[ad_1]

In his current report, Charles Edward, a distinguished crypto market analyst, launched an replace on the state of the Bitcoin (BTC) market. The report highlights the continuation of the downtrend for Bitcoin, which has been shedding its key help, the 50-day Transferring Common (MA).

The bearish pattern has been confirmed by technical indicators and the pure elementary Bitcoin Macro Index algorithm, which has seen an growing price of contraction over the past week.

Is Bitcoin Headed For $25,000?

The report supplies insights into each excessive and low timeframe technicals, with the subsequent help ranges for Bitcoin at $28,000, $24,000, and low-$20,000, every providing higher relative alternatives.

The low timeframe technicals point out a breakdown in help at $30,000 and the emergence of a brand new bearish pattern, with a goal of circa $25,000.

The Capriole Bitcoin Macro Index, which mixes over 40 of probably the most highly effective Bitcoin on-chain, macro market, and equities metrics right into a single machine studying mannequin, suggests an honest long-term worth for multi-year horizon buyers, however with lowering fundamentals over the past week.

Alternatively, the Three Issue Mannequin, a brand new open-source algorithm, values the S&P500 utilizing three elementary knowledge factors solely, indicating that the markets are pretty valued at this time, with room for extra upside, regardless of current bearish alerts.

Regardless of the bearish outlook, the report means that the macroeconomic backdrop stays favorable for Bitcoin over the approaching years.

The Federal Reserve has paused price hikes, and the S&P500 has had its longest successful streak in years. Nevertheless, the technicals and fundamentals are presently exhibiting a “not but” sign, indicating that the market may have to attend for a constructive set off such because the approval of the Blackrock ETF.

Total, the report suggests a long-term bullish outlook for Bitcoin, however with warning within the brief time period till technicals or fundamentals show in any other case.

In line with Edwards, the closest factors of technical alternative are $28,000, $25,000, and $21,000, or a each day shut again into the $30,000 vary.

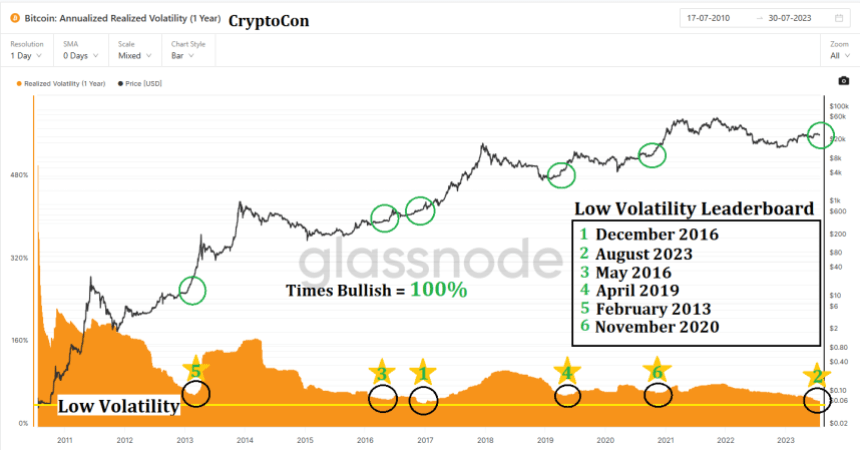

Low Volatility, Excessive Potential

Bitcoin’s worth volatility has been at historic lows, with the cryptocurrency experiencing its second-lowest stage of yearly volatility ever. This reality has been famous by many within the crypto group, together with Crypto Con, who factors out that traditionally, low volatility has been a bullish signal for Bitcoin.

Low volatility may be seen as an indication of stability and maturity for a cryptocurrency. It means that the market is turning into extra environment friendly and that there’s much less hypothesis driving costs up and down. This could be a constructive signal for long-term buyers, because it means that cryptocurrency is turning into extra dependable as a retailer of worth.

Furthermore, Bitcoin has traditionally carried out nicely after intervals of low volatility. Each time Bitcoin’s volatility has dropped to comparable ranges previously, it has been adopted by a big worth enhance.

This implies that, whereas the present low volatility could also be irritating for merchants on the lookout for fast earnings, it might be a constructive signal for long-term buyers.

In conclusion, whereas the present low volatility in Bitcoin’s worth will not be thrilling for merchants, it might be a constructive signal for long-term buyers. Traditionally, low volatility has been a bullish signal for Bitcoin, and the cryptocurrency’s present stability comes at a time when a number of constructive macroeconomic components might drive its worth up sooner or later.

As of the time of writing, Bitcoin has misplaced its essential help line of $29,000 and is presently buying and selling at $28,900, representing a decline of over 1% within the final 24 hours.

Featured picture from Unsplash, chart from TradingView.com

[ad_2]

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.