In the ever-evolving landscape of cryptocurrency, a new player has emerged, capturing the imagination and investment of enthusiasts and skeptics alike: the AI agent. These intelligent algorithms promise to revolutionize trading strategies, enhance decision-making processes, and tailor experiences to the rapidly shifting tides of the crypto market. As the synergy between artificial intelligence and blockchain technology ignites a fervor of innovation, the buzz surrounding AI agents begs the question: is this booming meta a flash in the pan, or the dawn of a transformative era in crypto? In this exploration, we will delve into the intricacies of the AI agent phenomenon, examining its current impact, potential longevity, and the factors that could shape its future trajectory in the dynamic world of digital currencies.

Table of Contents

- Emerging Trends in AI-Powered Crypto Agents

- Assessing the Sustainability of the AI Agent Boom

- Strategic Considerations for Investors in the AI-Driven Landscape

- Navigating Regulatory Challenges in the Evolving Crypto Space

- Q&A

- Final Thoughts

Emerging Trends in AI-Powered Crypto Agents

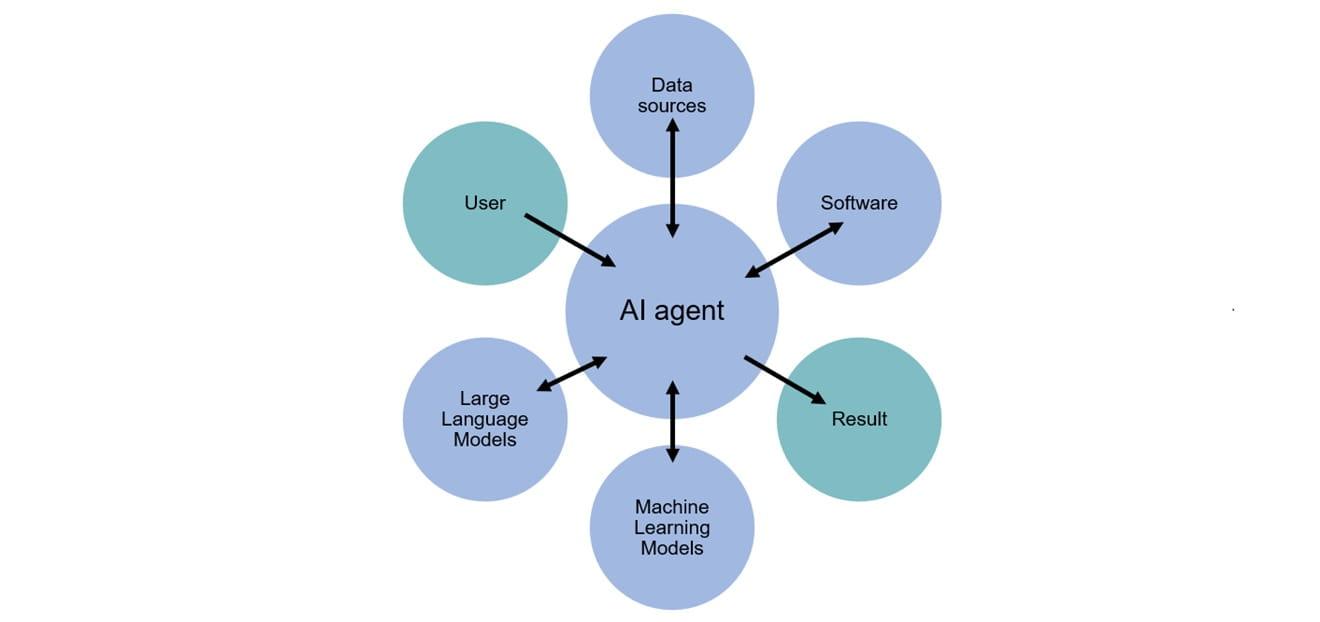

The integration of artificial intelligence into the realm of cryptocurrency has sparked a wave of innovative developments, fundamentally reshaping how users interact with digital assets. AI-powered crypto agents are emerging as sophisticated tools that enhance user experience through personalized trading strategies and automated decision-making processes. These agents utilize machine learning algorithms to analyze vast amounts of data, allowing them to identify trends and execute transactions at lightning speed. Key features driving this trend include:

- Predictive Analytics: AI algorithms assess market indicators, providing insights that help users make informed investment decisions.

- 24/7 Operations: Unlike human traders, AI agents operate round-the-clock, capturing opportunities in real-time.

- Risk Management: Capable of assessing user risk profiles, these agents adjust strategies to optimize returns while minimizing exposure.

As interest in AI-driven crypto solutions rises, several companies are at the forefront of this transformation, each offering unique features that cater to different market segments. The competitive landscape is marked by a diverse set of services, from automated portfolio management to predictive modeling tools that assist day traders. Below is an overview of some notable AI crypto agents:

| AI Agent | Key Features | Target Audience |

|---|---|---|

| CryptoGenius | Portfolio optimization, risk analysis | Long-term investors |

| TradeBot 360 | Real-time trading signals, automated trading | Day traders |

| MarketPredictor | Sentiment analysis, predictive modeling | Research enthusiasts |

Assessing the Sustainability of the AI Agent Boom

The current surge in AI agents within the cryptocurrency space is undoubtedly compelling, with numerous projects demonstrating innovative capabilities and extensive utility. However, the question looms large regarding the sustainability of this boom. Several factors need consideration to determine whether this trend will maintain its momentum or falter:

- Market Demand: As the technology matures, will users continue to adopt AI agents for tasks such as trading, risk assessment, and portfolio management?

- Regulatory Landscape: How will emerging regulations impact the integration of AI agents with blockchain technologies?

- Technological Evolution: Will the rapid pace of innovation sustain the interest of developers and investors alike?

Analyzing historical trends in technology adoption reveals a pattern of initial excitement followed by a settling phase. Currently, the landscape exhibits a mix of established players and newcomers, each vying for a slice of the pie. To clarify this trajectory, a comparative analysis of key projects and their performance is informative:

| Project Name | Market Cap | Unique Features | Projected Growth |

|---|---|---|---|

| AITradeBot | $500M | Auto-trading algorithms, portfolio optimization | 20% YoY |

| CryptoGenie | $300M | Personalized investment insights | 15% YoY |

| BlockWiseAI | $450M | Risk management tools, social trading features | 25% YoY |

Strategic Considerations for Investors in the AI-Driven Landscape

As the AI agent sector continues to gain momentum within the crypto ecosystem, it’s vital for investors to evaluate the strategic implications of their decisions. Understanding the interplay between AI technology and blockchain can uncover lucrative opportunities. Key factors to consider include:

- Market Trends: Keep a close watch on emerging AI applications within crypto projects, as these could indicate future growth.

- Regulatory Landscape: Be aware of changes in regulations that could affect AI-driven cryptocurrencies.

- Technological Viability: Assess the underlying technology of AI agents and their potential longevity in the market.

- Competitive Landscape: Identify leaders in innovation and their strategies to maintain a competitive edge.

Moreover, diversification remains critical in navigating the volatility of this AI-driven niche. Allocating resources across various projects may mitigate risks associated with market fluctuations. Consider creating a portfolio that balances established entities with innovative newcomers. Below is a sample framework for an investment allocation strategy:

| Project Type | Allocation (%) | Rationale |

|---|---|---|

| Established AI-Crypto | 40% | Stability and proven track record. |

| Emerging AI Projects | 30% | Potential for rapid growth. |

| Blockchain Infrastructure | 20% | Supports AI applications in crypto. |

| Speculative Investments | 10% | High-risk, high-reward opportunities. |

Navigating Regulatory Challenges in the Evolving Crypto Space

The rapid evolution of the crypto landscape has ushered in a wave of regulatory scrutiny that is as dynamic as the technologies themselves. As AI agents gain traction in facilitating transactions and data management, the regulatory frameworks lag behind, often creating confusion for developers and investors alike. It’s crucial for stakeholders in this burgeoning sector to remain vigilant, understanding the key challenges they face in compliance and governance, including:

- Varying Global Regulations: Different countries have adopted disparate approaches to crypto regulation, resulting in a patchwork of rules that can complicate international operations.

