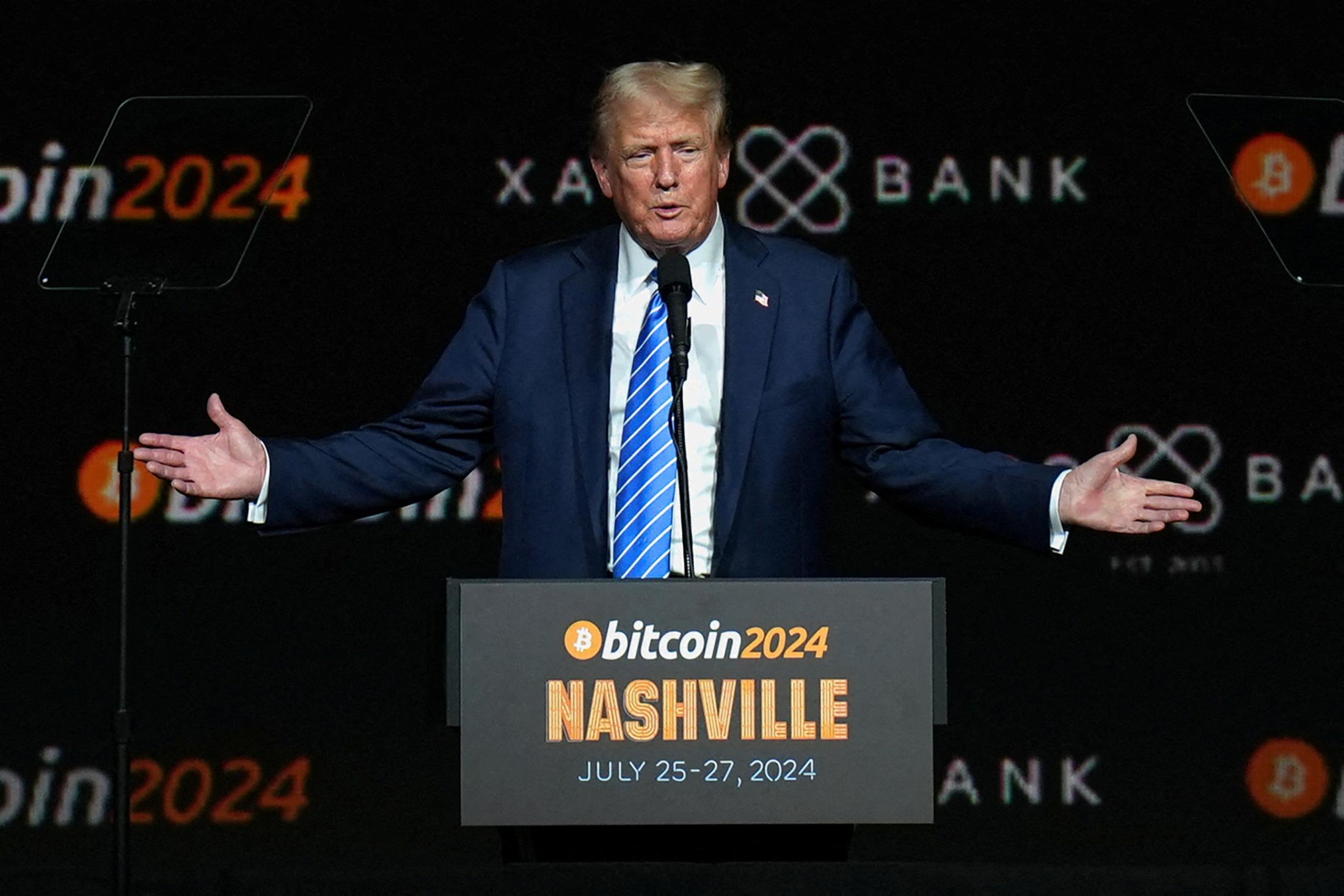

In an unexpected twist that has sent ripples through both the political and financial landscapes, former President Donald Trump has officially appointed Scott Bessent, a vocal proponent of Bitcoin and cryptocurrency reform, as his new Treasury Secretary. This move, emblematic of the ongoing debate over the future of digital currencies, marks a significant shift in the administration’s financial philosophy and signals a potential embrace of blockchain technology at the highest levels of government. As the nation grapples with economic recovery and evolving monetary policies, Bessent’s appointment raises critical questions about the intersection of traditional finance and the burgeoning world of cryptocurrencies. In this article, we will explore the implications of this appointment, delving into Bessent’s background, his vision for the Treasury, and what this could mean for the future of both the U.S. economy and the crypto landscape.

Table of Contents

- Analyzing Scott Bessents Vision for a Pro-Bitcoin Treasury Department

- Implications of a Cryptocurrency-Friendly Policy on the U.S. Economy

- Navigating Regulatory Challenges in the Evolving Digital Asset Landscape

- Recommendations for a Balanced Approach to Cryptocurrency Adoption

- Q&A

- Key Takeaways

Analyzing Scott Bessents Vision for a Pro-Bitcoin Treasury Department

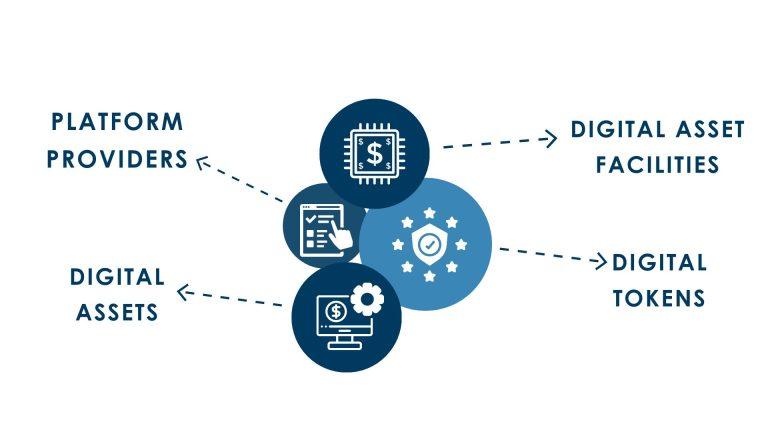

