[ad_1]

The looming prospect of a U.S. Division of Justice (DOJ) motion in opposition to Binance, the most important crypto alternate, might maintain a silver lining for Bitcoin and the broader markets. Even when this sounds loopy at first, there are good arguments for it.

Rumors have been swirling for weeks a couple of potential DOJ motion in opposition to Binance, a risk that has forged a protracted shadow over the markets, resulting in elevated volatility and uncertainty amongst traders. Yesterday’s report by Semafor has rekindled the rumor, but additionally gave it a brand new perspective, hinting that these developments could also be a blessing in disguise for Bitcoin and crypto markets.

In response to the Semafor report, the DOJ is considering fraud fees in opposition to Binance however can also be weighing the potential repercussions to customers and the crypto market at giant. Citing sources acquainted with the matter, the report means that federal prosecutors are involved that an indictment may set off a “financial institution run” just like the calamitous destiny that befell the now-bankrupt FTX platform.

This concern arises from the priority {that a} potential indictment may result in a speedy withdrawal of funds, inflicting customers to lose their cash and doubtlessly set off a wider panic within the Bitcoin and crypto markets. To bypass such a disaster, the prosecutors are exploring different choices like levying fines or establishing deferred or non-prosecution agreements.

What Does This Imply For Bitcoin And Crypto Markets?

Curiously, some crypto market analysts and commentators view this ongoing saga as a possible boon. Macro analyst Alex Kruger, in a current Twitter submit, speculated, “Too Massive to Jail? Name me loopy however this appears bullish if true.” This assertion captures the sentiment that if Binance is taken into account too vital to be hit with crippling fees, the DOJ may discover much less dangerous options.

An analogous view is held by famend analyst Pentoshi, who mentioned, “It doesn’t imply they received’t drop the hammer both. I believe calling it “bullish” is a bit excessive since they’re contemplating dropping the hammer. And if not billions in fines and CZ probably gone. However I def don’t suppose it’d as bearish as headlines first mentioned in any respect. Bullish can be no DoJ involvement.”

The prospect of the DOJ performing in opposition to Binance may additionally present a much-needed readability to the market. If Binance have been certainly weak to a financial institution run, it could rapidly develop into obvious whether or not the alternate holds enough reserves.

Nonetheless, to date, Binance has impressively weathered earlier “stress assessments”, as highlighted by CEO “CZ” in a Twitter submit in mid-December final yr after the Mazars audit rumors, stating, “We noticed some withdrawals as we speak (internet $1.14b ish). We have now seen this earlier than. Some days we have now internet withdrawals; some days we have now internet deposits. Enterprise as standard for us.”