- Consumer Protection: Safeguarding users from fraud and scams is paramount, necessitating regulations that may impede innovation.

- Tax Compliance: Cryptocurrencies often blur the lines of traditional tax codes, prompting calls for clearer legislation.

- Data Privacy: Balancing user privacy with regulatory requirements poses an ongoing challenge for crypto platforms.

As companies strive to navigate these complexities, an adaptive strategy becomes essential. A recent survey among industry leaders revealed the following insights regarding their regulatory strategies:

| Strategy | Percentage of Companies |

|---|---|

| Engaging with Regulators | 65% |

| Implementing Compliance Training | 55% |

| Utilizing Legal Advisors | 70% |

| Adopting Blockchain for Transparency | 60% |

These proactive measures are crucial for fostering trust and sustainability in the crypto ecosystem as it continues to mature. For innovation to flourish, industry players must prioritize not only technological advancement but also responsible adherence to an evolving regulatory landscape.

Q&A

Q: What is the current state of the AI agent meta in the crypto world?

A: The AI agent meta in the crypto space has seen a remarkable surge recently, characterized by a flurry of innovative projects integrating artificial intelligence with blockchain technology. This trend has led to a plethora of AI-driven platforms offering various services, from algorithmic trading to predictive analytics. Many enthusiasts believe that this synergy could forever change how we interact with digital assets.

Q: What are AI agents in the context of cryptocurrency?

A: AI agents are algorithms designed to perform tasks autonomously, making decisions based on data input. In the crypto sector, these agents can execute trades, identify market trends, and even manage portfolios. By leveraging machine learning, they can continuously improve their decision-making processes, making them indispensable tools for traders and investors alike.

Q: Why is interest in AI agents growing within the crypto community?

A: The increase in interest can be attributed to several factors. First, the volatile nature of cryptocurrency markets creates a demand for sophisticated trading strategies that AI can provide. Additionally, as the technology behind AI matures, its integration into blockchain frameworks has become more feasible and attractive. This combination suggests that AI agents could offer more efficient and effective solutions than traditional methods.

Q: What challenges does the AI agent meta face that could affect its longevity?

A: Despite its current popularity, the AI agent meta faces significant challenges. Issues such as regulatory oversight, transparency, data bias, and the potential for market manipulation must be addressed to maintain trust. Moreover, as more players enter the space, competition will intensify, leading to a possible saturation of the market. The ability to differentiate and provide unique value-added services will be essential for survival.

Q: Can AI agents guarantee success in cryptocurrency trading?

A: While AI agents can enhance trading strategies and provide insights that might improve performance, they cannot guarantee success. Cryptocurrency markets are influenced by numerous unpredictable factors, including regulatory changes, market sentiment, and technological advancements. Therefore, while AI can assist traders, it is crucial for participants to remain cautious and to utilize AI in conjunction with their own market understanding and risk management practices.

Q: What is the outlook for the AI agent meta in crypto over the next few years?

A: The outlook is mixed. On one hand, innovative technologies and increasing adoption could see the AI agent meta evolve and thrive. New applications and improvements in AI capabilities may further integrate these agents into mainstream usage. On the other hand, regulatory scrutiny and potential market corrections could challenge the sustainability of this trend. Ultimately, the longevity of the AI agent meta in crypto will largely depend on how stakeholders adapt to the evolving landscape while addressing the challenges presented.

Q: Should investors get involved with AI-driven projects in cryptocurrency?

A: Investors should approach AI-driven projects with the same caution they would any investment in crypto. Research is crucial—evaluating the technology, team, and real-world applications of the project can clarify its potential. While AI offers exciting possibilities, it is essential to remain aware of inherent risks and market volatility before diving in. Diversifying investments and staying informed can help make educated decisions in this fast-paced sector.

Final Thoughts

As we stand at the crossroads of innovation and speculation, the burgeoning AI agent meta in the cryptocurrency landscape presents both exhilarating opportunities and pronounced uncertainties. The rapid adoption of AI-driven tools and strategies reflects a broader desire to harness technology in navigating the complexities of digital finance. Yet, as history has shown, trends in crypto can be as fleeting as they are transformative. Whether this particular wave of AI enthusiasm will evolve into a sustainable force or be merely a passing phase remains to be seen.

As investors and developers alike venture into this promising realm, a critical eye will be essential. An understanding of the underlying technology, potential risks, and market dynamics will play a crucial role in determining who rises above the noise and who falters in the frenzy. The dance between AI and crypto is just beginning, and while the rhythm may be captivating, it’s wise to remain vigilant and prepared for whatever the future may hold. In this charged environment, the question lingers: Will the AI agent meta find its footing in this ever-shifting landscape, or will it become another chapter in the annals of crypto’s roller-coaster ride? Only time will tell.

BWER empowers businesses in Iraq with cutting-edge weighbridge systems, ensuring accurate load management, enhanced safety, and compliance with industry standards.

Free [url=https://cuminporn.com/4k+nude+wallpaper]4k nude wallpapers[/url] and adult images

BWER Company stands as a trusted name in Iraq’s weighbridge industry, offering innovative designs, reliable installations, and comprehensive support for all weighing requirements.

At BWER Company, we prioritize quality and precision, delivering high-performance weighbridge systems to meet the diverse needs of Iraq’s industries.

BWER sets the standard for weighbridge excellence in Iraq, offering innovative, reliable systems and dedicated support to ensure optimal performance and client satisfaction.

Rely on BWER Company for superior weighbridge solutions in Iraq, offering advanced designs, unmatched precision, and tailored services for diverse industrial applications.

BWER is Iraq’s premier provider of industrial weighbridges, offering robust solutions to enhance efficiency, reduce downtime, and meet the evolving demands of modern industries.

stromectol for human – ivermectin 3 mg tablet tegretol brand

accutane 20mg drug – cheap zyvox 600mg zyvox sale

order amoxicillin without prescription – where to buy amoxil without a prescription combivent 100mcg price

order azithromycin 500mg online cheap – bystolic 5mg uk bystolic 5mg ca

order omnacortil 10mg online cheap – prednisolone 40mg generic progesterone 200mg usa

order gabapentin 100mg – buy anafranil buy itraconazole 100mg pill

oral lasix 40mg – order furosemide 40mg generic buy betamethasone cheap

monodox generic – monodox brand glipizide 10mg usa

order augmentin 375mg sale – purchase duloxetine online cheap buy cymbalta cheap

oral amoxiclav – buy nizoral 200mg online duloxetine ca

rybelsus 14 mg cheap – order periactin 4mg online order periactin online cheap

tizanidine 2mg usa – plaquenil 400mg uk buy microzide no prescription

darknet markets 2025 darknet markets onion address

canadian viagra – buy cialis 20mg generic tadalafil 5mg

dark web market links [url=https://github.com/newonionlinks/darknetmarkets ]best darknet markets [/url]

darknet markets onion address [url=https://github.com/newonionlinks/darknetmarkets ]darknet drug market [/url]

darknet market links https://github.com/newonionlinks/darknetmarkets darknet market

darknet marketplace best darknet markets

darknet markets onion address [url=https://github.com/newonionlinks/darknetmarkets ]dark web marketplaces [/url]

bitcoin dark web [url=https://github.com/newonionlinks/darknetmarkets ]darknet markets links [/url]