Scott Bessent’s appointment as Treasury Secretary is a significant milestone for advocates of cryptocurrency, particularly Bitcoin. His vision for a pro-Bitcoin Treasury Department is expected to reshape the financial landscape through innovative policies that embrace digital assets. This approach may prioritize the integration of blockchain technology into existing financial infrastructures, aiming to bolster transparency and efficiency. Key aspects of his vision include:

- Regulatory Clarity: Establishing clear guidelines that promote innovation while ensuring consumer protection.

- Market Development: Facilitating the growth of a healthy crypto ecosystem in the U.S. that encourages investment and job creation.

- International Collaboration: Working with other nations to standardize cryptocurrency regulations and combat illicit activities.

Moreover, Bessent’s strategy could diversify the federal reserve’s assets, allowing it to hold Bitcoin as part of its reserve strategy. This move could signal a shift in how governments perceive cryptocurrencies, viewing them not merely as speculative investments but as viable financial instruments. The anticipated outcomes of this new direction may include:

| Outcome | Description |

|---|---|

| Increased Adoption | Encouraging businesses and consumers to use Bitcoin as a regular currency. |

| Enhanced Security | Utilizing blockchain for secure transaction methods and fraud prevention. |

| Economic Resilience | Creating a more robust economy by incorporating decentralized finance solutions. |

