[ad_1]

On the planet of economic markets, Bitcoin and crypto, worry and uncertainty usually dominate the headlines. Over the previous few months, there was rising hypothesis about an impending recession and the opportunity of a significant crash in threat property. Theses similar to Bitcoin will rise to $40,000 after which crash are at present in abundance.

Whereas nearly all of analysts anticipate a recessionary crash, with the timing being hotly disputed, macro analyst Alex Krueger presents a compelling case for why such fears could also be unfounded. In his analysis report, Krüger debunks prevalent bearish theses and sheds gentle on why he stays bullish on threat property, together with Bitcoin and cryptocurrencies.

1/ A recession is imminent, threat property are costly, and shares at all times backside throughout deleveraging pushed recessions.

Is a significant crash inevitable?

By no means

On this analysis report we discover how prevalent bearish theses are flawed and why we’re bullish on threat property. pic.twitter.com/6b456Pvz2l

— Alex Krüger (@krugermacro) July 3, 2023

Debunking Bearish Theses For Danger Belongings Like Bitcoin

In response to Krüger, the upcoming recession, if any, has been one of the extensively anticipated in historical past. This anticipation has led to market individuals and financial actors getting ready themselves, thereby decreasing the chance and potential magnitude of the recession. As Krüger astutely factors out, “What actually issues will not be if knowledge is available in constructive or damaging, but when knowledge is available in higher or worse than what’s priced in.”

One flawed notion usually related to recessions is the idea that threat property should backside out when a recession happens. Krüger highlights the restricted pattern dimension of US recessions and offers a counterexample from Germany, the place the DAX has reached all-time highs regardless of the nation being in a recession. This serves as a reminder that the connection between recessions and threat property will not be as simple as some would possibly assume.

Valuations, one other key side of market evaluation, might be subjective and depending on numerous components. The analyst emphasizes that biases in knowledge and timeframe choice can considerably impression valuations. Whereas some metrics would possibly counsel overvaluation, Krüger suggests wanting nearer at truthful pricing indicators, such because the ahead price-to-earnings ratio for the S&P 500 ex FAANG. By taking a nuanced strategy, buyers can achieve a extra correct understanding of the market panorama.

Moreover, the emergence of synthetic intelligence (AI) presents a revolutionary alternative. Krüger highlights the continued AI revolution, evaluating it to the transformative energy of the web and industrial revolution. He notes that AI has the potential to interchange a good portion of present employment and increase productiveness development, finally driving international GDP larger. Krüger says, “Is an AI bubble forming? Doubtless so, and it’s simply getting began!”