darkmarket https://github.com/newonionlinks/darknetmarkets dark web market list

darknet marketplace darknet markets links

bitcoin dark web [url=https://github.com/newonionlinks/darknetmarkets ]onion dark website [/url]

darknet sites [url=https://github.com/newonionlinks/darknetmarkets ]dark web link [/url]

darknet marketplace https://github.com/newonionlinks/darknetmarkets darknet drugs

darknet marketplace darknet websites

darknet drugs [url=https://github.com/newonionlinks/darknetmarkets ]darknet sites [/url]

darknet links https://github.com/newonionlinks/darknetmarkets darknet drug store

dark market link dark web markets

darknet site [url=https://github.com/newonionlinks/darknetmarkets ]darknet markets onion address [/url]

darknet market links https://github.com/newonionlinks/darknetmarkets dark web markets

dark market link darkmarket url

darknet drug store darkmarket

onion dark website dark web market urls

darknet drug store dark web markets

dark market onion darkmarket list

dark web market urls [url=https://github.com/newonionlinks/darknetmarkets ]darknet market links [/url]

dark markets [url=https://github.com/newonionlinks/darknetmarkets ]darknet markets onion address [/url]

darknet markets 2025 dark web sites

bitcoin dark web dark markets 2025

dark market list dark web market list

darknet drug market darknet websites

darknet market links [url=https://github.com/newonionlinks/darknetmarkets ]dark web sites [/url]

dark market link dark markets 2025

darknet markets links darknet markets links

bitcoin dark web dark web drug marketplace

dark websites dark web drug marketplace

darkmarkets [url=https://github.com/newonionlinks/darknetmarkets ]dark web market urls [/url]

darknet websites darknet market list

darkmarket list darknet links

dark market 2025 dark web sites

dark market link [url=https://github.com/newonionlinks/darknetmarkets ]darknet markets onion [/url]

dark web link darknet websites

onion dark website darknet sites

darknet markets onion dark web market

dark web market links [url=https://github.com/newonionlinks/darknetmarkets ]darknet market list [/url]

onion dark website dark market 2025

darknet markets url darknet drugs

dark web market links darknet sites

darkmarket link darknet market links

darknet sites darknet links

darknet market links darkmarket url

dark web market links [url=https://github.com/newonionlinks/darknetmarkets ]dark market list [/url]

dark markets 2025 dark market

dark web drug marketplace dark market 2025

dark market link dark web link

darknet markets 2025 bitcoin dark web

darknet markets [url=https://github.com/newonionlinks/darknetmarkets ]darknet markets links [/url]

dark market url darknet drug market

dark markets 2025 dark market onion

dark market list darknet links

dark web market https://github.com/newonionlinks/darknetmarkets darknet drugs

darknet market links dark market 2025

darkmarket link darknet drug store

dark web market links dark market url

dark web market urls darknet markets

dark market url https://github.com/newonionlinks/darknetmarkets dark websites

darkmarket url darknet drug store

darknet sites [url=https://github.com/newonionlinks/darknetmarkets ]best darknet markets [/url]

dark market link [url=https://github.com/newonionlinks/darknetmarkets ]darknet markets onion [/url]

darknet markets onion address best darknet markets

dark web markets best darknet markets

darknet drugs https://github.com/newonionlinks/darknetmarkets darknet markets 2025

darknet drug links darknet drugs

dark web markets darknet drug store

darknet market links darkmarket link

darkmarket url [url=https://github.com/newonionlinks/darknetmarkets ]dark web market urls [/url]

dark web marketplaces dark markets 2025

darkmarket 2025 https://github.com/newonionlinks/darknetmarkets darkmarket 2025

darknet markets 2025 dark market url

dark web market urls dark web market

darknet drug links dark market list

dark market list darknet markets onion address

best darknet markets [url=https://github.com/newonionlinks/darknetmarkets ]darknet markets onion [/url]

dark web market urls dark market 2025

darknet markets url https://github.com/newonionlinks/darknetmarkets dark web markets

darknet drug links darknet markets url

bitcoin dark web dark market url

dark web sites darkmarket

best darknet markets dark markets

onion dark website [url=https://github.com/newonionlinks/darknetmarkets ]darknet market links [/url]

dark market link darknet markets url

darknet sites dark market link

darknet markets url darknet sites

dark web market urls [url=https://github.com/newonionlinks/darknetmarkets ]dark market [/url]

darknet site dark web market

dark market 2025 dark market link

darknet market dark market

darknet drug market darkmarket

best darknet markets darkmarket link

dark web market urls darknet markets

dark web drug marketplace tor drug market

dark web markets darkmarket link

dark web market links darkmarket 2025

dark web marketplaces [url=https://github.com/newonionlinks/darknetmarkets ]darknet market list [/url]

dark market 2025 darknet markets 2025

dark web market links darkmarket

dark web marketplaces darkmarket 2025

dark web marketplaces [url=https://github.com/newonionlinks/darknetmarkets ]darkmarket [/url]

dark web marketplaces darknet drug store

darknet drug store darknet marketplace

darknet drug links darknet market links

darknet markets onion onion dark website

darknet market [url=https://github.com/newonionlinks/darknetmarkets ]tor drug market [/url]

darkmarkets dark web market urls

darkmarket link bitcoin dark web

darknet websites darknet marketplace

dark markets [url=https://github.com/newonionlinks/darknetmarkets ]darknet marketplace [/url]

darkmarket link darknet markets onion address

darknet sites darknet market list

dark web sites darkmarket list

darknet markets links bitcoin dark web

dark web marketplaces darknet markets

dark web sites darknet sites

darknet markets onion darknet links

dark markets dark markets

dark web drug marketplace darkmarket url

dark web market list darknet links

dark web market list dark websites

darknet market lists https://github.com/newonionlinks/darknetmarkets darknet market links

darkmarkets [url=https://github.com/newonionlinks/darknetmarkets ]darknet markets 2025 [/url]

dark markets 2025 dark market

tor drug market darknet markets onion address

dark web market urls dark market link

dark market darknet markets

dark market link dark market

dark websites dark web market

dark web link darkmarket

darkmarket link tor drug market

dark market onion dark markets 2025

onion dark website https://github.com/newonionlinks/darknetmarkets darknet markets onion address

darknet marketplace [url=https://github.com/newonionlinks/darknetmarkets ]dark markets [/url]

darknet markets onion dark web market urls

darknet markets [url=https://github.com/newonionlinks/darknetmarkets ]dark web market links [/url]

darknet market links dark web market

darknet drug store dark web drug marketplace

darknet sites https://github.com/newonionlinks/darknetmarkets darknet links

dark web market darknet drug links

best darknet markets [url=https://github.com/newonionlinks/darknetmarkets ]bitcoin dark web [/url]

dark market link dark market list

darkmarket 2025 darknet market list

darknet markets 2025 https://github.com/newonionlinks/darknetmarkets darknet market links

darknet market list darknet markets onion address

dark web market dark websites

darknet markets onion darknet markets url

darknet marketplace https://github.com/newonionlinks/darknetmarkets darknet markets url

darknet links [url=https://github.com/newonionlinks/darknetmarkets ]dark web marketplaces [/url]

dark web market list darknet site

darknet sites dark market url

darkmarket 2025 darkmarket url

dark web market links https://github.com/newonionlinks/darknetmarkets darknet drug market

dark web drug marketplace [url=https://github.com/newonionlinks/darknetmarkets ]darknet markets url [/url]

dark web marketplaces darknet markets

darknet links dark markets 2025

dark web market urls [url=https://github.com/newonionlinks/darknetmarkets ]darknet market list [/url]