Implications of a Cryptocurrency-Friendly Policy on the U.S. Economy

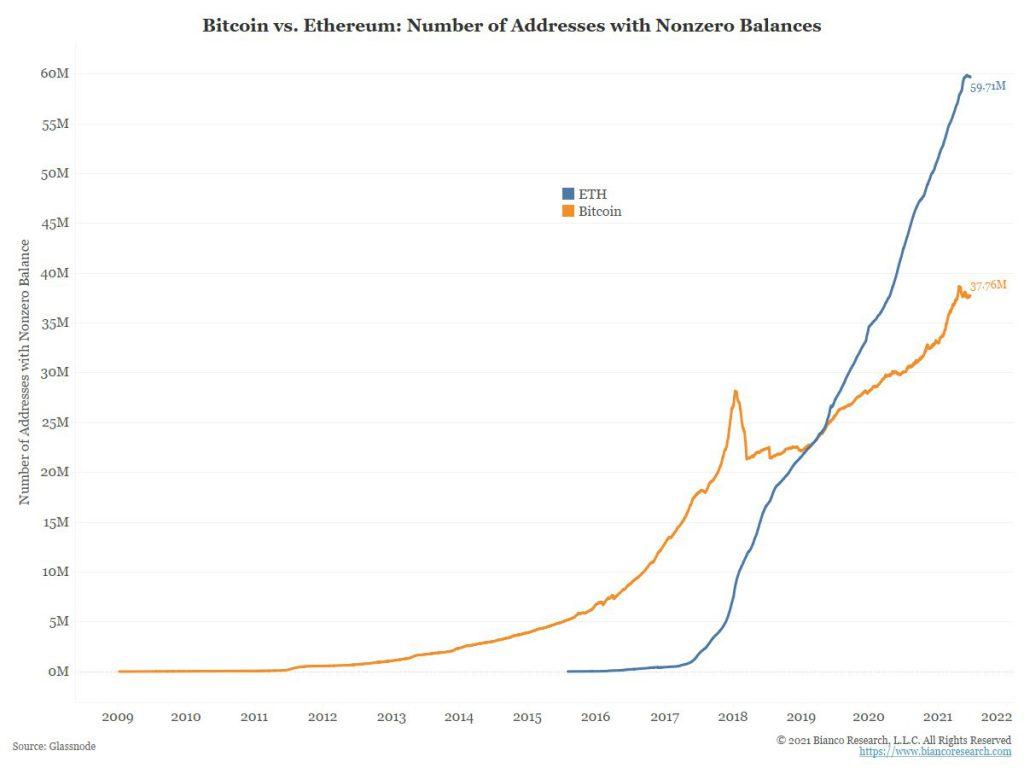

The appointment of Scott Bessent as Treasury Secretary heralds a pivotal moment for the U.S. economy, especially in the realm of cryptocurrency. A policy favorable to digital currencies could lead to significant transformations across various sectors. Consumer spending is likely to rise as cryptocurrencies gain mainstream acceptance, potentially boosting retail growth. Furthermore, with the introduction of blockchain technology, businesses could experience enhanced efficiency and lower transaction costs, thereby driving innovation and competition.

Moreover, a pro-cryptocurrency stance may attract foreign investments, as global investors seek jurisdictions that support digital assets. This influx can stimulate the economy, creating job opportunities in tech-driven industries and fostering the development of a skilled workforce. In addition, the potential for regulatory clarity could stabilize the market, thereby encouraging wider adoption among both individuals and institutions. The economic landscape might increasingly be shaped by the proliferation of digital currencies, leading to a more dynamic and diversified financial ecosystem.

Navigating Regulatory Challenges in the Evolving Digital Asset Landscape

As the digital asset landscape continues to evolve, the appointment of Scott Bessent as Treasury Secretary signals a significant shift in the regulatory environment. Bessent, known for his pro-Bitcoin stance, brings with him a wealth of experience navigating the complex intersection of finance and technology. With his leadership, we may see a more conducive regulatory framework that embraces innovation while ensuring consumer protection. This dual approach is critical as regulators grapple with the rapid pace of blockchain development and the proliferation of cryptocurrencies.

To effectively navigate the challenges ahead, stakeholders in the digital asset space should consider the following strategies:

- Engagement with Regulators: Establish open lines of communication with regulatory bodies to foster understanding and collaboration.

- Compliance Monitoring: Regularly assess compliance with existing regulations to avoid potential pitfalls as new rules emerge.

