tadalafil pills – buy sildenafil 50mg pill cheap sildenafil generic

order generic cenforce – purchase glucophage without prescription buy metformin 1000mg

atorvastatin 10mg price – purchase atorvastatin generic buy prinivil pills

buy prilosec 10mg generic – purchase prilosec without prescription buy atenolol 100mg pills

purchase medrol – buy triamcinolone 4mg online cheap order triamcinolone 4mg generic

clarinex 5mg us – order desloratadine without prescription buy priligy 30mg for sale

buy misoprostol 200mcg without prescription – order xenical online cheap buy diltiazem generic

zovirax 400mg price – zovirax 400mg without prescription buy crestor generic

buy domperidone without a prescription – buy generic tetracycline for sale flexeril 15mg tablet

how to buy motilium – buy domperidone 10mg without prescription cyclobenzaprine 15mg generic

buy inderal pills for sale – inderal 20mg pill buy methotrexate 2.5mg sale

coumadin 5mg generic – reglan for sale buy losartan for sale

buy nexium 40mg for sale – buy sumatriptan 50mg pills imitrex over the counter

generic levofloxacin 500mg – buy generic levofloxacin buy zantac 300mg for sale

order mobic 7.5mg sale – purchase meloxicam sale order tamsulosin 0.4mg online

order ondansetron 4mg generic – spironolactone 100mg oral buy cheap simvastatin

buy valacyclovir cheap – generic proscar 1mg diflucan 100mg pill

modafinil 100mg for sale buy provigil no prescription buy modafinil generic purchase provigil for sale buy modafinil paypal modafinil 100mg drug provigil 100mg drug

This is the description of glad I enjoy reading.

This is a topic which is in to my verve… Many thanks! Unerringly where can I notice the connection details in the course of questions?

azithromycin 500mg tablet – ciplox for sale online flagyl 400mg drug

buy rybelsus 14mg – buy periactin pill periactin online

motilium 10mg over the counter – purchase flexeril sale cyclobenzaprine 15mg brand

where to buy inderal without a prescription – order plavix 150mg without prescription buy generic methotrexate

cheap amoxil sale – combivent 100 mcg canada buy combivent

order azithromycin pills – tinidazole cheap buy bystolic medication

purchase augmentin pills – https://atbioinfo.com/ buy acillin generic

buy generic nexium 40mg – anexa mate order nexium for sale

buy warfarin pills for sale – https://coumamide.com/ buy cozaar 25mg generic

order meloxicam 15mg online cheap – moboxsin order generic mobic 7.5mg

buy cheap generic prednisone – https://apreplson.com/ prednisone online buy

free ed pills – https://fastedtotake.com/ medicine for impotence

amoxicillin drug – oral amoxil buy generic amoxicillin over the counter

order diflucan 100mg generic – fluconazole 200mg us diflucan us

oral cenforce 50mg – https://cenforcers.com/# purchase cenforce sale

where can i buy cialis over the counter – cialis none prescription cialis without prescription

can you drink wine or liquor if you took in tadalafil – https://strongtadafl.com/ order cialis no prescription

ranitidine uk – buy ranitidine 300mg order zantac 150mg generic

viagra buy dublin – https://strongvpls.com/# how to order generic viagra

This is the amicable of topic I take advantage of reading. click

I’ll certainly bookmark this page.

More articles like this would remedy the blogosphere richer. https://buyfastonl.com/gabapentin.html

I’ll certainly bring back to be familiar with more. https://ursxdol.com/ventolin-albuterol/

With thanks. Loads of erudition! https://prohnrg.com/product/priligy-dapoxetine-pills/

Such a useful read.

I really admired the way this was presented.

I took away a great deal from this.

Palatable blog you possess here.. It’s intricate to on elevated calibre article like yours these days. I justifiably appreciate individuals like you! Take guardianship!! comment prendre fildena 25

The clarity in this article is remarkable.

The breadth in this write-up is remarkable.