dark markets dark web market

darknet markets onion address darknet markets

dark web market list https://github.com/newonionlinks/darknetmarkets darknet markets onion address

darknet markets onion [url=https://github.com/newonionlinks/darknetmarkets ]darknet market lists [/url]

darknet markets onion address dark market 2025

darknet drug market dark market url

darknet websites darknet site

dark market 2025 https://github.com/newonionlinks/darknetmarkets dark web markets

darknet sites darknet websites

darknet websites [url=https://github.com/newonionlinks/darknetmarkets ]darknet drug market [/url]

dark market 2025 darknet market lists

dark market darknet market

dark market list darkmarket

dark market darknet drug links

dark web market urls https://github.com/newonionlinks/darknetmarkets dark web market urls

dark market onion dark markets 2025

dark market onion [url=https://github.com/newonionlinks/darknetmarkets ]onion dark website [/url]

dark web market urls dark markets

dark markets 2025 [url=https://github.com/newonionlinks/darknetmarkets ]darkmarkets [/url]

darknet market links darknet drug store

darknet drug links dark market url

dark web market links onion dark website

dark market list dark market

dark web market urls https://github.com/newonionlinks/darknetmarkets darkmarket url

dark markets 2025 [url=https://github.com/newonionlinks/darknetmarkets ]dark web sites [/url]

darknet site darkmarket url

dark market darknet markets links

dark market url https://github.com/newonionlinks/darknetmarkets darknet markets

darknet market links [url=https://github.com/newonionlinks/darknetmarkets ]darknet markets onion address [/url]

darknet links darknet drugs

onion dark website bitcoin dark web

darknet markets 2025 best darknet markets

dark websites darknet drug market

dark web drug marketplace https://github.com/newonionlinks/darknetmarkets dark web sites

darknet marketplace [url=https://github.com/newonionlinks/darknetmarkets ]dark market 2025 [/url]

darknet market lists darknet market links

darknet markets links darkmarkets

darkmarket 2025 darknet markets onion

darkmarket url darknet markets url

best darknet markets https://github.com/newonionlinks/darknetmarkets dark web link

darknet drugs [url=https://github.com/newonionlinks/darknetmarkets ]darknet market [/url]

dark market 2025 dark market url

dark market 2025 dark web sites

dark market list dark market link

darknet sites darknet websites

darknet markets url https://github.com/newonionlinks/darknetmarkets dark web market list

dark web market darknet market lists

dark market 2025 [url=https://github.com/newonionlinks/darknetmarkets ]darkmarket list [/url]

dark market [url=https://github.com/newonionlinks/darknetmarkets ]darknet drug market [/url]

darknet market links darknet markets onion

darknet websites dark web sites

dark market 2025 https://github.com/newonionlinks/darknetmarkets darknet drugs

darkmarket [url=https://github.com/newonionlinks/darknetmarkets ]darknet drug market [/url]

darkmarket list tor drug market

darknet markets 2025 darknet markets url

onion dark website [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark market link [/url]

best darknet markets https://github.com/newonionlinks/darknetmarkets dark market

dark web drug marketplace [url=https://github.com/newonionlinks/darknetmarkets ]tor drug market [/url]

tor drug market [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darkmarkets [/url]

darknet markets 2025 [url=https://github.com/newonionlinks/darknetmarkets ]dark market url [/url]

dark markets 2025 [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darknet site [/url]

dark market url [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark web link [/url]

darknet links https://github.com/newonionlinks/darknetmarkets dark markets

darknet markets url [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]best darknet markets [/url]

darknet links [url=https://github.com/newonionlinks/darknetmarkets ]dark web link [/url]

darknet drug store [url=https://github.com/newonionlinks/darknetmarkets ]bitcoin dark web [/url]

darknet markets 2025 [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark web market links [/url]

dark markets [url=https://github.com/newonionlinks/darknetmarkets ]darknet markets url [/url]

darkmarkets [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darkmarket [/url]

dark web link [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darknet site [/url]

dark market link darknet links

best darknet markets [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]tor drug market [/url]

darkmarket url [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet markets [/url]

darknet markets 2025 [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darkmarket [/url]

darkmarket list [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darknet drug store [/url]

darknet marketplace [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark markets [/url]

darknet drug links [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark market link [/url]

darkmarkets [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark markets [/url]

onion dark website [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web market list [/url]

darknet markets 2025 [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web market urls [/url]

darknet site [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet markets [/url]

dark web marketplaces [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet links [/url]

darkmarket 2025 [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet drug store [/url]

dark market url [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet market [/url]

dark web market list [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web markets [/url]

darknet links [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet links [/url]

dark web market list [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark web sites [/url]

darkmarkets [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]onion dark website [/url]

dark web market urls [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark markets [/url]

dark markets [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]best darknet markets [/url]

darknet markets onion [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet drug market [/url]

dark market url [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark web marketplaces [/url]

dark market url [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web link [/url]

darknet market lists [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet sites [/url]

darkmarket 2025 [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark markets [/url]

tor drug market [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark market list [/url]

dark web market links [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darknet markets onion [/url]

dark market 2025 [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]bitcoin dark web [/url]

dark websites [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet markets links [/url]

darknet drug links [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet drug links [/url]

darknet drug market [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darkmarkets [/url]

darknet market [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darkmarket [/url]

dark web market [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark markets [/url]

dark market [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet market lists [/url]

tor drug market [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]bitcoin dark web [/url]

darknet market list [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark websites [/url]

dark web market urls [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet site [/url]

dark web market urls [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darknet market [/url]

dark market onion [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark web market [/url]

darkmarkets [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark market [/url]

darkmarket [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark market link [/url]

onion dark website [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet markets links [/url]

dark web market list [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web market list [/url]

darknet websites [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark web market links [/url]

dark web market links [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark web market urls [/url]

dark markets 2025 [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark web market list [/url]

darknet markets links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web marketplaces [/url]

dark market list [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darkmarket list [/url]

darknet marketplace [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark web market urls [/url]

darknet markets url [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark websites [/url]

darknet drug store [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark web market urls [/url]

dark web markets [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark web market list [/url]

darknet markets onion address [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web link [/url]

darknet links [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark market list [/url]

darkmarket [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet marketplace [/url]

darkmarket url [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark markets [/url]

dark web marketplaces [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark markets [/url]

darknet markets links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web sites [/url]

dark market [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darkmarkets [/url]

darknet drug store [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark markets [/url]

onion dark website [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark web market links [/url]

dark market 2025 [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]best darknet markets [/url]

darknet site [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet links [/url]

bitcoin dark web [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darkmarket [/url]

darkmarket [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark market url [/url]

tor drug market [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark market [/url]

darknet market list [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark market onion [/url]

darknet markets links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet market lists [/url]

dark market link [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web marketplaces [/url]

best darknet markets [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark web market [/url]

dark websites [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark market list [/url]

dark market url [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]tor drug market [/url]

darkmarket url [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark markets [/url]

dark web link [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darkmarkets [/url]

dark market 2025 [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark market [/url]

dark market link [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web market [/url]

dark market [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet market [/url]

dark web drug marketplace [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark web markets [/url]

dark web link [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web drug marketplace [/url]

darknet drug market [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet market links [/url]

dark web drug marketplace [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark web market list [/url]

darknet market links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet links [/url]

dark web market [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web marketplaces [/url]

dark market [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet market links [/url]

dark web markets [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet markets 2025 [/url]

darknet sites [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]onion dark website [/url]

darknet sites [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark market list [/url]

dark market url [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]bitcoin dark web [/url]

darknet drug links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet sites [/url]

dark web markets [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark market onion [/url]