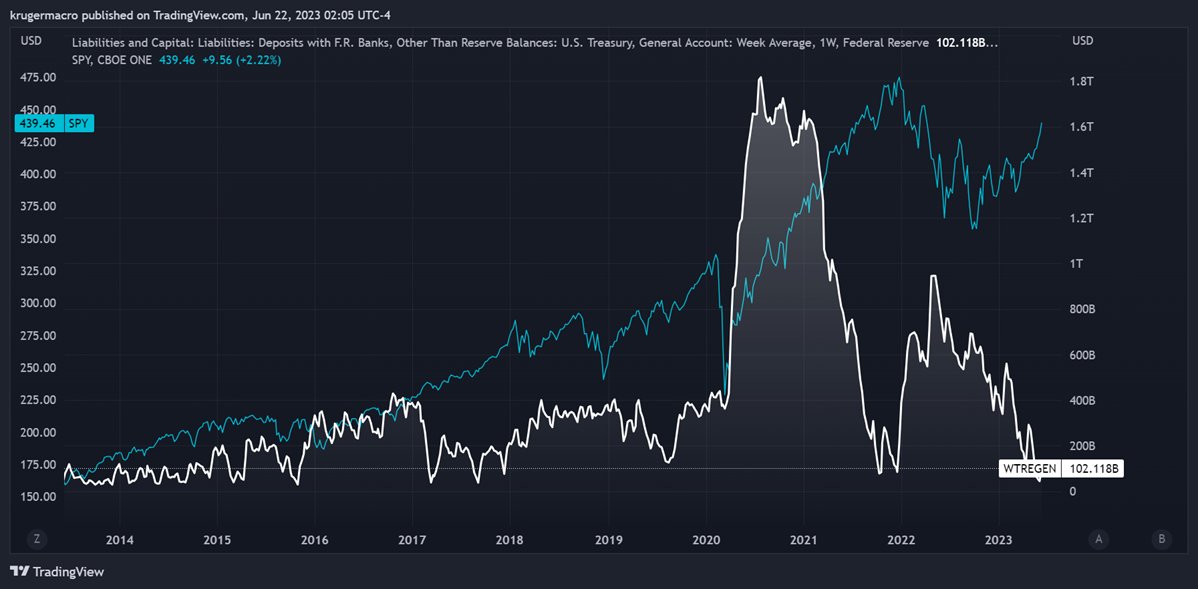

Addressing issues over liquidity, Krüger challenges the idea that liquidity alone drives threat asset costs. He argues that positioning, charges, development, valuations, and expectations collectively play a extra vital position. Whereas the refilling of the Treasury Normal Account (TGA) has been at present seen by a number of analysts as a possible headwind for Bitcoin and crypto, Krüger factors out that historic proof suggests the TGA’s impression available on the market has been minimal. He argues:

The TGA is thought to be decorrelated from threat property for very lengthy intervals of time. In truth, the 4 largest TGA rebuilds over the past 20 years have had a minimal impression available on the market.

The Greatest Is But To Come

Contemplating the financial coverage panorama, Krüger notes that the tightening cycle by the US Federal Reserve is nearing its finish. With nearly all of charge hikes already behind us, the potential impression of some further hikes is unlikely to trigger a big shift. Krüger reassures buyers that the Fed’s tightening cycle is sort of 90% full, thus decreasing the perceived threat of a crash in threat property.

Positioning is one other issue that Krüger highlights as being cash-heavy, as indicated by record-high cash market funds and institutional holdings. This implies that a good portion of market individuals have adopted a cautious strategy, which may function a buffer towards any potential draw back. Krüger states:

In response to the ICI, cash market funds hit a file $5.4 trillion, whereas establishments maintain $3.4 trillion as of June twenty eighth, roughly 2% above the prior highest stage on file, which occurred in Might 2020, the darkest level of the pandemic.

All in all, Krüger’s evaluation offers a refreshing perspective amidst a wave of bearish sentiment. Whereas market circumstances stay unpredictable, Krüger concludes:

Everyone seems to be bearish. However the recession has been front-run, AI revolution is actual, the Fed is sort of carried out, and the market is money heavy. We see no motive for altering our bullish stance, which we’ve held for all of 2023. The development is your pal. And the development is up.

At press time, the Bitcoin value was up 1.2% within the final 24 hours, buying and selling at $31,050.

Featured picture from iStock, chart from TradingView.com

[ad_2]

ivermectin 3mg pills – order tegretol 400mg generic tegretol oral

generic accutane – order dexona without prescription order linezolid generic

buy amoxil pills – amoxil pills buy ipratropium 100 mcg for sale

buy azithromycin tablets – oral zithromax buy generic bystolic online

purchase prednisolone pill – order progesterone 200mg generic buy prometrium sale

buy neurontin 600mg without prescription – purchase itraconazole online cheap buy generic sporanox 100 mg

buy furosemide 100mg online – how to get betnovate without a prescription3 cheap betamethasone 20gm

order doxycycline pills – glucotrol oral purchase glucotrol for sale

buy augmentin – augmentin 625mg canada generic cymbalta 20mg

brand amoxiclav – order cymbalta duloxetine 40mg over the counter

buy semaglutide medication – vardenafil without prescription buy generic periactin

buy generic tizanidine online – buy tizanidine 2mg generic buy microzide sale

50mg viagra – cialis 5mg uk liquid cialis

cheap cialis 10mg – sildenafil 50mg oral cost sildenafil

order cenforce 50mg without prescription – buy aralen 250mg pills buy glucophage 1000mg online

buy lipitor 20mg for sale – order norvasc generic prinivil over the counter

omeprazole 10mg for sale – order omeprazole for sale oral tenormin 100mg

medrol 8 mg for sale – triamcinolone 10mg without prescription brand aristocort 10mg

buy cheap generic clarinex – desloratadine 5mg cheap order dapoxetine generic

cytotec pills – buy diltiazem online buy diltiazem 180mg without prescription

acyclovir 800mg ca – allopurinol pill where can i buy crestor

domperidone online order – buy generic sumycin order cyclobenzaprine without prescription

buy motilium 10mg without prescription – order domperidone without prescription cyclobenzaprine tablet

buy inderal cheap – purchase inderal generic methotrexate 10mg drug

order warfarin 2mg without prescription – order reglan 20mg online buy cozaar 25mg for sale

buy esomeprazole 40mg without prescription – sumatriptan 25mg oral cheap sumatriptan 50mg

buy levofloxacin 500mg online – buy levaquin without a prescription generic zantac 300mg

mobic cheap – buy flomax 0.2mg generic order tamsulosin 0.4mg online

ondansetron 8mg oral – order spironolactone 25mg online zocor 10mg oral

I found new insight from this.

