As the cryptocurrency landscape continues to evolve, investors and enthusiasts alike are turning their gaze toward promising assets that could redefine the digital economy. Among these rising stars is TON, the native cryptocurrency of the The Open Network, which has gained attention for its innovative technology and ambitious vision. As we look ahead to the years 2024 through 2030, questions abound: Can TON sustain its momentum? What factors will influence its price trajectory? And most intriguingly, could TON actually reach the coveted $100 mark? In this article, we will explore the key indicators and trends shaping TON’s future, offering insights and analyses that may help illuminate the path forward for this intriguing digital asset. Join us as we delve into the potential scenarios that could unfold in the coming years and assess whether TON’s ambitious goal of reaching $100 is within striking distance.

Table of Contents

- Exploring the Factors Influencing TONs Market Trajectory

- Technological Innovations Set to Impact TONs Valuation

- Market Sentiment and Its Role in TONs Price Forecast

- Strategic Investments: Navigating the Path to Potential Growth

- Q&A

- Key Takeaways

Exploring the Factors Influencing TONs Market Trajectory

The market trajectory of TON is shaped by a confluence of factors that warrant a closer examination. Primarily, market sentiment plays a pivotal role; the emotional psychology of investors can drive prices dramatically, often leading to volatility. Additionally, technological advancements within the TON ecosystem, including speed improvements and scalability, could make it more attractive for mass adoption. Furthermore, partnerships and collaborations between TON and established entities can bolster credibility, attracting new investors and enhancing market stability.

Another critical aspect is regulatory influences, as the evolving landscape of cryptocurrency regulations can either facilitate or hinder market growth. The competition within the crypto space cannot be overlooked, as emerging projects might offer similar functionalities that could divert interest from TON. Economic indicators such as inflation rates, interest rates, and overall market health also contribute to the investment climate. As we delve deeper into the factors affecting TON’s valuation, it becomes clear that a multitude of dynamics interplay to shape its future, making predictions both challenging and intriguing.

Technological Innovations Set to Impact TONs Valuation

As the technological landscape evolves, several key innovations are anticipated to significantly influence the valuation of TON. The integration of decentralized finance (DeFi) solutions will empower users to leverage their TON holdings in innovative ways, potentially increasing demand. Furthermore, advancements in smart contract capabilities will make it easier for developers to create complex applications, enhancing the overall utility of the TON ecosystem. Additionally, the rise of cross-chain interoperability is set to facilitate seamless transactions between TON and other blockchain networks, broadening its reach and appeal in the crowded digital asset space.

Moreover, the introduction of layer-2 scaling solutions is expected to optimize transaction processing times and reduce fees, making TON a more attractive option for everyday users. Educational initiatives and community outreach will also play a crucial role in driving adoption, as more people become aware of the benefits TON has to offer. Below is a summary of the technological innovations expected to impact TON’s future valuation:

| Technology | Impact on TON |

|---|---|

| DeFi Solutions | Increased demand and usage. |

| Smart Contracts | Enhanced application development. |

| Cross-Chain Interoperability | Broader market access. |

| Layer-2 Solutions | Faster transactions, lower fees. |

Market Sentiment and Its Role in TONs Price Forecast

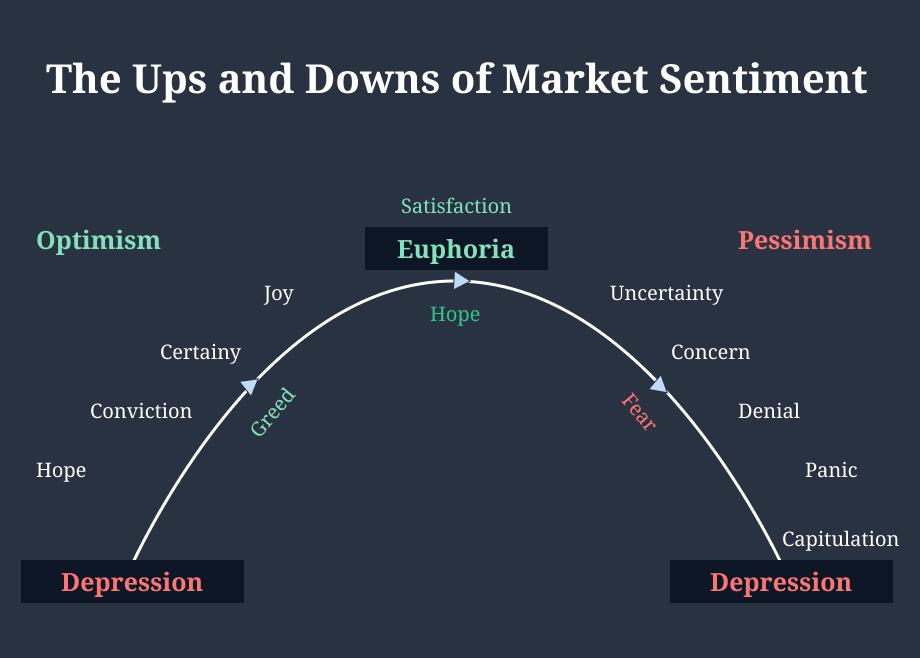

Market sentiment plays a pivotal role in the evaluation and prediction of TON’s price movements. Investors’ emotions, perceptions, and reactions to news—whether favorable or adverse—can significantly influence market trends. The psychology surrounding cryptocurrency markets can often lead to volatility that traditional assets might not experience to the same degree. As we look towards the potential of TON reaching $100, factors such as community engagement, technological advancements, and regulatory developments will weigh heavily on investor confidence. It is essential to monitor the sentiment indicators that arise from social media trends, trading volumes, and influencer opinions to gain insight into where the market might be heading.