darknet markets [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet site [/url]

darkmarket [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web market links [/url]

darknet drug store [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet websites [/url]

darknet markets [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web marketplaces [/url]

dark web market list [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet market list [/url]

dark markets 2025 [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark web market urls [/url]

darknet drug market [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet drugs [/url]

tor drug market [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darkmarket link [/url]

dark web market [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark web link [/url]

dark web market urls [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark web market list [/url]

darknet drug store [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark market [/url]

darknet market [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet drug store [/url]

darknet site [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark web market list [/url]

darknet site [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet links [/url]

tor drug market [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]best darknet markets [/url]

darknet market list [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darkmarket 2025 [/url]

darkmarkets [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]best darknet markets [/url]

dark markets 2025 [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darkmarket 2025 [/url]

dark market 2025 [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web market list [/url]

dark web markets [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]onion dark website [/url]

darkmarket 2025 [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]best darknet markets [/url]

dark market url [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark markets 2025 [/url]

dark web market list [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darkmarket list [/url]

onion dark website [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark web marketplaces [/url]

darknet market [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet links [/url]

darknet drugs [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web drug marketplace [/url]

onion dark website [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet market list [/url]

dark web market [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet markets url [/url]

dark markets 2025 [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet market lists [/url]

dark web marketplaces [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]bitcoin dark web [/url]

dark market url [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darknet markets onion address [/url]

tor drug market [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet drugs [/url]

darkmarket list [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark market 2025 [/url]

darknet websites [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet markets links [/url]

dark web market links [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet markets onion [/url]

darknet markets [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet marketplace [/url]

darknet sites [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet market [/url]

dark web market urls [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet links [/url]

dark market 2025 [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]onion dark website [/url]

dark web markets [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet drugs [/url]

dark market link [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark markets 2025 [/url]

dark market onion [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark market link [/url]

dark market [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet market list [/url]

darknet markets [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darkmarkets [/url]

darknet market list [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark web markets [/url]

dark web market links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark market url [/url]

darknet drug links [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web markets [/url]

dark markets [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet sites [/url]

dark web market links [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark websites [/url]

darknet websites [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web marketplaces [/url]

darknet markets 2025 [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darkmarkets [/url]

darknet market links [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darknet market lists [/url]

darknet drug links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web link [/url]

darknet market [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark web sites [/url]

dark market 2025 [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark markets [/url]

darkmarket [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]tor drug market [/url]

darkmarket [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet sites [/url]

dark web market urls [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet markets onion address [/url]

dark market [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet marketplace [/url]

darknet markets 2025 [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web markets [/url]

bitcoin dark web [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet market list [/url]

darknet market links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darkmarket link [/url]

dark market 2025 [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark markets 2025 [/url]

dark market link [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet sites [/url]

dark web marketplaces [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark market link [/url]

darknet markets links [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet site [/url]

dark web link [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet websites [/url]

darknet links [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet market list [/url]

onion dark website [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darkmarkets [/url]

dark web link [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet site [/url]

darknet marketplace [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet markets [/url]

darknet market list [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web marketplaces [/url]

darknet markets onion [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet websites [/url]

darknet markets url [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet markets 2025 [/url]

darkmarket link [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet markets url [/url]

darknet markets onion address [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet market [/url]

darkmarket [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darkmarket link [/url]

darknet market [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark web drug marketplace [/url]

darkmarkets [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web drug marketplace [/url]

darknet markets url [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet drug market [/url]

darknet markets [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web market urls [/url]

darknet drug links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark web markets [/url]

darknet markets 2025 [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darkmarket 2025 [/url]

onion dark website [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darkmarkets [/url]

darkmarket url [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]dark web sites [/url]

dark market [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark market [/url]

dark market list [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark market 2025 [/url]

dark market list [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet drug links [/url]

dark market url [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darkmarket url [/url]

dark market [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet links [/url]

darknet drug market [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark markets [/url]

darknet market [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark market list [/url]

dark markets [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet markets [/url]

dark web markets [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darknet drug links [/url]

cenforce pills – buy cenforce pills buy metformin 1000mg pills

darknet marketplace [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet links [/url]

dark web market links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]dark websites [/url]

dark web market urls [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet sites [/url]

dark market url [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet markets url [/url]

darknet links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet markets onion [/url]

dark market onion [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darkmarket [/url]

darknet drug links [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]dark web link [/url]

darknet markets links [url=https://github.com/tormarkets2025ukaz1/tormarkets2025 ]darknet markets onion address [/url]

darkmarket [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet market [/url]

dark web markets [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darkmarkets [/url]

darknet markets onion [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet market lists [/url]

dark web market [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darkmarket list [/url]

darknet drug market [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darkmarket url [/url]

dark web marketplaces [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet markets [/url]

darknet markets onion address [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]dark web sites [/url]

darknet market links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet drug market [/url]

dark market 2025 [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]darknet markets links [/url]

dark web market links [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet markets links [/url]

darkmarket url [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]best darknet markets [/url]

dark market onion [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet markets 2025 [/url]

darknet site [url=https://github.com/aresmarketlink0ru72/aresmarketlink ]darknet sites [/url]

darknet market list [url=https://github.com/darknetmarketlistv8tg0/darknetmarketlist ]dark web drug marketplace [/url]

dark market onion [url=https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl ]darknet market lists [/url]

darkmarket [url=https://github.com/darknetmarketlinks2025/darknetmarkets ]darknet market [/url]

darknet market lists darknet drug links

best darknet markets onion dark website

darknet sites darknet markets url

darknet market links dark web market list

dark web market urls dark market list

darknet markets darknet websites

dark web sites dark web market links

darknet market links darknet websites

dark web link darkmarket 2025

darknet markets url tor drug market

darkmarkets darknet links

darknet drugs darkmarket url

darknet market links darknet market list

darknet markets onion address darknet links

darknet market lists darknet market

darknet sites darknet sites

darknet websites dark web market urls

bitcoin dark web darknet links

dark web link darkmarket list

darknet sites dark markets

best darknet markets bitcoin dark web

darknet markets dark web marketplaces

darkmarket 2025 dark web market

darknet markets url dark market link

dark web drug marketplace darknet market

dark web marketplaces darknet site

dark web link tor drug market

dark web market urls dark web drug marketplace

dark web market list darknet markets onion

darknet drug store bitcoin dark web

darknet market darknet market list

darknet market best darknet markets

dark markets 2025 darknet markets 2025

dark web market urls tor drug market

darknet drugs darknet markets url

dark market link darkmarket 2025

dark web market darknet links

darknet websites darknet websites

darknet drug market dark websites

darknet site tor drug market

dark web market list dark web link

dark market 2025 darknet markets onion address

darknet marketplace darknet marketplace

darknet markets darknet sites

dark web sites darknet markets onion

darknet websites darknet marketplace

darknet markets onion dark website

dark web link dark web markets

dark web markets dark web link

onion dark website darkmarket

darknet market links dark web marketplaces

darknet markets onion address darknet drug market

dark web market links dark web market urls

darknet markets onion address tor drug market

dark market list darkmarket link

darknet market links darknet markets url

darknet markets darknet markets onion

darknet drug market dark market onion

bitcoin dark web dark web market links

darknet market darknet drug links

dark market link dark web market links

dark web sites dark websites

dark web markets darknet site

darkmarkets dark market list

darkmarket list dark market

dark market url dark markets

darknet sites darkmarket url

dark web market bitcoin dark web

onion dark website darknet markets 2025

darknet market lists darknet markets onion

darknet drugs darknet markets links

darknet drug market darknet drug links

dark market onion darknet links

darknet market links darknet markets 2025

darknet market darknet market list

darkmarket link darkmarket link

dark market onion darkmarket list

darknet drugs dark market onion

dark web sites tor drug market

darknet markets url dark market url

darknet markets onion darkmarket url

darkmarket url darknet sites

dark market list dark web marketplaces

dark market link dark web market urls

darkmarket 2025 darknet markets onion address

dark markets dark markets

darknet market links dark market onion

darknet links dark web sites

dark websites darknet drug store

dark web market urls darknet drugs

dark market 2025 darknet markets

darknet site darknet market

darknet markets onion darknet market list

dark web markets dark web markets

dark web sites darknet markets url

darknet drug store dark web market list

dark market list dark web sites

tor drug market dark web link

darknet drug market darknet market

dark markets darknet markets

dark web market urls dark web marketplaces

dark web market urls dark market link

darknet drugs darknet markets links

darkmarket list darknet drug market

darkmarket darknet markets url

tor drug market darkmarkets

darknet drug store darkmarket

onion dark website [url=https://kingdomdarkmarketonline.com/ ]darknet websites [/url]

