Introduction:

As the cryptocurrency landscape continues to evolve with remarkable speed, investors and enthusiasts alike find themselves captivated by the potential of emerging assets. Among these is EOS, a platform that promised unparalleled scalability and flexibility for decentralized applications. With its ambitious goals, EOS has sparked both intrigue and skepticism, particularly as the market grapples with its volatile nature and fluctuating values. As we look toward the future, the question looms large: will EOS ascend to the impressive heights of $100 per token by 2030? In this article, we will delve into the factors influencing EOS’s price trajectory, analyze market trends, and explore expert predictions for the years ahead, providing a comprehensive outlook on the possibilities that lie within the ever-dynamic world of cryptocurrency.

Table of Contents

- Future Trends and Market Influences on EOS Pricing

- Technological Developments and Their Impact on EOS Value

- Investor Sentiment and Strategic Approaches for the Coming Years

- Long-Term Scenarios: Achieving the $100 Milestone for EOS

- Q&A

- Future Outlook

Future Trends and Market Influences on EOS Pricing

The future of EOS pricing will largely be influenced by emerging trends within the blockchain landscape and broader market dynamics. As institutions continue to embrace decentralization and blockchain technology, adoption rates for platforms like EOS are expected to rise significantly. Some key factors to watch include:

- Mainstream Adoption: As more businesses integrate blockchain into their operations, EOS could see increased usage, potentially driving up its value.

- Technological Advancements: Innovations in smart contracts and decentralized applications supported by EOS can enhance its utility and attractiveness.

- Regulatory Environment: How governments react to cryptocurrencies can shape the market; favorable regulations might encourage investment in EOS.

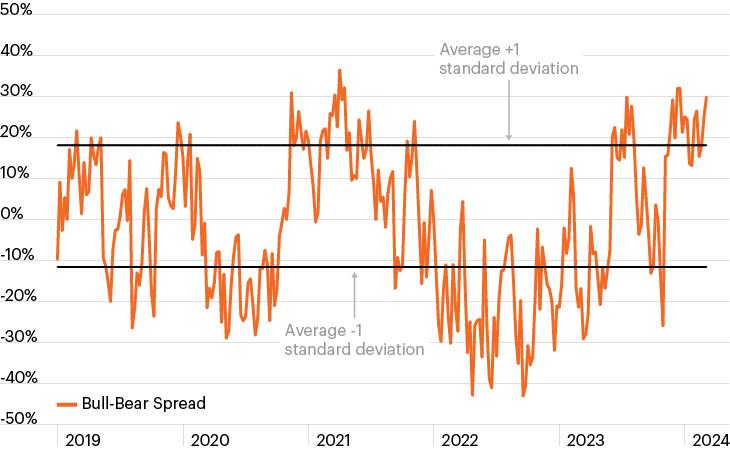

Moreover, market sentiment and investor psychology will play critical roles in determining EOS’s future price trajectory. Market cycles, affected by macroeconomic indicators and trends in cryptocurrency investing, will continue to dictate price movements. Observing trading volumes and social media sentiment can give insights into how the price may evolve. As we look toward 2030, the following market influences could further impact EOS pricing:

- Global Economic Conditions: Economic stability and growth can lead to increased cryptocurrency investments.

- Competing Technologies: The rise of alternative platforms could either challenge or complement EOS, influencing its market share.

- Community Development: A strong developer and user community can foster innovation and support, potentially boosting EOS’s market value.

Technological Developments and Their Impact on EOS Value

As the blockchain landscape continues to evolve, the technological advancements of the EOS platform are pivotal in shaping its market value. Innovations such as decentralized applications (dApps) and enhanced scalability have positioned EOS as a robust contender among blockchain protocols. The introduction of smart contracts not only enhances functionality but also attracts developers who are keen to create seamless, high-performance solutions. Key factors contributing to the potential rise in EOS value include:

- Improved User Experience: Fast transaction speeds and low fees are crucial for mass adoption.

- Decentralization Efforts: Ongoing initiatives to enhance governance and decentralization increase trust among investors.

- Strategic Partnerships: Collaborations with enterprises can drive demand and visibility.