buy provigil 100mg for sale buy modafinil generic buy provigil 100mg without prescription modafinil over the counter modafinil tablet order generic provigil 100mg buy modafinil 200mg pill

The depth in this ruined is exceptional.

More delight pieces like this would urge the интернет better.

cost zithromax 500mg – purchase ciprofloxacin flagyl 400mg ca

oral rybelsus 14mg – buy cyproheptadine 4 mg generic cyproheptadine 4 mg uk

order motilium generic – motilium 10mg price buy cheap generic flexeril

inderal medication – buy clopidogrel pill buy methotrexate without prescription

buy amoxicillin online cheap – diovan 160mg brand order ipratropium 100mcg pills

azithromycin 500mg ca – tindamax 300mg pill nebivolol 20mg sale

buy augmentin 1000mg generic – atbioinfo.com ampicillin generic

esomeprazole 40mg price – https://anexamate.com/ buy nexium without prescription

coumadin without prescription – https://coumamide.com/ losartan 25mg us

order generic meloxicam – https://moboxsin.com/ buy meloxicam without prescription

buy deltasone 20mg online cheap – https://apreplson.com/ prednisone 10mg oral

where to buy over the counter ed pills – ed pills that really work buy ed pills cheap

buy amoxil pill – https://combamoxi.com/ buy amoxicillin cheap

order fluconazole 100mg sale – https://gpdifluca.com/# buy forcan online cheap

cenforce 50mg usa – https://cenforcers.com/# cenforce 50mg drug

cialis 20mg side effects – https://ciltadgn.com/ order cialis online no prescription reviews

cialis 20 milligram – https://strongtadafl.com/# buy generic tadalafil online cheap

zantac 150mg drug – click buy zantac 300mg without prescription

can you buy viagra over counter uk – https://strongvpls.com/ sildenafil genfar 50mg

This is the kind of content I get high on reading. https://gnolvade.com/

I am actually delighted to gleam at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data. amoxicillin for sale online

I’ll definitely be back for more.

The depth in this serving is exceptional. https://ursxdol.com/propecia-tablets-online/

More posts like this would prosper the blogosphere more useful. https://prohnrg.com/

I genuinely admired the way this was explained.

Such a beneficial bit of content.

More content pieces like this would make the blogosphere more useful.

I learned a lot from this.

You’ve obviously spent time crafting this.

You’ve clearly done your homework.

I’ll gladly be back for more.

More articles like this would make the web more useful.

This is the kind of post I enjoy reading.

Such a practical insight.

The detail in this content is commendable.

The clarity in this article is noteworthy.

This submission is excellent.

Such a useful read.

More articles like this would make the internet more useful.

This submission is informative.

The depth in this piece is exceptional. https://ondactone.com/spironolactone/

The thoroughness in this break down is noteworthy.

https://doxycyclinege.com/pro/spironolactone/

More posts like this would make the online play more useful. https://myrsporta.ru/forums/users/dzoli-2/

buy dapagliflozin 10 mg without prescription – site buy cheap dapagliflozin

order orlistat generic – this orlistat us

More articles like this would make the blogosphere richer. http://www.kiripo.com/forum/member.php?action=profile&uid=1193199

You can protect yourself and your dearest close being cautious when buying pharmaceutical online. Some pharmaceutics websites manipulate legally and provide convenience, privacy, sell for savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/valtrex.html valtrex

Palatable blog you have here.. It’s severely to find great worth script like yours these days. I really recognize individuals like you! Go through guardianship!! TerbinaPharmacy

This is the make of post I unearth helpful.

https://t.me/s/beEFCASiNO_oFfIcIaLs

online gambling best sites

online

top rated online casinos

betmgm Alaska betmgm Washington mgm bet va

Awaken to the possibilities of overnight riches and fun. In crowncoins casino, scratch cards add instant gratification. Dive in and scratch your way to success!