[ad_1]

Bitcoin’s sustained worth stage above $30,000 has Brough a couple of noticeable shift in market conduct, notably amongst short-term holders.

Brief-term holders (STHs), or those that have held Bitcoin for lower than 155 days, play an important function in market evaluation. Their conduct typically gives insights into market sentiment and potential worth actions.

Usually, they’re extra reactive to cost adjustments and have a tendency to purchase or promote primarily based on current market developments. This will result in elevated volatility, as their buying and selling actions could cause sharp worth swings.

For example, when short-term holders begin to hodl, it may possibly cut back the sell-side stress out there, doubtlessly resulting in a extra steady worth surroundings.

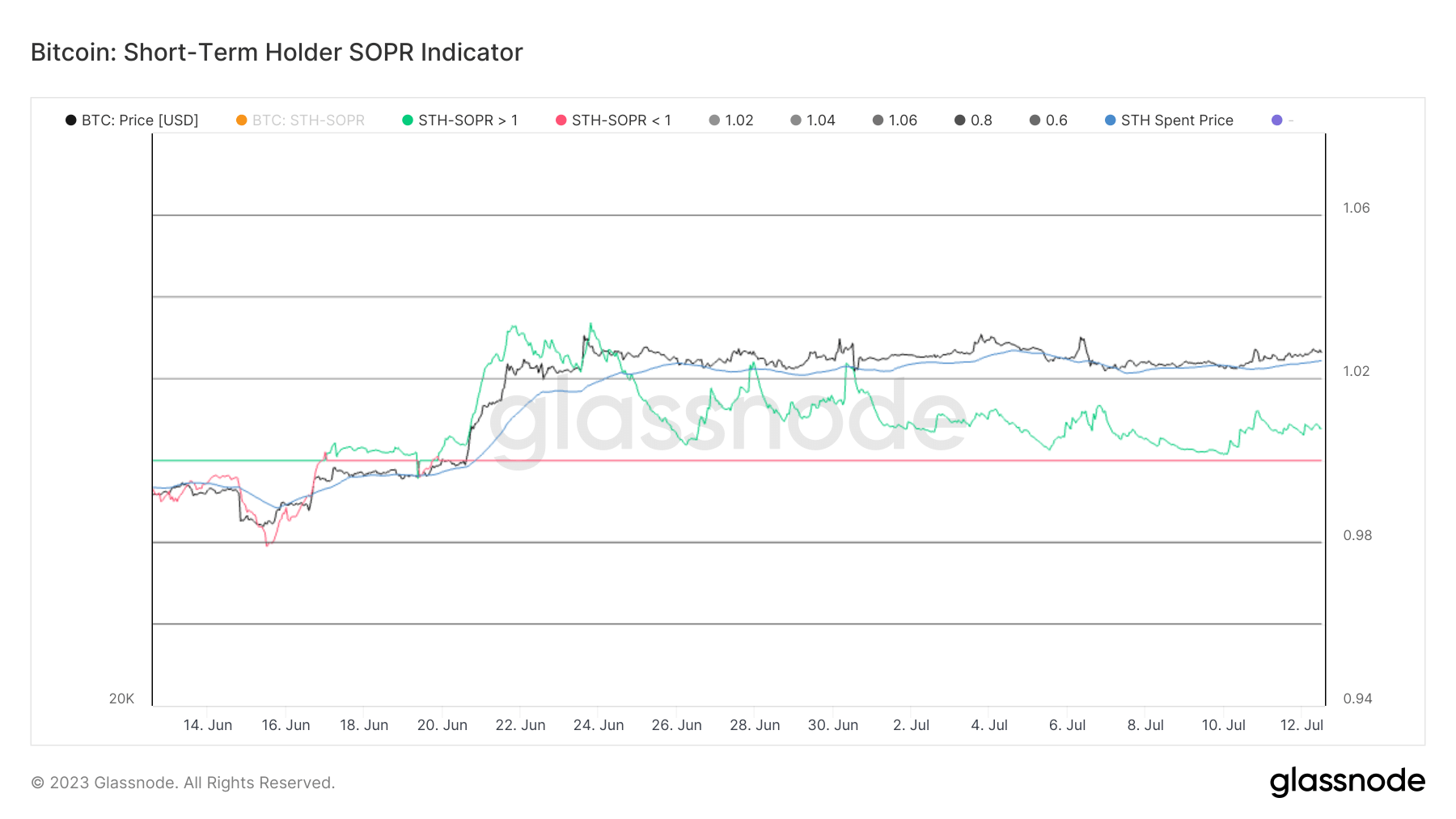

The current surge in Bitcoin’s worth from $26,000 to over $30,000 has put the vast majority of STHs in revenue. That is evident via the Brief-Time period Holder Spent Output Revenue Ratio (STH-SOPR) metric. SOPR is a metric that calculates the revenue ratio of cash moved on-chain, offering insights into whether or not holders are promoting at a revenue or loss. STH-SOPR focuses explicitly on short-term holders.