Moreover, the ongoing development of tools for interoperability with other blockchain networks can propel EOS’s utility and attractiveness. As the ecosystem matures, potential features like decentralized finance (DeFi) integrations and non-fungible token (NFT) capabilities are expected to significantly enhance the platform’s appeal. A glance at the upcoming technology roadmap reveals:

| Year | Expected Development | Impact on EOS Value |

|---|---|---|

| 2024 | Enhanced dApp Ecosystem | Increased Adoption |

| 2025 | Interoperability Solutions | Wider Market Reach |

| 2026 | DeFi Protocol Launch | Boost in User Engagement |

| 2027 | Governance Upgrades | Enhanced Investor Confidence |

| 2028 | Expansion into NFTs | New Revenue Streams |

| 2029-2030 | Global Partnerships | Significant Value Growth |

Investor Sentiment and Strategic Approaches for the Coming Years

As we look ahead, the investor sentiment surrounding EOS is a critical factor influencing its predicted trajectory toward the ambitious $100 mark. Following a period of volatility, there seems to be a growing sense of optimism, buoyed by EOS’s commitment to technological advancements and community engagement. Many investors are focusing on key metrics and indicators, including:

- Market Adoption: The increasing number of dApps built on the EOS platform.

- Partnerships: Strategic alliances with established companies and educational institutions.

- Regulatory environment: Navigating new regulations that could impact blockchain technologies.

Additionally, a variety of strategic approaches are emerging among investors looking to capitalize on potential growth. Diversification remains a core strategy, with many choosing to spread their portfolios across various cryptocurrencies while maintaining a focus on EOS. Investors are also analyzing historical data and market trends to identify optimal entry points. The following table summarizes some essential strategies for navigating the EOS landscape:

| Strategy | Description |

|---|---|

| Long-Term Holding | Buying and holding EOS for an extended period to benefit from potential price increases. |

| Active Trading | Frequent buying and selling of EOS based on market signals and trends. |

| Staking | Participating in the EOS network by staking tokens for rewards, supporting network security. |

Long-Term Scenarios: Achieving the $100 Milestone for EOS

To envision a future where EOS achieves the remarkable milestone of $100, we must explore several long-term scenarios that could contribute to this ambitious goal. Central to this vision is the evolution of the blockchain landscape, where EOS distinguishes itself through its unique strengths, such as scalability, flexibility, and low transaction costs. These features are pivotal, particularly as businesses increasingly migrate to decentralized applications (dApps). As adoption rates rise, the demand for EOS tokens is likely to surge, potentially propelling prices to unprecedented levels. Factors like enhanced partnerships, increased developer activity, and a thriving ecosystem of applications are crucial for creating a robust foundational framework that investors can trust.

In addition, market dynamics will play a significant role in the price trajectory of EOS. The integration of EOS into the broader crypto market, especially with trends seen in institutional adoption and mainstream financial acceptance, can act as a catalyst for price appreciation. Other influential elements include regulatory developments, potential technological upgrades, and the overall health of the cryptocurrency market. It is essential to consider the emotional aspect of market trends, where investor sentiment can drive sudden price fluctuations. Therefore, a strategic mix of innovation, community engagement, and market positioning will be vital in steering EOS towards that coveted $100 milestone.

Q&A

Q&A: EOS Price Prediction 2024-2030: Will EOS Reach $100?

Q1: What is EOS and why is it significant in the crypto market?

A1: EOS is a blockchain platform designed for the development of decentralized applications (dApps) and smart contracts. Its significance lies in its scalability and flexibility, enabling developers to build and run high-performance applications. EOS has gained traction due to its user-friendly approach and potential to revolutionize various sectors, making it a point of interest for investors and enthusiasts alike.

Q2: What factors will influence the price of EOS between 2024 and 2030?

A2: Several factors will likely influence EOS’s price over the coming years, including technological advancements, market trends, regulatory developments, and the overall adoption of blockchain technology. Additionally, competition with other blockchain platforms and the performance of the broader cryptocurrency market will play crucial roles.

Q3: Are there any upcoming developments or upgrades in the EOS ecosystem that could impact its price?

A3: EOS has a roadmap that includes significant updates aimed at enhancing its performance and usability. These developments often attract developers and users, which can positively affect the price. Keeping an eye on announcements from the EOS community regarding upgrades or partnerships will be essential for predicting price movements.