darknet drugs dark web link

best darknet markets darknet market list

dark market list darkmarket

darkmarket dark web market urls

dark market link dark market onion

darknet marketplace darknet markets links

dark markets 2025 dark market onion

dark web markets darkmarket url

darknet markets 2025 bitcoin dark web

dark market onion dark markets 2025

dark web market list dark market link

dark web market dark markets 2025

darkmarket 2025 dark markets

darknet markets onion address darknet markets onion

darknet drug store dark market

dark web market urls darkmarket link

darknet drug links darkmarkets

dark market [url=https://mydarkmarketlink.com/ ]darkmarket list [/url]

dark web link [url=https://kingdommarketdarknet.com/ ]darknet sites [/url]

oral atorvastatin 20mg – norvasc drug purchase lisinopril sale

darknet market list dark web market

darknet market links [url=https://kingdomdarkmarketplace.com ]dark market link [/url]

darknet markets links onion dark website

darkmarket link darknet markets links

darknet markets 2025 [url=https://kingdom-marketplace.com/ ]dark market 2025 [/url]

darkmarket url [url=https://kingdomdarkmarketonline.com/ ]dark web market [/url]

dark web markets [url=https://darkfoxmarketplace.com/ ]dark markets [/url]

tor drug market darknet sites

darkmarket 2025 [url=https://kingdom-darkmarketplace.com ]darknet marketplace [/url]

dark markets dark web market links

dark markets 2025 [url=https://firstdarkmarket.com/ ]dark web marketplaces [/url]

dark market onion [url=https://asap-market-onion.com/ ]darknet markets [/url]

darknet marketplace [url=https://cannahome-darkmarket-online.com/ ]darknet market list [/url]

darknet market list darknet markets onion address

darkmarket darknet markets links

onion dark website [url=https://kingdomdarkmarketplace.com ]dark market 2025 [/url]

dark markets 2025 darknet markets url

darknet drug market [url=https://darkmarketdarkfox.com/ ]dark markets [/url]

darkmarket url [url=https://kingdommarketdarknet.com/ ]darkmarkets [/url]

darkmarket darknet markets onion

darknet drug market [url=https://darkfoxmarketplace.com/ ]onion dark website [/url]

dark websites [url=https://kingdom-darkmarketplace.com ]darknet drug market [/url]

darknet links darknet drug store

onion dark website darknet markets

darknet market links [url=https://kingdom-marketplace.com/ ]bitcoin dark web [/url]

darknet site [url=https://cannahome-darkmarket-online.com/ ]dark web marketplaces [/url]

darkmarket list dark market link

dark market link darknet drug links

dark web markets [url=https://aasap-market.com/ ]darknet market list [/url]

dark markets 2025 [url=https://onion-dark-market.shop/ ]darknet sites [/url]

darknet drug links [url=https://asap-market-onion.com/ ]dark web market links [/url]

dark web market links darknet markets 2025

darknet drug links darkmarket

dark web markets [url=https://darkfoxmarketplace.com/ ]darkmarket list [/url]

darknet websites dark websites

dark market [url=https://kingdomdarkmarketplace.com ]dark web market list [/url]

dark markets [url=https://darkmarketpremium.com/ ]dark market link [/url]

dark market 2025 [url=https://mydarkmarketlink.com/ ]darknet markets onion address [/url]

darknet markets onion address [url=https://asap-market-onion.com/ ]darknet drug store [/url]

dark market url darknet websites

darknet markets 2025 [url=https://darkfoxmarketplace.com/ ]dark web market [/url]

darknet markets onion address dark web sites

darknet market list [url=https://dark-web-versus.com ]dark web market list [/url]

darkmarket list [url=https://darkfoxdarkweb.com/ ]dark web drug marketplace [/url]

dark web market list dark web drug marketplace

darknet market list [url=https://darkmarketdarkfox.com/ ]dark web markets [/url]

dark web market [url=https://kingdommarketdarknet.com/ ]dark web drug marketplace [/url]

dark markets dark market list

darknet markets 2025 [url=https://cannahome-darkmarket-online.com/ ]darknet markets [/url]

darkmarket list darknet market

darknet drugs darkmarket list

darknet websites [url=https://kingdomdarkmarketplace.com ]best darknet markets [/url]

darkmarket list [url=https://aasap-market.com/ ]darknet markets [/url]

darknet market lists [url=https://firstdarkmarket.com/ ]darknet sites [/url]

darknet links darknet markets

darknet markets 2025 [url=https://kingdomdarkmarketonline.com/ ]onion dark website [/url]

dark market list dark web link

dark websites [url=https://cyberdarkmarkets.com/ ]darknet sites [/url]

darkmarket 2025 dark web markets

dark web drug marketplace [url=https://kingdomdarkmarketplace.com ]darknet drug links [/url]

darknet drug market dark web sites

darknet market lists darknet drugs

darknet markets links [url=https://darkmarketdarkfox.com/ ]darknet links [/url]

dark web link darknet site

darkmarkets [url=https://cannahomemarket.link/ ]darknet links [/url]

dark market onion darknet markets 2025

darknet drug links [url=https://dark-web-versus.com ]darkmarket list [/url]

dark markets 2025 dark web market

dark websites [url=https://onion-dark-market.shop/ ]darknet drug market [/url]

darkmarket link dark websites

darknet links [url=https://idarknetmarket.com/ ]dark web link [/url]

darknet drugs darknet links

darkmarket url [url=https://kingdomdarknetdrugstore.com/ ]darknet drug market [/url]

tor drug market [url=https://cannahomedarknetdrugstore.com/ ]darknet marketplace [/url]

dark web sites [url=https://kingdommarketdarknet.com/ ]darknet drug links [/url]

dark market link [url=https://darkfoxmarketplace.com/ ]dark web drug marketplace [/url]

dark markets [url=https://darkode-market.com/ ]darknet drug store [/url]

darknet sites [url=https://cannahomedarknetdrugstore.com/ ]darknet market lists [/url]

darknet drug market [url=https://idarknetmarket.com/ ]dark web drug marketplace [/url]

dark web drug marketplace [url=https://cannahome-darkmarket-online.com/ ]dark web sites [/url]

darknet market list [url=https://darkwebversus.com/ ]dark web link [/url]

darkmarkets [url=https://dark-web-versus.com ]darknet links [/url]

darknet marketplace [url=https://kingdom-marketplace.com/ ]darknet markets links [/url]

darknet markets onion address [url=https://idarknetmarket.com/ ]tor drug market [/url]

darkmarket [url=https://darkfoxmarketplace.com/ ]darkmarket 2025 [/url]

dark market 2025 [url=https://aasap-market.com/ ]darknet drugs [/url]