- Educating the Workforce: Invest in training programs that equip employees with knowledge about regulatory requirements and industry best practices.

In this shifting regulatory landscape, proactive measures are essential for building a sustainable future for digital assets. Adaptability and foresight will be key as Bessent and his team formulate policies that balance innovation with accountability.

Recommendations for a Balanced Approach to Cryptocurrency Adoption

As the potential for cryptocurrency adoption expands under the guidance of key figures in government, a balanced approach is essential to harnessing its benefits while mitigating risks. It is crucial to establish a clear regulatory framework that promotes innovation without stifling growth. To achieve this, stakeholders should focus on the following key strategies:

- Engagement with Industry Experts: Collaborate with cryptocurrency experts to understand market dynamics and consumer protection needs.

- Public Education Campaigns: Implement educational programs to inform the public about cryptocurrency risks and opportunities.

- Flexible Regulatory Models: Develop adaptable regulatory structures that can evolve with technological advancements in the crypto space.

- Encouraging Innovation: Foster a supportive environment for startups and researchers to innovate within the cryptocurrency ecosystem.

Moreover, governments must establish a framework that addresses consumer safety while encouraging investment in crypto markets. A transparent dialog between regulators and the cryptocurrency community will ensure that the sector remains robust and resilient. An effective strategy might include:

| Action | Expected Outcome |

|---|---|

| Incorporate stakeholder feedback | Enhanced regulatory standards |

| Regular updates and policy reviews | Alignment with industry evolution |

| Support for responsible projects | Growth of sustainable crypto businesses |

Q&A

Q&A: Trump Taps Pro-Bitcoin Scott Bessent as Treasury Secretary

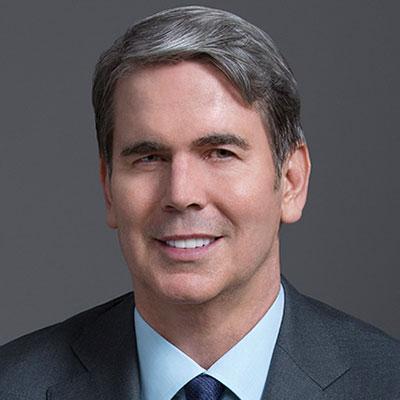

Q1: Who is Scott Bessent, and why is he a notable choice for Treasury Secretary?

A1: Scott Bessent is a prominent investment manager and a vocal advocate for Bitcoin and cryptocurrency. With a background that includes serving as the Chief Investment Officer of George Soros’s family office, Bessent has extensive experience in finance and market trends. His belief in the transformative potential of cryptocurrencies positions him as a forward-thinking candidate for Treasury Secretary, particularly in an era where digital assets are gaining traction.

Q2: What implications does Bessent’s appointment have for U.S. economic policy?

A2: Bessent’s appointment could signal a shift toward a more progressive stance on digital currencies within the U.S. government. His expertise may influence policy decisions that embrace blockchain technology and cryptocurrency innovation, potentially paving the way for regulatory frameworks that facilitate the growth of these markets while addressing concerns such as security and consumer protection.

Q3: How might Bessent’s background in cryptocurrency shape his approach to traditional financial systems?

A3: Given Bessent’s pro-Bitcoin stance, he may advocate for integrating digital currencies into traditional financial systems. This could lead to increased collaboration between central banks and the crypto industry, promoting modernized monetary policies. His unique perspective might encourage a more inclusive financial ecosystem that embraces innovation while ensuring stability in the broader economy.

Q4: What reactions have emerged from financial markets regarding Bessent’s nomination?

A4: Financial markets have responded with cautious optimism, particularly within the cryptocurrency sector, which saw a slight uptick in valuations following the announcement. Investors are keenly observing how Bessent will navigate the existing financial landscape and whether his policies will facilitate greater acceptance of Bitcoin as a viable financial instrument, thus influencing market dynamics.

Q5: What are the potential challenges Bessent may face in his new role?