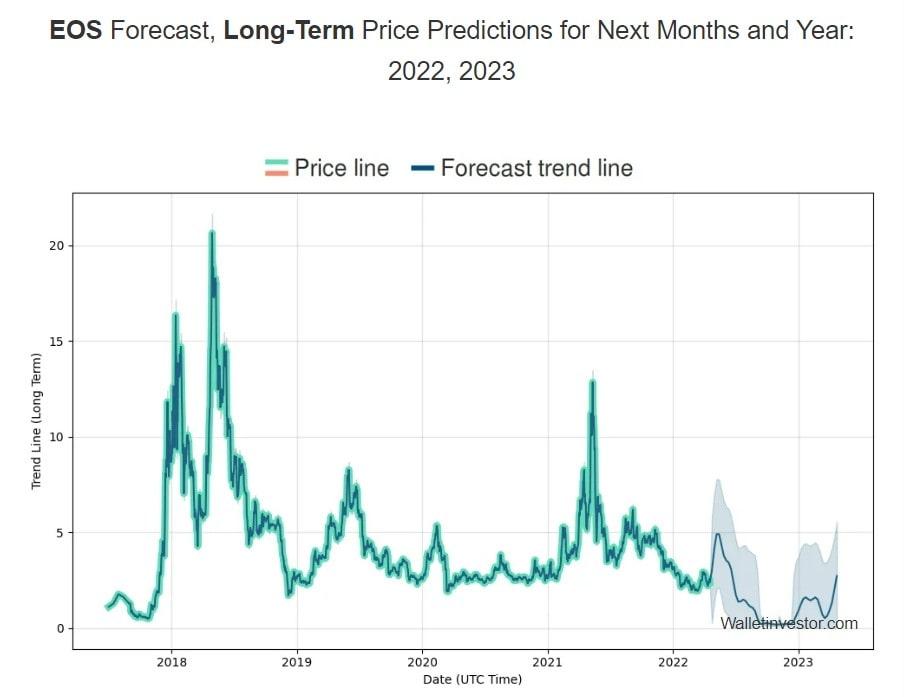

Q4: What historical price trends can provide insight into EOS’s future price movement?

A4: Historically, EOS peaked in early 2018, reaching an all-time high near $20 before experiencing significant volatility. Analyzing past price movements, including patterns of rapid ascent followed by corrections, can offer insight into potential future trends. However, past performance is not always indicative of future results, so caution is warranted.

Q5: Is a price of $100 realistic for EOS by 2030?

A5: A price of $100 for EOS by 2030 would require substantial market capitalization growth and widespread adoption of its platform. Investors must consider the current market dynamics and potential competitors. While it’s theoretically possible, many variables — including investor sentiment, technological progress, and macroeconomic conditions — will influence whether EOS can reach such heights.

Q6: What role does community sentiment play in the price prediction for EOS?

A6: Community sentiment is crucial in the cryptocurrency space. Positive news, developments, or endorsements from influential figures can lead to increased interest and investment, pushing prices upward. Conversely, negative press or controversies can result in sell-offs. The strength and engagement of the EOS community will be a key indicator of its potential price trajectory.

Q7: How should investors approach EOS price predictions?

A7: Investors should approach EOS price predictions with a balanced perspective. Understanding the technology, market dynamics, and broader financial factors is crucial. It’s advisable to conduct thorough research, diversify investments, and be prepared for the volatility characteristic of crypto markets. Setting realistic expectations and staying informed will enhance decision-making as EOS navigates the coming years.

Q8: What are the potential risks associated with investing in EOS?

A8: Like any cryptocurrency, investing in EOS comes with risks. Market volatility, regulatory uncertainties, and the competitive landscape can affect its value. Additionally, technological issues or failures to deliver on promised developments could impact investor confidence. Conducting proper risk assessment and understanding your investment’s volatility is essential before diving in.

Q9: What are the alternative scenarios for EOS’s price by 2030?

A9: Several scenarios could unfold for EOS by 2030: one optimistic scenario sees EOS gaining widespread adoption, leading to significant price appreciation, possibly reaching or surpassing $100. Conversely, a bearish scenario could see it struggle against competition or regulatory hurdles, leading to stagnation or depreciation in value. A balanced view of both outcomes will help investors prepare for various market conditions.

Q10: what should readers take away from this EOS price prediction discussion?

A10: Readers should understand that while EOS has potential for growth, particularly with technological advancements and adoption, predicting exact prices is inherently uncertain. By considering various factors, including market dynamics, community involvement, and external influences, investors can make informed decisions about their involvement with EOS as the cryptocurrency landscape evolves between 2024 and 2030.

