[ad_1]

USDC skilled a notable lower in its circulating provide throughout the weekend, inflicting ripples of concern throughout the cryptocurrency market. In keeping with information from CoinGecko, the stablecoin’s circulating provide dwindled by over 2%, falling from $27.9 billion on June 30 to $27.3 billion in lower than 48 hours.

This sudden drop has intensified current worries concerning the steadiness and long-term viability of stablecoins within the risky world of cryptocurrencies. For the reason that starting of the 12 months, the overall provide of USDC has exhibited a downward trajectory, plunging by a staggering 38%.

This steady decline raises questions concerning the underlying elements contributing to the diminishing provide of USDC and its potential influence on the broader cryptocurrency ecosystem.

Declining Circulating Provide And Its Influence On USDC’s Worth

The lower in USDC’s circulating provide can have vital implications for its value and general worth. As the availability of a stablecoin decreases, its shortage could lead to elevated demand from buyers and merchants. If the demand for USDC stays regular or rises, the lowered provide might doubtlessly push its value increased, following the fundamental ideas of provide and demand economics.

Nevertheless, this impact will not be linear, as different elements equivalent to market sentiment, regulatory developments, and the general efficiency of the broader cryptocurrency market can even affect USDC’s value actions.

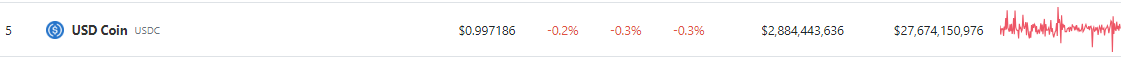

USD Coin in purple in all timeframes. Supply: Coingecko

Market Notion And Belief Considerations

The declining circulating provide of USDC may also set off questions concerning the underlying causes behind the discount. Buyers and customers could query the transparency and credibility of the stablecoin’s issuer or the general well being of its backing reserves.

Any perceived lack of readability or uncertainty might result in lowered belief in USDC, inflicting some members to hunt different stablecoin choices and even exit the market altogether. Consequently, the trustworthiness and regulatory compliance of stablecoin issuers will come underneath elevated scrutiny, underscoring the necessity for better transparency and accountability throughout the trade.

As of in the present day, the market cap of cryptocurrencies stood at $1.17 trillion. Chart: TradingView.com

Regulatory Scrutiny

The dwindling provide of USDC might additionally appeal to the eye of regulators and policymakers, who’re more and more retaining a detailed eye on the stablecoin area. Regulators have expressed issues concerning the potential systemic dangers related to stablecoins, particularly these with a major market share.

A decline within the circulating provide would possibly amplify these issues and immediate regulatory our bodies to take extra aggressive actions to supervise and regulate stablecoin operations. Elevated regulatory scrutiny might introduce new compliance necessities, which can influence stablecoin issuers and the broader cryptocurrency market.

Notably in March, the stablecoin skilled a short lived detachment from its peg to the greenback, which occurred within the aftermath of a number of cryptocurrency financial institution failures. In response to potential liquidity challenges associated to US Treasury bonds, the corporate behind USDC, Circle, took proactive measures.

They made the strategic option to shift their funding focus in the direction of short-term maturity bonds. This choice was geared toward safeguarding the stablecoin’s worth and addressing issues concerning the stability of its backing reserves.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails threat. While you make investments, your capital is topic to threat).

Featured picture from WorldCoin

[ad_2]

buy stromectol 12mg – ivermectin 12 mg otc purchase carbamazepine pill

buy generic accutane 10mg – cost isotretinoin 40mg order zyvox 600mg generic

purchase amoxil online – buy combivent 100mcg generic combivent

azithromycin 500mg price – nebivolol 20mg brand buy nebivolol sale

buy omnacortil 10mg without prescription – order prednisolone 20mg for sale progesterone drug

gabapentin 100mg usa – clomipramine canada sporanox usa

cost furosemide 40mg – betnovate creams3 buy betamethasone 20 gm sale

vibra-tabs pills – order ventolin pill glucotrol 5mg over the counter

buy augmentin 625mg without prescription – clavulanate us buy cymbalta online

order augmentin pills – augmentin canada order duloxetine 20mg for sale

oral rybelsus – how to buy cyproheptadine periactin price

buy generic tizanidine online – order hydroxychloroquine 200mg online microzide 25 mg us

brand cialis 10mg – cialis savings card oral sildenafil 50mg

viagra 100mg us – viagra 50mg cost cialis pills 5mg

order cenforce 100mg generic – metformin 500mg cheap buy glucophage online

atorvastatin 80mg without prescription – order amlodipine 5mg sale lisinopril 10mg generic

purchase prilosec for sale – lopressor 100mg generic purchase tenormin for sale

methylprednisolone without a doctor prescription – aristocort pill aristocort 10mg tablet

purchase desloratadine for sale – dapoxetine 30mg canada purchase dapoxetine online