A5: Bessent may encounter significant challenges, including resistance from traditional financial institutions and lawmakers wary of cryptocurrency’s volatility and regulation. Balancing innovation with economic stability while addressing regulatory concerns will be a critical aspect of his tenure. Additionally, convincing skeptics of the merits of digital currencies could prove difficult, requiring strategic communication and effective policy development.

Q6: How does this appointment fit into Trump’s broader economic strategy?

A6: Trump’s selection of Bessent aligns with his broader economic strategy of promoting growth and innovation. By appointing a pro-Bitcoin figure, the administration seems to be emphasizing the importance of adapting to technological advancements while fostering an environment conducive to entrepreneurship and investment. This approach may resonate with a demographic that values digital assets and financial freedom.

Q7: What does Bessent’s appointment mean for the future of cryptocurrencies in America?

A7: Bessent’s appointment could herald a more constructive dialog around cryptocurrencies in America. It suggests a recognition of the importance of digital assets in the modern economy and may lead to more comprehensive regulations that balance innovation with necessary oversight. Should he succeed, it could open doors for the U.S. to become a leader in the global cryptocurrency space, encouraging investment and innovation.

As the political and financial landscapes evolve, Scott Bessent’s role as Treasury Secretary could be pivotal in shaping the future of the cryptocurrency market in the U.S. Keep an eye on how this unfolds!

Key Takeaways

As the dust settles on this unexpected appointment, the financial landscape braces for what could be a paradigm shift under Scott Bessent’s stewardship at the Treasury. With his pro-Bitcoin stance and a track record in navigating the tumultuous waters of both traditional and digital finance, Bessent’s role may redefine the intersection of government policy and cryptocurrency. While his vision for the future of the dollar and digital currencies remains to be fully unveiled, it is clear that the implications of this appointment will ripple through financial markets and beyond. As we watch closely, the coming months will reveal not just the direction of fiscal policy but perhaps a reimagining of how we engage with money itself. Only time will tell if Bessent’s arrival heralds a new dawn for the Treasury or if it prompts a more cautious reflection on the role of cryptocurrencies in our economy. As always, stakeholders from every sector will be keenly tuning in, ready to adapt to whatever changes may unfold.

Bwer Company is a top supplier of weighbridge truck scales in Iraq, providing a complete range of solutions for accurate vehicle load measurement. Their services cover every aspect of truck scales, from truck scale installation and maintenance to calibration and repair. Bwer Company offers commercial truck scales, industrial truck scales, and axle weighbridge systems, tailored to meet the demands of heavy-duty applications. Bwer Company’s electronic truck scales and digital truck scales incorporate advanced technology, ensuring precise and reliable measurements. Their heavy-duty truck scales are engineered for rugged environments, making them suitable for industries such as logistics, agriculture, and construction. Whether you’re looking for truck scales for sale, rental, or lease, Bwer Company provides flexible options to match your needs, including truck scale parts, accessories, and software for enhanced performance. As trusted truck scale manufacturers, Bwer Company offers certified truck scale calibration services, ensuring compliance with industry standards. Their services include truck scale inspection, certification, and repair services, supporting the long-term reliability of your truck scale systems. With a team of experts, Bwer Company ensures seamless truck scale installation and maintenance, keeping your operations running smoothly. For more information on truck scale prices, installation costs, or to learn about their range of weighbridge truck scales and other products, visit Bwer Company’s website at bwerpipes.com.

stromectol pills canada – buy tegretol 400mg sale order carbamazepine 200mg generic

order isotretinoin 20mg for sale – isotretinoin ca buy zyvox medication

cheap amoxil generic – amoxil pills purchase ipratropium for sale

zithromax 250mg us – bystolic online order nebivolol 5mg without prescription

prednisolone where to buy – buy omnacortil 5mg buy progesterone pills for sale

lasix pills – buy nootropil generic betamethasone 20 gm drug

order generic neurontin 100mg – order itraconazole 100mg generic order sporanox generic

