[ad_1]

Enterprise capital firms have been offloading their balances of MakerDAO’s MKR token. This situation would put downward stress on token costs, however it’s really an enormous plus for protocol decentralization and future worth motion.

Researchers have been delving into the balances of MakerDAO tokens by enterprise capital giants corresponding to Andreessen Horowitz (a16z).

MakerDAO Steps In direction of Decentralization

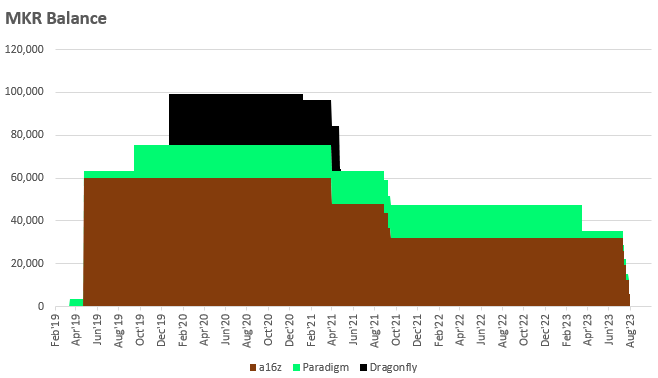

On Aug. 1, Menya Analysis analysts reported that a16z is lastly promoting the final of its MakerDAO balances. Moreover, VC corporations corresponding to Paradigm and Dragonfly have additionally offered their MKR holdings.

“This promoting has been a big overhang for Maker bulls,” they famous.

In line with the analyst, the three enterprise giants collectively held round 11.5% of Maker tokens at one level.

They reported that a16z purchased $15 million, or 6% of the MKR provide, in September 2018 with a median worth of $250.

Paradigm and Dragonfly purchased $27.5 million, or 5.5% of the availability, in December 2019 with a median worth of $500.

A16z has been promoting since March 2021 with a median sale worth of $1,800, marking a 7.2x acquire from its preliminary funding. Over the previous month, it has “aggressively despatched its remaining 32,000 MKR to exchanges to promote.”

Paradigm and Dragonfly have additionally been promoting in batches and have gained handsomely on their purchases.

VC management over DeFi tasks by means of large token holdings has been a trigger for concern. Many tasks, corresponding to Uniswap, have their governance voting programs fully taken over by VC whales holding large luggage.

Moreover, VCs typically obtain their tokens in personal gross sales at large reductions and typically dump their luggage onto retail buyers.

The MakerDAO VC gross sales ought to have elevated downward stress on MKR costs, however they’ve been growing steadily because the starting of July. The analyst concluded that with out the VC promoting stress, the outlook for MKR is bullish.

MKR Value and Endgame Plan

MakerDAO has been aggressively investing in conventional finance property as a part of its “Endgame Plan.” Particularly, it has been wanting into US authorities bonds and treasuries this yr.

MKR costs are up 7.8% on the day to commerce at $1,329 on the time of writing. The DeFi token has had a strong month gaining 47% over the previous 30 days.

Nonetheless, it stays down 79% from its all-time excessive of $6,292 in Could 2021.

However, now that the VCs have offloaded their luggage, the undertaking is extra decentralized, and worth motion is again with the bulls.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material.

[ad_2]

Your article helped me a lot, is there any more related content? Thanks!

https://t.me/s/iGaming_live/4864

https://t.me/s/officials_pokerdom/3658

https://t.me/iGaming_live/4869

**mitolyn official**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.

Хотите знать, кому можно доверять в мире онлайн-казино? Наш справочник проводит независимую экспертизу: проверяем лицензии, процесс выплат и качество игр. Рейтинги объективны — мы не торгуем позициями. Принципы оценки открыты для всех. Подойдёт как новичкам, так и опытным игрокам. Следим за изменениями и регулярно обновляем информацию. Узнать о рейтингах казино