[ad_1]

America Securities and Alternate Fee’s (SEC) defeat within the Ripple case, the place US District Decide Analisa Torres dominated in favor of the agency’s XRP gross sales, has sparked intense debate.

Because the mud settles, a urgent query emerges: does the SEC’s attraction in opposition to the XRP ruling genuinely have an opportunity of success?

The SEC’s Warning In opposition to Ripple’s Ruling

The SEC’s dissatisfaction was evident when it steered that Decide Torres’s ruling in opposition to them was inaccurate. Torres’s choice stood in Ripple’s favor, indicating {that a} substantial portion of its XRP gross sales didn’t transgress investor-protection statutes.

“It might definitely be the case that many programmatic patrons bought XRP with an expectation of revenue, however they didn’t derive that expectation from Ripple’s efforts. Not one of the programmatic patrons have been conscious that they have been shopping for XRP from Ripple,” Torres stated.

This ruling has stirred the waters. Different defendants, akin to Do Kwon of Terraform Labs, try to make the most of the judgment to counter his SEC expenses.

The core of the SEC’s discontent appears to stem from what it interprets as “baseless necessities” launched by Decide Torres to the take a look at of classifying an asset as a safety.

Torres’s perspective suggests Ripple’s gross sales to institutional traders mandated SEC oversight. In distinction, its gross sales to particular person traders by way of crypto exchanges didn’t.

The SEC responded that reconciling this reasoning with foundational securities legal guidelines is an uphill process.

“Opposite to [Terraform Labs’] assertions, a lot of the Ripple ruling helps the SEC’s claims on this case and rejects arguments [Terraform Labs] have raised right here. Nevertheless, with respect to the Programmatic and different gross sales, the SEC respectfully avers that Ripple conflicts with and provides baseless necessities to Howey and its progeny. Respectfully, these parts of Ripple have been wrongly determined, and this Court docket shouldn’t observe them,” the SEC stated.

It Will Take Years for the SEC to Succeed

John Deaton, founding father of Crypto Regulation, warns in opposition to perceiving the SEC’s attraction as an obstacle to Ripple’s latest courtroom triumph. He believes it could be a drawn-out affair even when an attraction materializes. Maybe, it might span years earlier than the 2nd Circuit points a call.

Till then, Torres’ choice reigns supreme.

“Even when the 2nd Circuit stated Torres was incorrect concerning her software of the third Howey issue, that doesn’t imply the SEC wins on Programmatic gross sales. All that occurs is that Torres then applies the opposite two elements and will probably nonetheless rule the identical actual manner,” Deaton stated.

Deaton factors out that Torres’s judgment centered on the intricacies of the Howey Check, the established benchmark to find out the existence of an funding contract throughout an asset’s sale. She dominated that many XRP purchasers may need anticipated revenue, however Ripple’s actions didn’t form these expectations.

Learn extra: Why the Crypto Market Future Lies on US Decide Analisa Torres

Difficult Torres’s software of the Howey Check would necessitate the SEC to enterprise into murkier waters, specializing in sides just like the “funding of cash” and the existence of a “widespread enterprise.”

Ripple Nonetheless Has to Reply to Different Fees

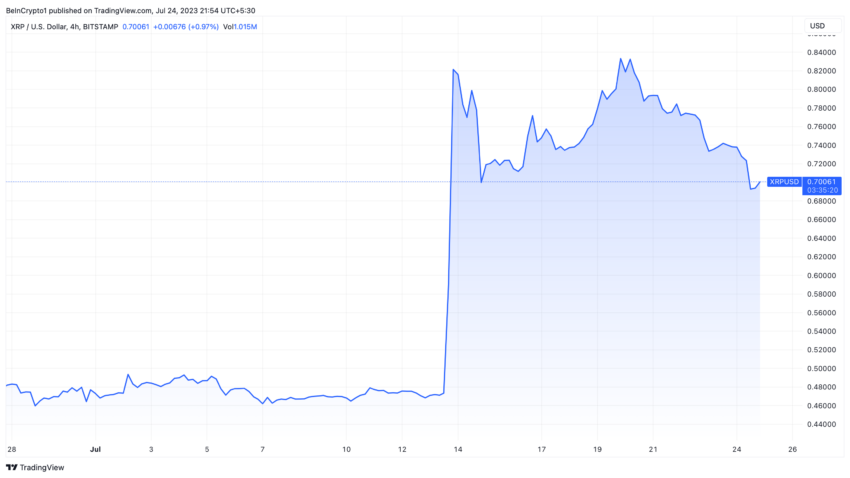

Ripple’s courtroom battles is likely to be reaching their crescendo, however its implications resonate all through the crypto market. This case is especially pivotal, marking the primary occasion the place a US choose favored a crypto agency, delineating sure XRP gross sales from US securities laws.

Whereas Ripple may rejoice a victory, the story will not be fully rosy. The corporate nonetheless breached the regulation by straight promoting XRP to savvy traders, suggesting a future full of intricate authorized hurdles.

For extra details about XRP’s value prediction, please click on right here!

Ripple’s CEO, Brad Garlinghouse, has already been vociferous concerning the SEC’s overreach. He indicated the company wrongfully designated itself because the cryptocurrency regulatory authority.

Nonetheless, the result of this attraction might largely chart the course of the crypto trade, each within the US and globally.

Disclaimer

Following the Belief Challenge pointers, this function article presents opinions and views from trade consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its employees. Readers ought to confirm info independently and seek the advice of with an expert earlier than making choices primarily based on this content material.

[ad_2]