Moreover, analyzing periodical sentiment shifts can provide critical clues about the underlying value of TON. Tools such as the Fear and Greed Index or sentiment analysis platforms can help identify whether the market is currently bullish or bearish. One should also consider the broader economic landscape, including inflation rates, geopolitical tensions, and the performance of major cryptocurrencies like Bitcoin and Ethereum, which often dictate market trends. When collating this data, a structured approach using tables can effectively present insights on how sentiment correlates with price movements:

| Sentiment Indicator | Market Impact | Current Status |

|---|---|---|

| Social Media Mentions | High | Increasing |

| Trading Volume | Medium | Stable |

| Fear and Greed Index | High | Greed |

Strategic Investments: Navigating the Path to Potential Growth

As investors seek to capitalize on the evolving landscape of digital currencies, strategic investments in TON offer a promising avenue for potential growth. With the emergence of TON’s unique technology and its strong community backing, there are compelling reasons to consider its long-term value. Key factors influencing TON’s price include:

- Market Adoption: The rate at which businesses and users embrace TON for transactions and services.

- Technological Advancements: Continuous upgrades in the network’s capabilities that enhance usability and security.

- Community Engagement: The strength and activity of the developer and user community in promoting the ecosystem.

To further illustrate the potential growth trajectory, it’s essential to analyze past performance and future forecasts. The table below highlights significant milestones that TON may encounter throughout its journey from 2024 to 2030, along with projected price points.

| Year | Projected Price Range | Key Milestones |

|---|---|---|

| 2024 | $5 – $15 | Increased adoption by startups. |

| 2025 | $15 – $25 | Partnerships with leading tech firms. |

| 2026 | $25 – $50 | Launch of a major upgrade with enhanced functionality. |

| 2027 | $50 – $75 | Recognition as a top-tier blockchain solution. |

| 2028 | $75 – $90 | Global market penetration and adoption. |

| 2029 | $90 – $100 | Significant financial institutions integrating TON. |

| 2030 | $100+ | Full-fledged mainstream use across various sectors. |

Q&A

Q&A: TON Price Prediction 2024-2030 – Will TON Reach $100?

Q1: What is TON, and why is it significant in the crypto market?

A1: TON, short for The Open Network, is a blockchain platform developed by the founders of Telegram. It aims to create a fast, scalable, and user-friendly environment for decentralized applications (dApps) and services. Its significance in the crypto market stems from its potential to integrate seamlessly with Telegram’s vast user base, promising unique advantages in user adoption and engagement.

Q2: What are the underlying factors that could influence TON’s price between 2024 and 2030?

A2: Several factors could influence TON’s price trajectory during this period, including:

- Adoption and Use Cases: The broader adoption of TON by developers and users for various applications can drive demand, impacting its value significantly.

- Market Trends: Overall trends in the cryptocurrency market, such as Bitcoin’s performance, regulatory developments, and macroeconomic conditions, will play a crucial role.

- Technological Advancements: Upgrades to the TON network or enhancements in scalability, security, and interoperability could attract more users, boosting demand.

- Partnerships and Collaborations: Forging strategic partnerships could enhance TON’s visibility and utility, positively affecting its price.

Q3: What price range do analysts predict for TON by 2024?

A3: Analysts predict that TON could see a price range varying from $10 to $50 by 2024, depending on how quickly it gains traction within its target market and the overall performance of the cryptocurrency sector. Factors such as competitive alternatives and regulatory clarity will be critical in shaping these predictions.

Q4: Is it realistic to expect TON to reach $100 by 2030?

A4: While reaching $100 is ambitious, it’s not impossible. This would require unprecedented growth in adoption, market capitalization, and overall demand amid a bullish crypto market environment. Such a target hinges on TON’s ability to carve out a significant niche amidst increasing competition and evolving regulatory landscapes.

Q5: What are the main risks that could prevent TON from reaching its price potential?

A5: The main risks include:

- Regulatory Challenges: Stringent regulations could stifle innovation or deter adoption.

- Market Volatility: The crypto market is notoriously volatile, and sudden downturns can dramatically impact price.

- Technological Competition: New or existing blockchain platforms with superior functionalities could overshadow TON’s capabilities.

- User Engagement: If user engagement with TON’s ecosystem fails to meet expectations, it could hinder growth and price appreciation.