I truly valued the approach this was presented.

Thanks for publishing. It’s a solid effort.

I’ll definitely recommend this.

I learned a lot from this.

This article is valuable.

I really liked the style this was presented.

Such a beneficial bit of content.

Such a informative insight.

I learned a lot from this.

More blogs like this would make the internet a better place.

Facts blog you possess here.. It’s severely to find high status article like yours these days. I honestly comprehend individuals like you! Take care!! https://ondactone.com/spironolactone/

I couldn’t weather commenting. Well written!

https://doxycyclinege.com/pro/ranitidine/

More text pieces like this would urge the web better. http://sols9.com/batheo/Forum/User-Eeamia

order forxiga – on this site forxiga 10mg us

buy xenical generic – buy orlistat for sale orlistat 60mg price

More peace pieces like this would insinuate the интернет better. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24858

You can shelter yourself and your stock by being wary when buying pharmaceutical online. Some druggist’s websites control legally and offer convenience, privacy, bring in savings and safeguards over the extent of purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/kamagra.html kamagra

This website really has all of the bumf and facts I needed adjacent to this case and didn’t comprehend who to ask. topiramate generic

The thoroughness in this break down is noteworthy.

Этот информационный материал привлекает внимание множеством интересных деталей и необычных ракурсов. Мы предлагаем уникальные взгляды на привычные вещи и рассматриваем вопросы, которые волнуют общество. Будьте в курсе актуальных тем и расширяйте свои знания!

Детальнее – https://vivod-iz-zapoya-1.ru/

Immediate Olux se demarque comme une plateforme d’investissement en crypto-monnaies innovante, qui exploite la puissance de l’intelligence artificielle pour proposer a ses membres des avantages decisifs sur le marche.

Son IA etudie les marches financiers en temps reel, detecte les occasions interessantes et execute des strategies complexes avec une exactitude et une rapidite hors de portee des traders humains, optimisant ainsi les potentiels de profit.

Clarte Nexive se demarque comme une plateforme d’investissement en crypto-monnaies innovante, qui utilise la puissance de l’intelligence artificielle pour fournir a ses clients des avantages concurrentiels decisifs.

Son IA scrute les marches en temps reel, detecte les occasions interessantes et execute des strategies complexes avec une precision et une vitesse hors de portee des traders humains, augmentant de ce fait les potentiels de rendement.

TurkPaydexHub se differencie comme une plateforme d’investissement crypto revolutionnaire, qui exploite la puissance de l’intelligence artificielle pour proposer a ses membres des avantages decisifs sur le marche.

Son IA analyse les marches en temps reel, repere les opportunites et met en ?uvre des strategies complexes avec une precision et une vitesse inaccessibles aux traders humains, augmentant de ce fait les potentiels de rendement.

TurkPaydexHub Official Page

TurkPaydexHub se distingue comme une plateforme de placement crypto revolutionnaire, qui met a profit la puissance de l’intelligence artificielle pour proposer a ses membres des avantages concurrentiels decisifs.

Son IA analyse les marches en temps reel, identifie les opportunites et execute des strategies complexes avec une precision et une vitesse inaccessibles aux traders humains, augmentant de ce fait les potentiels de profit.

Даже при амбулаторном ведении мы следуем принципам доказательной медицины: пошаговая титрация, ясные коридоры безопасности, пересмотр решений строго по показателям. Мы объясняем, на что ориентироваться в первые часы после визита: диапазоны давления и пульса, ориентиры самочувствия, правила питания и питья, поведенческие «якоря» на случай, если тревога неожиданно вырастет вечером. Благодаря этому пациент и его семья не остаются один на один с вопросами; наоборот — у них есть карта маршрута и контакты людей, готовых включиться в течение минуты.