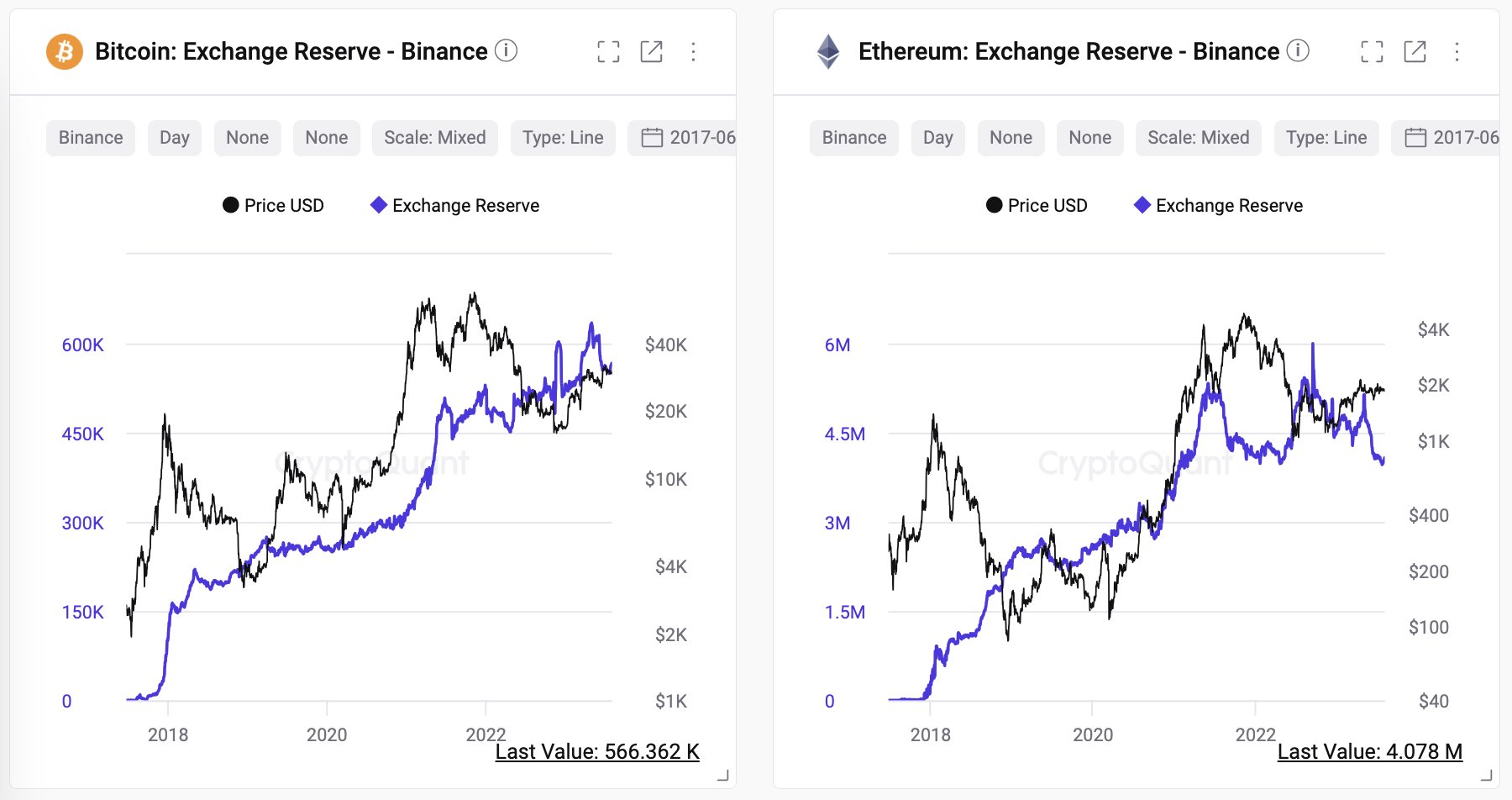

This sentiment is echoed by CryptoQuant CEO Ki Younger-Ju who shared knowledge supporting the energy of Binance’s consumer balances regardless of fixed rumors of insolvency. He said:

I’ve heard concerning the ‘financial institution run/insolvency danger on Binance’ 100 instances for years, however their consumer balances all the time inform a special story.