Future Outlook

As we stand at the crossroads of technological innovation and financial opportunity, the future of EOS remains a tantalizing prospect. With its robust blockchain capabilities, a growing ecosystem, and an ever-evolving community, the question of whether EOS can achieve the lofty heights of $100 by 2030 lingers in the air like the promise of dawn. While market dynamics and external factors will undoubtedly play pivotal roles in shaping its trajectory, potential investors and enthusiasts alike must tread thoughtfully, weighing the possibilities against their own risk appetites.

the road ahead is anything but certain. Whether EOS will soar to new heights or face headwinds along the way, one thing is clear: the journey will be as compelling as the destination. As we look toward the horizon, it’s essential to remain informed, adaptable, and open-minded—after all, the future of EOS is not just a metric; it’s a story still in the making.

ivermectin 3 mg without a doctor prescription – where can i buy carbamazepine buy cheap tegretol

buy accutane 40mg sale – dexamethasone 0,5 mg without prescription linezolid without prescription

amoxil ca – buy amoxicillin generic combivent 100 mcg uk

azithromycin 250mg canada – where can i buy tindamax brand bystolic 5mg

omnacortil 5mg ca – omnacortil 10mg pill buy prometrium 200mg sale

buy lasix sale – cheap piracetam order betamethasone 20gm online

gabapentin pills – order gabapentin online cheap buy sporanox 100mg pill

buy generic clavulanate – purchase cymbalta pills cymbalta over the counter

monodox without prescription – what to do when allergy medicine doesn’t work order glipizide 10mg generic

augmentin 1000mg brand – ketoconazole 200mg cheap buy duloxetine 20mg for sale

semaglutide 14 mg over the counter – buy cyproheptadine 4mg sale periactin pills

cost tizanidine – tizanidine 2mg price buy generic hydrochlorothiazide online

buy cialis 5mg online cheap – cialis 10mg sale viagra generic

purchase sildenafil generic – cialis sales tadalafil generic

lipitor 80mg for sale – zestril 10mg sale lisinopril 10mg cheap

buy generic cenforce – order glycomet 1000mg online cheap purchase glucophage pills

atorvastatin 20mg us – buy atorvastatin 80mg generic buy prinivil pills

purchase atorvastatin – order atorvastatin 10mg for sale zestril canada

buy prilosec 10mg pill – buy lopressor 100mg pill oral tenormin 100mg

how to get medrol without a prescription – aristocort buy online order generic aristocort

desloratadine price – dapoxetine order online buy dapoxetine 60mg sale

how to buy cytotec – xenical over the counter diltiazem order

acyclovir canada – zovirax 800mg sale buy rosuvastatin 10mg generic

order domperidone pill – purchase cyclobenzaprine sale buy flexeril tablets

order domperidone 10mg generic – buy flexeril pills buy generic flexeril 15mg

inderal 10mg for sale – generic methotrexate 5mg buy methotrexate 10mg pills

purchase medex without prescription – buy coumadin 2mg generic buy cheap generic losartan

order levaquin 250mg online cheap – order zantac 300mg online cheap cost ranitidine 300mg

buy nexium generic – order nexium 40mg online cheap buy sumatriptan cheap

mobic 15mg us – order generic celebrex tamsulosin 0.2mg generic

buy ondansetron 4mg online – cheap ondansetron simvastatin cheap

valacyclovir 500mg for sale – how to get finasteride without a prescription generic fluconazole 200mg

modafinil pill buy modafinil 200mg generic order generic modafinil 200mg provigil brand buy modafinil 200mg pills buy generic provigil oral modafinil 200mg

The reconditeness in this piece is exceptional.

This is the tolerant of delivery I turn up helpful.

zithromax 250mg for sale – buy flagyl 200mg online order metronidazole 200mg online cheap

buy rybelsus 14 mg pill – buy cyproheptadine 4mg generic periactin 4mg cost

domperidone 10mg us – order sumycin 500mg pill oral flexeril

how to get propranolol without a prescription – clopidogrel 150mg ca order methotrexate 10mg generic

amoxil buy online – buy ipratropium 100 mcg without prescription ipratropium over the counter

buy zithromax pills for sale – tinidazole online order bystolic tablet

order augmentin – https://atbioinfo.com/ buy ampicillin sale

order nexium pill – https://anexamate.com/ purchase nexium online

warfarin 2mg drug – coumamide generic losartan 25mg

mobic usa – swelling order meloxicam generic

cost deltasone 5mg – https://apreplson.com/ prednisone 40mg price

erection pills that work – buy ed pills cheap cheap erectile dysfunction pills online

order amoxil for sale – comba moxi amoxil order

cheap fluconazole – https://gpdifluca.com/# order diflucan 100mg pill

order lexapro 10mg pills – https://escitapro.com/# buy escitalopram cheap

buy cenforce without a prescription – cenforce where to buy generic cenforce

what does cialis look like – how long does tadalafil take to work does tadalafil lower blood pressure

super cialis – https://strongtadafl.com/# no prescription cialis

ranitidine price – https://aranitidine.com/# order zantac 300mg pill