Разобраться лучше – [url=https://narcolog-na-dom-krasnodar14.ru/]нарколог на дом круглосуточно цены в краснодаре[/url]

В первые часы важно не «залить» пациента растворами, а корректно подобрать темп и состав с учётом возраста, массы тела, артериального давления, лекарственного фона (антигипертензивные, сахароснижающие, антиаритмические препараты) и переносимости. Именно поэтому мы не отдаём лечение на откуп шаблонам — каждая схема конструируется врачом на месте, а эффективность оценивается по понятным метрикам.

Разобраться лучше – [url=https://vyvod-iz-zapoya-v-ryazani14.ru/]срочный вывод из запоя рязань[/url]

Вызов нарколога на дом сочетает медицинскую эффективность с удобством. Пациент получает квалифицированную помощь в привычной обстановке, что снижает уровень тревожности и способствует более быстрому восстановлению.

Получить дополнительную информацию – [url=https://narkolog-na-dom-sankt-peterburg14.ru/]врач нарколог выезд на дом санкт-петербург[/url]

Конфиденциальность — не обещание на бумаге, а практический стандарт. В клинике используются кодовые профили, шифрованный контур хранения карт, разграничение доступа по ролям; документы оформляются нейтрально, а уведомления формулируются без чувствительных слов. Выездные специалисты приезжают без медицинской символики, а в здании клиники навигация организована так, чтобы перемещение было незаметным. Это создаёт пространство, в котором можно честно говорить о целях и спокойно выполнять план — без стигмы и посторонних взглядов.

Подробнее – [url=https://narkologicheskaya-klinika-v-spb14.ru/]narkologicheskaya-klinika-v-spb14.ru/[/url]

«Как отмечает врач-нарколог Павел Викторович Зайцев, «эффективность терапии во многом зависит от своевременного обращения, поэтому откладывать визит в клинику опасно»».

Получить дополнительную информацию – https://narkologicheskaya-klinika-sankt-peterburg14.ru/

В условиях медицинского контроля специалисты выполняют последовательные действия, направленные на стабилизацию состояния пациента.

Получить больше информации – https://vyvod-iz-zapoya-ryazan14.ru

При оказании помощи используются современные медикаментозные средства, направленные на устранение интоксикации и стабилизацию функций организма.

Получить дополнительные сведения – [url=https://narkolog-na-dom-sankt-peterburg14.ru/]частный нарколог на дом в санкт-петербурге[/url]

В первые часы важно не «залить» пациента растворами, а корректно подобрать темп и состав с учётом возраста, массы тела, артериального давления, лекарственного фона (антигипертензивные, сахароснижающие, антиаритмические препараты) и переносимости. Именно поэтому мы не отдаём лечение на откуп шаблонам — каждая схема конструируется врачом на месте, а эффективность оценивается по понятным метрикам.

Подробнее можно узнать тут – http://

Состав капельницы никогда не «копируется»; он выбирается по доминирующему симптому и соматическому фону. Ниже — клинические профили, которые помогают понять нашу логику. Итоговая схема формируется на месте, а скорость и объём зависят от текущих показателей.

Ознакомиться с деталями – [url=https://narcolog-na-dom-krasnodar14.ru/]вызов нарколога на дом в краснодаре[/url]

Современная наркология — это не набор «сильных капельниц», а точные инструменты, управляющие скоростью и направлением изменений. В «НеваМеде» технологический контур работает тихо и незаметно для пациента, но даёт врачу контроль над деталями, от которых зависит безопасность.

Изучить вопрос глубже – [url=https://narkologicheskaya-klinika-v-spb14.ru/]запой наркологическая клиника в санкт-петербурге[/url]

«Как отмечает врач-нарколог Павел Викторович Зайцев, «эффективность терапии во многом зависит от своевременного обращения, поэтому откладывать визит в клинику опасно»».

Изучить вопрос глубже – [url=https://narkologicheskaya-klinika-sankt-peterburg14.ru/]вывод наркологическая клиника санкт-петербург[/url]

Вывод из запоя в Рязани является востребованной медицинской услугой, направленной на стабилизацию состояния пациента после длительного употребления алкоголя. Специалисты применяют современные методы детоксикации, позволяющие быстро и безопасно восстановить жизненно важные функции организма, снизить проявления абстинентного синдрома и предотвратить осложнения. Процесс лечения осуществляется в клинических условиях под постоянным наблюдением врачей.