Since June 20, STH-SOPR has trended above 1, indicating that short-term holders are, on common, shifting their cash at a revenue. The metric peaked at 1.033 on June 21 and has since trended downwards, reaching 1.006 on July 11. This means that whereas STHs are nonetheless profiting, the revenue margin has decreased.

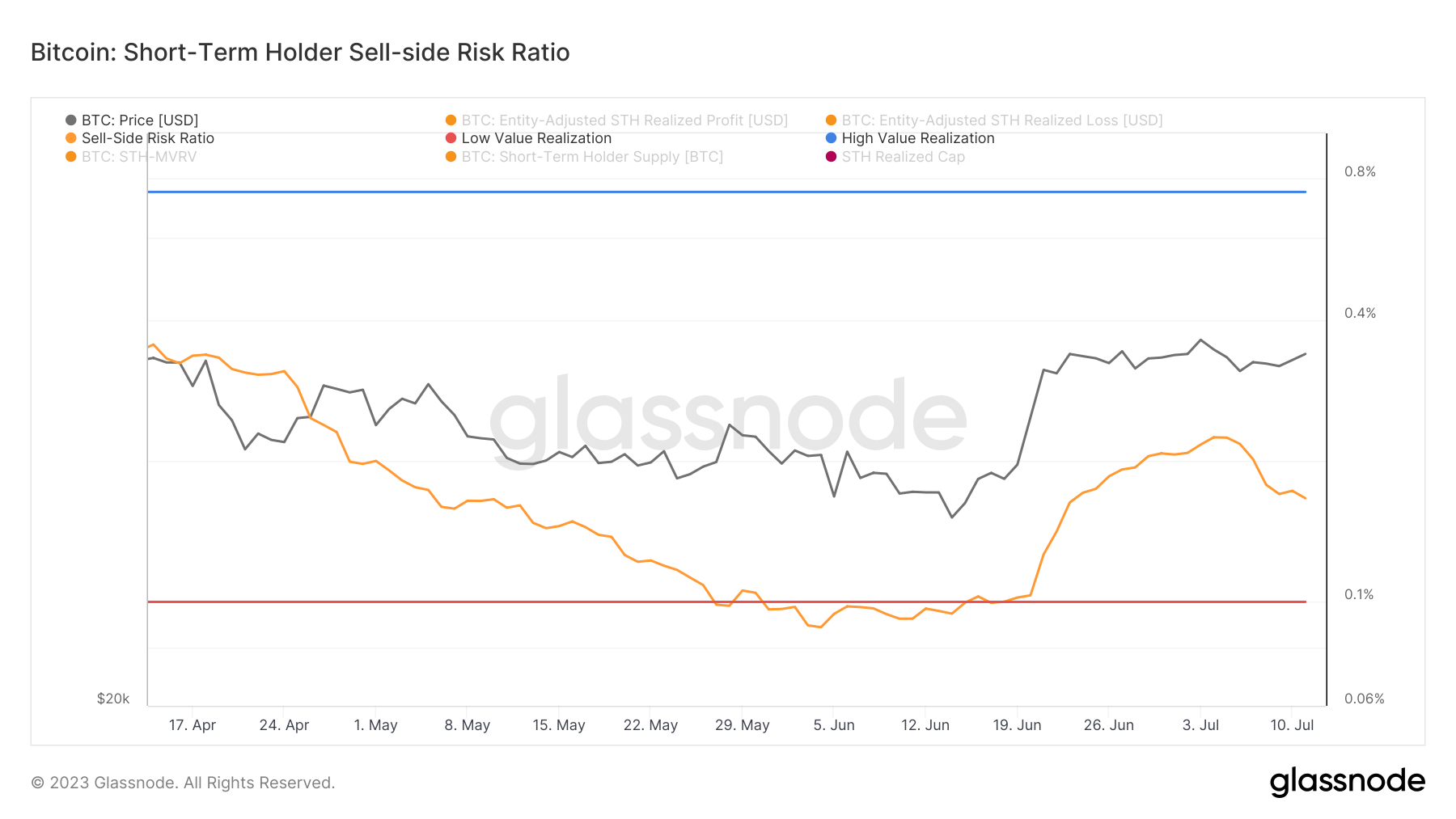

In the meantime, information from on-chain market evaluation platform Glassnode reveals that the sell-side danger ratio for short-term holders has declined. The sell-side danger ratio quantifies the combination sell-side danger out there by evaluating the overall USD worth that traders spend every day to the overall short-term holder realized capitalization. Excessive values are usually related to heavy profit-taking, whereas low values align with market consolidation phases and bear markets.

The ratio started growing on June 21, peaking on July 5. Since then, the ratio has sharply declined, indicating a lower in sell-side stress from short-term holders.

The mixture of those two metrics paints an attention-grabbing image. Whereas the revenue margin for short-term holders is reducing, so is the sell-side stress. This might recommend that short-term holders are selecting to maintain onto their Bitcoin, regardless of the diminishing income.

This conduct may doubtlessly stabilize the market and create a stable base for future worth will increase.

The publish Why are short-term holders HODLing as a substitute of taking income? appeared first on CryptoSlate.

[ad_2]