augmentin 625mg over the counter – ketoconazole 200mg sale duloxetine buy online

buy generic vibra-tabs – order ventolin 2mg pill glucotrol 5mg oral

buy augmentin pills – buy cymbalta 20mg sale duloxetine 20mg cheap

where can i buy semaglutide – cyproheptadine 4mg price order periactin pills

purchase tizanidine online – cheap tizanidine buy hydrochlorothiazide 25mg online

tadalafil 40mg tablet – cialis pills 5mg purchase sildenafil generic

buy generic viagra 50mg – viagra 50mg pills prices of cialis

brand lipitor 40mg – lipitor 20mg generic buy prinivil online

cenforce pills – cenforce 100mg for sale buy metformin 500mg

buy atorvastatin 80mg without prescription – buy lisinopril no prescription order zestril

order atorvastatin 80mg – amlodipine pill buy lisinopril 2.5mg pill

purchase omeprazole generic – tenormin order atenolol 50mg sale

medrol 16mg without a doctor prescription – buy pregabalin without prescription order triamcinolone generic

how to buy clarinex – order desloratadine 5mg generic order priligy 60mg without prescription

cytotec sale – order orlistat 120mg pills diltiazem for sale

order zovirax 400mg online cheap – zovirax 400mg over the counter order crestor pill

cost motilium 10mg – order domperidone 10mg pills buy cyclobenzaprine without a prescription

I am really inspired with your writing skills as neatly as with the structure in your blog. Is this a paid subject or did you modify it yourself? Either way keep up the excellent quality writing, it’s uncommon to peer a nice weblog like this one today!

order motilium 10mg generic – buy domperidone pills for sale cheap flexeril

order inderal online – buy generic clopidogrel cheap methotrexate 10mg

order warfarin pills – buy metoclopramide 20mg online cheap losartan 50mg brand

buy levofloxacin 250mg generic – order levofloxacin for sale order ranitidine 150mg online cheap

buy esomeprazole generic – buy imitrex 25mg sale oral imitrex 50mg

buy cheap generic mobic – flomax online cost flomax

This post is fantastic.

ondansetron 8mg for sale – buy aldactone 100mg without prescription order zocor 10mg without prescription

buy valacyclovir for sale – propecia oral how to get fluconazole without a prescription

buy provigil paypal oral provigil 100mg where to buy provigil without a prescription order modafinil sale provigil 200mg price order provigil 100mg sale modafinil sale

The vividness in this tune is exceptional.

This is the compassionate of writing I truly appreciate.

semaglutide cost – order cyproheptadine online buy cyproheptadine 4mg

motilium 10mg without prescription – cost flexeril cyclobenzaprine 15mg ca

buy generic inderal for sale – order inderal generic methotrexate 5mg generic

cheap amoxicillin generic – order generic amoxicillin buy ipratropium 100 mcg sale

buy zithromax – azithromycin 500mg usa nebivolol 5mg oral

amoxiclav generic – atbioinfo.com buy cheap generic ampicillin

buy esomeprazole 40mg pill – https://anexamate.com/ nexium 20mg generic

coumadin brand – cou mamide buy generic cozaar 50mg

mobic price – https://moboxsin.com/ order generic mobic 15mg

order deltasone 40mg generic – https://apreplson.com/ generic deltasone 5mg

buy cheap generic ed pills – https://fastedtotake.com/ buy ed pills medication

amoxil cost – https://combamoxi.com/ amoxil online buy

forcan buy online – https://gpdifluca.com/ order fluconazole 200mg online cheap

buy generic cenforce 100mg – https://cenforcers.com/# brand cenforce 50mg

cialis 20 mg best price – https://ciltadgn.com/ safest and most reliable pharmacy to buy cialis

does cialis lowers blood pressure – sildenafil vs tadalafil vs vardenafil cialis for sale toronto

buy zantac without prescription – https://aranitidine.com/ buy zantac for sale

cheap viagra alternative – order viagra from mexico cheap viagra online canada

This is the kind of advise I turn up helpful. order neurontin 100mg generic

More articles like this would pretence of the blogosphere richer. fildena comprar en espaГ±a

I found new insight from this.