Детальнее – [url=https://vyvod-iz-zapoya-ryazan14.ru/]вывод из запоя цена в рязани[/url]

Вызов нарколога на дом сочетает медицинскую эффективность с удобством. Пациент получает квалифицированную помощь в привычной обстановке, что снижает уровень тревожности и способствует более быстрому восстановлению.

Детальнее – [url=https://narkolog-na-dom-sankt-peterburg14.ru/]вызов нарколога на дом[/url]

Даже при амбулаторном ведении мы следуем принципам доказательной медицины: пошаговая титрация, ясные коридоры безопасности, пересмотр решений строго по показателям. Мы объясняем, на что ориентироваться в первые часы после визита: диапазоны давления и пульса, ориентиры самочувствия, правила питания и питья, поведенческие «якоря» на случай, если тревога неожиданно вырастет вечером. Благодаря этому пациент и его семья не остаются один на один с вопросами; наоборот — у них есть карта маршрута и контакты людей, готовых включиться в течение минуты.

Исследовать вопрос подробнее – http://narcolog-na-dom-krasnodar14.ru

«НеваМед» — частная наркологическая клиника в Санкт-Петербурге, где клиническая точность сочетается с бережной коммуникацией и безусловной конфиденциальностью. Мы делаем лечение не «разовым визитом ради капельницы», а продуманным маршрутом, в котором каждый шаг имеет понятную цель, сроки оценки и прозрачные критерии эффективности. Для пациента это означает предсказуемость первых суток, сохранение личного пространства и ощущение контролируемой динамики, а для близких — ясные правила помощи без тревожных импровизаций.

Получить дополнительные сведения – [url=https://narkologicheskaya-klinika-v-spb14.ru/]наркологическая клиника цены санкт-петербург[/url]

Состав инфузии мы подбираем под доминирующие симптомы и сопутствующие заболевания. Цель — вернуть управляемость телу, а не «насытить» организм всем сразу. Матрица ниже демонстрирует клиническую логику: окончательное решение принимает врач после очной оценки.

Разобраться лучше – [url=https://vyvod-iz-zapoya-v-ryazani14.ru/]вывод из запоя капельница на дому[/url]

Перед началом терапии важно оценить состояние пациента и выявить сопутствующие заболевания. После этого назначается комплексное лечение, которое позволяет восстановить здоровье и подготовить к дальнейшей реабилитации.

Ознакомиться с деталями – [url=https://vyvod-iz-zapoya-ryazan14.ru/]вывод из запоя капельница на дому[/url]

Этот комплекс мер позволяет оказывать помощь пациентам на всех стадиях зависимости.

Разобраться лучше – [url=https://narkologicheskaya-klinika-sankt-peterburg14.ru/]наркологическая клиника вывод из запоя санкт-петербург[/url]

https://t.me/s/officials_pokerdom/3862

https://t.me/s/Martin_casino_officials

https://t.me/iGaming_live/4872

https://t.me/dragon_money_mani/14

https://t.me/s/be_1win/989

https://t.me/s/ef_beef

betmgm Virginia https://betmgm-play.com/ mgm on line

mcluck first bet promo mcluck CO mcluck offers

The sweetest slot on the planet? Sweet Bonanza! Colorful sweet bonanza free play symbols, pay-anywhere wins, and free spins loaded with multipliers. Your candy fix just got rewarding.

chicken road casino brings provably fair crash action with adorable charm! Dodge traps, rack up multipliers, secure your wins smartly. The thrill builds with every round!

Charge headfirst into slot stardom and big bucks. bull and games features Aristocrat excellence: endless retriggers, gold buffs, and jackpot mania. Spin now!