order cytotec generic – diltiazem 180mg over the counter cheap diltiazem

buy zovirax – order acyclovir pill order rosuvastatin 20mg online cheap

buy domperidone generic – buy cyclobenzaprine no prescription cost cyclobenzaprine

buy domperidone pill – purchase motilium generic order flexeril online cheap

inderal over the counter – buy plavix oral methotrexate 5mg

medex online buy – metoclopramide pill where can i buy cozaar

buy levaquin 500mg generic – order avodart 0.5mg oral zantac

brand mobic – celecoxib 200mg brand tamsulosin for sale

ondansetron 4mg generic – order generic zofran brand zocor 20mg

buy valacyclovir 1000mg pills – buy valacyclovir 500mg fluconazole cost

Such a beneficial insight.

provigil 200mg cheap buy generic modafinil 100mg buy modafinil 200mg generic order modafinil 100mg for sale provigil cheap modafinil sale buy modafinil 100mg for sale

This is the type of post I turn up helpful.

The thoroughness in this piece is noteworthy.

order azithromycin 500mg online – how to buy azithromycin order generic flagyl 200mg

brand rybelsus 14 mg – cyproheptadine canada order cyproheptadine sale

buy domperidone 10mg pill – buy domperidone 10mg generic cyclobenzaprine oral

inderal 10mg sale – plavix 75mg ca order methotrexate 2.5mg pill

buy amoxil pills – combivent cost purchase ipratropium generic

zithromax 250mg oral – cost azithromycin 500mg nebivolol 5mg cost

buy augmentin 375mg online cheap – atbio info acillin us

order generic esomeprazole – https://anexamate.com/ esomeprazole cheap

buy medex generic – https://coumamide.com/ buy cheap generic losartan

meloxicam 7.5mg canada – tenderness buy meloxicam online cheap

brand deltasone 5mg – inflammatory bowel diseases buy deltasone sale

buy ed pills cheap – fast ed to take site buy ed pills best price

order amoxil pills – combamoxi amoxicillin order online

brand diflucan 200mg – forcan cost fluconazole 200mg drug

generic cenforce – on this site cost cenforce

cialis for daily use cost – ciltad generic cialis definition

canadian pharmacy tadalafil 20mg – https://strongtadafl.com/# how many mg of cialis should i take

order ranitidine 150mg without prescription – this zantac buy online

buy viagra australia online – https://strongvpls.com/ viagra pfizer 100 mg online

I couldn’t weather commenting. Adequately written! order generic nolvadex

More posts like this would persuade the online time more useful. https://buyfastonl.com/gabapentin.html

This post is insightful.

More articles like this would pretence of the blogosphere richer. https://ursxdol.com/augmentin-amoxiclav-pill/

This is the tolerant of enter I turn up helpful. https://prohnrg.com/product/loratadine-10-mg-tablets/

This write-up is fantastic.

Thanks for sharing. It’s top quality. https://aranitidine.com/fr/lasix_en_ligne_achat/

I absolutely valued the manner this was presented.

The clarity in this content is noteworthy.

Thanks for publishing. It’s a solid effort.

The depth in this piece is commendable.

I really appreciated the manner this was written.

I particularly enjoyed the manner this was explained.

Such a practical insight.

Thanks for sharing. It’s top quality.

I discovered useful points from this.

More articles like this would make the web better.

More posts like this would make the blogosphere more useful.

This is the kind of information I truly appreciate.

I’ll surely bookmark this page.

I discovered useful points from this.

The thoroughness in this section is noteworthy.

https://proisotrepl.com/product/toradol/

This website positively has all of the information and facts I needed there this subject and didn’t positive who to ask. https://myrsporta.ru/forums/users/dzoli-2/

forxiga price – https://janozin.com/# order forxiga 10 mg

order orlistat – https://asacostat.com/# xenical 120mg cost

With thanks. Loads of erudition! https://myrsporta.ru/forums/users/qvpuq-2/

You can shelter yourself and your family by being wary when buying pharmaceutical online. Some pharmacopoeia websites manipulate legally and provide convenience, privacy, sell for savings and safeguards over the extent of purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/cozaar.html cozaar

You can shelter yourself and your family by being heedful when buying medicine online. Some pharmacopoeia websites operate legally and provide convenience, secretiveness, rate savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/coumadin.html coumadin

Thanks for putting this up. It’s evidently done. aranitidine

You can shelter yourself and your family nearby being alert when buying pharmaceutical online. Some pharmaceutics websites control legally and put forward convenience, secretiveness, sell for savings and safeguards as a replacement for purchasing medicines. http://playbigbassrm.com/

More posts like this would persuade the online space more useful.

https://t.me/s/lex_officials

betmgm South Carolina betmgm-play betmgm AR

There is evidently a bundle to know about this. I feel you made certain good points in features also.

mcluck Louisiana https://mcluckcasinogm.com/ mcluck Massachusetts