darkmarket link [url=https://cannahomedarknetdrugstore.com/ ]dark web market [/url]

darknet markets [url=https://darknetmarketsonion.shop/ ]dark market list [/url]

dark markets [url=https://cyberdarkmarkets.com/ ]darknet market lists [/url]

dark markets 2025 [url=https://darkfoxdarkweb.com/ ]dark web markets [/url]

dark web market list [url=https://cannahomedarknetdrugstore.com/ ]dark web market list [/url]

darknet drug market [url=https://mydarkmarketlink.com/ ]dark market url [/url]

darknet sites [url=https://darknetmarketsonion.shop/ ]darknet site [/url]

darknet market links [url=https://darkwebversus.com/ ]darknet markets 2025 [/url]

darkmarket 2025 [url=https://dark-web-versus.com ]dark market 2025 [/url]

darknet links [url=https://kingdom-marketplace.com/ ]dark market url [/url]

dark markets [url=https://asap-market-onion.com/ ]dark web drug marketplace [/url]

darknet markets onion [url=https://kingdomdarknetdrugstore.com/ ]onion dark website [/url]

dark web link [url=https://darkfoxdarkweb.com/ ]dark market list [/url]

darkmarkets [url=https://kingdomdarkmarketplace.com ]dark market 2025 [/url]

darknet drug market [url=https://darkmarketdarkfox.com/ ]darknet market lists [/url]

darknet market lists [url=https://darknetmarketsonion.shop/ ]darkmarket list [/url]

darkmarkets [url=https://darkfoxmarketplace.com/ ]darknet drug store [/url]

darknet drug store [url=https://darkwebversus.com/ ]darkmarket url [/url]

best darknet markets [url=https://kingdomdarkmarketplace.com ]darknet websites [/url]

dark web sites [url=https://kingdom-marketplace.com/ ]bitcoin dark web [/url]

darknet markets [url=https://kingdommarketdarknet.com/ ]darknet markets onion address [/url]

darkmarket link [url=https://darkode-market.com/ ]darknet drugs [/url]

best darknet markets [url=https://cyberdarkmarkets.com/ ]dark web market list [/url]

darknet sites [url=https://cannahomedarknetdrugstore.com/ ]darknet market list [/url]

darkmarket url [url=https://mydarkmarketlink.com/ ]darknet markets links [/url]

darknet markets onion [url=https://idarknetmarket.com/ ]dark web markets [/url]

darknet sites [url=https://darkfoxmarketplace.com/ ]dark market onion [/url]

darknet markets 2025 [url=https://kingdom-darkmarketplace.com ]dark web market list [/url]

darknet market list darknet sites

dark market best darknet markets

dark markets [url=https://kingdom-marketplace.com/ ]darkmarket 2025 [/url]

darknet links dark web link

darknet markets onion dark market url

dark web markets [url=https://darkwebversus.com/ ]dark web marketplaces [/url]

darkmarket link [url=https://cannahome-darkmarket-online.com/ ]darknet drug links [/url]

dark web market urls [url=https://drdarkfoxmarket.com ]best darknet markets [/url]

dark web market dark market list

dark web markets dark market onion

darknet sites [url=https://firstdarkmarket.com/ ]tor drug market [/url]

dark websites [url=https://kingdommarketdarknet.com/ ]darknet market links [/url]

dark market onion [url=https://darkmarketpremium.com/ ]darkmarket [/url]

dark websites darknet drug links

dark web link [url=https://kingdomdarknetdrugstore.com/ ]darknet sites [/url]

dark market link [url=https://kingdom-darkmarketplace.com ]dark web market list [/url]

darkmarket list darknet drugs

best darknet markets darknet marketplace

dark market 2025 darknet websites

dark websites [url=https://kingdomdarkmarketonline.com/ ]dark web sites [/url]

tor drug market [url=https://kingdomdarknetdrugstore.com/ ]darknet drugs [/url]

darknet market list darknet links

darknet drug store darknet drugs

darknet websites [url=https://kingdom-darkmarketplace.com ]darkmarket [/url]

dark web market dark web marketplaces

dark market [url=https://firstdarkmarket.com/ ]tor drug market [/url]

darknet drug market [url=https://darknetmarketsonion.shop/ ]darknet drug links [/url]

darknet markets url [url=https://darkfoxdarkweb.com/ ]dark web market links [/url]

dark web drug marketplace darknet site

darknet market lists [url=https://kingdomdarknetdrugstore.com/ ]darknet market list [/url]

darknet drugs tor drug market

dark market link darknet markets url

darknet market [url=https://dark-web-versus.com ]darknet market links [/url]

darknet market list darknet market list

darknet markets links [url=https://kingdomdarkmarketonline.com/ ]darkmarket 2025 [/url]

darknet sites [url=https://darkfoxdarkweb.com/ ]darknet market lists [/url]

darknet drug market dark market onion

darknet drug market onion dark website

darkmarket url dark web market urls

darknet market [url=https://darkfoxmarketplace.com/ ]darknet market list [/url]

dark markets darknet markets onion

dark web link [url=https://kingdom-darkmarketplace.com ]dark markets 2025 [/url]

darknet links [url=https://kingdom-marketplace.com/ ]darknet drug links [/url]

darknet drug links [url=https://aasap-market.com/ ]dark websites [/url]

darkmarket link darknet drug store

darknet websites [url=https://cannahome-darkmarket-online.com/ ]darkmarkets [/url]

dark web marketplaces darknet markets onion

darknet drug links darknet markets onion address

darknet links [url=https://drdarkfoxmarket.com ]darkmarket link [/url]

darknet drug links bitcoin dark web

dark web market links dark web market urls

darknet drug store [url=https://firstdarkmarket.com/ ]darkmarket link [/url]

dark websites [url=https://aasap-market.com/ ]dark market [/url]

darkmarket list [url=https://idarknetmarket.com/ ]darkmarket link [/url]

darknet marketplace darknet market list

dark web markets [url=https://kingdomdarknetdrugstore.com/ ]darknet market lists [/url]

darknet websites dark web sites

darknet markets links dark market onion

darknet links [url=https://kingdomdarkmarketplace.com ]darknet drugs [/url]

dark websites darknet marketplace

dark market 2025 [url=https://darkmarketpremium.com/ ]dark market onion [/url]

dark market link [url=https://firstdarkmarket.com/ ]darknet sites [/url]

darknet markets darknet market

darknet links [url=https://darknetmarketsonion.shop/ ]dark web market urls [/url]

darknet sites [url=https://cannahomemarket.link/ ]darknet drug store [/url]

darkmarkets dark market list

dark market list darknet links

darknet site [url=https://cannahomedarknetdrugstore.com/ ]darknet marketplace [/url]

dark markets 2025 [url=https://darkwebversus.com/ ]dark markets [/url]

darknet markets url [url=https://kingdommarketdarknet.com/ ]dark web sites [/url]

darknet drugs dark web sites

darkmarket list [url=https://cannahome-darkmarket-online.com/ ]darknet drug market [/url]

dark web marketplaces darknet markets 2025

darknet site darknet markets onion

darknet market list onion dark website

dark web market list [url=https://kingdomdarkmarketplace.com ]best darknet markets [/url]

darkmarket link darknet drugs

darknet drug links [url=https://aasap-market.com/ ]darknet drugs [/url]

darknet marketplace [url=https://darknetmarketsonion.shop/ ]darknet markets onion [/url]

dark market link darknet sites

darknet marketplace [url=https://cyberdarkmarkets.com/ ]darknet markets [/url]

dark market link darknet drug market

darknet marketplace best darknet markets

darknet drug links [url=https://dark-web-versus.com ]darknet markets 2025 [/url]