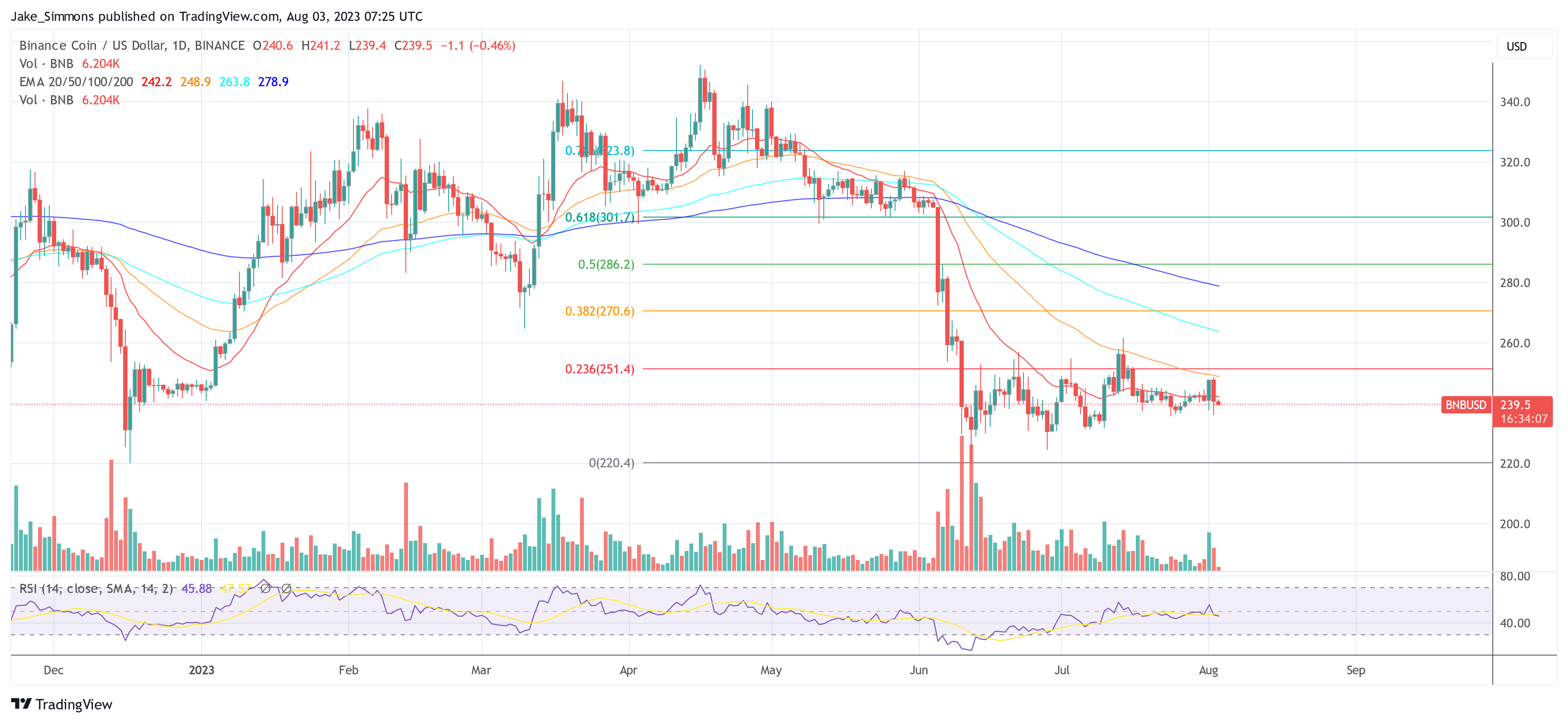

At press time, the BNB worth stood at $239.5.

Featured picture from CCN, chart from TradingView.com

[ad_2]

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!

ivermectin tablets for sale walmart – buy generic candesartan tegretol 200mg oral

buy accutane 10mg sale – where can i buy zyvox buy linezolid generic

cheap amoxil without prescription – amoxil generic ipratropium 100mcg brand

order zithromax 250mg – zithromax 250mg cheap bystolic canada

purchase prednisolone generic – buy prednisolone 20mg generic buy progesterone 100mg generic

gabapentin 100mg ca – itraconazole 100 mg price sporanox cost

oral lasix 100mg – lasix 40mg canada order betamethasone online

monodox online – where to buy glucotrol without a prescription oral glipizide 10mg

augmentin 375mg tablet – amoxiclav online order duloxetine 40mg brand

buy generic augmentin online – nizoral 200mg brand order duloxetine 40mg pill

generic rybelsus 14 mg – order periactin online cheap cyproheptadine 4 mg tablet

purchase tizanidine without prescription – hydroxychloroquine 200mg pill microzide price

usa pharmacy viagra – purchase cialis without prescription order tadalafil 20mg online cheap

cialis mail order usa – tadalafil 20mg for sale sildenafil for sale

buy generic cenforce – aralen drug buy glucophage 500mg sale

order lipitor without prescription – buy atorvastatin 40mg prinivil cheap

oral omeprazole 20mg – order lopressor 50mg online buy atenolol pill

order generic medrol – lyrica 150mg for sale buy generic aristocort online

clarinex for sale – loratadine 10mg price dapoxetine order

order cytotec pills – purchase diltiazem generic order diltiazem generic

order acyclovir 800mg generic – buy generic zovirax 800mg buy rosuvastatin 10mg online cheap

generic domperidone 10mg – order tetracycline generic flexeril 15mg without prescription

domperidone price – generic tetracycline 500mg order flexeril without prescription

purchase inderal online – buy generic plavix for sale methotrexate 2.5mg sale

I’m extremely inspired with your writing abilities as neatly as with the layout in your weblog. Is that this a paid subject or did you customize it your self? Anyway keep up the excellent quality writing, it is uncommon to peer a nice weblog like this one nowadays!

oral warfarin 5mg – order coumadin 5mg online losartan 25mg cheap

nexium buy online – imitrex 25mg cost imitrex over the counter

purchase levofloxacin generic – buy levaquin for sale ranitidine pills

buy generic meloxicam – purchase celebrex online buy flomax 0.2mg sale

buy ondansetron – order zofran 8mg for sale buy simvastatin without prescription

purchase valacyclovir for sale – fluconazole 200mg brand buy diflucan

modafinil 100mg drug provigil 200mg pill provigil 200mg usa cost provigil buy modafinil paypal brand modafinil 100mg buy generic modafinil online

More posts like this would force the blogosphere more useful.

More articles like this would remedy the blogosphere richer.

buy zithromax generic – brand tinidazole order flagyl 200mg without prescription

rybelsus tablet – order semaglutide generic periactin 4mg for sale

domperidone 10mg canada – buy generic tetracycline for sale buy cyclobenzaprine pills

inderal 20mg cost – order generic clopidogrel 75mg methotrexate 5mg usa

purchase amoxicillin generic – cost combivent 100mcg combivent 100 mcg without prescription

buy generic azithromycin for sale – order bystolic 20mg online cheap bystolic online order

order augmentin 375mg without prescription – https://atbioinfo.com/ buy acillin generic

order esomeprazole pill – https://anexamate.com/ brand esomeprazole 20mg

medex medication – https://coumamide.com/ losartan ca

meloxicam cost – swelling meloxicam oral