[ad_1]

The on-chain analytics agency Santiment means that this indicator will be the one to look at to get hints about when Bitcoin may rebound.

Massive Stablecoin Holders Have Seen Stagnant Provide Lately

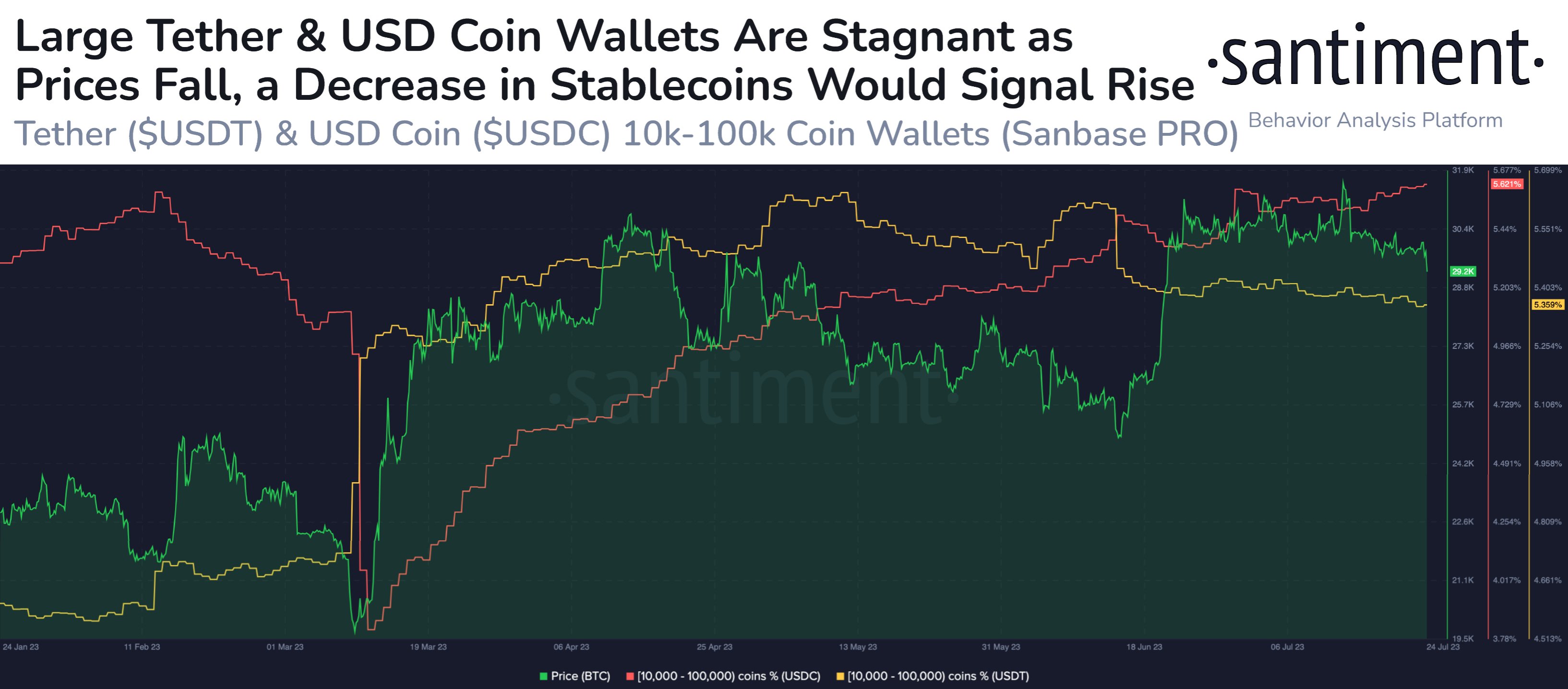

In line with Santiment, the actions of the dolphins and sharks of the highest stablecoins like Tether (USDT) and USD Coin (USDC) could also be related for the value of Bitcoin.

Usually, buyers make use of those fiat-tied tokens every time they need to escape the volatility related to different property out there, like BTC. Such buyers, nevertheless, are probably to purchase again into the unstable cryptocurrencies, as holders who’re really exiting the house achieve this by way of fiat.

When these buyers really feel that the costs are proper to leap again into the opposite cash, they merely alternate their stablecoins for them. Naturally, this shift can act as shopping for strain for the market they’re shifting into, and thus, present a bullish increase to the asset’s worth.

To examine whether or not there’s any important conversion of stables occurring into Bitcoin and others proper now, Santiment has appeared on the information for the provision of the comparatively giant stablecoin investor teams.

Extra particularly, the mixed holdings of the dolphins and sharks are of curiosity right here. These holders usually maintain between 10,000 and 100,000 BTC on their balances.

Now, here’s a chart that reveals how the provision of those investor cohorts has modified for USDT and USDC over the previous few months:

Appears like the 2 metrics have not proven a lot motion in latest days | Supply: Santiment on Twitter

As displayed within the above graph, the dolphins and sharks of the 2 largest stablecoins within the sector have seen their mixed provide transfer largely sideways throughout the previous few weeks.

Which means these decently-sized buyers haven’t been participating in any form of internet conversions not too long ago, whether or not it’s swapping Bitcoin into stables, or exchanging their stables for different property.

Curiously, this sideways development has continued throughout the previous few days, regardless of the plunge to the low $29,000 ranges that the cryptocurrency has noticed on this interval.

“At the moment, considered one of our key concerns revolves round whether or not this behavioral sample will proceed within the incoming 24 hours, particularly within the wake of at present’s fallen costs,” explains the analytics agency. “Will these customers understand this variation as a chance to ‘purchase the dip’? Or will they choose to ‘abandon ship’ amidst rising market uncertainty?”

Naturally, if the provision of those giant stablecoin holders begins to slide down within the close to future, it may be an indication that these buyers are shopping for Bitcoin whereas its worth is at a reduction.

Although, then again, a rise as a substitute would clearly be a worrying sign, as it might imply that the dolphins and sharks are beginning to surrender on BTC for now and exiting from it.

Bitcoin Worth

On the time of writing, Bitcoin is buying and selling round $29,200, down 3% within the final week.

The worth of the asset appears to have been shifting sideways for the reason that plummet | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.internet

[ad_2]