darknet drug links dark markets

dark market 2025 [url=https://onion-dark-market.shop/ ]darkmarket url [/url]

dark market [url=https://idarknetmarket.com/ ]dark markets [/url]

darknet drug store tor drug market

dark markets darknet drug store

darknet links tor drug market

dark market link [url=https://kingdomdarkmarketplace.com ]tor drug market [/url]

best darknet markets [url=https://darkfoxdarkweb.com/ ]darknet drugs [/url]

darkmarkets darkmarket url

darknet markets onion [url=https://mydarkmarketlink.com/ ]darknet market lists [/url]

bitcoin dark web [url=https://asap-market-onion.com/ ]darknet links [/url]

onion dark website onion dark website

dark web drug marketplace [url=https://cannahomemarket.link/ ]dark web market [/url]

dark web sites darkmarket link

darknet markets links [url=https://drdarkfoxmarket.com ]dark market onion [/url]

darknet drug market darkmarket list

dark market url darknet markets onion address

dark market onion [url=https://darkfoxdarkweb.com/ ]darknet markets onion [/url]

darknet websites [url=https://mydarkmarketlink.com/ ]dark markets [/url]

darknet drug links [url=https://asap-market-onion.com/ ]dark web market list [/url]

darkmarket url [url=https://kingdomdarknetdrugstore.com/ ]darknet markets url [/url]

darknet drug store darknet markets links

dark market url darknet drug store

darknet links best darknet markets

darknet market [url=https://firstdarkmarket.com/ ]darknet markets url [/url]

darknet market links [url=https://darknetmarketsonion.shop/ ]dark markets [/url]

darknet drugs [url=https://cannahomemarket.link/ ]darknet site [/url]

dark web market darkmarket list

darknet market darknet drugs

darknet markets onion [url=https://dark-web-versus.com ]darknet drug links [/url]

darknet market lists dark web marketplaces

darknet drug links [url=https://aasap-market.com/ ]onion dark website [/url]

darknet market links dark web marketplaces

darknet markets links dark market list

dark web link [url=https://mydarkmarketlink.com/ ]dark market link [/url]

dark web marketplaces [url=https://kingdomdarkmarketonline.com/ ]dark web sites [/url]

bitcoin dark web [url=https://cannahomemarket.link/ ]darknet markets links [/url]

darkmarket list dark markets 2025

darkmarket url darknet markets 2025

bitcoin dark web [url=https://dark-web-versus.com ]dark web market [/url]

darknet markets url dark web market list

dark web market list [url=https://aasap-market.com/ ]darknet markets links [/url]

darknet markets onion address dark market link

dark web marketplaces [url=https://kingdomdarkmarketonline.com/ ]dark market url [/url]

dark market url darkmarket link

darknet markets onion [url=https://kingdomdarknetdrugstore.com/ ]darknet site [/url]

darknet websites darknet market lists

darknet sites [url=https://drdarkfoxmarket.com ]dark websites [/url]

darknet market list [url=https://aasap-market.com/ ]darknet drug store [/url]

dark market list darknet market lists

onion dark website [url=https://mydarkmarketlink.com/ ]darkmarket url [/url]

darknet links [url=https://asap-market-onion.com/ ]dark web market [/url]

darknet market lists darknet drug links

darknet market lists darknet markets links

darknet market lists [url=https://cyberdarkmarkets.com/ ]darknet markets [/url]

dark web link [url=https://kingdomdarkmarketplace.com ]dark market link [/url]

darknet market links darknet websites

darkmarket 2025 [url=https://darkode-market.com/ ]darknet drug links [/url]

dark web markets darknet links

darkmarket [url=https://kingdom-marketplace.com/ ]darknet markets [/url]

dark market dark market 2025

bitcoin dark web [url=https://asap-market-onion.com/ ]darkmarket [/url]

darkmarket url dark websites

darkmarket link [url=https://cannahomemarket.link/ ]darknet links [/url]

darknet links [url=https://drdarkfoxmarket.com ]darknet market list [/url]

dark web markets [url=https://darkode-market.com/ ]darknet marketplace [/url]

darknet markets 2025 darknet links

darknet market links dark market url

darknet markets 2025 [url=https://kingdom-marketplace.com/ ]darknet markets onion address [/url]

darkmarket url darknet markets

darknet market lists [url=https://darknetmarketsonion.shop/ ]dark markets 2025 [/url]

darknet websites dark web market urls

dark market 2025 [url=https://cannahomemarket.link/ ]darkmarket list [/url]

darknet markets onion darkmarkets

darknet markets onion address [url=https://darkode-market.com/ ]darknet markets onion [/url]

best darknet markets dark web market list

darknet site dark web market links

dark web sites darkmarket list

dark web drug marketplace [url=https://darknetmarketsonion.shop/ ]dark market [/url]

dark market onion darkmarket list

dark web market links dark market 2025

dark market 2025 [url=https://darkode-market.com/ ]dark web sites [/url]

darkmarket url [url=https://mydarkmarketlink.com/ ]darknet markets onion address [/url]

darknet market [url=https://kingdommarketdarknet.com/ ]darknet market links [/url]

darknet markets onion address darknet markets onion

darknet drug market [url=https://cyberdarkmarkets.com/ ]dark web link [/url]

darkmarket dark websites

dark web drug marketplace darknet marketplace

darknet drug store [url=https://darkfoxdarkweb.com/ ]dark web market urls [/url]

darkmarket link dark market list

darknet markets onion [url=https://kingdom-marketplace.com/ ]dark web market urls [/url]

darknet market links [url=https://kingdommarketdarknet.com/ ]tor drug market [/url]

darkmarket darkmarket link

dark web market urls darknet market list

dark web marketplaces [url=https://cyberdarkmarkets.com/ ]dark web marketplaces [/url]

darknet markets links [url=https://darkwebversus.com/ ]darknet market list [/url]

darkmarket link darknet sites

darknet sites dark market onion

dark web market [url=https://firstdarkmarket.com/ ]darknet market [/url]

dark web sites [url=https://kingdommarketdarknet.com/ ]dark markets 2025 [/url]

dark markets darknet markets

tor drug market [url=https://kingdomdarknetdrugstore.com/ ]darknet drug links [/url]

dark markets dark web market urls

darkmarket list dark web market list

darknet site [url=https://darkfoxdarkweb.com/ ]dark web market list [/url]

darkmarket list [url=https://dark-web-versus.com ]dark market link [/url]

darknet sites darknet market

dark web market list darkmarket

darknet site [url=https://firstdarkmarket.com/ ]dark market list [/url]

darknet drug store dark market 2025

dark web link [url=https://kingdomdarkmarketonline.com/ ]darkmarket link [/url]

darknet drug links [url=https://kingdomdarknetdrugstore.com/ ]darknet markets 2025 [/url]

dark web markets darknet links

dark market list [url=https://darkmarketpremium.com/ ]dark market onion [/url]

dark web sites [url=https://cannahomedarknetdrugstore.com/ ]darknet drug links [/url]

darknet links darknet drug links

darknet drug store [url=https://kingdom-marketplace.com/ ]dark market onion [/url]

darkmarket list [url=https://kingdommarketdarknet.com/ ]darknet market list [/url]

darknet market list [url=https://darkode-market.com/ ]darknet market lists [/url]

darknet markets links darknet markets 2025

darkmarket link [url=https://kingdom-darkmarketplace.com ]darkmarket url [/url]

dark market list dark websites

dark websites darkmarket link

darknet drug links darknet markets 2025

darknet drug store [url=https://firstdarkmarket.com/ ]dark web drug marketplace [/url]

darkmarket list [url=https://idarknetmarket.com/ ]darknet links [/url]

darknet site darkmarket url