Q6: What should investors keep in mind when considering TON as a potential investment?

A6: Investors should consider their risk tolerance, do thorough research, and stay updated on industry developments. Understanding the fundamental technology, market dynamics, and regulatory environment will provide a clearer picture of TON’s potential. Asset diversification and a long-term investment horizon are also prudent strategies in the inherently volatile crypto landscape.

Q7: what’s the bottom line on TON’s future price prospects?

A7: The path for TON from 2024 to 2030 remains uncertain, shaped by a multitude of factors. While a price of $100 might be an ambitious leap contingent on strong adoption and favorable market conditions, potential investment in TON could still be fruitful if aligned with strategic foresight and careful analysis of evolving trends in the cryptocurrency sphere. Investors should weigh both potential rewards and risks and stay vigilant in their assessments.

Key Takeaways

As we draw the curtain on our exploration of TON’s price trajectory from 2024 to 2030, one thing remains clear: the cryptocurrency landscape is ever-evolving. While predictions can illuminate potential pathways, they are inherently speculative, shaped by technological advancements, market sentiment, and broader economic factors. Will TON reach the coveted $100 mark? Only time will tell. Investors and enthusiasts alike will need to keep a pulse on developments in the TON ecosystem, regulatory shifts, and the overall crypto market dynamics. As we step into the future, remember that the journey of cryptocurrency is filled with both opportunities and challenges. Staying informed and adaptable will be key as you navigate this thrilling space. So, whether you’re a seasoned investor or a curious newcomer, the next chapter in TON’s story is just beginning – and it promises to be a fascinating ride.

generic stromectol – ivermectin 12 mg oral tegretol 400mg brand

accutane 10mg cheap – buy isotretinoin online order zyvox 600mg generic

cheap amoxil for sale – buy combivent 100 mcg for sale generic ipratropium 100mcg

order zithromax – order tindamax order nebivolol 5mg pill

buy generic prednisolone – order progesterone 200mg without prescription brand prometrium

gabapentin 800mg sale – itraconazole uk itraconazole 100mg over the counter

buy furosemide medication – furosemide pills order betnovate 20 gm generic

augmentin 625mg without prescription – order nizoral online cheap cymbalta 40mg canada

acticlate oral – doxycycline without prescription buy glipizide 5mg sale

buy amoxiclav generic – duloxetine 40mg for sale cheap duloxetine 20mg

order rybelsus without prescription – levitra 20mg uk generic cyproheptadine

zanaflex drug – order hydroxychloroquine generic buy hydrochlorothiazide 25 mg

cialis walmart – viagra overnight delivery brand name viagra

sildenafil for men over 50 – purchase tadalafil for sale cialis 5mg cost

order atorvastatin 40mg generic – lisinopril 5mg cheap buy zestril no prescription

order cenforce 100mg without prescription – chloroquine generic glycomet 1000mg without prescription

treat indigestion – buy metoprolol 100mg generic atenolol price

order depo-medrol for sale – triamcinolone 4mg canada buy triamcinolone cheap

clarinex canada – priligy online order buy dapoxetine

buy misoprostol generic – buy xenical 120mg diltiazem sale

buy generic zovirax over the counter – order generic zovirax buy generic rosuvastatin 20mg

generic motilium – how to get tetracycline without a prescription flexeril cost

brand motilium 10mg – order sumycin 500mg pill buy cheap generic flexeril

propranolol pill – buy generic propranolol for sale buy methotrexate generic

coumadin 5mg price – reglan 10mg drug buy cozaar for sale

generic levaquin – brand levaquin 250mg ranitidine 300mg over the counter

purchase esomeprazole for sale – imitrex oral sumatriptan where to buy

mobic 15mg sale – buy flomax 0.4mg online cheap cost flomax 0.2mg

buy zofran 4mg pills – purchase ondansetron sale simvastatin cheap

buy modafinil online cheap provigil 100mg oral modafinil 200mg generic modafinil 100mg modafinil 200mg cheap buy provigil 200mg online order provigil 200mg online cheap

More peace pieces like this would insinuate the интернет better.

More articles like this would make the blogosphere richer.

buy azithromycin 250mg for sale – buy generic flagyl generic flagyl

rybelsus 14 mg ca – buy periactin online periactin 4 mg over the counter

purchase domperidone sale – domperidone cheap buy flexeril online

buy inderal for sale – order inderal 10mg sale methotrexate medication

buy generic amoxil – amoxil without prescription combivent online buy

zithromax online order – tinidazole 300mg cost order bystolic 20mg generic

buy augmentin 625mg without prescription – atbioinfo order ampicillin generic

buy esomeprazole 40mg capsules – anexa mate order esomeprazole online

coumadin 2mg over the counter – https://coumamide.com/ buy cozaar

mobic 15mg sale – https://moboxsin.com/ buy meloxicam 15mg

prednisone 40mg drug – corticosteroid prednisone 5mg uk

how to get ed pills without a prescription – https://fastedtotake.com/ free ed pills